TIDMTRD

RNS Number : 3222X

Triad Group Plc

20 December 2023

Legal Entity Identifier (LEI) No. 213800MDNBFVEQEN1G84

Triad Group Plc

Half year results for the six months ended 30 September 2023

Financial highlights

Six months to Six months to Audited year ended

30 September 2023 30 September 2022 Change 31 March 2023

-------------------------------- ------------------- ------------------- ---------- -------------------

Revenue GBP6.39m GBP7.12m -GBP0.73m GBP14.9m

-------------------------------- ------------------- ------------------- ---------- -------------------

Gross profit GBP0.95m GBP1.38m -GBP0.43m GBP3.5m

-------------------------------- ------------------- ------------------- ---------- -------------------

Gross profit % 14.9% 19.3% -4.4% 23.6%

-------------------------------- ------------------- ------------------- ---------- -------------------

(Loss)/Profit before tax (GBP0.99m) (GBP0.41m) -GBP0.58m GBP0.0m

-------------------------------- ------------------- ------------------- ---------- -------------------

Loss after tax (GBP1.00m) (GBP0.41m) -GBP0.59m (GBP0.0m)

-------------------------------- ------------------- ------------------- ---------- -------------------

Cash reserves GBP2.62m GBP4.37m -GBP1.75m GBP4.8m

-------------------------------- ------------------- ------------------- ---------- -------------------

Basic loss per share (6.03p) (2.48p) -3.55p (0.27p)

-------------------------------- ------------------- ------------------- ---------- -------------------

Interim/final dividend payable 2p 2p - 4p

-------------------------------- ------------------- ------------------- ---------- -------------------

Chairman's statement

Dr John Rigg

Overview of results

In my Chairman's statement accompanying the first half year

results for the previous year, I explained that a weak first half

had been entirely the result of "external factors beyond our

control". I also said that we were expecting a strong upturn in the

second half, and this in fact proved to be the case. The

disappointing results announced above are the result of similar

circumstances and influences as those we experienced during the

first half of last year but significantly worse. We had expected

this would not be the case, but unfortunately, once again due to

factors entirely outside our control, this has not proved to be

so.

Now to the excellent news. During the last two months, we have

succeeded in winning four new longer-term lines of business, with

prestigious clients in the public sector. All four have now been

formally awarded. One major result of this will be that the cliff

edge which we have experienced, particularly in the last two years

at March 31st will not affect us in future as we will be able to

continue working seamlessly through that period. This should

transform our second half results for the current year, and in

particular the full year results for the next financial year and

going forward. I personally have never felt so confident and

enthusiastic about the state and prospects of the Company for more

than 20 years.

Unlike many firms in our sector who have sought to lay off

staff, the Company held its nerve and used its strong position to

maintain staffing levels in line with those established over the

last two years. Without doing so, our successful efforts to secure

the long-term pipeline would have been severely undermined. We are

now vigorously pursuing the recruitment of a substantial number of

the very best professional staff.

The model of the business reflects a commitment to the use of

permanent staff to produce the very best outcomes for our clients.

Steps were taken during the period to improve and increase our

work-winning rate to sustain higher headcount levels and the

associated risk of bench costs arising from the model.

Our strategy concentrates on providing outstanding digital

consultancy services to Central Government clients and their

agencies. In addition, we are continuing to develop our footprint

in the UK's law enforcement arena including both national bodies

and local forces. Whilst we have other clients within the

portfolio, our work-winning efforts have been focused on these two

important sectors where our track record and strength in depth

allows us to make a real impact on society.

I believe that we are at the beginning of a period of increasing

major success and growth. I have no doubt that other significant

client wins will follow in due course.

Outlook

I can do no better than to repeat and confirm what I said last

year that "The vital signs of the Company, including cash, margins

and control of overheads, continue to be extremely robust. The

quality of our technological expertise is constantly improving and

our business is based upon the reality of delivering working

effective systems and advice to meet real client needs and policy

demands. As a result, the level of internal morale, client

confidence and accumulated goodwill also continues to strengthen.

Our staff turnover is very low."

Underlying this impressive level of success is the superb

quality of our people at every level.

Business highlights

The first half saw several projects concluding successfully,

including two separate engagements around the implementation of

legislation within policing, the completion of development on a

major project at DfT, and the successful handover of a discovery

project to an existing team at our OPSS client.

