Quadient strengthens its financial position through a USD100 million US Private Placement from MetLife

22 Janeiro 2025 - 4:00AM

UK Regulatory

Quadient strengthens its financial position through a

USD100 million US Private Placement from MetLife

Quadient strengthens its financial

position through

a USD100 million US Private Placement from

MetLife

Paris, January 22, 2025

Quadient S.A. (Euronext Paris:

QDT), a global automation platform powering secure and sustainable

business connections, today announces that it has signed a new

USD100 million US Private Placement (USPP) with MetLife

Investment Management (“MIM”), reinforcing its financial position.

This new USPP of USD 100 million senior notes has a 7-year average

maturity and comes with an additional shelf facility allowing the

issue of senior notes for a maximum aggregate principal amount of

USD50 million.

Since the beginning of the financial year 2024

and including this transaction, Quadient has successfully raised

the equivalent of €330 million through various financial

instruments including a Schuldschein, term loans and this

USPP, all contributing towards the repayment of existing credit

lines maturing in 2025 notably a bond issue with an

outstanding amount of €260 million, bearing a 2.25% coupon and

a €29 million Schuldschein tranche.

This new USPP contributes to extending the

average maturity to around 4 years. The covenants attached to it

are aligned with Quadient’s main financial covenants, in particular

a leverage ratio excluding leasing

operations(1) below 3.0x and

Group shareholders’ equity greater than €600 million. As

of 31 July 2024, Quadient leverage ratio excluding leasing stood at

1.6x and Group’s shareholders’ equity at €1,064 million.

Laurent du Passage, Chief Financial Officer of

Quadient, commented: “We are delighted with the signing of this

new debt facility and to continue working closely with MIM. This

new USPP allows us to optimize our financing, meet refinancing

obligations and extend the maturity of our debt, while the agreed

terms highlight the strength of Quadient’s credit

profile.”

Stephen Valvona, Director at MIM said: “We are

delighted to support Quadient with this new financing, enabling the

Company to further diversify its sources of funding and extend its

debt maturity profile, while also providing additional capacity for

future borrowing through the shelf facility.”

About Quadient®

Quadient is a global

automation platform provider powering secure and sustainable

business connections through digital and physical channels.

Quadient supports businesses of all sizes in their digital

transformation and growth journey, unlocking operational efficiency

and creating meaningful customer experiences. Listed in

compartment B of Euronext Paris (QDT) and part of the CAC® Mid

& Small and EnterNext® Tech 40 indices, Quadient shares

are eligible for PEA-PME investing.

For more information about Quadient, visit

https://invest.quadient.com/en/

Contacts

Catherine Hubert-Dorel, Quadient

+33 (0)1 45 36 30 56

c.hubert-dorel@quadient.com

financial-communication@quadient.com |

OPRG Financial

Fabrice Baron

+33 (0)6 14 08 29 81

fabrice.baron@omnicomprgroup.com |

(1) Leverage ratio defined

as net debt excluding leasing/EBITDA excluding leasing

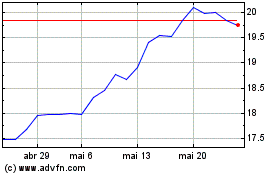

QUADIENT (EU:QDT)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

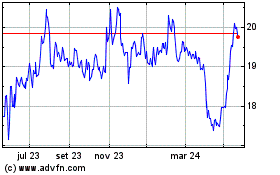

QUADIENT (EU:QDT)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025