KLÉPIERRE: 6.3% LFL NRI GROWTH OVER 9M AND GUIDANCE INCREASE

23 Outubro 2024 - 2:30AM

UK Regulatory

KLÉPIERRE: 6.3% LFL NRI GROWTH OVER 9M AND GUIDANCE INCREASE

PRESS RELEASE

6.3% LFL NRI GROWTH OVER 9M AND GUIDANCE

INCREASE

Klépierre is ranked first worldwide by GRESB in

the listed retail space and first in Europe in the global listed

real-estate

Paris — October 23, 2024

Klépierre, the premier shopping malls specialist

with exclusive focus on continental Europe today revises its 2024

guidance upwards, following a solid outperformance over the first

nine months of 2024.(1)

- 2024 net current cash flow now

expected at €2.55 per share driven by:

- Continued leasing demand and

further improvements in operating KPIs:

1,280 leases signed, up 7% year-on-year, with a

4.0% positive rental uplift

Financial occupancy rate at 96.5%, up 30 bps over three months and

70 bps year-on-year

9-month retailer sales(2) up 4.0%

like-for-like, supported by a 2.4% increase in footfall

Occupancy Cost Ratio at 12.6%, down 20 bps year-on-year

- Solid rental growth: 9-month

like-for-like(3) net rental income

up 6.3%

- Sector-leading credit metrics:

- Net debt to EBITDA of 7.2x, cost of

debt at 1.7%

- Net debt at €7,590 million, up €241

million versus December 2023, following the acquisitions closed

year-to-date

REVENUE

|

In millions of euros, total share |

9M 2024 |

Like-for-like change(3) |

|

Gross rental income |

902.0 |

|

|

|

Revenues |

1,155.7 |

|

|

|

|

|

|

|

|

Net rental income |

783.7 |

+6.3% |

|

Klépierre’s total

revenue(4) for the first nine

months of 2024 amounted to €1,155.7 million.

Accelerating rental growth supported by positive operating

momentum

Over the first nine months of 2024, net rental

income amounted to €783.7 million, up 5.7% year-on-year or 6.3% on

a like-for-like(3) basis,

representing a spread of 350 basis points over indexation driven by

higher collection and occupancy rates as well as a solid increase

in additional revenues (turnover rents, car park revenues and mall

income).

This solid performance was supported by consistently strong leasing

demand with 1,280 leases signed (up 7% in volume terms

year-on-year) and a 4.0% positive rental uplift on renewals and

relettings, evidencing the crucial role of best-in-class malls for

retailers. In addition, momentum was amplified by Klépierre’s

operational excellence that is translating into the continuous

enhancement of occupancy, up 30 basis points compared to June 30,

2024, and 70 basis points year-on-year at 96.5%.

Simultaneously, the occupancy cost ratio stood at 12.6%, showcasing

affordable level of rents amid a 4.0%

like-for-like(2) increase in

retailer sales over the first nine months (peaking at 6.2% and 6.1%

in August and September respectively) and 2.4% growth in

footfall.

Sector-leading balance sheet providing options to create

value

As of September 30, 2024, consolidated net debt

stood at €7,590 million, up €241 million compared to

December 31, 2023, mainly on the back of the €238 million

invested in the acquisitions of O’Parinor (France) and RomaEst

(Italy). The integration of these two super-regional malls has been

an immediate success with a higher-than-anticipated performance

over the summer. Meanwhile, Klépierre continued to invest in its

assets and delivered the Maremagnum extension (Barcelona, Spain) in

July – which is already posting solid footfall growth (+20% in

August and +39% in September) - while the extension work at

Odysseum (Montpellier, France) is advancing on time and on budget.

Yield on costs of these projects stands at 13.5% and 9%,

respectively.

Lastly, the Group continues to operate sector-leading credit

metrics with net debt to EBITDA at the historically low level of

7.2x, an average debt maturity of 6.0 years and a cost of debt of

1.7%.

Worldwide leader in sustainable

development

Klépierre has once again been recognized for the

excellence of its corporate social responsibility performance by

the Global Real Estate Sustainability Benchmark (GRESB) that ranked

the Group first worldwide in the Listed Retail category. Besides

this remarkable achievement, Klépierre is also number one in the

European Listed Real-Estate category (all classes of assets). The

Group obtained a total score of 95/100 (up 2 points compared

to 2023) and maintained its 5-star rating, awarded to the top 20%

best-performing companies across all categories.