Our consultants on the MoJ project management service continued

to deliver outcomes in areas as diverse as prisons expansion,

legacy justice systems replacements, and deployment of Wi-Fi across

the probation estate.

Within law enforcement, we delivered a common user interface

template for a national policing organisation and completed the fit

out of regional operations room capabilities. We also started work

to introduce a new records management system into a pioneering

police force. Our policing footprint expanded as we took on Kent

and Essex police forces, helping them to develop their contact

management strategy.

For DEZNZ, we successfully moved the digital service for the

Clean Heat Market Mechanism (CHMM) from alpha to beta, passing the

GDS assessment in record time.

The recent significant contract wins involve providing digital

expertise across domains including programme and project

management, business architecture and business analysis, and

full-spectrum digital delivery capabilities (including the

implementation of AI co-pilots within corporate functions) to

support ongoing pipelines of work at our new clients.

In November, at the highly prestigious BCS UK IT Industry Awards

ceremony attended by many of the best known names in our industry,

our work in two separate projects was rewarded when we received two

top prizes: for Digital Transformation Project of the Year with

MoJ, and for User Experience (UX) Project of the Year with DfT. We

were also delighted to see one of our staff recognised as the

Rising Star of the Year at the same award ceremony. No other

company at the ceremony received as many as three awards.

Dividend

The Board now have the confidence to maintain the interim

dividend at the same level as last year at 2p.

Employees

I would like to thank all our staff, both our long serving

employees and first rate recent recruitees, who have performed

excellently despite some of the most challenging external

circumstances the Company has experienced in its 35 year

history.

Dr John Rigg

Executive Chairman

19 December 2023

Unaudited condensed consolidated statement of comprehensive

income and expense for the six months ended 30 September 2023

Unaudited Unaudited Audited year ended 31 March

Group and Company Note 2023 2022 2023

GBP'000 GBP'000 GBP'000

Revenue 2 6,393 7,123 14,858

Cost of sales (5,442) (5,745) (11,354)

--------------------------------------------------------- ----- ---------- ---------- ----------------------------

Gross profit 951 1,378 3,504

Administrative expenses (1,932) (1,783) (3,469)

--------------------------------------------------------- ----- ---------- ---------- ----------------------------

(Loss)/Profit from operations (981) (405) 35

Finance income 14 2 17

Finance expense 3 (27) (10) (43)

--------------------------------------------------------- ----- ---------- ---------- ----------------------------

(Loss)/Profit before tax (994) (413) 9

Tax (charge)/credit 4 (5) 2 (53)

--------------------------------------------------------- ----- ---------- ---------- ----------------------------

Loss for the period and total comprehensive income

attributable to equity holders of the parent (999) (411) (44)

--------------------------------------------------------- ----- ---------- ---------- ----------------------------

Basic loss per share 6 (6.03p) (2.48p) (0.27p)

--------------------------------------------------------- ----- ---------- ---------- ----------------------------

Diluted loss per share 6 (6.03p) (2.48p) (0.27p)

--------------------------------------------------------- ----- ---------- ---------- ----------------------------

All amounts relate to continuing activities.

Unaudited condensed consolidated statement of changes in equity

for the six months ended 30 September 2023

Group Share Capital Share premium account Capital redemption Retained earnings Total

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 April 2022 165 880 104 4,869 6,018

Loss for the period

and total

comprehensive income - - - (411) (411)

Dividend paid - - - (663) (663)

Ordinary shares issued 1 6 - - 7

Share-based payments - - - 117 117

----------------------- -------------- ---------------------- ----------------------- ------------------ --------

At 30 September 2022

(unaudited) 166 886 104 3,912 5,068

----------------------- -------------- ---------------------- ----------------------- ------------------ --------

At 1 April 2023 166 894 104 4,030 5,194

Loss for the period

and total

comprehensive income - - - (999) (999)

Dividend paid - - - (664) (664)

Ordinary shares issued - 7 - - 7

Share-based payments - - - 110 110

----------------------- -------------- ---------------------- ----------------------- ------------------ --------

At 30 September 2023

(unaudited) 166 901 104 2,477 3,648

----------------------- -------------- ---------------------- ----------------------- ------------------ --------

At 1 April 2022 165 880 104 4,869 6,018

Loss for the year and

total comprehensive

income - - - (44) (44)

Dividend paid - - - (995) (995)

