Societe Generale: Second quarter 2024 earnings

RESULTS AT 30 JUNE 2024

Press

release

Paris, 1 August 2024

QUARTERLY

RESULTS

Quarterly revenues of EUR 6.7

billion, up by +6.3% vs. Q2 23, driven by an

excellent quarter for Global Markets and Transaction Banking,

increased margins at Ayvens and NII recovery underway in France

despite facing headwinds from deposit beta and a slower loan

origination in a muted environment

Positive jaws,

tight grasp on operating expenses, up by +2.9% vs. Q2 23 and by

+0.7%* at constant perimeter and exchange rates

Cost-to-income ratio at 68.4% in

Q2 24, improving by 2.2 percentage points vs. Q2

23 and 6.5 percentage points vs Q1 241

Cost of risk at 26 basis points

in Q2 24, stock of provisions on performing loans

of EUR 3.2 billion

Group net income of EUR 1.1

billion, up +24% vs. Q2 23

Profitability (ROTE) at

7.4%

FIRST HALF 2024

RESULTS

Half-year revenues of EUR 13.3

billion, up +2.9% vs. H1 23

Positive jaws,

operating expenses slightly up by +0.6% vs. H1 23, down by -3.2%*

at constant perimeter and exchange rates

Cost-to-income ratio at 71.6% in

H1 24, improving by 1.7 percentage points vs. S1

231

Profitability (ROTE) at

5.8%

SOLID CAPITAL AND LIQUIDITY

PROFILE

CET1 ratio at

13.1%2 at end of Q2

24, around 285 basis points above the regulatory

requirement, and expected to be above 13% at

end-2024

Liquidity Coverage Ratio at 152% at

end-Q2 24

Provision for distribution of EUR

0.913 per share, at end-June

2024

Completion of the 2023 share buy-back

programme of around EUR 280 million

Slawomir Krupa, the Group’s Chief

Executive Officer, commented:

“In the second quarter, our commercial and financial performance is

significantly improving, in line with our 2024 targets and our 2026

roadmap. Our revenues are driven by an excellent quarter in Global

Banking and Investor Solutions, a sustained performance of our

international retail banking activities, higher margins at Ayvens,

while the net interest income is recovering in French retail

despite being still impacted by an increasing share of

interest-bearing deposits and a slower loan origination in a muted

environment. Growth in revenues, combined with our disciplined

costs and risks management, allows us to significantly improve our

cost-to-income ratio and profitability. Our capital and liquidity

ratios remain very strong. We continue to move forward in an

orderly and efficient manner with the implementation of our

strategic roadmap, as demonstrated in the sustained development of

BoursoBank which is exceeding the 6.5 million clients threshold,

and as shown by the launch of the first phase of our 1 billion

euros investment dedicated to the energy transition. We also

continue to simplify our business portfolio and are determined to

capitalize on those positive dynamics to pursue the successful

execution of our strategic plan in order to build a more profitable

bank and create more value over the long term for all our

stakeholders.”

-

GROUP CONSOLIDATED RESULTS

|

In EURm |

Q2 24 |

Q2 23 |

Change |

H1 24 |

H1 23 |

Change |

|

Net banking income |

6,685 |

6,287 |

+6.3% |

+4.8%* |

13,330 |

12,958 |

+2.9% |

-0.5%* |

|

Operating expenses |

(4,570) |

(4,441) |

+2.9% |

+0.7%* |

(9,550) |

(9,498) |

+0.6% |

-3.2%* |

|

Gross operating income |

2,115 |

1,846 |

+14.5% |

+15.0%* |

3,780 |

3,460 |

+9.2% |

+6.8%* |

|

Net cost of risk |

(387) |

(166) |

x2.3 |

x2.3* |

(787) |

(348) |

x2.3 |

x2.2* |

|

Operating income |

1,728 |

1,680 |

+2.8% |

+3.5%* |

2,993 |

3,112 |

-3.8% |

-6.2%* |

|

Net profits or losses from other assets |

(8) |

(81) |

+90.6% |

+90.9%* |

(88) |

(98) |

+10.6% |

+5.9%* |

|

Income tax |

(379) |

(425) |

-10.8% |

-10.3%* |

(653) |

(753) |

-13.2% |

-15.9%* |

|

Net income |

1,348 |

1,181 |

+14.1% |

+15.4%* |

2,265 |

2,273 |

-0.4% |

-2.7%* |

|

O.w. non-controlling interests |

235 |

281 |

-16.5% |

-25.3%* |

472 |

506 |

-6.7% |

-20.4%* |

|

Group net income |

1,113 |

900 |

+23.7% |

+29.5%* |

1,793 |

1,768 |

+1.4% |

+2.6%* |

|

ROE |

6.5% |

4.9% |

|

|

5.1% |

4.9% |

|

|

|

ROTE |

7.4% |

5.6% |

|

|

5.8% |

5.6% |

|

|

|

Cost to income |

68.4% |

70.6% |

|

|

71.6% |

73.3% |

|

|

Societe Generale’s Board of Directors, which met

under the chairmanship of Lorenzo Bini Smaghi on 31 July 2024,

examined Societe Generale Group’s results for the second quarter

and for the first half of 2024.

Net banking

income

Net banking income stood at EUR 6.7

billion, up by +6.3% vs. Q2 23.

Revenues of French Retail, Private

Banking and Insurance were up by +1.1% vs. Q2 23 and

totalled EUR 2.1 billion in Q2 24. Still penalised by the residual

impact of short-term hedges booked until the beginning of 2022

(around EUR -150 million over the quarter), net interest income

continued to recover in Q2 24 (+10% vs. Q2 23) despite an

increasing share of interest-bearing deposits and a muted loan

environment in a competitive market on the other hand. Assets under

management in the Private Banking and Insurance

businesses increased sharply over the quarter, respectively by +6%

and +7% in Q2 24 vs. Q2 23. Last, BoursoBank

continued its sustained client acquisition with more than 300,000

new clients over the quarter, allowing to reach over 6.5 million

clients at the end of Q2 24.

Global Banking and Investor

Solutions registered a sharp +10.0% increase in revenues

in Q2 24 relative to Q2 23. Revenues totalled EUR 2.6 billion over

the quarter, driven by an excellent performance of Global

Markets and Global Transaction & Payment

Services’ activities, which increased respectively by

+15.7% and +13.5% vs. Q2 23. On Global Markets, revenues of equity

businesses grew by +24%, driven by high volumes in a conducive

environment. Fixed income and currencies businesses increased by

+3% in a context of spread tightening on rates and low volatility

on foreign exchange. Financing and Advisory turned

in a solid performance with revenues of EUR 879 million, up by 2.9%

relative to an already high level in Q2 23. Revenues were driven by

a strong quarter for securitization, a rebound in investment

banking activities and ongoing sustained commercial momentum for

financing activities. Global Transaction & Payment

Services’ activities posted a +13.5% increase in revenues

vs. Q2 23, driven by favourable market environment and a sustained

commercial development across the board.

Mobility, International

Retail Banking and Financial Services’ revenues were down

by -2.3% vs. Q2 23. International Retail

Banking’s revenues stood at EUR 1.0 billion, which is

stable vs. Q2 23, notably on the back of a favourable environment

in Romania and Africa. Revenues for the Mobility and

Financial Services’ businesses contracted by -4.0% vs. Q2

23 owing to the high base effect of around EUR 200 million on

Ayvens whose revenues notably benefited in Q2 23 from significant

positive impacts associated with reduction in depreciation costs

(around EUR +160 million in Q2 23), while they were negatively

impacted by almost EUR 40 million in Q2 24 on the back of

hyperinflation in Turkey. Excluding these items, Ayvens’ margins

increased sharply over the quarter relative to Q1 24 and the used

car sales results pursued their normalisation with an average

result per unit at EUR 1,4804 in Q2 24.

The Corporate Centre recorded

revenues of EUR -206 million in Q2 24.

Over the first half of the year, net

banking income increased by +2.9% vs. H1 23.

