QUADIENT: H1 2024 results: Solid 3.2% reported revenue growth and

sharp improvement in profitability from Digital

H1 2024 results: Solid 3.2% reported

revenue growth

and sharp improvement in profitability from

Digital

Key highlights

- H1

2024 consolidated sales of €534 million, up

+3.2% on a reported basis including the contribution of

the latest acquisitions (Daylight and Frama) and

up +0.8%

organically(1)

- H1 2024

subscription-related revenue up +0.7% on

an organic basis, representing 72% of total

revenue

- Strong

performance from North America at +2.8%

organic growth in H1 2024, representing 58% of Group

Sales

- H1 2024

EBITDA of €111 million, up 2.6% organically, primarily

driven by a strong increase in

profitability in Digital

- H1 2024 Group

current EBIT of €61 million,

up 0.3% organically

- Net attributable

income of €24 million

- Leverage

ratio excluding leasing reduced to

1.6x2

- FY 2024

outlook confirmed

- Launch

of share buyback program for up to €30 million

Paris, 23 September 2024

Quadient S.A. (Euronext Paris:

QDT), a global automation platform powering secure and sustainable

business connections, , today announces its 2024 second-quarter

consolidated sales and first half results (period ended

on 31 July 2024). The first-half 2024 results were

approved by the Board of Directors during a meeting held

on 20 September 2024.

Geoffrey Godet, Chief Executive Officer of

Quadient S.A., stated:

“Quadient achieved a solid performance in

the first half of 2024, setting a good start to the execution of

our new strategic plan, ‘Elevate to 2030’, which aims at delivery

€1 billion of subscription-related revenue by 2030. The various

modules of our SaaS communication and financial automation platform

are further recognized for their technical specificities as well as

for their ease of use, reflecting our strong customer centric

approach. Our highly recurring business model continues to be

fueled by good results in both cross-selling and up-selling our

solutions, by the strong outperformance of our Mail business as

well as by a solid volume increase within our European parcel

lockers open networks.

In parallel, the profitability of our

Digital business has sharply increased. Indeed, our Digital EBITDA

margin gained 6 points compared to the first half of 2023,

demonstrating our commitment to strengthen our investment

proposition. Confident in our value-creation potential and in our

capacity to achieve our short- and long-term guidance, including

our 2026 leverage target, we are announcing today a share buy-back

program aimed at improving the return to our shareholders. More

than ever, our objective is to accelerate our existing growth

trajectory and propel Quadient as the leader in intelligent

automation.”

Comments on H1 2024

performance

Group sales came in at

€534 million in H1 2024, a 3.2% increase on a reported

basis, and 0.8% organic growth compared to H1 2023 in

line with Quadient’s expectations. The reported growth includes a

positive currency impact of €1 million and a positive scope effect

of €12 million, which is related to the acquisition of

Daylight in September 2023 and to the acquisition of Frama in

February 2024. In Q2 2024, organic revenue growth reached 0.6%

compared to Q2 2023.

Consolidated sales and EBITDA by

solution

H1 2024 consolidated sales

|

In € million |

H1 2024 |

H1 2023

restated(a) |

Change |

Organic change |

|

Digital |

130 |

120 |

+8.3% |

+5.9% |

|

Mail |

362 |

353 |

+2.5% |

(0.5)% |

|

Lockers |

43 |

45 |

(4.7)% |

(2.5)% |

|

Group total |

534 |

517 |

+3.2% |

+0.8% |

(a) The full-year 2023 financial statements

published in March 2024 reflected Quadient’s decision to review the

future of its Mail activity in Italy with a view to divest this

subsidiary within the next 12 months.

As this was the case in the full-year 2023 statements, H1 2023

revenue from the aforementioned subsidiary is not represented in

the consolidated revenue of the Group as it is recorded as

discontinued operations. This is still the case in H1

2024. |

EBITDA and EBITDA margin

|

|

H1 2024 |

H1 2023 restated (a) |

|

In € million |

EBITDA |

EBITDA margin |

EBITDA |

EBITDA margin |

|

Digital |

20 |

15.7% |

11 |

9.3% |

|

Mail |

94 |

25.8% |

102 |

29.0% |

|

Lockers |

(3) |

(6.7)% |

(1) |

(3.0)% |

|

Group total |

111 |

20.8% |

112 |

21.7% |

(a) The full-year 2023 financial statements

published in March 2024 reflected Quadient’s decision to review the

future of its Mail activity in Italy with a view to divest this

subsidiary within the next 12 months.

