TIDMBRH

RNS Number : 7153W

Braveheart Investment Group plc

14 December 2023

The information contained within this announcement is deemed by

the Company to constitute inside information pursuant to Article 7

of EU Regulation 596/2014 as it forms part of UK domestic law by

virtue of the European Union (Withdrawal) Act 2018 as amended.

14 December 2023

Braveheart Investment Group Plc

("Braveheart", the "Company" or the "Group")

Interim Results

Braveheart Investment Group plc (AIM: BRH), announces its

interim results for the six months ended 30 September 2023.

Highlights:

-- Loss of GBP732,000 in the six months ended 30 September 2023

(six months ended 30 September 2022*: GBP561,000), loss per share

of 1.15p

-- Net Asset Value ("NAV") of GBP9,826,816 at 30 September 2023

(30 September 2022*: GBP8,374,878), NAV per share of 15.42p

-- Decision to seek a cash buyer for Paraytec with the objective

of realising near term shareholder value.

*restated

For further information:

Braveheart Investment Group plc Tel: 01738 587555

Trevor Brown, Chief Executive Officer

Viv Hallam, Executive Director

Allenby Capital Limited (Nominated Adviser Tel: 020 3328 5656

and Joint Broker)

James Reeve / George Payne

Peterhouse Capital Limited (Joint Broker) Tel: 020 7469 0936

Duncan Vasey / Lucy Williams

CHIEF EXECUTIVE OFFICER'S STATEMENT

We are pleased to report to shareholders the results for the six

months ended 30 September 2023. Progress has continued in

activities of the Group's portfolio companies and summaries of

their operations follow later in this report.

Financial Review

The Directors have undertaken an unaudited interim review of the

valuations of the Group's investments and have concluded that, as

at 30 September 2023, the fair value of the Group's investments

were as follows:

-- Valuation of Portfolio Investments: GBP157,000 (31 March 2023: GBP154,000)*

-- Valuation of unconsolidated Strategic Investments:

GBP8,684,000 (31 March 2023: GBP9,304,000)**

* these are the historic investments made by Braveheart up to

2015

** these are the new investments made by Braveheart since

2015

Therefore, the total unaudited value of our unconsolidated

investment portfolio as at 30 September 2023 is GBP8,841,000 (31

March 2023: GBP9,458,000). As at 30 September 2022, the comparable

total valuation of our investments was GBP5,348,000.

Net asset value ("NAV") of GBP9.8 million as at 30 September

2023 (30 September 2022: GBP8.3 million, 31 March 2023: GBP10.5

million). This resulted in a reduction in net asset value per share

from 17 pence as at 31 March 2023 to 15.42 pence as at 30 September

2023.

The Group reports a loss after tax for the period under review

of GBP732,000 (September 2022: loss of GBP561,000). This equates to

a loss per share of 1.15 pence (September 2022: 0.88 pence).

The loss and the reduction in Strategic Investments in the

half-year came principally from the reduction in the valuation of

Phasefocus Holdings, details provided in the narrative below.

The Directors believe that the Strategic Investments continue to

be the most likely drivers of growth in shareholder value over the

remainder of the current year and so have concentrated the

remainder of this CEO Statement on their operations and

prospects.

Strategic Investments Overview

Paraytec Limited (Braveheart owns 100% per cent of the

company)

Paraytec develops high performance specialist detectors for the

analytical and life sciences instrumentation markets. Its rapid

test instrument ("CX300") is being developed for identifying cancer

and pathogens, including viruses.

The CX300 instrument has been successfully CE marked and tested

in the in the detection of Adeno-associated viruses, which are used

in gene therapy. An instrument has been delivered to the Gene

Therapy Innovation and Manufacturing Centre ("GTIMC") in Sheffield,

for 'industrial' testing in GTIMC's research and development

lab.

The first sale of its CX300 instrument has been made to

Nottingham Trent University (NTU) for the laboratory of Professor

Elisabetta Verderio Edwards, who's work focuses on the role of

extracellular factors in cell survival in conditions of

neurodegeneration and tissue repair. The CX300 instrument will be

used to further NTU's research in Alzheimer's, Dementia and

Parkinson's diseases.

Paraytec has agreed a further sales contract with the University

of Nottingham (UoN) for a CX300 instrument. The instrument is to be

installed in the laboratory under the leadership of Professor Snow

Stolnik. Her research centres on design and development of

nano-sized drug delivery systems and their interactions with cells,

in the context of cell targeting, trafficking, and drug exposure.

