Reabold Resources PLC Recommencement of Share Buyback Programme (5551W)

13 Dezembro 2023 - 4:01AM

UK Regulatory

TIDMRBD

RNS Number : 5551W

Reabold Resources PLC

13 December 2023

13 December 2023

Reabold Resources plc

("Reabold" or the "Company")

Recommencement of Share Buyback Programme

Total Voting Rights

Reabold Resources plc, the oil & gas investing company with

a diversified portfolio of exploration, appraisal and development

projects, is pleased to announce the restart of its share buyback

programme, under new terms (the "Programme").

On 31 October 2022, Reabold announced its intention to commence

a share buyback programme with the intention to return GBP4 million

of excess cash to shareholders upon receipt of GBP9.5 million of

deferred net proceeds to Reabold from Shell, relating to the sale

of the Victory asset. The Company accelerated this return with an

initial GBP750,000 buyback programme that commenced in April 2023

and has returned GBP156,154 to shareholders to date.

Reabold has now received GBP5.2 million of the deferred

consideration from Shell in respect of the sale of the Victory

asset, and is recommencing the Programme with up to a further

GBP593,846 to be returned to shareholders.

Reabold's Board evaluates many investment opportunities

consistent with its investing policy and believes that the current

market value of the Company's Ordinary Shares makes the buyback an

appropriate use of capital. The maximum quantum of the Programme

has been set by the Board after having considered the current

capital position and future capital needs of the Company, such that

it retains financial flexibility whilst maintaining an efficient

balance sheet.

The Board will keep the Programme under review to ensure that it

continues as an efficient and effective means of generating value

for Reabold shareholders. While the Company has launched the

Programme, there is no certainty on the volume of shares that may

be acquired, nor any certainty on the pace and quantum of

acquisitions.

Stifel Nicolaus Europe Limited ("Stifel"), will continue to

conduct the Programme and repurchase Ordinary Shares on Reabold's

behalf, for a maximum amount of GBP593,846 worth of Ordinary

Shares. During any closed periods of the Company, the buyback

agreement will grant Stifel the authority to enact purchases of

Ordinary Shares and make trading decisions concerning the timing of

the purchases under the Programme independently of the Company. The

purpose of the Programme is to reduce the issued ordinary share

capital of Reabold.

The Programme will be conducted within certain pre-set

parameters in accordance with the Company's general authority

granted to the Company at its General Meeting on 29 June 2023 and

will not exceed acquisitions of more than 2,263,532,572 Ordinary

Shares. The average daily volume figure acquired under the

Programme will be no more than 25% of the average daily volume

traded in the calendar month preceding this announcement, thus the

maximum daily volume limit will be 16,414,069 Ordinary Shares.

Any Ordinary Shares acquired under the Programme shall be at a

maximum price (excluding expenses) of the higher of: (i) 10% above

the average of the middle market quotations for an Ordinary Share

as derived from the AIM Section of the Daily Official List of the

London Stock Exchange for the five business days before the date on

which the contract for the purchase is made; and (ii) an amount

equal to the higher of the price of the last independent trade and

current independent bid as derived from the London Stock Exchange

trading system.

It is intended that the Programme will be conducted within the

parameters prescribed by the Market Abuse Regulation 596/2014 (as

in force in the UK by virtue of the European Union (Withdrawal) Act

2018 and as amended by the Market Abuse (Amendment) (EU Exit)

Regulations 2019) (the "Regulation"), the Commission Delegated

Regulation (EU) 2016/1052 (as in force in the UK by virtue of the

European Union (Withdrawal) Act 2018 and as amended by the FCA's

Technical Standards (Market Abuse Regulation) (EU Exit) Instrument

2019) (the "Delegated Regulation").

The Programme is expected to continue until the Company's

General Meeting to be held on 10 January 2024, at which point the

Programme will be reviewed.

Any market repurchase of Ordinary Shares will be announced no

later than 7:30 a.m. on the business day following the calendar day

on which the repurchase occurred.

Total voting rights

Following the admission to trading on AIM of the 486,486,487 new

Ordinary Shares issued to LNEnergy pursuant to the exercise of the

second option as announced on 11 December 2023, the total issued

share capital of the Company consists of 10,474,685,207 Ordinary

Shares. The Company holds 111,572,837 Ordinary Shares in treasury.

Accordingly, the total number of voting rights in the Company is

10,363,112,370 and this is the figure that may be used by

shareholders as the denominator for the calculations by which they

will determine if they are required to notify their interest in, or

a change in their interest in, the share capital of the Company

under the FCA's Disclosure Guidance and Transparency Rules.

Ends

For further information, contact:

Reabold Resources plc c/o Camarco

Sachin Oza +44 (0) 20 3757

Stephen Williams 4980

Strand Hanson Limited - Nominated &

Financial Adviser +44 (0) 20 7409

James Spinney 3494

James Dance

Rob Patrick

Stifel Nicolaus Europe Limited - Joint

Broker +44 (0) 20 7710

Callum Stewart 7600

Simon Mensley

Ashton Clanfield

Cavendish - Joint Broker +44 (0) 20 7220

Barney Hayward 0500

Camarco

Billy Clegg

Rebecca Waterworth +44 (0) 20 3757

Sam Morris 4980

Notes to Editors

Reabold Resources plc has a diversified portfolio of

exploration, appraisal and development oil & gas projects.

Reabold's strategy is to invest in low-risk, near-term projects

which it considers to have significant valuation uplift potential,

with a clear monetisation plan, where receipt of such proceeds will

be returned to shareholders and re-invested into further growth

projects. This strategy is illustrated by the recent sale of the

undeveloped Victory gas field to Shell, the proceeds of which are

being returned to shareholders and re-invested.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCGPGAPPUPWGRP

(END) Dow Jones Newswires

December 13, 2023 02:01 ET (07:01 GMT)

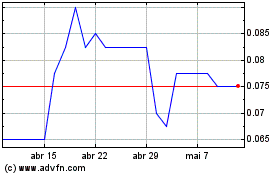

Reabold Resources (LSE:RBD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Reabold Resources (LSE:RBD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024