As this was the case in the full-year 2023 statements, H1 2023

EBITDA from the aforementioned subsidiary is not represented in the

consolidated EBITDA of the Group as it is recorded as discontinued

operations. This is still the case in H1 2024. |

Digital

In H1 2024, revenue from Digital reached

€130 million, up 5.9% organically

(+5.8% in Q2 2024 vs. Q2 2023) and

up 8.3% on a reported basis

(including the contribution from Daylight) compared to H1 2023.

Importantly, growth for the Solution was still impacted by the

delay in the implementation of two large contracts, announced in Q3

2023.

At the end of H1 2024, annual recurring

revenue (ARR), which is a forward-looking indicator of

future subscription-related revenue, reached

€221 million, up from €206 million at the end of

FY 2023, representing a 15.3%

organic(3)

growth on an annualized basis.

In H1 2024, subscription-related revenue

recorded a strong 8.7% organic growth, now representing

82% of Digital total sales, a

further increase compared to 80% in H1 2023. The share of

SaaS customers stands at 83% at the end of

H1 2024.

EBITDA for Digital was

€20 million for the period, representing a

15.7% EBITDA margin, up 6.4 points

compared to H1 2023. Strong improvement in

profitability continues, supported by the combination of

subscription-related revenue growth, and platform size benefits,

despite further commercial and innovation investments. The

profitability is expected to continue improving in FY 2024.

As part of the customer acquisition focus,

Digital continues to experience strong commercial

dynamics, supported by solid cross-selling with Mail

including some large deals (notably one deal above

USD1 million) in North America. Digital is benefiting from a

positive start to Q3 2024 thanks to a new large deal with a US

insurance company worth more than USD7 million over 5 years.

Regarding the upcoming e-invoicing regulation in Europe,

Quadient is now officially registered as a Partner

Dematerialization Platform in France.

As part of the customer expansion process, the

onboarding of all eligible customers on the Quadient Hub is now

completed. Focus continues on further increasing

up-selling. New partnerships, notably

with Microsoft business central, Sage200 (ERP solutions) and Stripe

(payment solution), have also been signed. Lastly, the

churn rate in Digital continues to decline, now

standing well below 5%.

Mail

Mail revenue reached

€362 million in H1 2024, down only

0.5% on an organic basis (-0.8% in Q2 2024 vs. Q2 2023).

The reported growth stood at +2.5%, including the

contribution of Frama.

Hardware sales recorded a 4.8% organic

growth in H1 2024, with strong contributions from North

America, including a positive impact from decertification. The

focus on investing into renewing the products offering continues to

support product placements, as seen in the further increase in the

share of the upgraded installed base, reaching 36.6% at the end of

H1 2024 vs. 31.5% at the end of FY 2023.

Subscription-related revenue

(68% of Mail sales) recorded a limited 2.8% organic

decline in H1 2024.

EBITDA for Mail was €94 million

for H1 2024. EBITDA margin reached 25.8%, down 3.2 points compared

to H1 2023. The level of EBITDA margin of Mail was impacted by the

higher proportion of revenue from equipment sales as well as by the

dilution due to Frama acquisition, which performance is expected to

improve significantly from 2025.

Thanks to its strong customer acquisition focus,

Quadient’s Mail business continues to outperform the market. The

commercial performance is expected to be resilient in Q3 2024. On

the acquisition side, the aim is to upgrade the installed base.

As part of the customer expansion focus, the

cross-selling remains solid, especially in the US, with several

large contracts signed. Lastly, Mail benefited from the positive

impact of the ongoing US mailing systems decertification.

Lockers

Lockers revenue reached €43

million in H1 2024, a 2.5% decrease on an organic basis

(-1.8% in Q2 2024 vs Q2 2023) and a 4.7% decrease on a reported

basis compared to H1 2023.

Subscription-related revenue was up 5.3%

organically in H1 2024, benefiting from the solid

volumes ramp up within the UK and the French open

networks, as well as the contribution of the existing installed

base, supported by the higher number of carriers committed to use

Quadient’s open networks. However, change in commercial agreements

with Yamato in Japan in Q3 2023 leading to a greater focus on usage

as opposed to a rental-based model, continues for now to weigh on

the subscription-related revenue. Overall, subscription-related

revenue stood at 65% of total revenue in H1 2024, up from

61% in H1 2023.