The CX300 instrument is to be used to advance and further develop

UoN's understanding of nano-system properties, as well as their

association with cells.

In July 2023, Paraytec's COVID-19 test completed a very

successful clinical study at Sheffield Teaching Hospitals NHS

Foundation Trust, in which it proved highly effective in detecting

the presence of SARS-CoV-2 in recently infected participants.

Several important conclusions were made on the basis of the

statistical analysis of data arising from the clinical trial.

Primarily, this analysis confirmed the clear utility of Paraytec's

Covid test as a potential point-of-care test for the detection of

SARS-Cov2 in swab samples taken from people with symptoms of

respiratory illness.

The trial compared the CX300-based test to either qPCR or viral

culture as a means to detect people who were infected with

SARS-Cov2, as well as utilising the CX300 to identify the best

location - nose, throat or saliva - from which to obtain swab

samples for analysis. Paraytec's test detects the presence of viral

particles, PCR determines the number of viral genomes, while viral

culture detects viruses by determining their ability to kill animal

cells growing in a laboratory - each a different measure of the

presence of virus in a sample.

Viral culture was poor at identifying people who were infected

with SARS-Cov2, correctly identifying people 30% of the time. This

likely reflects the limitations of the culture conditions to

facilitate the growth of viral particles that normally only infect

epithelial cells present in the nasal passage, mouth and throat.

Paraytec's test identified people who were positive by PCR around

93% of the time. This value rose to 100% in people with a very low

viral load indicating the particular efficacy of the Paraytec test

in identifying infected individuals at the very beginning of the

infection cycle when viral particles present are relatively few in

number, but at the point where from a clinical perspective, it is

most important to identify infected individuals to facilitate

isolation to prevent spread of disease, and to provide early

intervention in vulnerable patients.

The trial demonstrated that, compared with taking samples

uniquely from the nasal cavity, or from saliva, a combined sample

from nose and throat was the optimal sampling regimen, as the

former were successful at detecting viral particles in SARS-Cov2

positive participants 84% and 76% of the time, respectively. These

data likely indicate a preference of the viral variants in

circulation over the course of the trial, for cells in the throat

compared to the nose and or mouth.

Importantly, from a research perspective, the data obtained in

the trial revealed the absence of correlation between viral

particle numbers estimated by Paraytec's test and the number of

genomes detected by PCR. The cellular processes by which viral

genomes and viral coat components are generated, are different. The

trial finding indicates that cells produce viral genomes and coat

components in varying relative amounts throughout the early stages

of an infection, and this explains why some samples (about 7%)

tested positive by PCR but negative in Paraytec's test. These

likely reflect people who are no longer infectious but whose

samples contain remnants of viral genomes that were not assembled

into functional viral particles.

The results successfully demonstrate the efficacy of Paraytec's

COVID-19 test and Professor Carl Smythe from the University of

Sheffield's School of Bioscience, who led the work with Paraytec,

commented: "We are particularly impressed that this technology has

the potential to be used in a point-of-care setting to rapidly

detect the presence of viral particles in people with early

symptoms of infection, WITHOUT the need for sophisticated and

expensive centralised laboratory-based PCR testing. Of particular

note is its ability to detect viral particles at low viral loads

indicating the particular efficacy of the Paraytec test in

identifying infected individuals at the very beginning of the

infection cycle when viral particles present are relatively few in

number. It thus provides an opportunity to identify infected

individuals to facilitate their isolation to prevent spread of

disease, and to provide early intervention in vulnerable

patients."

Paraytec now offers the CX300 instrument and ParaySelect(TM)

separation technology for sale to research laboratories, as a very

effective means for researchers to investigate mechanisms of viral

infection in patient populations as well as in model cell systems,

whilst engaging with partners wishing to produce a point of care

instrument.

Paraytec has now applied its CX300 instrument and

ParaySelect(TM) separation technology to Covid-19, sepsis detection

and a growing list of further applications. The Board of Braveheart

believes that it is in the best interests of the Company's

shareholders to seek a cash buyer for this investment, in which

Braveheart has a 100% interest. The Company has engaged an M&A

specialist to market Paraytec in order to seek acquirers for the

business, products and technology portfolio. This process is at an

early stage but many of the potential acquirers are already

familiar with the business and have been awaiting results from the

sepsis Proof of Concept.