Operating

expenses

Operating expenses came to EUR 4,570

million in Q2 24, up +2.9% vs. Q2 23.

They include around EUR 105 million perimeter

effect from the integration of LeasePlan and Bernstein activities.

The slight increase in Q2 24 operating expenses is mainly explained

by the increase of EUR 81 million in expenses related to variable

remuneration and the employee profit sharing scheme in France, in

line with the Group’s performance. Adjusted for these items,

operating expenses decreased by EUR -56 million in Q2 24 vs. Q2

23.

The cost-to-income ratio stood at 68.4%

in Q2 24, down vs. Q2 23 (70.6%) and Q1 24 (74.9%).

Over the first half of the

year, operating expenses rose slightly (+0.6% vs. H1 23)

and the cost-to-income ratio came to 71.6% (vs. 73.3% for H1

23).

Cost of

risk

The cost of risk reached 26 basis points

in Q2 24, or EUR 387 million, which is within the

anticipated range of between 25 and 30 basis points for 2024. It

breaks down as a EUR 501 million provision for doubtful loans

(around 34 basis points), which includes the impact of specific

market files in France, and a EUR -114 million reversal on

performing loan outstandings (around -8 basis points).

At 30 June 2024, the Group’s provisions on

performing loans amounted to EUR 3,178 million, down

EUR -394 million relative to 31 December 2023, mainly owing to the

application of IFRS 5 accounting standards for activities under

disposal.

The gross non-performing loan ratio stood at

3.0%5,6 at 30 June 2024. The net

coverage ratio on the Group’s non-performing loans stood at

80%7 at 30 June 2024 (after netting of guarantees and

collateral).

Group net

income

Group net income stood at EUR 1,113

million for the quarter, up by +24% vs. Q2 23,

corresponding to a Return on Tangible Equity (ROTE) of 7.4%.

Over the first half of the year, Group

net income stood at EUR 1,793 million, equating to a

Return on Tangible Equity (ROTE) of 5.8%.

ESG

Societe Generale continues to successfully

execute its sustainability roadmap and has reached its EUR 300

billion sustainable finance target more than 18 months ahead of

schedule (initial target set between the end of 2021 and the end of

2025).

The Group is consistently recognised by

stakeholders for its leadership in ESG. It was recently rated as

the best diversified bank worldwide by Moody's ESG (with a score of

72/100) and was awarded for the "Best Transition Strategy" by

Euromoney for the third year in a row.

The recently announced acquisition of a majority

stake in Reed Management SAS illustrates the Group’s ambitions in

ESG. It bolsters the Group’s leadership in equity investment in

emerging leaders of the energy transition. This acquisition

represents a key milestone in the EUR 1 billion energy transition

investment8.

Lastly, the Group continues to strengthen the

support of its accompaniment of clients in their energy

transitions, offering them the most innovative and comprehensive

financing solutions and through new partnerships with relevant

actors of the transition.

2. THE

GROUP’S FINANCIAL STRUCTURE

At 30 June 2024, the Group’s Common

Equity Tier 1 ratio stood at 13.1%9, or around

285 basis points above the regulatory requirement. Likewise, the

Liquidity Coverage Ratio (LCR) was well above regulatory

requirements at 152% at end-June 2024 (149% on average for the

quarter), and the Net Stable Funding Ratio (NSFR) stood at 118% at

end-June 2024.

The Single Resolution Board notified Societe

Generale Group of the Minimum Requirement for Own Funds and

Eligible Liabilities (MREL) applicable from June 2024. The MREL

requirements were 23.27% of Group RWAs, in addition to the

CBR10 (vs. 22.96% previously), and at 6.23% of Group

leverage ratio exposure (vs. 6.08% previously). At end-Q2 24, the

MREL ratio stood at 33.1% of RWAs and 8.8% of leverage ratio

exposure, which is well above the regulatory requirement. In

addition, Societe Generale has chosen to waive the possibility

offered by Article 72b(3) of the Capital Requirements Regulation to

use senior preferred debt for compliance with its TLAC

requirement.

All liquidity and solvency ratios are well above the regulatory

requirements.

|

|

30/06/2024 |

31/12/2023 |

Current requirements |

|

CET1(1) |

13.1% |

13.1% |

10.26% |

|

CET1 fully loaded |

13.1% |

13.1% |

10.26% |

|

Tier 1 ratio |

15.7% |

15.6% |

12.19% |

|

Total Capital(1) |

18.5% |

18.2% |

14.75% |

|

Leverage ratio |

4.2% |

4.3% |

3.6% |

|

TLAC (% RWA)(1) |

28.4% |

31.9% |

22.33% |

|

TLAC (% leverage)(1) |

7.5% |

8.7% |

6.75% |

|

MREL (% RWA)(1) |

33.1% |

33.7% |

27.60% |

|

MREL (% leverage)(1) |

8.8% |

9.2% |

6.23% |

|

End of period LCR |

152% |

160% |

>100% |

|

Period average LCR |

149% |

155% |

>100% |

|

NSFR |

118% |

119% |

>100% |

|

In EURbn |

30/06/2024 |

31/12/2023 |

|

Total consolidated balance sheet |

1,592 |

1,554 |

|

Group shareholders’ equity |

67 |

66 |

|

Risk-weighted assets |

389 |

389 |

|

O.w. credit risk |

327 |

326 |

|

Total funded balance sheet |

965 |

970 |

|

Customer loans |

466 |

497 |

|

Customer deposits |

620 |

618 |

At 17 July 2024, the parent company has issued a

total of 34.0 billion of medium medium/long-term debt, of which EUR

17.6 billion of vanilla notes. The subsidiaries had issued EUR 4.0

billion. In all, the Group has issued a total of EUR 38.0 billion

of medium/long-term notes.

The Group is rated by four rating agencies: (i)

FitchRatings - long-term rating “A-”, positive outlook, senior

preferred debt rating “A”, short-term rating “F1” (ii) Moody’s -

long-term rating (senior preferred debt) “A1”, negative outlook,

short-term rating “P-1” (iii) R&I - long-term rating (senior

preferred debt) “A”, stable outlook; and (iv) S&P Global

Ratings - long-term rating (senior preferred debt) “A”, stable

outlook, short-term rating “A-1”.

3. FRENCH RETAIL,PRIVATE

BANKING AND INSURANCE

|

In EURm |

Q2 24 |

Q2 23 |

Change |

H1 24 |

H1 23 |

Change |

|

Net banking income |

2,125 |

2,103 |

+1.1% |

4,136 |

4,189 |

-1.3% |

|

Net banking income excl. PEL/CEL |

2,122 |

2,099 |

+1.1% |

4,133 |

4,195 |

-1.5% |

|

Operating expenses |

(1,649) |

(1,618) |

+1.9% |

(3,377) |

(3,464) |

-2.5% |

|

Gross operating income |

476 |

485 |

-1.7% |

759 |

725 |

+4.7% |

|

Net cost of risk |

(173) |

(110) |

+57.1% |

(420) |

(198) |

x 2.1 |

|

Operating income |

304 |

375 |

-19.0% |

339 |

527 |

-35.6% |

|

Net profits or losses from other assets |

8 |

(1) |

n/s |

8 |

3 |

x 2.4 |

|

Group net income |

236 |

279 |

-15.4% |

263 |

396 |

-33.6% |

|

RONE |

6.0% |

7.3% |

|

3.4% |

5.1% |

|

|

Cost to income |

77.6% |

77.0% |

|

81.7% |

82.7% |

|

Commercial

activity

SG Network, Private Banking and

Insurance

Average outstanding deposits of the SG Network

amounted to EUR 235 billion in Q2 24. Deposits increased by EUR 2

billion relative to Q1 24 (-2% vs. Q2 23), with a rise in

interest-bearing deposits and financial savings.

The SG Network’s average loan outstandings

contracted by -5% on the Q2 23 level to EUR 197 billion.

