TIDMALK

RNS Number : 0703X

Alkemy Capital Investments PLC

18 December 2023

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

CONSTITUTE OR FORM ANY PART OF AN OFFER TO SELL OR ISSUE, OR A

SOLICITATION OF AN OFFER TO BUY, SUBSCRIBE FOR OR OTHERWISE ACQUIRE

ANY SECURITIES IN THE UNITED STATES, AUSTRALIA, THE REPUBLIC OF

SOUTH AFRICA, JAPAN OR ANY OTHER JURISDICTION IN WHICH SUCH OFFER

OR SOLICITATION WOULD BE UNLAWFUL OR TO ANY PERSON TO WHOM IT IS

UNLAWFUL TO MAKE SUCH OFFER OR SOLICITATION. NO PUBLIC OFFERING OF

THE FUNDRAISE SHARES IS BEING MADE IN ANY SUCH JURISDICTION. ANY

FAILURE TO COMPLY WITH THESE RESTRICTIONS MAY CONSTITUTE A

VIOLATION OF THE SECURITIES LAWS OF SUCH JURISDICTIONS.

THIS ANNOUNCEMENT IS NOT FOR PUBLIC RELEASE, PUBLICATION OR

DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN OR

INTO THE UNITED STATES, AUSTRALIA, THE REPUBLIC OF SOUTH AFRICA,

JAPAN OR ANY OTHER JURISDICTION IN WHICH SUCH RELEASE, PUBLICATION

OR DISTRIBUTION WOULD BE UNLAWFUL.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS DEFINED IN

ARTICLE 7 OF THE MARKET ABUSE REGULATION NO. 596/2014 ("MAR") AS IN

FORCE IN THE UNITED KINGDOM PURSUANT TO THE EUROPEAN UNION

(WITHDRAWAL) ACT 2018. UPON THE PUBLICATION OF THIS ANNOUNCEMENT,

THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC

DOMAIN.

18 December 2023

Alkemy Capital Investments Plc

Oversubscribed Placing to raise GBP650,000

Alkemy Capital Investments plc ("Alkemy") (LSE: ALK) is pleased

to announce that it has raised GBP650,000 in an oversubscribed

placing of 650,000 new ordinary shares at a placing price of GBP1

per share, being the total amount available under the Company's

existing share authorities.

This includes a subscription of GBP50,000 of shares at the

placing price from director Sam Quinn.

The net proceeds will be used to further the development of

TVL's lithium hydroxide processing facility in Teesside, UK and for

general working capital purposes ahead of the company seeking to

secure mezzanine financing for that facility, without diluting

Alkemy's shareholders.

Following the placing, the directors will have the following

beneficial shareholdings in the Company:

Number of Shares % of enlarged

capital

Paul Atherley 3,078,000 37.59%

----------------- --------------

Sam Quinn 446,428(1) 5.06%

----------------- --------------

Helen Pein 25,000 0.28%

----------------- --------------

Vikki Jeckell 0 0%

----------------- --------------

(1) Including shares held by Silvertree Partners in which Mr

Quinn has an interest

The placing is conditional upon and an application will be made

for 650,000 Ordinary Shares to be admitted to the official list

(Standard Segment) of the FCA and to trading on the Main Market of

the London Stock Exchange ("Admission") and Admission is expected

to occur at 8.00 a.m. on 22 December 2023.

In accordance with the FCA's Disclosure Guidance and

Transparency Rules, the Company confirms that following Admission,

the Company's enlarged issued ordinary share capital will comprise

8,814,851 Ordinary Shares each with a right to vote and with no

shares held in treasury. Therefore, following Admission, the above

figure may be used by shareholders in the Company as the

denominator for the calculations to determine if they are required

to notify their interest in, or a change to their interest in the

Company, under the FCA's Disclosure Guidance and Transparency

Rules.

In addition, 52,000 broker warrants are being issued in

conjunction with the placing, exerciseable at GBP1 per share for a

period of 2 years from Admission.

Alkemy Director Sam Quinn commented:

"We are grateful to all the existing and new shareholders who

have contributed to this fundraise, which will enable the further

development of TVL's lithium hydroxide processing facility in

Teesside, UK. Funds will be used to continue to advance FEED and

for G&A ahead of securing a non-dilutive mezzanine facility for

TVL which is targeted for early 2024. We appreciate the ongoing

support from all stakeholders and look forward to a successful 2024

as we move to establish the UK's first major independent and

sustainable lithium hydroxide producer at the Wilton International

Chemicals Park in Teesside, UK".