Ordinary shares issued 1 14 - - 15

Share-based payments - - - 200 200

----------------------- -------------- ---------------------- ----------------------- ------------------ --------

At 31 March 2023 166 894 104 4,030 5,194

----------------------- -------------- ---------------------- ----------------------- ------------------ --------

Unaudited condensed consolidated statement of financial position

as at 30 September 2023

Audited year ended 31 March

Note Unaudited 2023 Unaudited 2022 2023

GBP'000 GBP'000 GBP'000

Non-current assets

Intangible assets 1 1 1

Property, plant and equipment 177 238 199

Right-of-use assets 7 481 251 572

Finance lease receivables 7 348 - 396

Deferred tax 4 103 163 108

------------------------------- ----- --------------- --------------- ----------------------------

1,110 653 1,276

------------------------------- ----- --------------- --------------- ----------------------------

Current assets

Trade and other receivables 8 2,529 2,294 2,541

Finance lease receivables 7 96 29 94

Cash and cash equivalents 2,621 4,369 4,795

------------------------------- ----- --------------- --------------- ----------------------------

5,246 6,692 7,430

------------------------------- ----- --------------- --------------- ----------------------------

Total assets 6,356 7,345 8,706

------------------------------- ----- --------------- --------------- ----------------------------

Current liabilities

Trade and other payables 9 (1,610) (1,815) (2,269)

Short term provisions - (61) -

Lease liabilities 7 (271) (168) (292)

------------------------------- ----- --------------- --------------- ----------------------------

(1,881) (2,044) (2,561)

------------------------------- ----- --------------- --------------- ----------------------------

Non-current liabilities

Long term provisions (197) (136) (197)

Lease liabilities 7 (630) (97) (754)

------------------------------- ----- --------------- --------------- ----------------------------

(827) (233) (951)

------------------------------- ----- --------------- --------------- ----------------------------

Total liabilities (2,708) (2,277) (3,512)

------------------------------- ----- --------------- --------------- ----------------------------

Net assets 3,648 5,068 5,194

------------------------------- ----- --------------- --------------- ----------------------------

Shareholders' equity

Share capital 166 166 166

Share premium account 901 886 894

Capital redemption reserve 104 104 104

Retained earnings 2,477 3,912 4,030

------------------------------- ----- --------------- --------------- ----------------------------

Total shareholders' equity 3,648 5,068 5,194

------------------------------- ----- --------------- --------------- ----------------------------

Unaudited condensed consolidated statement of cash flows for the

six months ended 30 September 2023

Audited year ended 31 March

Unaudited 2023 Unaudited 2022 2023

Note GBP'000 GBP'000 GBP'000

Cash flows from operating activities

(Loss)/Profit for the period before taxation (994) (413) 9

Adjustments for:

Depreciation of property, plant and

equipment 33 44 87

Amortisation of right of use assets 91 94 185

Amortisation/impairment of intangible assets - 1 1

Interest received (14) (2) (17)

Finance expense 27 11 43

Share-based payment expense 110 117 200

Changes in working capital

Decrease in trade and other receivables 12 391 143

(Decrease)/Increase in trade and other

payables (660) (422) 32

Cash (consumed)/generated by operations (1,395) (179) 683

Foreign exchange gain - - 1

--------------------------------------------- ----- --------------- ----------------- ----------------------------

Net cash (outflow)/inflow from operating

activities (1,395) (179) 684

--------------------------------------------- ----- --------------- ----------------- ----------------------------

Investing activities

Finance lease interest received 14 2 17

Finance lease payments received 45 55 102

Purchase of property, plant and equipment (8) (5) (9)

--------------------------------------------- ----- --------------- ----------------- ----------------------------

Net cash used in investing activities 51 52 110

--------------------------------------------- ----- --------------- ----------------- ----------------------------

Financing activities

Proceeds of issue of shares 6 6 15

Lease liabilities principal payments (145) (161) (300)

Lease liabilities interest payments (27) (11) (44)

Dividends paid 5 (664) (663) (995)

--------------------------------------------- ----- --------------- ----------------- ----------------------------

Net cash outflow from financing activities (830) (829) (1,324)

--------------------------------------------- ----- --------------- ----------------- ----------------------------

Net decrease in cash and cash equivalents (2,174) (956) (530)

Cash and cash equivalents at beginning of

the period 4,795 5,325 5,325

--------------------------------------------- ----- --------------- ----------------- ----------------------------

Cash and cash equivalents at end of the

period 2,621 4,369 4,795

--------------------------------------------- ----- --------------- ----------------- ----------------------------

Notes to the financial statements for the six months ended 30

September 2023

1. Principal accounting policies

Basis of preparation

The principal accounting policies adopted in the preparation of

the financial statements are set out below. The policies have been

consistently applied to all the periods presented, unless otherwise

stated.