Outstanding loans to corporate and professional clients were stable

vs. Q2 23, excluding government-guaranteed PGE loans, the latter

having contracted by EUR 3 billion vs. Q2 23. Home loan production

continued its recovery, with a +49% increase over the quarter

relative to Q2 23, to levels that are still nonetheless around 65%

lower compared with 2021’s quarterly average.

As a result, the average loan to deposit ratio

came to 83.8% in Q2 24, down 2.7 percentage points compared to Q2

23.

Private Banking activities,

which include French and international activities, posted record

assets under management (AuM) of EUR 152 billion in Q2 24. The net

asset gathering pace (annualized net new money divided by AuM) has

risen by +6% since the start of the year, with net asset inflows

totalling EUR 2.2 billion in Q2 24. Net banking income came to EUR

377 million over the quarter, which is a -0.9% decrease vs.

Q2 23, and to EUR 753 million over the first half of the year,

a +0.7% increase vs. H1 23.

Insurance, which includes

French and international activities, posted very solid commercial

performances. Life insurance outstandings increased by +7% vs. Q2

23 to reach a record of EUR 143 billion at end-June 2024. The

unit-linked portion of 39% remains at a high level and rose by +1

percentage points vs. Q2 23. Gross life insurance savings inflows

amounted to EUR 5.3 billion in Q2 24, up sharply by +67% vs. Q2

23.

Risk life and property & casualty premia

grew by +3% vs. Q2 23.

BoursoBank

BoursoBank maintained a high acquisition pace

with more than 300,000 new clients in Q2 24, in line with its

strategic ambitions. The Bank demonstrates an efficient and well

monitored clients onboarding, with a -14% decrease in client

acquisition costs over the quarter compared with previous quarter.

The number of clients at BoursoBank topped 6.5 million at the end

of June 2024, a +31% increase vs. Q2 23.

As in previous quarters, BoursoBank continued to

gain market share and posted a lower churn rate of around 3%, which

is below the market rate.

Average loan outstandings were stable compared with Q2 23 level, at

EUR 15 billion in Q2 24. The rebound in loan production was

confirmed in Q2 24, both for home loans (+23.9% vs. Q1 24) and

consumer loans (+12.8% vs. Q1 24), albeit at lower levels than in

2021.

Average outstanding savings including deposits

and financial savings registered an increase by +14.6% vs. Q2 23,

to EUR 61 billion. Average deposit outstandings totalled

EUR 37 billion in Q2 24, on the back of a sharp increase in deposit

inflows over the period (+17.1% vs. Q2 23) thanks to robust inflow

momentum on interest-bearing deposits. Life insurance posted

average outstandings of EUR 12 billion in Q2 24 (o/w 46%

unit-linked products, a +3.8 percentage-point increase vs. Q2 23),

up by a sharp +6.5% vs. Q2 23 owing to high gross savings insurance

inflows over the quarter (+62.0% vs. Q2 23). The brokerage

activity registered more than 2.2 million transactions during the

quarter (+42% vs. Q2 23).

Revenues (excluding PEL/CEL and client

acquisition costs) rose by over +9.1% relative to Q2 23.

Net banking

income

Over the quarter, revenues came

to EUR 2,125 million, up +1.1% vs. Q2 23, excluding PEL/CEL. Net

interest income for French Retail, Private Banking and Insurance

increased by +10.6% vs. Q2 23 (+8.6% vs. Q1 24) to EUR

893 million in Q2 24 (including PEL/CEL). Fees11

were stable in Q2 23, but rose by +2.3% excluding BoursoBank client

acquisition costs (+1.3% vs. Q1 24).

Over the first half of

the year, revenues came to EUR 4,136 million, down -1.5%

vs. H1 23, excluding PEL/CEL. Net interest income excluding PEL/CEL

was up by +3.7% vs. H1 23. Fee income1 was up by +0.6% relative to

H1 23.

In the second quarter, the share of

interest-bearing deposits continued to increase and the loan

environment stayed subdued in a market that remained competitive.

In this context and based on the latest assumptions, the net

interest income for French Retail, Private Banking and Insurance is

expected, in our best estimate, around EUR 3.8 billion for

2024.

Operating

expenses

Over the quarter, operating

expenses came to EUR 1,649 million, up +1.9% vs. Q2 23. Adjusted

for the reversal of one-off EUR 60 million booked in Q2 23, they

contracted by -1.7%. Operating expenses for Q2 24 included EUR 45

million in transformation costs. The cost-to-income ratio reached

77.6% in Q2 24.

Over the first half of the

year, operating expenses totalled EUR 3,377 million (-2.5%

vs. H1 23). The cost-to-income ratio stood at 81.7% and improved by

1 percentage point vs. H1 23.

Cost of

risk

Over the quarter, the cost of

risk amounted to EUR 173 million or 29 basis points, which was

lower than in Q1 24 (41 basis points).

Over the first half of the

year, the cost of risk totalled EUR 420 million, or 35

basis points.

Group net

income

Over the quarter, Group net

income totalled EUR 236 million. RONE stood at 6.0% in Q2 24.

Over the first half of the

year, Group net income totalled EUR 263 million. RONE

stood at 3.4% in H1 24.

4. GLOBAL BANKING AND

INVESTOR SOLUTIONS

|

In EUR m |

Q2 24 |

Q2 23 |

Variation |

H1 24 |

H1 23 |

Change |

|

Net banking income |

2,621 |

2,383 |

+10.0% |

+8.6%* |

5,244 |

5,148 |

+1.9% |

+1.3%* |

|

Operating expenses |

(1,647) |

(1,638) |

+0.6% |

-0.6%* |

(3,404) |

(3,709) |

-8.2% |

-8.7%* |

|

Gross operating income |

973 |

745 |

+30.6% |

+28.9%* |

1,840 |

1,439 |

+27.9% |

+26.9%* |

|

Net cost of risk |

(21) |

27 |

n/s |

n/s |

(1) |

22 |

n/s |

n/s |

|

Operating income |

952 |

772 |

+23.3% |

+21.7%* |

1,839 |

1,461 |

+25.8% |

+24.8%* |

|

Reported Group net income |

770 |

620 |

+24.3% |

+23.1%* |

1,462 |

1,168 |

+25.1% |

+24.3%* |

|

RONE |

20.4% |

16.2% |

+0.0% |

+0.0%* |

19.5% |

15.0% |

+0.0% |

+0.0%* |

|

Cost to income |

62.9% |

68.7% |

+0.0% |

+0.0%* |

64.9% |

72.1% |

+0.0% |

+0.0%* |

Net banking

income

Global Banking and Investor

Solutions again delivered a very strong performance in the

second quarter, posting revenues of EUR 2,621million, up +10.0%

with respect to Q2 23.

Over the first half of

the year revenues grew by +1.9% vs. H1 23 (EUR 5,244

million vs. EUR 5,148 million).

Global Markets and Investor

Services recorded a rise in revenues of +14.0% to EUR

1,742 million over the quarter vs. Q2 23. Over H1 24, revenues

totalled EUR 3,485 million, i.e., a slight +1.1% increase vs.

H1 23. This growth was driven by Global

Markets which realized a very strong performance, posting

revenues of EUR 1,560 million in Q2 24 (up by a sharp +15.7% vs. Q2

23) thanks to conducive market conditions, notably for equities. In

H1 24, revenues were up +2.8% in comparison to H1 23 at EUR 3,142

million.

The Equities

business again delivered an excellent performance,

posting revenues of EUR 989 million in Q2 24, up +24.4% vs. Q2 23.

The business benefited from positive market conditions across all

activities. Over the first half of the year revenues grew by +14.2%

vs. H1 23 at EUR 1,858 million.

Fixed Income and Currencies

registered a good performance with revenues up by +3.0% to

EUR 571 million, notably owing to supportive client

activity in the investment solutions business which more than

offset the contraction in flow and hedging activities in a context

of tighter spreads in rates and low volatility on foreign exchange

rates. In H1 24 revenues were down -10.3% versus H1 23 at EUR 1,284

million.

