TIDMALK

RNS Number : 0699A

Alkemy Capital Investments PLC

18 January 2024

18 January 2024

Alkemy Capital Investments Plc

Corporate Update

Alkemy Capital Investments plc ("Alkemy") (LSE: ALK) (FRA:JV2)

is pleased to provide a corporate and strategic update.

HIGHLIGHTS

-- Macro outlook for lithium processing remains extremely robust

despite a recent fall in lithium prices, with European demand for

lithium remaining on an unprecedented upward trajectory.

-- Tees Valley Lithium's refinery at the Wilton International

Chemicals Park in Teesside is a refinery of strategic importance in

Europe, having already secured environmental and planning

permission, and will create over 1,000 local jobs in the UK when in

full production in 2026.

-- Feedstock has been secured for the Wilton refinery's first train from global leader Wogen.

-- Project financing discussions advancing with multiple

potential providers of debt, strategic equity and green bond

finance; mezzanine finance discussions with tier one financial

institutions progressing well.

-- Port Hedland Lithium's refinery at the Boodarie Strategic

Industrial Area in Port Hedland provides a mid-stream solution for

Australia's spodumene miners with direct access to the European

premium market and a low-carbon feedstock supply for TVL's Wilton

refinery.

-- Alkemy is actively exploring opportunities to expand its

downstream processing strategy to other key critical battery

minerals in conjunction with strategic and industry partners.

Chairman Paul Atherley commented:

"Since the inception of our company, we have made excellent

progress in advancing our lithium refinery projects, including

securing key sites in Teesside and Port Hedland, receiving planning

and environmental permissions, securing feedstock and establishing

other key strategic partnerships along with key governmental,

industry and media recognition, reflecting our commitment to

becoming a leader in the low-carbon production of battery-grade

lithium hydroxide.

The success of these strategic initiatives and partnerships

places us at the forefront of Europe's critical minerals processing

sector, and we are now poised to replicate this success across

other key critical battery minerals, that could deliver for Alkemy

a potentially transformational multi-minerals strategy.

In the short term we remain focussed on securing mezzanine

finance to advance the project and I am pleased to report that we

are making excellent progress with several tier one financial

institutions on this front."

Macro outlook for lithium processing remains robust despite the

recent downturn in lithium prices

Despite recent market shifts, European demand for lithium

remains on an unprecedented upward trajectory. With the UK and EU's

transition towards electric vehicles (EVs), there's a forecasted

demand for lithium that far exceeds current supply

capabilities.

The UK and European Commission's move to ban combustion engine

cars by 2035 is a significant catalyst, signalling a shift towards

a more sustainable and electric future. This policy change, along

with similar initiatives worldwide, is expected to fuel a

consistent and growing demand for lithium.

As Europe's car makers make the switch to EVs to meet this

burgeoning demand there is over 700GW of gigafactory capacity

either in construction or planned to provide the batteries for

these EVs. These gigafactories will require over 650,000 tonnes of

locally refined lithium per year in the form of either hydroxide or

carbonate depending on the type of vehicle. Currently the UK and

Europe has very limited lithium refining capacity.

Building a European lithium processing facility will reduce the

regional dependence on China, which currently controls 90% of the

world's lithium refining capacity.

Recognising the escalating demand for lithium, Alkemy has been

actively developing its lithium refining portfolio through Tees

Valley Lithium (TVL) and Port Hedland Lithium (PHL). Alkemy's focus

is not just on meeting the immediate market needs but on

establishing a supply chain that is resilient, environmentally

responsible, and capable of adapting to the rapidly evolving energy

landscape.

TVL's processing refinery in Teesside is expected to produce

enough lithium hydroxide to supply 100% of the forecasted

automotive demand in the UK by 2030, with a further 35% of its

total production available for export to other countries in Europe

and elsewhere.

Feedstock secured for TVL's Teesside refinery

TVL has reached an agreement in principle with international

trading house Wogen for the supply of technical grade lithium

carbonate to TVL's merchant refinery at Wilton.

Wogen is a leading international trader of off-exchange

specialty metals and minerals, with a long history and

well-established presence in the battery metals market across Asia,

the United States and Europe. Wogen has an active trading book in

lithium products procuring from an array of producing countries and

selling into the battery supply chain.