Outlook revised upwards

The current business momentum combined with the

performance in the first 9 months has led the Group to raise its

2024 guidance. Consequently, Klépierre now expects to generate a 6%

increase in EBITDA and net current cash flow to reach €2.55 per

share in 2024.

RETAILER SALES

|

9-month change in retailer sales by geography compared to

9-month

2023(2) |

|

Geography |

Like-for-like change |

Share in total reported retailer sales |

|

France |

+5.3% |

40% |

|

Italy |

+3.5% |

26% |

|

Scandinavia |

+0.1% |

11% |

|

Iberia |

+3.9% |

12% |

|

Netherlands/Germany/Central Europe |

+4.9% |

11% |

|

TOTAL |

+4.0% |

100% |

9-month change in retailer sales by segment compared to

9-month

2023(2) |

|

Segment |

Like-for-like change |

Share in total reported retailer sales |

|

Fashion |

+2.9% |

38% |

| Culture,

sports & leisure |

+2.7% |

19% |

| Health &

beauty |

+11.2% |

15% |

| Food &

beverage |

+4.3% |

12% |

| Household

equipment |

-0.1% |

9% |

|

Other |

+5.5% |

7% |

|

TOTAL |

+4.0% |

100% |

|

AGENDA |

|

|

February 11, 2025 |

2024 full-year earnings (after market close) |

|

INVESTOR RELATIONS CONTACTS |

MEDIA

CONTACTS |

|

Paul Logerot, Group Head of IR and Financial

Communication

+33 (0)7 50 66 05 63 — paul.logerot@klepierre.com

Hugo Martins, IR Manager

+33 (0)7 72 11 63 24 — hugo.martins@klepierre.com

Tanguy Phelippeau, IR Manager

+33 (0)7 72 09 29 57 —tanguy.phelippeau@klepierre.com |

Hélène Salmon, Group Head of Communication

+33 (0)6 43 41 97 18 – helene.salmon@klepierre.com

Wandrille Clermontel, Taddeo

+33 (0)6 33 05 48 50 – teamklepierre@taddeo.fr |

|

ABOUT KLÉPIERRE

Klépierre is the premier shopping malls

specialist with an exclusive focus on continental Europe, combining

property development and asset management skills. The Company’s

portfolio is valued at €19.9 billion at June 30, 2024, and

comprises large shopping centers in more than 10 countries in

Continental Europe which together host hundreds of millions of

visitors per year. Klépierre holds a controlling stake in Steen

& Strøm (56.1%), one of the leading operators of shopping

centers in Scandinavia. Klépierre is a French REIT (SIIC) listed on

Euronext Paris and is included in the CAC Next 20 and EPRA Euro

Zone Indexes. It is also included in ethical indexes, such as

Euronext CAC 40 ESG, CAC SBT 1.5, MSCI Europe ESG Leaders,

FTSE4Good, Euronext Vigeo Europe 120, and features in CDP’s

“A-list”. These distinctions underscore the Group’s commitment to a

proactive sustainable development policy and its global leadership

in the fight against climate change.

For more information, please visit the newsroom on our website:

www.klepierre.com

This press release is available in the

“Publications section” of Klépierre’s Finance page:

www.klepierre.com/en/finance/publications

(1) The data disclosed in this release have not been

audited.

(2) Excluding the impact of asset sales, acquisitions and excluding

Turkey.

(3) Like-for-like data exclude the contribution of new spaces

(acquisitions, greenfield projects and extensions), spaces being

restructured, and disposals completed since January 2023.

(4) Total revenue is calculated as the sum of gross rental income,

service charge income and management and development fees.

- PR_KLEPIERRE_2024_Q3_TRADING UPDATE

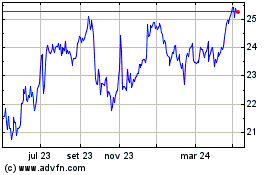

Klepierre (EU:LI)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

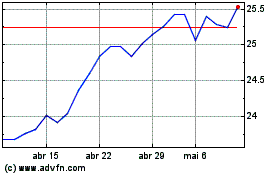

Klepierre (EU:LI)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025