Non-recurring revenue (license

& hardware sales and professional services) were down

15.1% organically in H1 2024. Hardware sales were still

impacted by slower new installations in North America.

Quadient’s global locker installed base

reached c.21,400 units at the end of H1 2024 vs.

c.20,200 units at the end of FY 2023. This is reflecting

an acceleration in the pace of installation of new lockers,

notably in the UK, fueled by the partnerships signed by

Quadient to host parcel lockers in new suitable locations.

EBITDA for Lockers was negative

at €(3) million in H1 2024. EBITDA margin stood at (6.7)%, down by

3.7 points. The decrease in EBITDA margin was mainly due to the

negative impact from the change in commercial agreement with Yamato

for the Japanese installed base at the start of H2 2023.

As part of the customer acquisition focus,

Quadient is accelerating the installation pace for lockers in the

open networks in Europe, mostly in France and in the UK. This is

supported by the additional deals signed for premium locations and

conversion of existing lockers. Conversely, the trend remains slow

in North America.

As part of the customer expansion focus, volume

increased strongly from both pick-up and drop-off in the open

networks. The lockers business is also fueled by innovation in

usage offerings, notably with new partnership with KeyNest in the

United Kingdom, bringing additional volumes into the open

network.

REVIEW OF 2024 FIRST HALF-YEAR

RESULTS

Simplified P&L

|

In € million |

H1 2024 |

H1 2023 restated (a) |

Change |

|

Sales |

534 |

517 |

+3.2% |

|

Gross profit |

399 |

387 |

+3.2% |

|

Gross margin |

74.4% |

74.8% |

|

|

EBITDA |

111 |

112 |

(1.1)% |

|

EBITDA margin |

20.8% |

21.7% |

|

|

Current EBIT |

61 |

65 |

(6.0)% |

|

Current EBIT margin |

11.5% |

12.6% |

|

|

Optimization expenses and other operating income &

expenses |

(16) |

(6) |

n/a |

|

EBIT |

45 |

59 |

(24.4)% |

|

Financial income/(expense) |

(21) |

(16) |

+32.3% |

|

Income before tax |

24 |

43 |

(45.4)% |

|

Income taxes |

2 |

(6) |

n/a |

|

Net income of continued operations |

26 |

37 |

(31.0)% |

|

Net income from discontinued operations |

(1) |

(0) |

n/a |

|

Net attributable income |

24 |

36 |

(32.8)% |

|

Earnings per share |

0.71 |

1.05 |

n/a |

|

Diluted earnings per share |

0.71 |

1.05 |

n/a |

(a) The full-year 2023 financial statements

published in March 2024 reflected Quadient’s decision to review the

future of its Mail activity in Italy with a view to divest this

subsidiary within the next 12 months.

As this was the case in the full-year 2023 statements, H1 2023

contribution from the aforementioned subsidiary is not represented

in the consolidated P&L of the Group as it is recorded as

discontinued operations. This is still the case in H1

2024.

|

Gross margin stood at

74.4% in H1 2024 from 74.8% in H1 2023, due to slightly

higher cost of sales and the impact of Frama integration.

EBITDA(4) for the

Group reached €111 million

in H1 2024, almost flat compared to H1 2023. Organically, the

EBITDA grew by 2.6%, thanks to a solid increase at Digital

offsetting a weaker EBITDA performance in Mail. EBITDA

margin stood at 20.8% in H1 2024, vs

21.7% in H1 2023.

Depreciation and amortization

stood at €50 million in H1 2024, compared to €47 million in H1

2023. This is mainly due to slightly higher amortization of

Lockers’ capex for rent.

Current operating income (current

EBIT) reached €61 million in H1 2024

compared to €65 million in H1 2023, down 6.0% on a reported

basis and up 0.3% on an organic basis.

Current operating margin stood at 11.5%

of sales in H1 2024 compared to 12.6% in H1 2023.

Optimization costs and other

operating expenses stood at €16 million in H1

2024, versus €6 million in H1 2023 which was impacted by the

write-off of an IT project and additional office optimization in

the United States and the United Kingdom.