These financial statements have been prepared in accordance with

UK adopted International Financial Reporting Standards (IFRSs) and

the provisions of the Companies Act 2006.

The comparative financial information for the year ended 31

March 2023 included within this report does not constitute the full

statutory accounts for that period. The statutory Annual Report and

Financial Statements for 2023 have been filed with the Registrar of

Companies. The Independent Auditor's Report on the Annual Report

and Financial Statements for 2023 was unqualified, did not draw

attention to any matters by way of emphasis, and did not contain a

statement under 498(2) or 498(3) of the Companies Act 2006.

The financial information for the half years ended 30 September

2023 and 30 September 2022 does not constitute statutory accounts

within the meaning of section 434(3) of the Companies Act 2006 and

has been neither audited nor reviewed pursuant to guidance issued

by the Auditing Practices Board.

These financial statements have been prepared on a going concern

basis.

These financial statements have been prepared on a historical

cost basis and are presented in pounds sterling, generally rounded

to the nearest thousand, the functional currency of the

Company.

Going Concern

The Group continues to operate an efficient low-cost and cash

generative model. For the six months ended 30 September 2023, the

Group has not utilised any external debt or lending facilities

(2022: nil) with no exposure to bad debts in the period. Cash

balances have reduced to GBP2.6m at the balance sheet date (2022:

GBP4.4m), which reflects a total dividend paid in the 6 months

period of GBP0.7m (2022 GBP0.7m). The future cash position remains

robust.

The going concern assessment made at the year ended 31 March

2023 is still relevant to both current and future trading

expectations. This going concern assessment included in particular

a reverse stress test model which included the most extreme

scenario possible with all current client contracts discontinued at

expiry, with no extension or replacement and with no cost

mitigation. Following a review of these assessments in light of

current trading performance and cash flow forecasts for the next 12

months, the Directors have concluded that the Group would have

sufficient headroom and cash balances to continue in operation.

After making enquiries, the Directors have a reasonable

expectation that the Group has adequate resources to continue in

operational existence for the foreseeable future and at least

twelve months from the date of approval of the financial

statements. Accordingly, they continue to adopt the going concern

basis in preparing the half year accounts.

New standards, interpretations and amendments

The accounting policies applied in these financial statements

are as applied in the annual report and accounts for the year ended

31 March 2023.

2. Revenue

The Group operates solely in the UK. All material revenues are

generated in the UK.

In accordance with IFRS 15, the Group disaggregates revenue by

contract type as management believe this best depicts how the

nature, timing and uncertainty of the Group's revenue and cash

flows are affected by economic factors. Accordingly, the following

table disaggregates the Group's revenue by contract type:

Group and Company Unaudited six months ended Unaudited six months ended 30 Audited year ended

30 September September 31 March

2023 2022 2023

GBP'000 GBP'000 GBP'000

Time and materials 6,161 7,043 14,386

Fixed price 234 62 442

Licencing (2) - 12

Permanent recruitment fees - 18 18

---------------------------- --------------------------- -------------------------------------- -------------------

6,393 7,123 14,858

---------------------------- --------------------------- -------------------------------------- -------------------

The Group also disaggregates revenue by operating sector

reflecting the different commercial risks (e.g., credit risk)

associated with each.

Group and Company Unaudited six months ended Unaudited six months ended 30 September Audited year ended

30 September 2022 31 March

2023 2023

GBP'000 GBP'000 GBP'000

Public sector 4,994 5,594 11,597

Private sector 1,399 1,529 3,261

------------------- --------------------------- ---------------------------------------- -------------------

6,393 7,123 14,858

------------------- --------------------------- ---------------------------------------- -------------------

3. Finance expense

Unaudited six months ended Unaudited six months ended 30 Audited year ended

30 September September 31 March

2023 2022 2023

GBP'000 GBP'000 GBP'000

Interest expense on lease

liability 27 10 44

Net foreign exchange gain - - (1)