Phasefocus Holdings Limited (Braveheart owns 48.3% of the

company)

Phasefocus' patented imaging and analysis technology uses a

novel computational method for high fidelity Quantitative Phase

Imaging ("QPI") and advanced microscopy, known in the scientific

literature as "ptychography". The technology is useful for a wide

range of applications including live cell imaging, engineering

metrology and electron microscopy.

On 14 August 2023, Phasefocus announced the launch of its

revolutionary new T-Cell Killing Assay for the Livecyte(R) cell

imaging platform

https://www.phasefocus.com/about/news-events/news/t-cell-assay-announcement

. The new assay quantifies interactions between immune cells and

cancer cells, addressing a major unmet need for researchers

developing the latest novel cancer therapies. In the assay, the

characteristics of T cell interactions in the period immediately

preceding target cell death, can be measured independently from

cytotoxicity. Livecyte's T-Cell Killing Assay offers unparalleled

insights at the single-cell level, empowering researchers to unlock

new frontiers in cancer therapy development and evaluation.

The company shipped two Livecyte systems to China in October and

made two further system sales to the Far East, with shipment

expected in December.

As reported on 21 August 2023, Braveheart made a further

investment of GBP150,000, taking its total interest to 48.3% of the

issued share capital of Phasefocus.

Kirkstall Limited (Braveheart owns 86.11% of the company)

Kirkstall operates in the market known as 'organ-on-a-chip',

where it has developed Quasi Vivo(R), a system of chambers for cell

and tissue culture in laboratories. Its patented technology is used

by researchers in the growing New Approach Methodologies ("NAMs"),

which enable human-relevant drug safety decisions to be made

without the need for animal testing.

As reported on 8 September 2023, Kirkstall, in conjunction with

the Biomedical Ultrasonics, Biotherapy and Biopharmaceutical

Laboratory within the Institute of Biomedical Engineering at the

University of Oxford, has developed an "organ on a chip" model of

an innovative, milli-fluidic system, human blood-brain barrier

which has been used to map the interaction between the blood-brain

barrier and brain cancer.

This is the first time a dynamic milli-fluidic model has been

developed where the interactions between the blood-brain barrier

and medulloblastoma brain cancer spheroids have been demonstrated.

The model uses the Kirkstall's Quasi Vivo(R) platform, a unique

milli-fluidic system. This innovation will enable the observation

of the in vitro performance of drugs designed for treating brain

cancer and central nervous system diseases such as Alzheimer's.

On December 6th, Kirkstall presented its QV1200 products and

provide training workshops for prospective users at the 3R-days

conference in Innsbruck, Austria.

Kirkstall's research team at University of Sheffield has now

developed its initial batch of toxicity test assays for liver, lung

and gut cells and will offer these to its customers. In parallel

work, researchers at Oxford University have developed a blood-brain

barrier assay for Kirkstall. The aim is to provide customers with

data to prove that QV1200 system replicates the human physiology

more effectively than other flow systems.

Other investments

At 30 September 2023, Braveheart held investments in the

following AIM listed companies:

Aukett Swanke Group plc (Braveheart held 11.49% of the company

(31 March 2023: 12.96%)): a professional services group that

principally provides architectural and interior design services in

the primary international market sectors of offices, residential,

education, industrial, hospitality and mixed use or 'hybrid'

developments. Post period, Braveheart has sold 1,650,000 shares and

hence reduced its holding to 32,032,351 shares (10.93% of the

company).

Autins Group plc (Braveheart held 16.09% of the company (31

March 2023: 15.98%)): an industry-leading designer, manufacturer

and supplier of acoustic and thermal insulation solutions for the

automotive industry and other sectors.

Image Scan Group plc (Braveheart held 8.06% of the company (31

March 2023: 7.05%)): a specialist supplier of X-ray screening

systems to the security and industrial inspection markets. Post

period, Braveheart purchased 250,000 shares and hence increased its

holding to 11,283,276 shares (8.24% of the company).

A total of 460,614 shares in Velocity Composites plc were sold

during the period. No shares were held in Velocity Composites plc

at the end of the period.

Your Board believes these technology-driven companies each has a

significant opportunity to build sales and deliver profit. As

always, Braveheart is an active investor, regularly communicating

with their boards and seeking to introduce opportunities that help

deliver shareholder returns.

