SCOR Investment Partners launches SCOR Real Estate Loans V, dedicated to value-add projects

15 Outubro 2024 - 4:09AM

UK Regulatory

SCOR Investment Partners launches SCOR Real Estate Loans V,

dedicated to value-add projects

|

PRESS RELEASE | October 15th, 2024 |

N° 03- 2024 |

SCOR Investment Partners, the asset management

subsidiary of leading reinsurer, SCOR Group, announces the launch

of SCOR Real Estate Loans V, the fifth vintage in its successful

series of senior value-add debt funds. Since 2013, SCOR Investment

Partners has held a unique position in the value-add market by

financing real estate projects focused on renovations,

restructurings, repositioning, or development of assets.

SCOR Real Estate Loans V is strategically

positioned to capitalize on structural market changes and to

respond to energy transition stakes in the real estate sector. The

latter is driven by European regulatory changes, the growing demand

for new or restructured and certified assets, and the need for

investments to ensure ongoing functionality of assets.

This new fund aims to offer investors an

attractive risk/return profile by leveraging the currently

favorable conditions for lenders in the real estate debt market. It

will finance projects located in the heart of major European

cities, using a multi-sectoral approach that includes top-tier,

senior, and whole loans.

In line with SCOR Investment Partners'

sustainable investment philosophy, the fund's investments will

focus on improving the energy efficiency of existing buildings.

SCOR Real Estate Loans V is classified Article 9 under the European

Sustainable Finance Disclosure Regulation (SFDR) and has obtained

the LuxFLAG ESG -Applicant Fund Status.

This new vintage reinforces SCOR Investment

Partners' commitment to the value-add real estate debt market. Our

historical presence positions us as a preferred partner for such

operations, whether collaborating directly with sponsors or

initiating them in partnership with banks.

Targeted towards institutional investors, the

fund has already secured a EUR 100 million investment commitment

from SCOR Group, thus ensuring a strong alignment of interests, and

aiming for a total size of EUR 500 to EUR 700 million.

Pierre Saeli, Head of Real

Estate Loans at SCOR Investment Partners, commented: "We are

thrilled to launch SCOR Real Estate Loans V, a new vintage

specifically designed to adapt to the structural changes in the

real estate market, prioritizing assets in city centers, logistics,

and housing sectors, as well as renovation projects. This fund

highlights our unique expertise in the value-add real estate debt

market, which offers historically attractive returns.”

Louis Bourrousse, CEO of SCOR

Investment Partners, added: “Our real estate debt strategy has

consistently adapted to market trends. Our team has an in-depth

knowledge of the sector which allows for a diversified portfolio

construction. We are convinced that real estate debt is an ideal

vehicle for investors looking to gain or regain exposure to the

underlying real estate via levels of leverage that allow to absorb

eventual fluctuations of the value of the assets.”

Over the past decade, SCOR Investment Partners’

real estate debt strategy has successfully deployed

EUR 2.2 billion across 87 transactions, spanning over

various debt types including senior, whole loan, junior, and

mezzanine. This extensive experience has enabled SCOR Investment

Partners to be more agile in evolving its strategy in response to

rapid market trends and aligning with broader sustainable and

responsible investment objectives.

- End -

CONTACTS

SCOR Investment Partners

Anne-Laure Mugnier

+33 (0) 1 58 44 84 53

amugnier@scor.com. |

FGS Global

Xavier Mas

+33 (0)6 82 52 76 42

xavier.mas@fgsglobal.com |

Carolyn Pike

+41 (0)79 905 14 29

carolyn.pike@fgsglobal.com |

About SCOR Investment

Partners

Financing the sustainable development of societies,

together.

SCOR Investment Partners is the asset management

company of the SCOR Group. Created in 2008 and accredited by the

Autorité des Marches financiers, the French financial market

regulatory body, in May 2009 (no. GP09000006). SCOR Investment

Partners has more than 80 employees and is structured around seven

management desks: Fixed Income, Corporate Loans, Infrastructure

Loans, Direct Real Estate, Real Estate Loans, Insurance-Linked

Securities and Fund Selection. Since 2012, SCOR Investment Partners

has given institutional investors access to some of the investment

strategies developed for the SCOR Group. Assets managed for outside

investors totaled EUR 7.6 billion as of June 30, 2024. As of that

same date, SCOR Investment Partners had total assets under

management of EUR 20.5 billion (including undrawn commitments).

Visit the SCOR Investment Partners

website at: www.scor-ip.com

This advertising communication, intended

exclusively for journalists and professionals of the press and

media, is produced for informational purposes only and should not

be construed as an offer, solicitation, invitation, or

recommendation to purchase any service or investment product.

Before making any final investment decision, you

must read all regulatory documents of the Fund, available free of

charge upon request, from the Sales & Marketing team of SCOR

Investment Partners SE.

|

All content

published by the SCOR group since January 1, 2024, is certified

with Wiztrust. You can check the authenticity of this content at

wiztrust.com. |

- SCOR IP_PR_2024 10_RELV_VEN Wiztrust

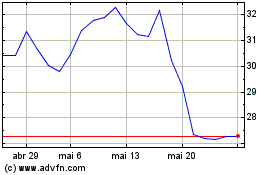

Scor (EU:SCR)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Scor (EU:SCR)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024