--------------------------------- ---------------------------- -------------------------------- -------------------

Total finance expense 27 10 43

--------------------------------- ---------------------------- -------------------------------- -------------------

4. Tax charge/(credit)

Unaudited six months ended 30 Unaudited six months ended 30 Audited year ended

September 2023 September 31 March

2022 2023

GBP'000 GBP'000 GBP'000

Current tax

Current tax on profits for the - - -

period

Deferred tax

Decrease/(increase) in

recognised deferred tax asset 5 (2) 40

Change in tax rate - - 13

------------------------------- ------------------------------- ------------------------------- -------------------

Total tax charge/(credit) for

the period 5 (2) 53

------------------------------- ------------------------------- ------------------------------- -------------------

The differences between the actual tax charge for the period and

the standard rate of corporation tax in the UK applied to profits

for the period are as follows:

Unaudited six months ended 30 Unaudited six months ended 30 Audited year ended

September 2023 September 2022 31 March

2023

GBP'000 GBP'000 GBP'000

(Loss)/Profit before tax (994) (413) 9

(Loss)/Profit before tax

multiplied by standard rate

of corporation tax in the UK

of 25% (2022:19%) (249) (103) 2

Expenses not deductible for

tax purposes 6 44 4

Allowances recognised (3) (7) (13)

Derecognition of deferred tax

on losses 251 66 58

Change in tax rate - (3) 13

Prior year adjustments - 1 (11)

Tax charge/(credit) for the

period 5 (2) 53

------------------------------- ------------------------------- ------------------------------- -------------------

Unaudited six months ended 30 Unaudited six months ended 30 Audited year ended

September 2023 September 2022 31 March

2023

GBP'000 GBP'000 GBP'000

Deferred tax asset

The movement in deferred tax

is as follows:

At beginning of the period 108 161 161

Reversal of previously

recognised deferred tax on

losses (5) (1) (40)

Increase in relation to timing - 3 -

differences

Tax rate changes - - (13)

------------------------------- ------------------------------- ------------------------------- -------------------

At end of the period 103 163 108

------------------------------- ------------------------------- ------------------------------- -------------------

Deferred tax assets have been recognised in respect of tax

losses where the Directors believe it is probable that the assets

will be recovered. This expectation of recovery is calculated by

modelling estimates of future taxable profits that can be offset

with historic trading losses brought forward. A deferred tax asset

amounting to GBP689,022 (2022: GBP530,000) has not been recognised

in respect of trading losses of GBP2,756,089 (2022: GBP2,125,000),

which can be carried forward indefinitely.

Deferred tax assets have not been recognised for potential

temporary differences arising from unexercised share options and

restricted stock units of GBP114k (2022: GBP107k) and general

provisions of GBP27k (2022: GBP24k) as the Directors believe it is

not certain these assets will be recovered.

The UK Budget on 3 March 2021 announced an increase in the UK

corporation tax rate from 19% to 25% with effect from 1 April 2023.

The effect of the rate increase is reflected in the consolidated

financial statements as has been substantively enacted at the

balance sheet date.

5. Dividends

The Directors propose an interim dividend for the period to 30

September 2023 of 2p per share (2022 interim dividend: 2p per

share).

The Company will pay the dividend on 31 January 2024 to all

shareholders on the register of members of the Company at the close

of business on 5 January 2024. The ex-dividend date will be on 4

January 2024.

6. Earnings per ordinary share

Earnings per share have been calculated on the profit for the

year divided by the weighted average number of shares in issue

during the period based on the following:

Unaudited 30 Unaudited 30 Audited 31 March

September 2023 September 2022 2023

Loss for the period (GBP999,000) (GBP411,000) (GBP44,000)

---------------------------- ---------------------------- ---------------------------- ----------------------------

Average number of shares in

issue 16,571,366 16,554,727 16,565,870

Effect of dilutive options - - -

---------------------------- ---------------------------- ---------------------------- ----------------------------

Average number of shares in

issue plus dilutive

options 16,571,366 16,554,727 16,565,870

---------------------------- ---------------------------- ---------------------------- ----------------------------

Basic loss per share (6.03p) (2.48p) (0.27p)

---------------------------- ---------------------------- ---------------------------- ----------------------------

Diluted loss per share (6.03p) (2.48p) (0.27p)

---------------------------- ---------------------------- ---------------------------- ----------------------------