Further information

For further information, please visit the Company's website:

www.alkemycapital.co.uk or www.teesvalleylithium.co.uk

-Ends-

Alkemy Capital Investments Plc Tel: 0207 317 0636

info@alkemycapital.co.uk

SI Capital Limited Tel: 0148 341 3500

VSA Capital Limited Tel: 0203 005 5000

ABOUT ALKEMY CAPITAL

Alkemy is seeking to establish independent and sustainable

lithium hydroxide production by developing lithium sulphate and

lithium hydroxide facilities in the UK and Australia.

Alkemy, through its wholly owned UK subsidiary Tees Valley

Lithium, has secured a 9.6 ha brownfields site with full planning

permission at the Wilton International Chemicals Park in Teesside,

a major UK Freeport, to build the UK's first and one of Europe's

largest lithium hydroxide processing facility.

Tees Valley Lithium has completed a Class 4 Feasibility Study

for its proposed lithium hydroxide refinery which will process

feedstock imported from various sources to produce 96,000 tonnes of

premium, low-carbon lithium hydroxide or an equivalent amount of

lithium carbonate annually, representing around 15% of Europe's

projected demand.

Alkemy, through its wholly owned Australian subsidiary Port

Hedland Lithium, has secured a 43.7 ha site at the Boodarie

strategic industry area, near Port Hedland, Western Australia to

build a world-class sustainable lithium sulphate refinery that will

provide reliable feedstock for Tees Valley Lithium's refinery.

Port Hedland Lithium has completed a Class 4 Feasibility Study

for its proposed lithium sulphate refinery, each train of which

will process spodumene concentrate to produce 40,000 tonnes of

lithium sulphate annually.

Forward Looking Statements

This news release contains forward--looking information. The

statements are based on reasonable assumptions and expectations of

management and Alkemy provides no assurance that actual events will

meet management's expectations. In certain cases, forward--looking

information may be identified by such terms as "anticipates",

"believes", "could", "estimates", "expects", "may", "shall",

"will", or "would". Although Alkemy believes the expectations

expressed in such forward--looking statements are based on

reasonable assumptions, such statements are not guarantees of

future performance and actual results or developments may differ

materially from those projected. In addition, factors that could

cause actual events to differ materially from the forward-looking

information stated herein include changes in market conditions,

changes in metal prices, general economic and political conditions,

environmental risks, and community and non-governmental actions.

Such factors will also affect whether Alkemy will ultimately

receive the benefits anticipated pursuant to relevant agreements.

This list is not exhaustive of the factors that may affect any of

the forward--looking statements. These and other factors should be

considered carefully and readers should not place undue reliance on

forward-looking information.

The Notification of Dealing Form provided in accordance with the

requirements of the Market Abuse Regulation in relation to the

transaction listed above is set out below.

Details of the person discharging managerial responsibilities

1 / person closely associated

a) Name Sam Quinn

--------------------------------------- -------------------------------------

Reason for the notification

2

------------------------------------------------------------------------------

a) Position/status Non-Executive Director

--------------------------------------- -------------------------------------

b) Initial notification Initial Notification

/Amendment

--------------------------------------- -------------------------------------

Details of the issuer, emission allowance market participant,

3 auction platform, auctioneer or auction monitor

------------------------------------------------------------------------------

a) Name Alkemy Capital Investments PLC

--------------------------------------- -------------------------------------

b) LEI 213800NW5GVIRMXSRL48

--------------------------------------- -------------------------------------

Details of the transaction(s): section to be repeated

4 for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

------------------------------------------------------------------------------

a) Description of the Ordinary shares

financial instrument,

type of instrument

Identification code GB00BMD6C023

b) Nature of the transaction Subscription of shares

--------------------------------------- -------------------------------------

c) Price(s) and volume(s)

---------------- ----------------

Price(s) Volume(s)

---------------- ----------------

GBP1.00 50,000

------------------------------------------------------------- ----------------

d) Aggregated information

- Aggregated volume 50,000

- Price GBP1

e) Date of the transaction 18/12/2023

--------------------------------------- -------------------------------------

f) Place of the transaction Outside a trading venue

--------------------------------------- -------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOETRBBTMTBBTBJ

(END) Dow Jones Newswires

December 18, 2023 02:00 ET (07:00 GMT)

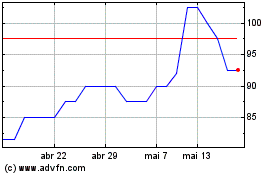

Alkemy Capital Investments (LSE:ALK)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Alkemy Capital Investments (LSE:ALK)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024