The Company also has a number of portfolio investments that are

smaller scale legacy investments which we continue to manage and

seek exits where appropriate.

Outlook

The decision to seek a buyer for Paraytec is considered to be

the most effective way for Braveheart shareholders to realise value

from their considerable investment and the significant

technological progress made by the Company over recent years. There

can be no guarantee of concluding a sale but interest has already

been received from credible and well known operators in the sector

and we will keep shareholders abreast of events as the develop.

Trevor Brown

Chief Executive Officer

13 December 2023

Condensed consolidated statement of comprehensive income

for the six months ended 30 September 2023

Six months ended Restated Six months ended

Year ended

30 September 30 September 31 March

2023 2022 2023

(unaudited) (unaudited) (audited)

Continuing operations Note GBP GBP GBP

--------------------------------------------- ----- ------------------- ---------------------------- -------------

Revenue 46,494 26,170 50,902

Change in fair value of investments 3 (651,444) (105,781) 2,957,665

Profit on disposal of investments 79,761 - 170,576

Total income (525,189) (79,611) 3,179,143

--------------------------------------------- ----- ------------------- ---------------------------- -------------

Employee benefits expense (271,363) (352,113) (556,146)

Other operating costs (143,995) (105,490) (283,356)

Total operating costs (415,358) (457,603) (839,502)

--------------------------------------------- ----- ------------------- ---------------------------- -------------

Finance income 9,628 4,170 21,003

Finance costs (1,322) (1,065) (2,154)

--------------------------------------------- ----- ------------------- ---------------------------- -------------

Total costs (407,052) (454,498) (820,653)

(Loss)/ Profit before tax (932,241) (534,109) 2,358,490

--------------------------------------------- ----- ------------------- ---------------------------- -------------

Tax 200,049 (27,376) (773,652)

(Loss)/ Profit after tax for the period and

total comprehensive income for the period (732,192) (561,485) 1,584,838

(Loss)/ Profit attributable to :

Equity holders of the parent (732,192) (561,485) 1,584,838

(732,192) (561,485) 1,584,838

--------------------------------------------- ----- ------------------- ---------------------------- -------------

Basic (loss)/earnings per share Pence Pence Pence

* Basic 2 (1.15) (0.88) 2.68

* Diluted 2 (1.15) (0.82) 2.68

The above condensed consolidated Statement of Comprehensive

Income should be read in conjunction with the accompanying

notes.

Condensed consolidated statement of financial position

as at 30 September 2023

Restated 30 September

30 September 31 March

2023 2022 2023

(unaudited) (unaudited) (audited)

Note GBP GBP GBP

-------------------------------------------------- ----- --------------- ---------------------- ------------

ASSETS

Non-current assets

Property, plant and equipment 229 607 418

Investments at fair value through profit or loss 3 8,841,515 5,348,790 9,458,324

Debtors due in over one year 1,340,952 1,115,200 1,155,200

10,182,696 6,464,597 10,613,942

-------------------------------------------------- ----- --------------- ---------------------- ------------

Current assets

Trade and other receivables 89,256 206,314 64,510

Cash and cash equivalents 399,034 1,959,243 934,861

-------------------------------------------------- ----- --------------- ---------------------- ------------

488,290 2,165,557 999,371

-------------------------------------------------- ----- --------------- ---------------------- ------------

Total assets 10,670,986 8,630,154 11,613,313

-------------------------------------------------- ----- --------------- ---------------------- ------------

LIABILITIES

Current liabilities

Trade and other payables (100,169) (84,502) (149,656)

(100,169) (84,502) (149,656)

-------------------------------------------------- ----- --------------- ---------------------- ------------

Non-current liabilities

Deferred taxation (744,001) (197,774) (944,050)

(744,001) (197,774) (944,050)

-------------------------------------------------- ----- --------------- ---------------------- ------------

Total liabilities (844,170) (282,276) (1,093,706)

-------------------------------------------------- ----- --------------- ---------------------- ------------

Net assets 9,826,816 8,347,878 10,519,607

-------------------------------------------------- ----- --------------- ---------------------- ------------

EQUITY

Called up share capital 4 1,274,469 1,274,469 1,274,469

Share premium 5,370,711 5,370,711 5,370,711

Share based payment reserve 510,604 503,652 471,203

Retained earnings 2,671,032 1,199,046 3,403,224

-------------------------------------------------- ----- --------------- ---------------------- ------------