Consequently, EBIT reached

€45 million in H1 2024, versus

€59 million

recorded in H1 2023.

Net attributable income

Net cost of debt was up

year-on-year at €20 million, against €15 million in H1

2023, impacted by higher interest rates on the variable portion of

the debt (one third of Quadient’s debt). The currency gains

& losses and other financial items was a loss of

€(1) million in H1 2024, stable vs. H1 2023. Overall,

net financial result was a loss of

€21 million in H1 2024 compared to a loss of

€16 million in H1 2023.

Income tax reached a

€2 million profit in H1 2024, benefitting

from the positive impact of internal IP transfers. It compares to

an expense of €6 million in H1 2023.

Net income from discontinued

operations of the Mail Italian subsidiary amounts to €(1)

million, including additional fees related to the ongoing sale

process for this subsidiary.

Net attributable

income after minority interest amounted

to €24 million in H1 2024 compared to €36 million in H1

2023.

Earnings per share from continued

operations came in at €0.74 in H1

2024 compared to €1.06 in H1

2023. The fully diluted earnings per

share(5)

was €1.05 in H1 2023.

Earnings per share stood at

€0.71 in H1 2024 compared to €1.05 in H1 2023. The fully diluted

earnings per share(5) was €0.71 in H1 2024 compared to

€1.05 in H1 2023. The impact of dilutive instruments is accretive,

dilutive earnings per share is therefore brought into line with net

earnings per share.

Cash flow generation

The change in working capital

was a net cash outflow by €19 million in H1 2024 compared to a

net cash outflow of €55 million in H1 2023, mostly

reflecting a better level of cash collection and the one-off

positive impact from timing differences in VAT payments.

The leasing portfolio and other

financing services stood at €591 million as of

31 July 2024, compared to €598 million as of 31 January

2024 (only down by (1.0)% on an organic basis), thanks to the solid

performance of the Mail activity. While generating future

subscription-related revenue, the expected increase in lease

receivables resulting from the good performance in the placement of

new equipment will translate into a cash outflow in H2 2024. At the

end of H1 2024, the default rate of the leasing portfolio stood at

around 1.2% compared to c.1.3% at the end of FY 2023.

Interest and taxes paid

increased slightly to €38 million in H1 2024 versus the amount of

€35 million paid in H1 2023. The difference was mostly explained by

higher interest rates in H1 2024.

Capital expenditure reached

€46 million in H1 2024, stable compared to H1 2023 reflecting

an increase in capex for rent offset by the non-renewal of office

leases (lower IFRS 16 capex). Capex for Digital reached €12 million

in H12024, slightly up compared to €11 million in H1 2023 and

was mainly focused on R&D. Capex for Mail decreased from

€25 million to €22 million, due to lower IFRS 16 capex linked

to less office leases renewal. Capex for Lockers increased from

€10 million to €13 million to support the open network

deployment in the UK and France.

All in all, cash flow after capital

expenditure was up from a negative amount of €15 million

in H1 2023 to a positive amount of €3 million in H1 2024.

Leverage and liquidity

position

Net debt stood at

€726 million as of 31 July 2024, a slight increase against the

€709 million of net financial debt recorded

as of 31 January 2024. In June 2024, the Group

extended by an additional year the maturity of its Revolving Credit

Facility to 2029. In July 2024, Quadient proceeded to a partial

bond buy-back for a total amount of €7 million, leaving the

outstanding amount of the 2.25% bond at €260 million.

The Group is well positioned to refinance its

2.25% bond, maturing early 2025.

The leverage ratio (net

debt/EBITDA) remained broadly stable from

3.0x(2)

as of 31 July 2024 compared to

2.9x(2) as of

31 January 2024. Excluding leasing, Quadient

leverage ratio improved from

1.65x(2) as of 31 January 2024 to

1.6x(2)

as of 31 July 2024.

As of 31 July 2024, the Group had a robust

liquidity position of

€494 million, split between €194 million

in cash and a €300 million undrawn credit line, maturing

in 2029.

Shareholders’ equity stood at

€1,064 million as of 31 January 2024 compared to

€1,069 million as of 31 January 2024. The gearing

ratio(6)

stood at 68,2% as of 31 July 2024.