Securities Services’ revenues

were up +1.1% in Q2 24 at EUR 181 million, but increased by +2.0%

excluding the impact of equity participations. Positive trend in

fee generation, but net interest income remained penalised by the

end of the remuneration of minimum reserve. Over the first half of

the year, revenues were down -12.0% and -1.4% excluding equity

participations. Assets under Custody and Assets under

Administration amounted to EUR 4,808 billion and EUR 598 billion,

respectively.

The Financing and Advisory

business posted revenues of EUR 879 million, up +2.9% vs.

Q2 23. Over the first half of the year, the contribution to Group

revenues totalled EUR 1,760 million, up by 3.4% vs. H1 23.

The Global Banking and Advisory

revenues were broadly stable relative to Q2 23. The business was

notably driven by the Asset-Backed Products platform which

delivered an excellent quarter and by a sharp rebound in the

Investment Banking business that was driven by Merger &

Acquisitions and Debt Capital Markets. However, volumes remained

low in the Equity Capital Markets activity. Financing activities

posted a sustained performance that was slightly down on the high

baseline in Q2 23. Over the first half of the year, revenues grew

by +1.1% vs. H1 23.

Global Transaction & Payment

Services again turned in a very robust performance

compared with Q2 23, posting a sharp +13.5% increase in

revenues driven by strong commercial momentum and durably

favourable market conditions amid ongoing high interest rates. In

H1 24, revenues were up +10.6% versus H1 23.

Operating

expenses

Operating expenses came to EUR 1,647

million over the quarter and included EUR 29

million in transformation costs. Operating expenses rose

slightly by +0.6% relative to Q2 23 and up +5.5% restated from Q2

23 one-offs and perimeter effect. The cost-to-income ratio came to

62.9% over the quarter.

Over the first half of 2024,

operating expenses contracted by -8.2% compared with H1 23

translating into a cost-to-income ratio, which came to 64.9% in H1

24.

Cost of

risk

Over the quarter, the cost of

risk was a very low EUR 21 million, or 5 basis points.

Over the first half of the

year, the cost of risk was EUR 1 million, or 0 basis

points.

Group net

income

Group net income totalled EUR 770

million in Q2 24, up strongly by +24.3% vs. Q2 23. Over

the first half of the year, Group net income rose by +25.1% to EUR

1,462 million.

Global Banking and Investor Solutions reported

RONE of 20.4% for the quarter and RONE of 19.5% for the

first half of the year.

5. MOBILITY,

INTERNATIONAL RETAIL BANKING AND FINANCIAL SERVICES

|

In EURm |

Q2 24 |

Q2 23 |

Change |

H1 24 |

H1 23 |

Change |

|

Net banking income |

2,145 |

2,196 |

-2.3% |

-5.7%* |

4,295 |

4,263 |

+0.8% |

-9.3%* |

|

Operating expenses |

(1,261) |

(1,153) |

+9.3% |

+3.4%* |

(2,611) |

(2,240) |

+16.6% |

+2.7%* |

|

Gross operating income |

884 |

1,043 |

-15.2% |

-15.6%* |

1,684 |

2,023 |

-16.8% |

-22.7%* |

|

Net cost of risk |

(189) |

(83) |

x 2.3 |

x 2.2* |

(370) |

(174) |

x 2.1 |

x 2.0* |

|

Operating income |

696 |

960 |

-27.5% |

-27.6%* |

1,313 |

1,849 |

-29.0% |

-34.7%* |

|

Non-controlling interests |

208 |

247 |

-15.9% |

-25.6%* |

400 |

437 |

-8.4% |

-24.1%* |

|

Reported Group net income |

316 |

473 |

-33.3% |

-28.6%* |

589 |

948 |

-37.9% |

-40.0%* |

|

RONE |

12.1% |

20.5% |

|

|

11.3% |

20.6% |

|

|

|

Cost to income |

58.8% |

52.5% |

|

|

60.8% |

52.5% |

|

|

Commercial

businesses

International Retail

Banking

International Retail

Banking12 continued its solid

performance in Q2 24, recording loan outstandings of EUR 67

billion, an increase of +1.4% compared with Q2 23 (+4.5%* vs. Q2

23). Outstanding deposits totalled EUR 83 billion in Q2 24, an

increase of +2.9% compared with Q2 23 (+6.5%* vs. Q2 23).

Europe posted solid commercial

momentum in all client segments for both entities, with growth in

total loan outstandings of +1.5% vs. Q2 23 (+5.9%*, outstandings of

EUR 42 billion in Q2 24) and growth of +3.3% in outstanding

deposits vs. Q2 23 (+7.7%*, outstandings of EUR 55 billion in Q2

24).

In Africa, Mediterranean Basin and

French Overseas Territories loan outstandings were up by

+2.2%* vs. Q2 23, with outstandings of EUR 25 billion in Q2 24.

Deposit outstandings stood at EUR 28 billion in Q2 24. They

increased overall by +4.2%* vs. Q2 23, with observable growth in

all segments across both the Mediterranean Basin and sub-Saharan

Africa.

Mobility and Financial

Services

Overall, Mobility and Financial

Services recorded good commercial performances.

Ayvens’ earning assets totalled EUR 53.2 billion

at end-June 2024, around +10% increase vs. end-June 2023 (around

+1% vs. Q1 24).

The Consumer Finance business

posted loans outstanding of EUR 23 billion at Q2 24, down -4.2%

vs. Q2 23 amid a durably challenging environment, notably

in France.

The Equipment Finance

outstandings at EUR 15 billion in Q2 24, recorded a slight rise

relative to the year-earlier period.

Net banking

income

Over the quarter,

Mobility, International Retail Banking and

Financial Services’ revenues decreased by -2.3% vs. Q2 23

to EUR 2,145 million.

Over the first half of the

year, revenues were at EUR 4,295 million, up by +0.8%

compared with the first six months of 2023.

International Retail Banking’s

net banking income was stable for the quarter vs. Q2 23 at

EUR 1,040 million but up by +3.5%* at constant perimeter

and exchange rates. Over the first half of the year, revenues came

to EUR 2,073 million, stable vs. H1 23 and up +3.5%* at constant

perimeter and exchange rates.

Europe posted solid revenues of

EUR 492 million for the second quarter of 2024, slightly up by

+0.8%* vs. Q2 23 (-3.3% at current exchange rates). Revenues were

driven by high fee income generated by KB and increased net

interest income in Romania, in contrast to the Czech Republic where

banks’ net interest income was negatively impacted by the end of

remuneration of minimum reserves.

Net banking income in Africa,

Mediterranean Basin and French Overseas

Territories rose by +5.9%* vs. Q2 23 to EUR 547 million in

Q2 24, driven by a sharp increase in fee income and a rise in net

interest income vs. Q2 23.

In Q2 24, Mobility and Financial

Services’ revenues decreased by -4.0% vs. Q2 23 to EUR

1,105 million. Over the first half of the year, they rose by +1.7%

to EUR 2,222 million.

Ayvens’ net banking income

decreased by -4.2%13 in Q2 24 vs. Q2

23. It includes changes in the perimeter and negative base effects

on non-recurring items. Compared to Q1 24, revenues restated from

non-recurring items increased by

+4.5%14. Ayvens posted a margin of 539

basis points15 this quarter, increasing

relative to Q1 24 (522 basis points)3, and generated EUR

27 million of additional synergies in line with the annual target

of EUR 120 million (EUR 47 million in H1 24). The average used car

sales result per vehicle (UCS) continued to normalise to EUR

1,48016 per unit in Q2 24 (excluding

the impact of reduction in depreciation costs and Purchase Price

Allocation) vs. EUR 1,661 in Q1 244.

Outstandings for the Consumer

Finance business decreased by -4,2% relative to Q2 23,

with revenues negatively impacted by a durably challenging

environment, notably in France, which resulted in a -4.9%

contraction in net banking income in Q2 24 vs. Q2 23.

Equipment Finance posted a net banking income

stable over the same period.