Equity attributable to owners of the parent 9,826,816 8,374,878 10,519,607

Total equity 9,826,816 8,374,878 10,519,607

-------------------------------------------------- ----- --------------- ---------------------- ------------

The above condensed consolidated statement of financial position

should be read in conjunction with the accompanying notes

Condensed consolidated statement of CASH FLOWS

For the six months ended 30 September 2023

Six months ended Restated six months ended

30 September 30 September 31 March

2023 2022 2023

(unaudited) (unaudited) (audited)

GBP GBP GBP

--------------------------------------------------------- ----------------- -------------------------- ------------

Operating activities

(Loss)/ Profit before tax (932,241) (534,109) 2,358,490

Adjustments to reconcile profit before tax to net cash

flows from operating activities

Decrease/ (Increase) in the fair value movements of

investments 651,444 105,781 (2,957,665)

Share based payment 39,401 193,817 219,223

Profit on disposal of equity investments (79,761) - (170,576)

Movement in liabilities due to Viking fund 127 104 6,801

Depreciation and amortisation 189 189 378

Interest income (9,628) (4,170) (21,003)

Increase in trade and other receivables (210,498) (296,532) (194,728)

Decrease in trade and other payables (49,487) (74,259) (9,106)

--------------------------------------------------------- ----------------- -------------------------- ------------

Net cash flow used in operating activities (590,454) (609,179) (768,186)

--------------------------------------------------------- ----------------- -------------------------- ------------

Investing activities

Proceeds from sale of investments 228,515 - 428,066

Acquisition of investments (183,516) (218,853) (1,529,127)

Interest received 9,628 4,170 21,003

--------------------------------------------------------- ----------------- -------------------------- ------------

Net cash flow used in investing activities 54,627 (214,683) (1,080,058)

--------------------------------------------------------- ----------------- -------------------------- ------------

Financing activities

Funds raised, net of share issue costs - 930,363 930,363

Net cash flow from financing activities - 930,363 930,363

Net (decrease) / (increase) in cash and cash equivalents (535,827) 106,501 (917,881)

Cash and cash equivalents at the start of the period 934,861 1,852,742 1,852,742

--------------------------------------------------------- ----------------- -------------------------- ------------

Cash and cash equivalents at the end of the period 399,034 1,959,243 934,861

--------------------------------------------------------- ----------------- -------------------------- ------------

Condensed consolidated statement of changes in equity

for the six months ended 30 September 2023

Attributable to owners of the Parent

----------------------------------------------------------

Share

based

Share Share payment Retained Total

Capital Premium Reserve Earnings Total Equity

GBP GBP GBP GBP GBP GBP

----------------------- ---------- ---------- --------- ---------- ----------- -----------

At 31 March 2022

(audited) restated 1,044,807 4,371,343 309,835 1,760,531 7,486,516 7,486,516

----------------------- ---------- ---------- --------- ---------- ----------- -----------

Total comprehensive

income for the

period - - - (561,485) (561,485) (561,485)

Transactions

with owners recorded

directly in equity:

Allotment of shares 229,662 1,034,118 - - 1,263,780 1,263,780

Cost of shares

issued - (34,750) - - (34,750) (34,750)

Share based payments - - 193,817 - 193,817 193,817

At 30 September

2022 (unaudited)

restated 1,274,469 5,370,711 503,652 1,199,046 8,374,878 8,374,878

----------------------- ---------- ---------- --------- ---------- ----------- -----------

Total comprehensive

income for the

period - - - 2,146,323 2,146,323 2,146,323

----------------------- ---------- ---------- --------- ---------- ----------- -----------

Transactions

with owners recorded

directly in equity:

----------------------- ---------- ---------- --------- ---------- ----------- -----------

Share based payments - - 25,406 - 25,406 25,406

Transfer to retained

earnings - surrender

of options - - (57,855) 57,855 - -

At 31 March 2023

(audited) 1,274,469 5,370,711 471,203 3,403,224 10,519,607 10,519,607

----------------------- ---------- ---------- --------- ---------- ----------- -----------

Total comprehensive

income for the

period - - - (732,192) (732,192) (732,192)

Transactions

with owners recorded

directly in equity:

Share based payments - - 39,401 - 39,401 39,401

At 30 September

2023 (unaudited) 1,274,469 5,370,711 510,604 2,671,032 9,826,816 9,826,816

----------------------- ---------- ---------- --------- ---------- ----------- -----------

Notes to the interim financial statements

1 Basis of preparation

The financial information presented in this half-yearly report

constitutes the condensed consolidated financial statements (the

interim financial statements) of Braveheart Investment Group plc

("Braveheart" or "the Company"), a company incorporated in the

United Kingdom and registered in Scotland, and its subsidiaries

(together, "the Group") for the six months ended 30 September 2023.