MAIL ITALIAN SUBSIDIARY

Following the reclassification of the Mail

Italian Subsidiary as discontinued operations under IFRS 5 in

full-year 2023, an agreement for its sale has been signed with a

local mail distribution company in July 2024.

CAPITAL ALLOCATION

In line with Quadient’s capital allocation

policy, the Company announces the launch of a share buyback program

for a total consideration of up to €30 million to be executed on

the market over an18-month(7)

period.

This operation aims at improving shareholders’

return. It also demonstrates Quadient’s confidence in the value

creation potential of its new Elevate to 2030 strategic plan, its

ability to reach its FY 2026 leverage ratio

target(8) and is in line with the

capital allocation policy of the Company. A press release detailing

this share buyback program has been published alongside today’s H1

2024 results.

OUTLOOK

With H1 2024 organic growth in line with

expectations, Quadient confirms its FY 2024 financial guidance of

organic growth both at the revenue and current EBIT levels. H2 2024

will benefit from an easier comparison basis for both Digital and

Lockers as there will no longer be any negative impact neither from

the delay in implementation of the two large SaaS contracts, nor

from the change in commercial agreement with Yamato, which took

place at the beginning of H2 2023.

Q2 2024 BUSINESS HIGHLIGHTS

Approval of all resolutions by the

combined Shareholders’ meeting of 14 June 2024

On 17 June 2024, Quadient announced that its combined Annual

General Meeting was held on 14 June 2024, under the chairmanship of

Mr. Didier Lamouche. All submitted resolutions were ratified, with

an attendance rate of 74.19% (quorum for ordinary

and extraordinary resolutions).

The Annual General Meeting approved the renewal

of the three-year terms of directorship of Hélène Boulet-Supau,

Geoffrey Godet, Richard Troksa. Vincent Mercier’s directorship was

renewed for an 18-month term, until 31 December 2025. The Annual

General Meeting also approved the co-option and approved the

renewal for a three-year term of Bpifrance Investissement,

represented by Emmanuel Blot.

Quadient expands its Open Locker Network

in new high traffic locations in Japan, leveraging existing JR East

Smart Logistics Lockers

On 21 June 2024, Quadient announced a significant expansion of its

open locker network in Japan through a strategic partnership

with JR East Smart Logistics Co., Ltd., the logistics arm of

the major Japanese rail company. This collaboration integrates

Quadient’s advanced parcel delivery and pickup functionalities into

JR East’s existing multifunctional locker system,

Multi E-Cube, across Japan’s extensive railway network. This

marks the first time Quadient is expanding its intelligent locker

capacities to third-party networks, highlighting its agility in

deploying an open and interoperable logistics ecosystem with new

approaches.

Quadient reports cross-selling success in

North America, reinforcing strategic vision

On 2 July 2024, Quadient announced that nearly 50% of the large

deals signed in North America with mail automation customers in May

included digital automation platform applications, confirming the

critical role its software solutions play in influencing customer

decisions. Additionally, two-thirds of these cross-sell deals,

secured by Quadient's mail teams, featured both mail and digital

automation solutions, reaching an over 60% integration rate.

Quadient launches new cloud-based

application to empower small businesses in their Mail management

processes

On 4 July 2024, Quadient announced the launch of Secure

Barcode, a cloud-based application designed to enhance the

security of customer physical communications through

seamless barcode generation and insertion into documents.

This innovative solution is tailored for small businesses that are

beginning their journey into digital mail solutions, providing

immediate benefits in document management and operational

efficiency.

Quadient and Punch Pubs Partner to enhance

parcel locker access for UK communities

On 11 July 2024, Quadient announced a new contract with Punch

Pubs, a leading pub company in the UK. This partnership will see

the deployment of Quadient’s Parcel Pending open locker

network across 1,261 pub locations managed by Punch Pubs, enhancing

the accessibility and convenience of parcel deliveries and returns

for communities nationwide. This collaboration supports sustainable

growth strategies, leveraging Punch Pubs' nationwide commercial

properties to deliver value to local populations.

More than 1.5 million higher education

Students in the U.S. now rely on Quadient smart lockers for package

delivery

On 25 July 2024, Quadient announced it has reached a new milestone

of installed smart lockers totaling more than 250 colleges and

universities across the United States. Across the campuses, more

than 1.5 million students per year are served by the automated

lockers.