Wogen intends to supply up to 20,000 tonnes of technical grade

lithium carbonate feedstock per annum, for an initial period of

five years. The supply will be sufficient to fill the first of the

proposed four trains at Wilton producing around 24,000 tonnes of

battery grade lithium hydroxide or lithium carbonate

equivalent.

TVL's partnership with Wogen ensures a reliable supply of

lithium, critical for its first production train. This partnership

is however more than just a supply agreement: it's a strategic

alignment that ensures a steady and sustainable flow of lithium to

TVL's Teesside refinery. This collaboration is critical in

establishing a reliable and ethical supply chain which is crucial

in the volatile commodity market. Wogen, known for its global reach

and expertise in speciality metals and minerals, brings not just

the supply security but also a wealth of industry knowledge and

market insight.

This partnership, combined with ongoing dialogues with other

industry leaders, will propel Alkemy forward in its mission to

become a significant force in the battery minerals sector,

underpinning the Alkemy group's commitment to sustainability and

ethical sourcing.

Project and mezzanine funding discussions are progressing

well

TVL is in discussions with a number of leading financial

institutions for the financing of its Wilton refinery.

The $300m approximate capital cost of train 1 is expected to be

financed largely through green bonds (for which TVL will seek

accreditation) combined with a mix of debt, strategic equity

finance and grant funding, all at project level.

Having secured feedstock for its first train at Wilton, a key

component for these financing discussions, TVL is now working with

several leading financial institutions to obtain initial mezzanine

funding which will enable it to complete Front End Engineering

Design (FEED) and commence the purchase of key long lead items for

the refinery. Alkemy is currently making excellent progress in

these discussions and will update the market as soon as this key

piece of funding is secured.

TVL's Teesside lithium refinery is of strategic importance for

the UK

The Critical Minerals Association United Kingdom (CMA), a key

interlocutor between the UK Government and the critical minerals

industry, has identified TVL's lithium refinery in Teesside as a

case study project that in its opinion will form a key strategic

component of the UK's critical minerals midstream processing and

refining sector.

In addition, the UK Automotive Transformation Fund (ATF), which

is designed to help fund the UK's automotive supply chain, has

approved TVL's initial expression of interest and TVL remains in

discussions with the ATF to secure a grant which will form part of

TVL's project financing package. The ATF is a funding programme

created to support large-scale industrialisation and will invest up

to GBP1 billion to develop a high-value end-to-end electrified

automotive supply chain in the UK.

The endorsement from the CMA and the engagement with the ATF are

testaments to the national significance of this project. It's not

just an industrial venture but a crucial part of the UK's strategic

move towards a sustainable automotive industry. TVL's refinery,

with its cutting-edge technology and capacity, is set to become a

cornerstone in the UK's industrial landscape, contributing

significantly to the country's environmental goals and its position

in the global battery supply chain.

Port Hedland Lithium provides a mid-stream solution for

Australia's spodumene miners with direct access to the premium

European market

The Western Australian government has allocated PHL an area of

approximately 43.7 hectares within the Boodarie Strategic

Industrial Area for the construction of its proposed Port Hedland

LSM refinery with Wave Engineering and GHD engaged to undertake the

engineering and planning approvals.

Port Hedland, Western Australia is the largest bulk export port

in the world, the largest container port in Australia and with the

planned US$470 million multi-user logistics hub at Lumsden Point it

is expected to become the world's biggest exporter of lithium.

PHL has been allocated land along with BP, POSCO, Fortescue

Metals and Alinta Energy with the aim of making Boodarie part of an

A$70 billion globally competitive Pilbara green industrial

precinct.

PHL represents a strategic initiative that transcends

geographical boundaries. It's a symbol of the new era of critical

mineral supply chains, effectively bridging the Australian mining

capabilities with the European automotive industry. This project

not only reinforces the strong trade relations between the UK and

Australia but also establishes a direct and efficient supply line

to Europe's rapidly expanding battery market.

The Port Hedland facility is poised to become a vital link in

the global supply chain of lithium, facilitating the transfer of

raw materials from one of the world's richest mining regions

directly to the heart of the UK and Europe's battery manufacturing

hub.