7. Leases

Right-of-use Assets

The carrying amounts of the right-of-use assets recognised and

the movements during the period are outlined below:

Land and buildings Total

GBP'000 GBP'000

At 31 March 2022

Opening position 345 345

Amortisation (94) (94)

---------------------- ------------------- --------

At 30 September 2022 251 251

---------------------- ------------------- --------

At 31 March 2023

Opening position 572 572

Amortisation (91) (91)

---------------------- ------------------- --------

At 30 September 2023 481 481

---------------------- ------------------- --------

As of 6th October 2022, the lease break option on one lease was

not enacted, and the lease continues until 27th March 2028. As of

this date, the total asset value was increased by GBP412,000.

Lease Liabilities

The carrying amounts of the lease liabilities recognised are as

follows:

Land and buildings Total

GBP'000 GBP'000

At 31 March 2022

Opening position 426 426

Interest expense 11 11

Lease payments (172) (172)

---------------------- ------------------- --------

At 30 September 2022 265 265

---------------------- ------------------- --------

At 31 March 2023

Opening position 1,046 1,046

Interest expense 27 27

Lease payments (172) (172)

---------------------- ------------------- --------

At 30 September 2023 901 901

---------------------- ------------------- --------

As of 6th October 2022, the lease break option on one premises

was not enacted, and the lease continues until 27th March 2028. As

of this date, the total lease liability was increased by

GBP920,000.

At the balance sheet date, the Group had outstanding commitments

for future lease payments as follows:

At 30 September 2022 Up to 3 months Between 3 and 12 months Between 1 and 2 years

GBP'000 GBP'000 GBP'000

-------------------------------- --------------- ------------------------ ----------------------

Discounted lease liabilities 79 89 97

-------------------------------- --------------- ------------------------ ----------------------

Undiscounted lease liabilities 86 97 102

-------------------------------- --------------- ------------------------ ----------------------

At 30 September 2023 Up to 3 months Between 3 and 12 months Between 1 and 2 years Between 2 and 5 years

GBP'000 GBP'000 GBP'000 GBP'000

--------------------------- --------------- ------------------------ ---------------------- ----------------------

Discounted lease

liabilities 74 197 184 446

--------------------------- --------------- ------------------------ ---------------------- ----------------------

Undiscounted lease

liabilities 86 231 215 484

--------------------------- --------------- ------------------------ ---------------------- ----------------------

Finance lease receivables

The carrying amounts of the lease receivable asset are as

follows:

Land and buildings Total

GBP'000 GBP'000

At 31 March 2022

Opening position 84 84

Interest received 2 2

Payments received (57) (57)

---------------------- ------------------- --------

At 30 September 2022 29 29

---------------------- ------------------- --------

At 31 March 2023

Opening position 490 490

Interest received 13 13

Payments received (59) (59)

---------------------- ------------------- --------

At 30 September 2023 444 444

---------------------- ------------------- --------

As of 2nd October 2022, the lease break option on one premises

was not enacted by the tenant, and the lease continues until 23rd

March 2028. As of this date, the total finance lease receivable was

increased by GBP508,000.

At the balance sheet date, the Group had future lease

receivables as follows:

At 30 September 2022 Up to 3 months

GBP'000

-------------------------------- ---------------

Discounted lease receivables 29

-------------------------------- ---------------

Undiscounted lease receivables 30

-------------------------------- ---------------

At 30 September 2023 Up to 3 months Between 3 and 12 months Between 1 and 2 years Between 2 and 5 years

GBP'000 GBP'000 GBP'000 GBP'000

--------------------------- --------------- ------------------------ ---------------------- ----------------------

Discounted lease

receivables 24 72 101 247

--------------------------- --------------- ------------------------ ---------------------- ----------------------

Undiscounted lease

receivables 30 89 119 267

--------------------------- --------------- ------------------------ ---------------------- ----------------------

8. Trade and other receivables

Audited year ended

Unaudited six months ended 30 Unaudited six months ended 30 31 March

September 2023 September 2022 2023

GBP'000 GBP'000 GBP'000

Trade receivables 1,643 1,241 2,006

Less: provision for expected

credit losses (5) (14) (5)

-------------------------------- ------------------------------ ------------------------------- -------------------

Trade receivables-net 1,638 1,227 2,001

Contract assets 603 548 225

Unbilled income 1 141 150

Other debtors 5 160 -

-------------------------------- ------------------------------ ------------------------------- -------------------

Trade and other receivables 2,247 2,076 2,376

Prepayments 282 218 165

-------------------------------- ------------------------------ ------------------------------- -------------------

2,529 2,294 2,541

-------------------------------- ------------------------------ ------------------------------- -------------------

Analysed as:

Current asset 2,529 2,294 2,541

-------------------------------- ------------------------------ ------------------------------- -------------------

Total 2,529 2,294 2,541

-------------------------------- ------------------------------ ------------------------------- -------------------

The fair value of trade and other receivables approximates

closely to their book value.