POST-CLOSING EVENTS

Quadient recognized as a major player for

first time in IDC MarketScape for worldwide accounts payable

automation software for midmarket and small businesses

On 14 August 2024, Quadient announced it has been named a Major

Player for the first time in two IDC MarketScape reports – IDC

MarketScape: Worldwide Accounts Payable Automation Software for

Midmarket 2024 Vendor Assessment (doc # US52378624, July 2024)

and IDC MarketScape: Worldwide Accounts Payable Automation Software

for Small Businesses 2024 Vendor Assessment (doc # US52378824, July

2024).

Quadient secures major contract in North

America, demonstrating strength in integrating Digital

communications and Mail automation solutions

On 28 August 2024, Quadient announced a new contract with a North

American global leader in financial services, worth approximately

€1.4 million per year over an initial period of three years. This

successful deal underscores Quadient’s capability to meet the

complex communication needs of large organizations through its

extensive portfolio of digital and mail automation platforms,

combined with high-level consulting and professional services.

Quadient unveils new mobile app, enabling

any local business to offer parcel locker delivery services to

customers

On 4 September 2024, Quadient announced the launch of a mobile app

that enables local businesses to deliver customer orders directly

to Quadient open network lockers without the need for specific

software integrations. The app is already available in the Japanese

market under the name PUDO ACCESS and will soon be made available

in other countries, continuing to create value for merchants and

their local communities.

E-invoicing mandate for businesses in

France: Quadient officially registered as a Dematerialization

Platform Partner

On 12 September 2024, Quadient announced its official registration

as a Partner Dematerialization Platform (PDP) under number 0060.

This registration, issued on 12 September 2024 by the PDP

Registration Service of the Public Finance Department, acknowledges

that Quadient meets all the requirements of the new Finance Law and

is authorized to participate in the next phase of interoperability

tests with the tax authorities' platform when it becomes

available.

Quadient Named a Leader in 2024 SPARK

Matrix for Accounts Payable Automation

On 19 September 2024, Quadient announced it has been recognized as

a Technology Leader in the “SPARK Matrix: Accounts Payable

Automation” report, a detailed analysis of the accounts payable

(AP) automation market by independent analyst firm QKS Group. The

recognition comes on the heels of Quadient also being named a

Technology Leader in the “2024 SPARK Matrix: Accounts Receivable

(AR) Applications” report, which was published in May. This marks

the second year in a row that Quadient has been named a leader in

both AP and AR in the SPARK Matrix reports.

To know more about Quadient’s news flow,

previous press releases are available on our website at the

following address: https://invest.quadient.com/en/newsroom.

CONFERENCE CALL &

WEBCAST

Quadient will host a

conference call and webcast today at 6:00 pm Paris time (5:00 pm

London time).

To join the webcast,

click on the following link: Webcast.

To join the conference

call, please use one of the following phone numbers:

▪ France: +33 (0) 1 70

37 71 66.

▪ United States: +1

786 697 3501.

▪ United Kingdom

(standard international): +44 (0) 33 0551 0200.

Password: Quadient

A replay of the

webcast will also be available on Quadient’s Investor Relations

website for 12 months.

Calendar

- 27 November

2024: Third quarter 2024 sales release (after

close of trading on the Euronext Paris regulated market).

About Quadient®

Quadient is a global

automation platform provider powering secure and sustainable

business connections through digital and physical channels.

Quadient supports businesses of all sizes in their digital

transformation and growth journey, unlocking operational efficiency

and creating meaningful customer experiences. Listed in

compartment B of Euronext Paris (QDT) and part of the CAC® Mid

& Small and EnterNext® Tech 40 indices, Quadient shares

are eligible for PEA-PME investing.

For more information about Quadient, visit

https://invest.quadient.com/en/.