Operating

expenses

Over the quarter, operating

expenses came to EUR 1,261 million, up by +9,3% vs. Q2 23 (+3,4%*

at constant perimeter and exchange rates). They include the

integration of LeasePlan costs over a full quarter and EUR 50

million of transformation charges. The cost-to-income ratio came to

58.8% in Q2 24.

Over the first half of the

year, operating expenses came to EUR 2,611 million, up

+16.6% vs. H1 23.

International Retail Banking

recorded a controlled rise in operating expenses of +2.7% vs. Q2 23

amid an inflationary environment (EUR 596 million in Q2 24).

The Mobility and Financial

Services business recorded a +16.0% increase in operating

expenses over the quarter vs. Q2 23 at EUR 665 million, owing

notably to the integration of LeasePlan costs and related

transformation costs. Operating expenses were stable* vs. Q2 23 at

constant perimeter and exchange rates.

Cost of

risk

Over the quarter, the cost of

risk normalised to 45 basis points (or EUR 189 million).

Over the first half of

the year, the cost of risk stood at 44 basis points.

Group net

income

Over the quarter, Group net

income came to EUR 316 million. RONE was at 12.1% for the pillar in

Q2 24,15.4% in International Retail Banking, and 10.0% in

Mobility and Financial Services.

Over the first half of the

year, Group net income came to EUR 589 million. RONE stood

at 11.3% in H1 24. RONE was 13.8% in International Retail

Banking, and 9.7% in Mobility and Financial Services in

H1 24.

6. CORPORATE

CENTRE

|

In EURm |

Q2 24 |

Q2 23 |

Change |

H1 24 |

H1 23 |

Change |

|

Net banking income |

(206) |

(395) |

+47.7% |

+48.5%* |

(345) |

(642) |

+46.3% |

+47.0%* |

|

Operating expenses |

(13) |

(32) |

-57.9% |

-69.4%* |

(158) |

(85) |

+87.3% |

+78.8%* |

|

Gross operating income |

(220) |

(426) |

+48.5% |

+50.1%* |

(503) |

(727) |

+30.8% |

+32.5%* |

|

Net cost of risk |

(4) |

(0) |

n/s |

n/s |

5 |

2 |

n/s |

n/s |

|

Net profits or losses from other assets |

(15) |

(80) |

+81.1% |

+81.1%* |

(99) |

(100) |

+1.2% |

+1.2%* |

|

Income tax |

61 |

57 |

-6.6% |

-2.5%* |

145 |

129 |

-12.0% |

-8.8%* |

|

Reported Group net income |

(209) |

(472) |

+55.7% |

+56.9%* |

(521) |

(745) |

+30.2% |

+31.5%* |

The Corporate Centre includes:

- the property management of the

Group’s head office,

- the Group’s equity portfolio,

- the Treasury function for the

Group,

- certain costs related to

cross-functional projects, as well as several costs incurred by the

Group that are not re-invoiced to the businesses.

Net banking

income

The Corporate Centre’s net banking

income totalled EUR -206 million in Q2 24 vs. EUR -395

million in Q2 23.

Operating

expenses

Operating expenses totalled EUR -13

million in Q2 24 vs. EUR -32 million in Q2 23.

Group net

income

The Corporate Centre’s Group net income

totalled EUR -209 million in Q2 24 vs. EUR -472 million in

Q2 23.

Societe Generale received at the end of July

2024 proceeds of EUR 301 million closing out its remaining

exposures in Russia linked to its past local presence through

Rosbank. Those exposures which were either valued at zero or

provisioned in the Group accounts, have been recovered in

accordance with applicable regulations and after approvals of

regulatory authorities. The financial elements linked to this

operation will be booked in the third quarter 2024 accounts, they

will generate a positive contribution to the Group net income

comprised between EUR 200 and EUR 250 million after tax.

7. 2024 AND 2025

FINANCIAL CALENDAR

2024 and 2025 Financial communication calendar

|

31 October, 2024 Third quarter and nine month 2024 results

6 February, 2025 Fourth quarter and full year 2024 results

30 April, 2025 First quarter 2025 results |

The Alternative Performance Measures, notably the notions

of net banking income for the pillars, operating expenses, cost of

risk in basis points, ROE, ROTE, RONE, net assets and tangible net

assets are presented in the methodology notes, as are the

principles for the presentation of prudential ratios.

This document contains forward-looking statements relating to the

targets and strategies of the Societe Generale Group.

These forward-looking statements are based on a series of

assumptions, both general and specific, in particular the

application of accounting principles and methods in accordance with

IFRS (International Financial Reporting Standards) as adopted in

the European Union, as well as the application of existing

prudential regulations.

These forward-looking statements have also been developed from

scenarios based on a number of economic assumptions in the context

of a given competitive and regulatory environment. The Group may be

unable to:

- anticipate all the risks, uncertainties or other factors likely

to affect its business and to appraise their potential

consequences;

- evaluate the extent to which the occurrence of a risk or a

combination of risks could cause actual results to differ

materially from those provided in this document and the related

presentation.

Therefore, although Societe Generale believes that these statements

are based on reasonable assumptions, these forward-looking

statements are subject to numerous risks and uncertainties,

including matters not yet known to it or its management or not

currently considered material, and there can be no assurance that

anticipated events will occur or that the objectives set out will

actually be achieved. Important factors that could cause actual

results to differ materially from the results anticipated in the

forward-looking statements include, among others, overall trends in

general economic activity and in Societe Generale’s markets in

particular, regulatory and prudential changes, and the success of

Societe Generale’s strategic, operating and financial

initiatives.

More detailed information on the potential risks that could affect

Societe Generale’s financial results can be found in the section

“Risk Factors” in our Universal Registration Document filed with

the French Autorité des Marchés Financiers (which is available on

https://investors.societegenerale.com/en).

