TIDMBLOE

RNS Number : 7524Z

Block Energy PLC

16 January 2024

16 January 2024

Block Energy plc

("Block" or the "Company")

Study Concludes Block XIB Offers Commercial Carbon Capture and

Storage Opportunity

Block Energy plc, the development and production company focused

on Georgia, is pleased to announce a study identifying a Carbon

Capture and Storage ("CCS") opportunity within the Company's Block

XIB with the potential to support a major net-zero CO(2) industrial

hub.

The study, commissioned by the Company, estimates a CO(2)

storage capacity ranking - at both reservoir and basin scales -

amongst the highest in Europe. The reservoir scale storage is

estimated at 256 million metric tonnes, equivalent to offsetting

emissions from 55 million cars, and the basin scale at up to 8.7

gigatonnes, equivalent to offsetting emissions from Turkey for 20

years.

The research suggests Block XIB is best suited to the Mineral

Trapping (Mineralisation) method whereby CO(2) is injected with

water and mineralises as solid carbonates, a technique successfully

used in Iceland to permanently inject 100,000 tonnes of CO(2) to

date into basaltic rock.

The Middle Eocene volcaniclastics facilitate the movement and

efficient containment of injected CO(2) and sections are abundant

with Zeolites, highly reactive minerals, enriched with substantial

calcium, that enhance the potential for successful and sustainable

CCS by Mineralisation.

These and other supportive geological features, including an

active aquifer and ideal pressure and temperature conditions,

indicate the possibility for a very rapid rate of carbonation:

initial calculations show 95% mineralisation of CO(2) within 250

days, compared to 1,000 years in sedimentary systems. Carbon

storage capacity could be further enhanced by localised dissolution

of fractures, increasing pore space and pore volume.

The study, commissioned in the course of the Company's Project

III development planning, was undertaken by Oilfield Production

Consultant ("OPC"), a consultancy recognised internationally for

its expertise and experience in this field.

OPC have worked on the White Rose, Golden Eye, Gorgon and Viking

projects, as well as on projects in the Gulf of Mexico. The study

was led by Professor Eric Oelkers, a recognised expert in the field

of water-rock interactions.

Block Energy plc's Chief Executive Officer, Paul Haywood,

said:

"The CCS study opens another significant commercial opportunity

for the Company while underlining our commitment to

sustainability.

"The study highlights that Block XIB's storage potential could

be amongst the largest in Europe, indicating the prospect of a

major net-zero industrial hub within central Georgia - of interest

to the hydrogen, fertiliser, steel and refined petroleum products

industries - close to the XIB license."

**ENDS**

Stephen James BSc, MBA, PhD (Block's Subsurface Manager) has

reviewed the reserve, resource and production information contained

in this announcement. Dr James is a geoscientist with over 40 years

of experience in field development and reservoir management.

THIS ANNOUNCEMENT CONTAINS INFORMATION PREVIOUSLY DEEMED BY THE

COMPANY TO BE INSIDE INFORMATION AS STIPULATED UNDER THE UK VERSION

OF THE MARKET ABUSE REGULATION NO 596/2014 WHICH IS PART OF ENGLISH

LAW BY VIRTUE OF THE EUROPEAN (WITHDRAWAL) ACT 2018, AS AMENDED.

WITH THE PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY

INFORMATION SERVICE, SUCH INFORMATION IS CONSIDERED TO BE IN THE

PUBLIC DOMAIN.

For further information please visit

http://www.blockenergy.co.uk/ or contact:

Paul Haywood Block Energy plc Tel: +44 (0)20

(Chief Executive 3468 9891

Officer)

Neil Baldwin Spark Advisory Partners Tel: +44 (0)20

(Nominated Adviser) Limited 3368 3554

Peter Krens Tennyson Securities Tel: +44 (0)20

(Corporate Broker) 7186 9030

P hilip Dennis C elicourt Communications Tel: +44 (0)20

/ M ark Antelme 7770 6424

/ Ali AlQahtani

(Financial PR)

Notes to editors

Block Energy plc is an AIM-listed independent oil and gas

company focused on production and development in Georgia, applying

innovative technology to realise the full potential of previously

discovered fields.

Block has a 100% working interest in Georgian onshore licence

blocks IX and XIB. Licence block XIB is Georgia's most productive

block. During the mid-1980s, production peaked at 67,000 bopd and

cumulative production reached 100 MMbbls and 80 MMbbls of oil from

the Patardzeuli and Samgori fields, respectively. The remaining 2P

reserves across block XIB are 64 MMboe, comprising 2P oil reserves

of 36 MMbbls and 2P gas reserves of 28 MMboe. (Source: CPR Bayphase

Limited: 1 July 2015). Additionally, following an internal

technical study designed to evaluate and quantify the undrained oil

potential of the Middle Eocene within the Patardzeuli field, the

Company has estimated gross unrisked 2C contingent resources of 200

MMbbls of oil.

The Company has a 100% working interest in licence block XIF

containing the West Rustavi onshore oil and gas field. Multiple

wells have tested oil and gas from a range of geological horizons.

The field has so far produced over 75 Mbbls of light sweet crude

and has 0.9 MMbbls of gross 2P oil reserves in the Middle Eocene.

It also has 38 MMbbls of gross unrisked 2C contingent resources of

oil and 608 Bcf of gross unrisked 2C contingent resources of gas in

the Middle, Upper and Lower Eocene formations (Source: CPR

Gustavson Associates: 1 January 2018).

Block also holds 100% and 90% working interests respectively in

the onshore oil producing Norio and Satskhenisi fields.

Project I is focused on developing oil production from the

Middle Eocene reservoir of the West Rustavi/Krtsanisi field.

Project II aims to redevelop the Middle Eocene reservoir of the

Patardzeuli and Samgori fields.

Project III is focused on the undeveloped gas-bearing natural

fracture system within the Lower Eocene and Upper Cretaceous

reservoirs - each more than a kilometre thick - spanning the XIB

and XIF blocks.

Project IV is focused on exploring the full potential of our

licences, including licence IX and Didi Lilo where we have

identified significant prospectivity.

The Company offers a clear entry point for investors to gain

exposure to Georgia's growing economy and the strong regional

demand for oil and gas.

Glossary

-- bbls: barrels. A barrel is 35 imperial gallons.

-- Bcf: billion cubic feet.

-- boe: barrels of oil equivalent.

-- boepd: barrels of oil equivalent per day.

-- bopd: barrels of oil per day.

-- Mbbls: thousand barrels.

-- Mboe: thousand barrels of oil equivalent.

-- Mcf: thousand cubic feet.

-- MD: measured depth.

-- MMbbls: million barrels.

-- MMboe: million barrels of oil equivalent.

-- MMcf: million cubic feet.

-- TVD: True Vertical Depth.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

STRBRGDBXGBDGSU

(END) Dow Jones Newswires

January 16, 2024 02:00 ET (07:00 GMT)

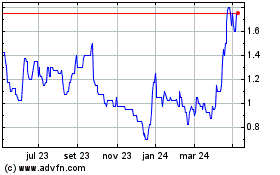

Block Energy (LSE:BLOE)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

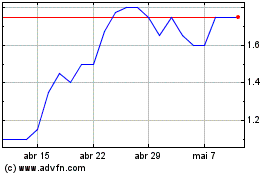

Block Energy (LSE:BLOE)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025