The interim financial statements should be read in conjunction with

the Annual Report and Accounts for the year ended 31 March 2023 and

have been prepared in accordance with UK-adopted international

accounting standards in accordance with the requirements of the

Companies Act 2006. The financial information in this half-yearly

report, which was approved by the Board and authorised for issue on

13 December 2023 is unaudited.

The interim financial statements do not constitute statutory

accounts for the purpose of sections 434 and 435 of the Companies

Act 2006. The comparative financial information presented herein

for the year ended 31 March 2023 has been extracted from the

Group's Annual Report and Accounts for the year ended 31 March 2023

which have been delivered to the Registrar of Companies. The

Group's independent auditor's report on those accounts was

unqualified, did not include references to any matters to which the

auditors drew attention by way of emphasis without qualifying their

report and did not contain a statement under section 498(2) or

498(3) of the Companies Act 2006.

The preparation of the half-yearly report requires management to

make judgements, estimates and assumptions that affect the policies

and the reported amounts of assets and liabilities, income and

expenses. The estimates and associated assumptions are based on

historical experience and other factors that are believed to be

reasonable under the circumstances, the results of which form the

basis of making judgements about carrying values of assets and

liabilities that are not readily apparent from other sources.

Actual results may differ from these estimates. In preparing this

half-yearly report, the significant judgements made by management

in applying the Group's accounting policies and the key sources of

estimation uncertainty were the same as those applied to the

audited consolidated financial statements for the year ended 31

March 2023.

The interim financial statements have been prepared using the

same accounting policies as those applied by the Group in its

audited consolidated financial statements for the year ended 31

March 2023 and which will form the basis of the 2024 Annual Report

and Accounts. The interim financial statements have been prepared

on the same basis as the financial statements for year ended 31

March 2023 which is on the assumption that the Company is a going

concern.

Going Concern

The Directors have reviewed the Group's and the Company's

budgets and plans, taking account of reasonably possible changes in

trading performance and have a reasonable expectation that the

Group and the Company have adequate resources to continue in

operational existence for the foreseeable future and that it is

therefore appropriate to continue to adopt the going concern basis

in preparing the financial statements.

a) New and amended standards adopted by the Group

A number of new or amended standards became applicable for the

current reporting period. These new/amended standards do not have a

material impact on the Group, and the Group did not have to change

its accounting policies or make retrospective adjustments as a

result of adopting these standards.

b) New accounting policies adopted by the Group

There were no new accounting policies adopted by the Group

during the period, nor any amendments to existing accounting

policies.

2 (Loss)/Earnings per share

The basic (loss)/earnings per share has been calculated by

dividing the (loss)/ profit for the period attributable to equity

holders of the parent by the weighted average number of ordinary

shares in issue during the period.

The calculation of (loss)/ earnings per share is based on the

following profit and number of shares in issue:

Six months ended Six months ended Year ended

30 Sept 2023 30 Sept 2022 31 Mar 2023

(unaudited) (unaudited) (audited)

GBP GBP GBP

-------------------------------------------------------------- ------------------- ------------------- ------------

(Loss)/ Profit for the period attributable to equity holders

of the parent (732,192) (561,485) 1,584,838

-------------------------------------------------------------- ------------------- ------------------- ------------

Weighted average number of ordinary shares in issue:

* For basic earnings per ordinary share 63,723,789 54,450,921 59,104,950

* Potentially dilutive ordinary shares - 4,596,000 -

-------------------------------------------------------------- ------------------- ------------------- ------------

* For diluted earnings per ordinary share 63,723,789 59,046,921 59,104,950

-------------------------------------------------------------- ------------------- ------------------- ------------

Dilutive earnings per share adjusts for share options granted

where the exercise price is less than the average price of the

ordinary shares during the period. At the end of the current period

there were no potentially dilutive ordinary shares.