Investors are advised to take into account factors of uncertainty

and risk likely to impact the operations of the Group when

considering the information contained in such forward-looking

statements. Other than as required by applicable law, Societe

Generale does not undertake any obligation to update or revise any

forward-looking information or statements. Unless otherwise

specified, the sources for the business rankings and market

positions are internal. |

8. APPENDIX 1: FINANCIAL

DATA

GROUP NET INCOME BY CORE

BUSINESS

|

In EURm |

Q2 24 |

Q2 23 |

Variation |

H1 24 |

H1 23 |

Variation |

|

French Retail, Private Banking and Insurance |

236 |

279 |

-15.4% |

263 |

396 |

-33.6% |

|

Global Banking and Investor Solutions |

770 |

620 |

+24.3% |

1,462 |

1,168 |

+25.1% |

|

Mobility, International Retail Banking & Financial

Services |

316 |

473 |

-33.3% |

589 |

948 |

-37.9% |

|

Core Businesses |

1,322 |

1,372 |

-3.7% |

2,313 |

2,513 |

-7.9% |

|

Corporate Centre |

(209) |

(472) |

+55.7% |

(521) |

(745) |

+30.2% |

|

Group |

1,113 |

900 |

+23.7% |

1,793 |

1,768 |

+1.4% |

MAIN EXCEPTIONAL

ITEMS

|

In EURm |

Q2 24 |

Q2 23 |

H1 24 |

H1 23 |

|

Net Banking Income - Total exceptional items |

0 |

(240) |

0 |

(240) |

|

One-off legacy items - Corporate Centre |

0 |

(240) |

0 |

(240) |

|

|

|

|

|

|

|

Operating expenses - Total one-off items and transformation

charges |

(124) |

(271) |

(476) |

(517) |

|

Transformation charges |

(124) |

(236) |

(476) |

(482) |

|

Of which French Retail, Private Banking and Insurance |

(45) |

(134) |

(127) |

(284) |

|

Of which Global Banking & Investor Solutions |

(29) |

(32) |

(183) |

(61) |

|

Of which Mobility, International Retail Banking & Financial

Services |

(50) |

(70) |

(119) |

(137) |

|

Of which Corporate Centre |

0 |

0 |

(47) |

0 |

|

One-off items |

0 |

(35) |

0 |

(35) |

|

|

|

|

|

|

|

Other one-off items - Total |

0 |

(79) |

0 |

(79) |

|

Net profits or losses on other assets - Disposals |

0 |

(79) |

0 |

(79) |

CONSOLIDATED BALANCE

SHEET

|

In EUR m |

|

30.06.2024 |

31.12.2023 |

|

Cash, due from central banks |

|

223,220 |

223,048 |

|

Financial assets at fair value through profit or loss |

|

530,826 |

495,882 |

|

Hedging derivatives |

|

5,352 |

10,585 |

|

Financial assets at fair value through other comprehensive

income |

|

92,138 |

90,894 |

|

Securities at amortised cost |

|

30,353 |

28,147 |

|

Due from banks at amortised cost |

|

78,415 |

77,879 |

|

Customer loans at amortised cost |

|

455,438 |

485,449 |

|

Revaluation differences on portfolios hedged against interest rate

risk |

|

(1,259) |

(433) |

|

Insurance and reinsurance contracts assets |

|

473 |

459 |

|

Tax assets |

|

4,583 |

4,717 |

|

Other assets |

|

77,131 |

69,765 |

|

Non-current assets held for sale |

|

28,661 |

1,763 |

|

Investments accounted for using the equity method |

|

387 |

227 |

|

Tangible and intangible fixed assets |

|

61,356 |

60,714 |

|

Goodwill |

|

5,070 |

4,949 |

|

Total |

|

1,592,144 |

1,554,045 |

|

In EUR m |

|

30.06.2024 |

31.12.2023 |

|

Due to central banks |

|

9,522 |

9,718 |

|

Financial liabilities at fair value through profit or loss |

|

407,702 |

375,584 |

|

Hedging derivatives |

|

12,189 |

18,708 |

|

Debt securities issued |

|

161,886 |

160,506 |

|

Due to banks |

|

105,778 |

117,847 |

|

Customer deposits |

|

540,355 |

541,677 |

Revaluation differences on portfolios hedged

against interest rate risk |

|

(6,994) |

(5,857) |

|

Tax liabilities |

|

2,405 |

2,402 |

|

Other liabilities |

|

97,255 |

93,658 |

|

Non-current liabilities held for sale |

|

19,219 |

1,703 |

|

Insurance contracts related liabilities |

|

146,420 |

141,723 |

|

Provisions |

|

4,143 |

4,235 |

|

Subordinated debts |

|

15,852 |

15,894 |

|

Total liabilities |

|

1,515,732 |

1,477,798 |

|

Shareholder's equity |

|

- |

- |

|

Shareholders' equity, Group share |

|

- |

- |

|

Issued common stocks and capital reserves |

|

20,966 |

21,186 |

|

Other equity instruments |

|

9,357 |

8,924 |

|

Retained earnings |

|

34,207 |

32,891 |

|

Net income |

|

1,793 |

2,493 |

|

Sub-total |

|

66,323 |

65,494 |

|

Unrealised or deferred capital gains and losses |

|

506 |

481 |

|

Sub-total equity, Group share |

|

66,829 |

65,975 |

|

Non-controlling interests |

|

9,583 |

10,272 |

|

Total equity |

|

76,412 |

76,247 |

|

Total |

|

1,592,144 |

1,554,045 |

9. APPENDIX 2:

METHODOLOGY

1 - The financial information presented

for the second quarter and first half 2024 was examined by the

Board of Directors on July

31st, 2024

and has been prepared in accordance with IFRS as adopted in the

European Union and applicable at that date. The limited review

procedures on the condensed interim statement at 30 June 2024

carried by the Statutory Auditors are currently underway.

2 - Net banking income

The pillars’ net banking income is defined on

page 42 of Societe Generale’s 2024 Universal Registration Document.

The terms “Revenues” or “Net Banking Income” are used

interchangeably. They provide a normalised measure of each pillar’s

net banking income taking into account the normative capital

mobilised for its activity.

3 - Operating expenses

Operating expenses correspond to the “Operating

Expenses” as presented in note 5 to the Group’s consolidated

financial statements as at December 31st, 2023. The term

“costs” is also used to refer to Operating Expenses. The

Cost/Income Ratio is defined on page 42 of Societe Generale’s 2024

Universal Registration Document.

4 - Cost of risk in basis points,

coverage ratio for doubtful outstandings

The cost of risk is defined on pages 43 and 770

of Societe Generale’s 2024 Universal Registration Document. This

indicator makes it possible to assess the level of risk of each of

the pillars as a percentage of balance sheet loan commitments,

including operating leases.

|

In EURm |

|

Q2 24 |

Q2 23 |

H1 24 |

H1 23 |

French Retail, Private Banking and Insurance

|

Net Cost Of Risk |

173 |

109 |

420 |

198 |

|

Gross loan Outstandings |

236,044 |

249,843 |

237,219 |

251,266 |

|

Cost of Risk in bp |

29 |

18 |

35 |

16 |

Global Banking and Investor Solutions

|

Net Cost Of Risk |

21 |

(27) |

1 |

(22) |

|

Gross loan Outstandings |

164,829 |

165,847 |

163,643 |

171,719 |

|

Cost of Risk in bp |

5 |

(7) |

0 |

(3) |

Mobility, International Retail Banking & Financial

Services

|

Net Cost Of Risk |

189 |

83 |

370 |

174 |

|

Gross loan Outstandings |

166,967 |

137,819 |

167,429 |

136,404 |

|

Cost of Risk in bp |

45 |

24 |

44 |

26 |

Corporate Centre

|

Net Cost Of Risk |

4 |

1 |

(5) |

(2) |

|

Gross loan Outstandings |

24,583 |

18,873 |

23,974 |

17,705 |

|

Cost of Risk in bp |

6 |

2 |

(5) |

(2) |

Societe Generale Group

|

Net Cost Of Risk |

387 |

166 |

787 |

348 |

|

Gross loan Outstandings |

592,422 |

572,382 |

592,265 |

577,093 |

|

Cost of Risk in bp |

26 |

12 |

27 |

12 |

The gross coverage ratio for doubtful

outstandings is calculated as the ratio of provisions

recognised in respect of the credit risk to gross outstandings

identified as in default within the meaning of the regulations,

without taking account of any guarantees provided. This coverage

ratio measures the maximum residual risk associated with

outstandings in default (“doubtful”).

5 - ROE, ROTE, RONE

The notions of ROE (Return on Equity) and ROTE

(Return on Tangible Equity), as well as their calculation

methodology, are specified on pages 43 and 44 of Societe Generale’s

2024 Universal Registration Document. This measure makes it

possible to assess Societe Generale’s return on equity and return

on tangible equity.

RONE (Return on Normative Equity) determines the return on average

normative equity allocated to the Group’s businesses, according to

the principles presented on page 44 of Societe Generale’s 2024

Universal Registration Document.

Group net income used for the ratio numerator is the accounting

Group net income adjusted for “Interest paid and payable to holders

if deeply subordinated notes and undated subordinated notes, issue

premium amortisation”. For ROTE, income is also restated for

goodwill impairment.