Contacts

Catherine Hubert-Dorel, Quadient

+33 (0)1 45 36 30 56

c.hubert-dorel@quadient.com

financial-communication@quadient.com |

OPRG Financial

Isabelle Laurent / Fabrice Baron

+33 (0)6 42 37 54 17 /+33 (0)6 14 08 29 81

isabelle.laurent@omnicomprgroup.com

fabrice.baron@ omnicomprgroup.com |

Caroline Baude, Quadient

+33 (0)1 45 36 31 82

c.baude@quadient.com |

|

APPENDIX

Digital: New name for Intelligent Communication

Automation

Mail: New name for Mail-Related Solutions

Lockers: New name for Parcel Locker Solutions

H1 2024 and Q2 2024 consolidated

sales

H1 2024 consolidated sales by

geography

|

In € million |

H1 2024 |

H1 2023

restated (a) |

Change |

Organic

change |

|

North America |

308 |

295 |

+4.1% |

+2.8% |

|

Main European countries(b) |

182 |

173 |

+4.9% |

(1.6)% |

|

International(c) |

45 |

49 |

(8.0)% |

(2.5)% |

|

Group total |

534 |

517 |

+3.2% |

+0.8% |

(a) The full-year 2023 financial statements

published in March 2024 reflected Quadient’s decision to review the

future of its Mail activity in Italy with a view to divest this

subsidiary within the next 12 months.

As this was the case in the full-year 2023 statements, H1 2023

revenue from the afore-mentioned subsidiary is not represented in

the consolidated revenue of the Group as it is recorded as

discontinued operations. This is still the case in H1

2024.

(b) Including Austria, Benelux, France, Germany,

Ireland, Italy (excluding Mail), Switzerland, and the United

Kingdom

(c) International includes the activities of

Digital, Mail and Lockers outside of North America and the Main

European countries |

Q2 2024 consolidated sales by

Solution

|

In € million |

Q2 2024 |

Q2 2023

restated (a) |

Change |

Organic change |

|

Digital |

66 |

61 |

+8.1% |

+5.8% |

|

Mail |

183 |

179 |

+2.4% |

(0.8)% |

|

Lockers |

23 |

24 |

(3.2)% |

(1.8)% |

|

Group total |

273 |

264 |

+3.3% |

+0.6% |

(a) The full-year 2023 financial

statements published in March 2024 reflected Quadient’s decision to

review the future of its Mail activity in Italy with a view to

divest this subsidiary within the next 12 months.

As this was the case in the full-year 2023 statements, Q2 2023

revenue from the afore-mentioned subsidiary is not represented in

the consolidated revenue of the Group as it is recorded as

discontinued operations. This is still the case in Q2

2024. |

Q2 2024 consolidated sales by

geography

|

In € million |

Q2 2024 |

Q2 2023

restated (a) |

Change |

Organic

change |

|

North America |

157 |

150 |

+4.9% |

+3.2% |

|

Main European countries(b) |

93 |

89 |

+4.2% |

(1.8)% |

|

International(c) |

22 |

25 |

(10.1)% |

(5.8)% |

|

Group total |

273 |

264 |

+3.3% |

+0.6% |

(a) The full-year 2023 financial statements

published in March 2024 reflected Quadient’s decision to review the

future of its Mail activity in Italy with a view to divest this

subsidiary within the next 12 months.

As this was the case in the full-year 2023 statements, Q2 2023

revenue from the afore-mentioned subsidiary is not represented in

the consolidated revenue of the Group as it is recorded as

discontinued operations. This is still the case in Q2

2024.

(b) Including Austria, Benelux, France, Germany,

Ireland, Italy (excluding Mail), Switzerland, and the United

Kingdom

(c) International includes the activities of

Digital, Mail and Lockers outside of North America and the Main

European countries |

First half-year 2024

Consolidated income

statement

|

In € million |

H1 2024

(period ended

on 31 July 2024) |

H1 2023 restated

(period ended

on 31 July 2023) |

|

Sales |

534 |

517 |

|

Cost of sales |

(135) |

(131) |

|

Gross margin |

399 |

387 |

|

R&D expenses |

(31) |

(31) |

|

Sales and marketing expenses |

(143) |

(139) |

|

Administrative and general expenses |

(97) |

(90) |

|

Service and support expenses |

(58) |

(55) |

|

Employee profit-sharing, share-based payments and other

expenses |

(5) |

(3) |

|

Acquisition-related expenses |

(4) |

(3) |

|

Current operating income |

61 |

65 |

|

Optimization expenses and other operating income &

expenses |

(16) |

(6) |

|

Operating income |

45 |

59 |

|

Financial income/(expense) |

(21) |

(16) |

|

Income before taxes |

24 |

43 |

|

Income taxes |

2 |

(6) |

|

Share of results of associated companies |

0 |

(0) |

|

Net income from continued operations |

26 |

37 |

|

Net income of discontinued operations |

(1) |

(0) |

|

Net income |

25 |

37 |

|

Of which:

|

1 |

1 |

|

|

24 |

36 |

Simplified consolidated balance

sheet

Assets

In € million |

H1 2024

(period ended

on 31 July 2024) |

FY 2023

(period ended

on 31 January 2024) |

|

Goodwill |

1,089 |

1,082 |

|

Intangible fixed assets |

118 |

121 |

|

Tangible fixed assets |

158 |

156 |

|

Other non-current financial assets |

66 |

65 |

|

Other non-current receivables |

2 |

2 |

|

Leasing receivables |

591 |

598 |

|

Deferred tax assets |

47 |

17 |

|

Inventories |

71 |

67 |

|

Receivables |

193 |

228 |

|

Other current assets |

74 |

84 |

|

Cash and cash equivalents |

194 |

118 |

|

Current financial instruments |

2 |

2 |

|

Assets held for sale |

11 |

9 |

|

TOTAL ASSETS |

2,617 |

2,550 |

Liabilities

In € million |

H1 2024

(period ended

on 31 July 2024) |

FY 2023

(period ended

on 31 January 2024) |

|

Shareholders’ equity |

1,064 |

1,069 |

|

Non-current provisions |

15 |

12 |

|

Non-current financial debt |

552 |

715 |

|

Current financial debt |

329 |

66 |

|

Lease obligations |

39 |

46 |

|

Other non-current liabilities |

4 |

2 |

|

Deferred tax liabilities |

119 |

104 |

|

Financial instruments |

4 |

5 |

|

Trade payables |

69 |

79 |

|

Deferred income |

190 |

212 |

|

Other current liabilities |

219 |

225 |

|

Liabilities held for sale |

13 |

15 |

|

TOTAL LIABILITIES |

2,617 |

2,550 |

Simplified cash flow

statement

In €millions |

H1 2024

(period ended

on 31 July 2024) |

H1 2023 restated

(period ended

on 31 July 2023) |

|

EBITDA |

111 |

112 |

|

Other elements |

(11) |

(7) |

|

Cash flow before net cost of debt and income

tax |

100 |

105 |

|

Change in the working capital requirement |

(19) |

(55) |

|

Net change in leasing receivables |

6 |

16 |

|

Cash flow from operating activities |

87 |

66 |

|

Interest and tax paid |

(38) |

(35) |

|

Net cash flow from operating activities |

49 |

31 |

|

Capital expenditure |

(46) |

(46) |

|

Net cash flow after investing activities |

3 |

(15) |

|

Impact of changes in scope |

(8) |

0 |

|

Others |

0 |

(0) |

|

Net cash flow after acquisitions and

divestments |

(5) |

(15) |

|

Dividends paid |

0 |

(0) |

|

Change in debt and others |

64 |

25 |

|

Net cash flow from financing activities |

64 |

25 |

|

Cumulative translation adjustments on cash |

(0) |

(1) |

|

Net cash from discontinued operations |

2 |

(1) |

|

Change in net cash position |

60 |

10 |

Figures exclude Mail Italian

subsidiary which has been reclassified as discontinued operations

in 2023.

(1) H1 2024 sales are compared to H1 2023

sales, to which is added pro rata temporis the revenue of Daylight

and Frama for a consolidated amount of €12 million.

The currency impact is positive for €1 million.

(2) Including IFRS 16

(3) H1 2024 ARR impacted by a €0.2 million

negative currency effect vs 31 January 2024

(4) EBITDA = current operating income +

provisions for depreciation of tangible and intangible fixed

assets.

(5) For the H1 2024, the average compounded

number of shares is 33,950,930. Diluted number of shares is

34,487,900.

(6) Net debt / shareholders’ equity

(7) Subject to the renewal of the share

buyback authorizations at the 2025 AGM

(8) FY 2026 leverage ratio excluding

leasing target of 1.5x

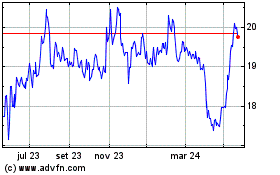

QUADIENT (EU:QDT)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

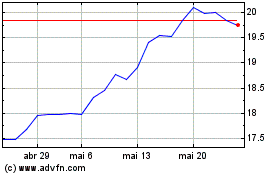

QUADIENT (EU:QDT)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025