3 Investments at fair value through profit or loss

Level 1 Level 2 Level 3

----------------- ---------------- --------------------------------- ---------------------------------- ----------

Equity Equity Debt Equity Debt

investments in investments in investments in investments in investments in

quoted unquoted unquoted unquoted unquoted

companies companies companies companies companies Total

GBP GBP GBP GBP GBP GBP

----------------- ---------------- --------------- ---------------- ---------------- ---------------- ----------

At 31 March 2022

restated

(audited) 1,133,854 - - 3,803,301 - 4,937,155

Additions at

cost 333,553 - - 183,968 - 517,521

Disposals - - - - - -

Amount owed to

creditors - - - (105) (105)

Change in Fair

Value (105,737) - - (44) - (105,781)

At 30 September

2022 restated

(unaudited) 1,361,670 - - 3,987,120 - 5,348,790

----------------- ---------------- --------------- ---------------- ---------------- ---------------- ----------

Additions at

cost 843,586 - - 466,688 - 1,310,274

Disposals (257,490) - - - - (257,490)

Amount owed to

creditors - - - (6,696) - (6,696)

Change in Fair

Value 64,111 - - 2,999,335 - 3,063,446

----------------- ---------------- --------------- ---------------- ---------------- ---------------- ----------

At 31 March 2023

(audited) 2,011,877 - - 7,446,447 - 9,458,324

Additions at

cost 33,516 - - 150,000 - 183,516

Disposals (148,754) - - - - (148,754)

Amount owed to

creditors - - - (127) (127)

Change in Fair

Value (44,758) - - (606,686) - (651,444)

At 30 September

2023

(unaudited) 1,851,881 - - 6,989,634 - 8,841,515

The Group classifies its investments using a fair value

hierarchy. Classification within the hierarchy has been determined

on the basis of the lowest level input that is significant to the

fair value measurement of the relevant investment as follows:

-- Level 1 - valued using quoted prices in active markets for identical assets;

-- Level 2 - valued by reference to valuation techniques using

observable inputs other than quoted prices included within Level 1;

and

-- Level 3 - valued by reference to valuation techniques using

inputs that are not based on observable market data.

The fair values of quoted investments are based on bid prices in

an active market at the reporting date. All unquoted investments

have been classified as Level 3 within the fair value hierarchy,

their respective valuations having been calculated using a number

of valuation techniques and assumptions, notwithstanding that the

basis of the valuation methodology used most commonly by the Group

is 'price of most recent investment'. When using the DCF valuation

method, reasonably possible alternative assumptions could have a

material effect on the fair valuation of investments. The valuation

of PhaseFocus Holdings Limited has been amended to be in line with

market feedback our board received during Phasefocus' search for

potential acquirers. The impact on the fair value of investments if

the discount rate and provision shift by 1% is GBP88,415 (2022:

GBP53,479).

4 Share capital

30 Sept 30 Sept 31 Mar 2023

2023 2022

(unaudited) (unaudited) (audited)

Authorised GBP GBP GBP

83,723,489 ordinary shares of 2 pence

each

(30 September 2022: 68,674,431,

31 March 2023: 68,674,431) 1,674,470 1,373,489 1,373,489

--------------------------------------- ------------ ------------ ------------

Allotted, called up and fully paid

63,723,489 ordinary shares of 2 pence

each

(30 September 2022: 63,723,489,

31 March 2023: 63,723,489) 1,274,469 1,274,469 1,274,469

--------------------------------------- ------------ ------------ ------------

The Company has one class of ordinary shares. All shares carry

equal voting rights, equal rights to income and distribution of

assets on liquidation or otherwise, and no right to fixed

income.

5 Availability of Interim Results

Shareholder communications

A copy of this report is available on request from the Company's

registered office: 1 George Square, Glasgow, G2 1AL. A copy has

also been posted on the Company's website:

www.braveheartinvestmentgroup.co.uk .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DGBDDDXBDGXX

(END) Dow Jones Newswires

December 14, 2023 02:00 ET (07:00 GMT)

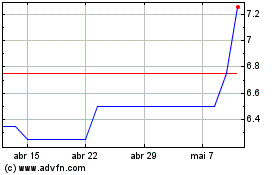

Braveheart Investment (LSE:BRH)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Braveheart Investment (LSE:BRH)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024