Details of the corrections made to the accounting equity in order

to calculate ROE and ROTE for the period are given in the table

below:

ROTE calculation: calculation

methodology

|

End of period (in EURm) |

Q2 24 |

Q2 23 |

H1 24 |

H1 23 |

|

Shareholders' equity Group share |

66,829 |

68,007 |

66,829 |

68,007 |

|

Deeply subordinated and undated subordinated notes |

(9,747) |

(10,815) |

(9,747) |

(10,815) |

|

Interest payable to holders of deeply & undated subordinated

notes, issue premium amortisation(1) |

(19) |

(28) |

(19) |

(28) |

|

OCI excluding conversion reserves |

705 |

688 |

705 |

688 |

|

Distribution provision(2) |

(718) |

(982) |

(718) |

(982) |

|

Distribution N-1 to be paid |

- |

(441) |

- |

(441) |

|

ROE equity end-of-period |

57,050 |

56,430 |

57,050 |

56,430 |

|

Average ROE equity |

56,797 |

56,334 |

56,660 |

56,203 |

|

Average Goodwill(3) |

(4,073) |

(4,041) |

(4,040) |

(3,847) |

|

Average Intangible Assets |

(2,937) |

(3,117) |

(2,947) |

(2,997) |

|

Average ROTE equity |

49,787 |

49,176 |

49,673 |

49,359 |

|

|

|

|

|

|

|

Group net Income |

1,113 |

900 |

1,793 |

1,768 |

|

Interest paid and payable to holders of deeply subordinated notes

and undated subordinated notes, issue premium amortisation |

(190) |

(216) |

(356) |

(379) |

|

Cancellation of goodwill impairment |

- |

- |

- |

- |

|

Adjusted Group net Income |

923 |

684 |

1,437 |

1,390 |

|

ROTE |

7.4% |

5.6% |

5.8% |

5.6% |

171819

RONE calculation: Average capital

allocated to Core Businesses (in EURm)

|

In EURm |

Q2 24 |

Q2 23 |

Change |

H1 24 |

H1 23 |

Change |

|

French Retail , Private Banking and Insurance |

15,642 |

15,219 |

+2.8% |

15,560 |

15,403 |

+1.0% |

|

Global Banking and Investor Solutions |

15,125 |

15,340 |

-1.4% |

14,978 |

15,567 |

-3.8% |

|

Mobility, International Retail Banking & Financial

Services |

10,413 |

9,222 |

+12.9% |

10,417 |

9,190 |

+13.3% |

|

Core Businesses |

41,180 |

39,782 |

+3.5% |

40,955 |

40,160 |

+2.0% |

|

Corporate Center |

15,617 |

16,552 |

-5.6% |

15,705 |

16,043 |

-2.1% |

|

Group |

56,797 |

56,334 |

+0.8% |

56,660 |

56,203 |

+0.8% |

6 - Net assets and tangible net

assets

Net assets and tangible net assets are defined

in the methodology, page 45 of the Group’s 2024 Universal

Registration Document. The items used to calculate them are

presented below:

2021

|

End of period (in EURm) |

H1 24 |

Q1 24 |

2023 |

|

Shareholders' equity Group share |

66,829 |

67,342 |

65,975 |

|

Deeply subordinated and undated subordinated notes |

(9,747) |

(10,166) |

(9,095) |

|

Interest of deeply & undated subordinated notes, issue premium

amortisation(1) |

(19) |

(71) |

(21) |

|

Book value of own shares in trading portfolio |

96 |

54 |

36 |

|

Net Asset Value |

57,159 |

57,158 |

56,895 |

|

Goodwill(2) |

(4,143) |

(4,004) |

(4,008) |

|

Intangible Assets |

(2,917) |

(2,958) |

(2,954) |

|

Net Tangible Asset Value |

50,099 |

50,196 |

49,933 |

|

|

|

|

|

|

Number of shares used to calculate

NAPS(3) |

787,442 |

799,161 |

796,244 |

|

Net Asset Value per Share |

72.6 |

71.5 |

71.5 |

|

Net Tangible Asset Value per Share |

63.6 |

62.8 |

62.7 |

7 - Calculation of Earnings Per Share

(EPS)

The EPS published by Societe Generale is

calculated according to the rules defined by the IAS 33 standard

(see page 44 of Societe Generale’s 2024 Universal Registration

Document). The corrections made to Group net income in order to

calculate EPS correspond to the restatements carried out for the

calculation of ROE and ROTE.

The calculation of Earnings Per Share is described in the following

table:

|

Average number of shares (thousands) |

H1 24 |

Q1 24 |

2023 |

|

Existing shares |

802,980 |

802,980 |

818,008 |

|

Deductions |

|

|

|

|

Shares allocated to cover stock option plans and free shares

awarded to staff |

4,791 |

5,277 |

6,802 |

|

Other own shares and treasury shares |

3,907 |

0 |

11,891 |

|

Number of shares used to calculate

EPS(4) |

794,282 |

797,703 |

799,315 |

|

Group net Income (in EUR m) |

1,793 |

680 |

2,493 |

|

Interest on deeply subordinated notes and undated subordinated

notes (in EUR m) |

(356) |

(166) |

(759) |

|

Adjusted Group net income (in EUR m) |

1,437 |

514 |

1,735 |

|

EPS (in EUR) |

1.81 |

0.64 |

2.17 |

22

8 - The Societe Generale Group’s Common Equity Tier 1

capital is calculated in accordance with applicable

CRR2/CRD5 rules. The fully loaded solvency ratios are presented pro

forma for current earnings, net of dividends, for the current

financial year, unless specified otherwise. When there is reference

to phased-in ratios, these do not include the earnings for the

current financial year, unless specified otherwise. The leverage

ratio is also calculated according to applicable CRR2/CRD5 rules

including the phased-in following the same rationale as solvency

ratios.

9 - Funded balance sheet, loan to

deposit ratio

The funded balance sheet is

based on the Group financial statements. It is obtained in two

steps:

- A first step aiming at reclassifying

the items of the financial statements into aggregates allowing for

a more economic reading of the balance sheet. Main

reclassifications:

Insurance: grouping of the accounting items

related to insurance within a single aggregate in both assets and

liabilities.

Customer loans: include outstanding loans with customers (net of

provisions and write-downs, including net lease financing

outstanding and transactions at fair value through profit and

loss); excludes financial assets reclassified under loans and

receivables in accordance with the conditions stipulated by IFRS 9

(these positions have been reclassified in their original

lines).

Wholesale funding: Includes interbank liabilities and debt

securities issued. Financing transactions have been allocated to

medium/long-term resources and short-term resources based on the

maturity of outstanding, more or less than one year.

Reclassification under customer deposits of the share of issues

placed by French Retail Banking networks (recorded in

medium/long-term financing), and certain transactions carried out

with counterparties equivalent to customer deposits (previously

included in short term financing).

Deduction from customer deposits and reintegration into short-term

financing of certain transactions equivalent to market

resources.

- A second step aiming at excluding

the contribution of insurance subsidiaries, and netting

derivatives, repurchase agreements, securities borrowing/lending,

accruals and “due to central banks”.

The Group loan/deposit ratio is

determined as the division of the customer loans by customer

deposits as presented in the funded balance sheet.

NB (1) The sum of values contained in the tables

and analyses may differ slightly from the total reported due to

rounding rules.

(2) All the information on the results for the period (notably:

press release, downloadable data, presentation slides and

supplement) is available on Societe Generale’s website

www.societegenerale.com in the “Investor” section.

10. APPENDIX

3 : CHANGE IN NAME OF INTERNATIONAL RETAIL

BANKING, MOBILITY AND LEASING SERVICES’ ACTIVITIES

The name of International Retail Banking,

Mobility and Leasing Services’ activities was changed as follows:

Mobility, International Retail Banking and Financial Services. This

change in name has no impact on historical financial results of the

pillar.

11. APPENDIX 4:

PUBLICATION OF NEW QUARTERLY SERIES

Societe Generale is reporting new

quarterly series mainly reflecting the impacts from the

organisation changes operated within Global Banking and Investor

Solutions’ activities.

In compliance with the strategic goal of a more

asset-light capital model, the Group set up in the second quarter

2024 a common sales platform between teams working in Financing

& Advisory and Global Markets activities to boost the

distribution of assets held on the balance sheet. This change

resulted in, on the one hand, the gathering of revenues and costs

within a single entity and, on the other, a change in their share

between Financing and Advisory and Global Markets.

Also, a few other minor adjustments have been

made on the share of revenues and costs within some activities.

2022, 2023 and Q1 24 quarterly series were

restated accordingly and are available on Societe Générale website

(the data of this press release have not been audited).