Alkemy to replicate downstream strategy in other key critical

battery minerals in conjunction with strategic partners

Building on the successful foundations laid by TVL and PHL,

Alkemy is actively exploring new horizons in the battery minerals

sector. Alkemy's vision extends beyond lithium to encompass a range

of critical battery minerals, positioning it as a diversified

leader in the energy transition sector.

Alkemy is committed to being a pivotal force in critical

minerals processing, guiding its portfolio companies towards not

only achieving operational excellence but also adhering to

sustainable practices in premium mineral production. Alkemy will

seek to nurture their growth and expansion, while strategically

forging partnerships to diversify and align its portfolio with the

evolving demands of the energy transition industry. Alkemy's focus

is steadfastly on driving consistent growth, ensuring global market

resilience, and fostering long-term value creation.

Alkemy continues to advance discussions with potential key

strategic and industry partners to develop additional downstream

processing refineries for other battery minerals. These projects

will build on the key relationships already in place between TVL

and its various stakeholders and will be fully complementary to

TVL's aims and objectives.

Alkemy expects to make further announcements in due course once

key agreements have been entered into.

Further information

For further information, please visit the Company's website:

www.alkemycapital.co.uk or www.teesvalleylithium.co.uk

-Ends-

Alkemy Capital Investments Plc Tel: 0207 317 0636

info@alkemycapital.co.uk

SI Capital Limited Tel: 0148 341 3500

VSA Capital Limited Tel: 0203 005 5000

ABOUT ALKEMY CAPITAL

Alkemy is seeking to establish independent and sustainable

lithium hydroxide production by developing lithium sulphate and

lithium hydroxide facilities in the UK and Australia.

Alkemy, through its wholly owned UK subsidiary Tees Valley

Lithium, has secured a 9.6 ha brownfields site with full planning

permission at the Wilton International Chemicals Park in Teesside,

a major UK Freeport, to build the UK's first and one of Europe's

largest lithium hydroxide processing facility.

Tees Valley Lithium has completed a Class 4 Feasibility Study

for its proposed lithium hydroxide refinery which will process

feedstock imported from various sources to produce 96,000 tonnes of

premium, low-carbon lithium hydroxide or an equivalent amount of

lithium carbonate annually, representing around 15% of Europe's

projected demand.

Alkemy, through its wholly owned Australian subsidiary Port

Hedland Lithium, has secured a 43.7 ha site at the Boodarie

strategic industry area, near Port Hedland, Western Australia to

build a world-class sustainable lithium sulphate refinery that will

provide reliable feedstock for Tees Valley Lithium's refinery.

Port Hedland Lithium has completed a Class 4 Feasibility Study

for its proposed lithium sulphate refinery, each train of which

will process spodumene concentrate to produce 40,000 tonnes of

lithium sulphate annually.

Forward Looking Statements

This news release contains forward--looking information. The

statements are based on reasonable assumptions and expectations of

management and Alkemy provides no assurance that actual events will

meet management's expectations. In certain cases, forward--looking

information may be identified by such terms as "anticipates",

"believes", "could", "estimates", "expects", "may", "shall",

"will", or "would". Although Alkemy believes the expectations

expressed in such forward--looking statements are based on

reasonable assumptions, such statements are not guarantees of

future performance and actual results or developments may differ

materially from those projected. In addition, factors that could

cause actual events to differ materially from the forward-looking

information stated herein include changes in market conditions,

changes in metal prices, general economic and political conditions,

environmental risks, and community and non-governmental actions.

Such factors will also affect whether Alkemy will ultimately

receive the benefits anticipated pursuant to relevant agreements.

This list is not exhaustive of the factors that may affect any of

the forward--looking statements. These and other factors should be

considered carefully and readers should not place undue reliance on

forward-looking information.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDBIGDBUXBDGSR

(END) Dow Jones Newswires

January 18, 2024 02:00 ET (07:00 GMT)

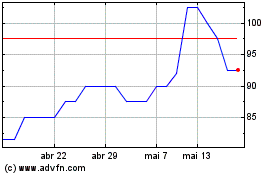

Alkemy Capital Investments (LSE:ALK)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Alkemy Capital Investments (LSE:ALK)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024