Unbilled income is in respect to the billing profile of a

licence agreement.

Movements on the provision for expected credit loss are as

follows:

Audited year ended

Unaudited six months ended 30 Unaudited six months ended 30 31 March

September 2023 September 2022 2023

GBP'000 GBP'000 GBP'000

At beginning of the period 5 14 14

Credited to income statement - - (9)

At end of the period (credit

loss allowance) 5 14 5

------------------------------- ------------------------------- ------------------------------- -------------------

The carrying amount of the Group's trade and other receivables

are denominated in the following currencies:

Audited year ended

Unaudited six months ended 30 September Unaudited six months ended 30 September 31 March

2023 2022 2023

GBP'000 GBP'000 GBP'000

Sterling 2,222 2,076 2,376

Euros 25 - -

---------- ----------------------------------------- ------------------------------------------ -------------------

2,247 2,076 2,376

---------- ----------------------------------------- ------------------------------------------ -------------------

9. Trade and other payables

Audited year ended

Unaudited six months ended 30 Unaudited six months ended 30 31 March

September 2023 September 2022 2023

GBP'000 GBP'000 GBP'000

Trade payables 606 524 666

Accruals 165 301 335

771 825 1,001

Contract liabilities 33 81 37

Other taxation and social

security 806 909 1,231

-------------------------------- ------------------------------ ------------------------------- -------------------

1,610 1,815 2,269

-------------------------------- ------------------------------ ------------------------------- -------------------

Analysed as:

Current liability 1,610 1,815 2,269

Total 1,610 1,815 2,269

-------------------------------- ------------------------------ ------------------------------- -------------------

The majority of trade and other payables are settled within

three months from the period end.

The fair value of trade and other payables approximates closely

to their book value.

The carrying amount of trade and other payables is denominated

in the following currencies:

Audited year ended

Unaudited six months ended 30 September Unaudited six months ended 30 September 31 March

2023 2022 2023

GBP'000 GBP'000 GBP'000

Sterling 641 825 1,001

Euros 130 - -

---------- ----------------------------------------- ------------------------------------------ -------------------

771 825 1,001

---------- ----------------------------------------- ------------------------------------------ -------------------

10. Related party transactions and ultimate control

The Group and Company rents one of its offices under a lease

with a sub-tenant in occupation on one floor. The current annual

rent of GBP215,000 was fixed, by independent valuation, at the last

rent review in 2008. J C Rigg, a Director, has notified the Board

that he has a 50% beneficial interest in this contract. The balance

owed at the period end was GBPnil (2022: GBPnil). There is no

ultimate controlling party.

11. Statement of the directors' responsibilities

The Board confirms to the best of their knowledge:

-- that the condensed consolidated half year financial

statements for the six months to 30 September 2023 have been

prepared in accordance with IAS 34 'Interim Financial Reporting' as

per UK adopted international accounting standards; and

-- that the Half Year Report includes a fair review of the

information required by sections 4.2.7R and 4.2.8R of the

Disclosure and Transparency Rules, being an indication of important

events that have occurred during the period and their impact on the

condensed consolidated half year financial statements; a

description of the principal risks and uncertainties for the

remainder of the current financial year; and the disclosure

requirements in respect of material related party transactions.

By order of the Board

James McDonald

Company Secretary

19 December 2023

Names of the current Board of Directors can be found on the

Company website at www.triad.co.uk .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UKOARORUUAAA

(END) Dow Jones Newswires

December 20, 2023 02:00 ET (07:00 GMT)

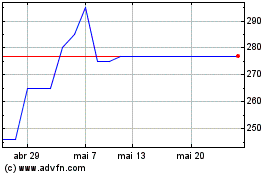

Triad (LSE:TRD)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Triad (LSE:TRD)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025