2022, 2023 and Q1 24 financial impacts on

Global Banking and Investor Solutions’ activities

2022 (In EURm)

|

|

Global Markets and Investor Services |

Financing and Advisory |

|

Global Banking and Investor Solutions |

|

|

Reported

03/05/2024 |

Reported

01/08/2024 |

Gap |

|

Reported

03/05/2024 |

Reported

01/08/2024 |

Gap |

|

Reported

03/05/2024 |

Reported

01/08/2024 |

Gap |

|

Net Banking Income |

6,721 |

6,671 |

-50 |

|

3,387 |

3,438 |

51 |

|

10,108 |

10,110 |

2 |

|

Operating expenses |

-4,878 |

-4,791 |

87 |

|

-1,954 |

-2,038 |

-84 |

|

-6,832 |

-6,830 |

2 |

|

Gross operating income |

1,843 |

1,880 |

37 |

|

1,433 |

1,400 |

-33 |

|

3,276 |

3,280 |

4 |

|

Group net income |

1,402 |

1,429 |

27 |

|

891 |

868 |

-23 |

|

2,293 |

2,297 |

4 |

2023 (In EURm)

|

|

Global Markets and Investor Services |

Financing and Advisory |

|

Global Banking and Investor Solutions |

|

|

Reported

03/05/2024 |

Reported

01/08/2024 |

Gap |

|

Reported

03/05/2024 |

Reported

01/08/2024 |

Gap |

|

Reported

03/05/2024 |

Reported

01/08/2024 |

Gap |

|

Net Banking Income |

6,299 |

6,273 |

-26 |

|

3,341 |

3,369 |

28 |

|

9,640 |

9,642 |

2 |

|

Operating expenses |

-4,755 |

-4,698 |

57 |

|

-2,032 |

-2,091 |

-59 |

|

-6,787 |

-6,788 |

-1 |

|

Gross operating income |

1,544 |

1,575 |

31 |

|

1,309 |

1,279 |

-30 |

|

2,853 |

2,854 |

1 |

|

Group net income |

1,166 |

1,191 |

25 |

|

1,114 |

1,090 |

-24 |

|

2,280 |

2,280 |

0 |

Q1 24 (In EURm)

|

|

Global Markets and Investor Services |

Financing and Advisory |

|

Global Banking and Investor Solutions |

|

|

Reported

03/05/2024 |

Reported

01/08/2024 |

Gap |

|

Reported

03/05/2024 |

Reported

01/08/2024 |

Gap |

|

Reported

03/05/2024 |

Reported

01/08/2024 |

Gap |

|

Net Banking Income |

1,764 |

1,743 |

-21 |

|

859 |

881 |

+22 |

|

2,623 |

2,623 |

0 |

|

Operating expenses |

-1,198 |

-1,185 |

+13 |

|

-559 |

-572 |

-13 |

|

-1,757 |

-1,757 |

0 |

|

Gross operating income |

566 |

558 |

-8 |

|

316 |

309 |

+9 |

|

866 |

867 |

1 |

|

Group net income |

428 |

421 |

-7 |

|

262 |

270 |

+8 |

|

690 |

691 |

1 |

Societe Generale

Societe Generale is a top tier European Bank with

more than 126,000 employees serving about 25 million clients in 65

countries across the world. We have been supporting the development

of our economies for nearly 160 years, providing our corporate,

institutional, and individual clients with a wide array of

value-added advisory and financial solutions. Our long-lasting and

trusted relationships with the clients, our cutting-edge expertise,

our unique innovation, our ESG capabilities and leading franchises

are part of our DNA and serve our most essential objective - to

deliver sustainable value creation for all our stakeholders.

The Group runs three complementary sets of businesses, embedding

ESG offerings for all its clients:

- French Retail,

Private Banking and Insurance, with leading retail bank SG

and insurance franchise, premium private banking services, and the

leading digital bank BoursoBank.

- Global Banking

and Investor Solutions, a top tier wholesale bank offering

tailored-made solutions with distinctive global leadership in

equity derivatives, structured finance and ESG.

- Mobility,

International Retail Banking and Financial Services,

comprising well-established universal banks (in Czech Republic,

Romania and several African countries), Ayvens (the new ALD I

LeasePlan brand), a global player in sustainable mobility, as well

as specialized financing activities.

Committed to building together with its clients a

better and sustainable future, Societe Generale aims to be a

leading partner in the environmental transition and sustainability

overall. The Group is included in the principal socially

responsible investment indices: DJSI (Europe), FTSE4Good (Global

and Europe), Bloomberg Gender-Equality Index, Refinitiv Diversity

and Inclusion Index, Euronext Vigeo (Europe and Eurozone), STOXX

Global ESG Leaders indexes, and the MSCI Low Carbon Leaders Index

(World and Europe).

For more information, you can follow us on

Twitter/X @societegenerale or visit our website

societegenerale.com.

Asterisks * in this document refers to data at

constant perimeter and exchange rates

1 Reported Cost/Income ratio of 70.6% in Q2 23, 74.9% in Q1 24 and

73.3% in H1 23

2 Including IFRS 9 phasing, proforma including Q2 24 results

3 Based on a pay-out ratio of 50% of the Group net income, at the

high-end of the 40%-50% pay-out ratio, as per regulation, restated

from non-cash items and after deduction of interest on deeply

subordinated notes and undated subordinated notes

4 Excluding the impact of previous reduction in depreciation costs

and Purchase Price Allocation

5 Ratio calculated according to European Banking Authority (EBA)

methodology published on 16 July 2019

6 Ratio excluding loans outstanding of companies currently being

disposed of in compliance with IFRS 5 (in particular Société

Générale Equipment Finance, SG Marocaine de Banques and La

Marocaine Vie)

7 Ratio of S3 provisions, guarantees and collaterals over gross

outstanding non-performing loans

8 EUR 1bn Group’s energy transition investment, announced at the

Capital Markets Day in September 2023, with 3 components: emerging

leaders for the energy transition, nature-based solutions and

impact-driven opportunities contributing to the UN SDGs

9 Including IFRS 9 phasing, proforma including Q2 24 results

10 Combined Buffer Requirement (CBR) of 4.33% at end-Q2 24

11 Including revenues from Insurance

activities

12 Including Moroccan outstandings

13 -3.9% vs. Q2 23 restated both from non-recurring items (notably

reduction in depreciation costs at EUR 7m in Q2 24 vs. EUR 158m in

Q2 23 and hyperinflation in Turkey at EUR -37m in Q2 24 vs. EUR 1m

in Q2 23) and perimeter effect including Purchase Price Allocation

(base effect of ~EUR 130m as the first contribution of LeasePlan

happened on May 22 2023)

14 Excluding non-recurring items (driven by hyperinflation in

Turkey at EUR -37m in Q2 24 vs. EUR -2m in Q1 24)

15 Annualised and as a percentage of average earning assets

16 Excluding the impact of previous reduction in depreciation costs

and Purchase Price Allocation

17 Interest net of tax

18 The dividend to be paid is calculated based on a pay-out ratio

of 50%, restated from non-cash items and after deduction of

interest on deeply subordinated notes and on undated subordinated

notes

19 Excluding goodwill arising from non-controlling interests

20 Interest net of tax

21 Excluding goodwill arising from non-controlling interests

22 The number of shares considered is the average number of

ordinary shares outstanding during the period, excluding treasury

shares and buybacks, but including the trading shares held by the

Group.

4 The number of shares considered is the number of

ordinary shares outstanding at end of period, excluding treasury

shares and buybacks, but including the trading shares held by the

Group

-

Societe-Generale-Q2-2024-Financial-Results-Press-release-en

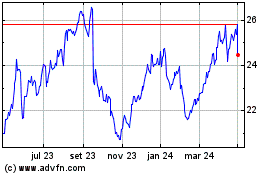

Societe Generale (EU:GLE)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

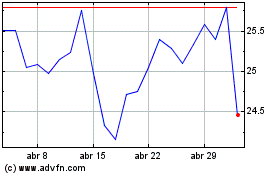

Societe Generale (EU:GLE)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025