Margin Expansion and Increasing Cash Flows

Expected

Customer Obsession Drives Profitable Growth

Lyft, Inc. (NASDAQ: LYFT) (the “Company” or “Lyft”) will host

its first Investor Day today. The event will feature presentations

by Lyft’s CEO David Risher, CFO Erin Brewer, and other leaders from

across the Company, who will discuss Lyft’s plans for its next

phase of profitable growth. The event will conclude with a live

Q&A session.

“Lyft’s customer-obsessed strategy is working. Our execution

keeps getting better, we’re delivering industry-leading innovation,

and we are working closely with partners to create great shared

customer experiences,” said CEO David Risher. “We’re excited to

share our vision for Lyft’s road ahead.”

“Over the last year we’ve transformed our business and

established a strong foundation for improving profitability and

cash flow,” said CFO Erin Brewer. “The financial targets we are

announcing today reflect our expectations of healthy top-line

growth and margin expansion as we deliver on our strategic

priorities. I’m excited about Lyft’s next chapter as we continue

building a financially healthy and customer-obsessed Lyft.”

2027 Financial Targets

The Company expects:

- A Gross Bookings compound annual growth rate of approximately

15% between full-year 2024 and full-year 2027;

- An Adjusted EBITDA margin (measured as a percentage of Gross

Bookings) of approximately 4% on a full-year basis in 2027;

and

- Free cash flow conversion (measured as a percentage of Adjusted

EBITDA) of more than 90% annually each year between 2025 and

2027.

2024 Financial Outlook Reaffirmed

There is no change to Lyft’s previously announced outlook for Q2

2024 or to the Company’s directional commentary for full-year 2024,

which were updated during the company’s first quarter 2024 earnings

call on May 7, 2024.

We have not provided the forward-looking GAAP equivalents to our

non-GAAP financial targets or outlook or GAAP reconciliations as a

result of the uncertainty regarding, and the potential variability

of reconciling items such as stock-based compensation and income

tax. Accordingly, a reconciliation of these non-GAAP guidance

metrics to their corresponding GAAP equivalent is not available

without unreasonable effort. However, it is important to note that

the reconciling items could have a significant effect on future

GAAP results. For more information regarding the non-GAAP financial

measures discussed in this press release, please see “Non-GAAP

Financial Measures” below.

Investor Day: How To Participate

The event will begin at 9:00 AM ET and will be webcast live on

Lyft’s Investor Relations page: investor.lyft.com. A replay and the

presentation materials will be available at the same webpage.

About Lyft

Lyft is one of the largest transportation networks in North

America, bringing together rideshare, bikes, and scooters all in

one app. We are customer-obsessed and driven by our purpose:

getting riders out into the world so they can live their lives

together and providing drivers a way to work that gives them

control over their time and money.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements generally relate to future

events or Lyft's future financial or operating performance. In some

cases, you can identify forward-looking statements because they

contain words such as "may," "will," "should," "expects," "plans,"

"anticipates,” “going to,” "could," "intends," "target,"

"projects," "contemplates," "believes," "estimates," "predicts,"

"potential" or "continue" or the negative of these words or other

similar terms or expressions that concern Lyft's expectations,

strategy, priorities, plans or intentions. Forward-looking

statements in this release include, but are not limited to, Lyft’s

guidance and outlook, including for the second quarter and full

fiscal year 2024, Lyft’s financial targets through 2027, the trends

and assumptions underlying such guidance, outlook and targets, and

statements about profitable growth. The financial targets presented

here are based on Lyft’s current roadmap and are contingent upon

many factors, including Lyft’s execution, various market conditions

and legal and regulatory factors. These financial targets and any

other forward-looking statements illustrate Lyft’s current thinking

and are subject to various risks and uncertainties. Over time, Lyft

may also modify its financial targets and goals or pursue

alternative objectives and strategies. Lyft’s expectations and

beliefs regarding these matters may not materialize, and actual

results in future periods are subject to risks and uncertainties

that could cause actual results to differ materially from those

projected, including risks related to the macroeconomic environment

and risks regarding our ability to forecast our performance due to

our limited operating history and the macroeconomic environment.

The forward-looking statements contained in this release are also

subject to other risks and uncertainties, including those more

fully described in Lyft's filings with the Securities and Exchange

Commission (“SEC”), including in our Quarterly Report on Form 10-Q

for the quarter ended March 31, 2024 that was filed with the SEC on

May 9, 2024. The forward-looking statements in this release are

based on information available to Lyft as of the date hereof, and

Lyft disclaims any obligation to update any forward-looking

statements, except as required by law. This press release discusses

"customers." For rideshare, there are two customers in every car -

the driver is Lyft's customer, and the rider is the driver's

customer. We care about both.

Non-GAAP Financial Measures

To supplement Lyft's financial information presented in

accordance with generally accepted accounting principles in the

United States of America, or GAAP, Lyft considers certain financial

measures that are not prepared in accordance with GAAP, including

Adjusted EBITDA, Adjusted EBITDA margin (calculated as a percentage

of Gross Bookings), free cash flow and free cash flow conversion

(calculated as a percentage of Adjusted EBITDA). Lyft defines

Adjusted EBITDA as net loss adjusted for interest expense, other

income (expense), net, provision for (benefit from) income taxes,

depreciation and amortization, stock-based compensation expense,

payroll tax expense related to stock-based compensation and

sublease income, as well as, if applicable, restructuring charges,

costs related to acquisitions and divestitures and costs from

transactions related to certain legacy auto insurance liabilities.

Adjusted EBITDA margin (calculated as a percentage of Gross

Bookings) is calculated by dividing Adjusted EBITDA for a period by

Gross Bookings for the same period and is considered a key metric.

Lyft defines free cash flow as GAAP net cash provided by (used in)

operating activities less purchases of property and equipment and

scooter fleet. Free cash flow conversion (calculated as a

percentage of Adjusted EBITDA) is calculated by dividing free cash

flow for a period by Adjusted EBITDA for the same period.

Lyft uses its non-GAAP financial measures in conjunction with

GAAP measures as part of our overall assessment of our performance,

including the preparation of our annual operating budget and

quarterly forecasts, to evaluate the effectiveness of our business

strategies, and to communicate with our board of directors

concerning our financial performance. Free cash flow and free cash

flow conversion are measures used by our management to understand

and evaluate our operating performance and trends. We believe these

measures are a useful indicator of liquidity that provides our

management with information about our ability to generate or use

cash to enhance the strength of our balance sheet, further invest

in our business and pursue potential strategic initiatives. Free

cash flow and free cash flow conversion have certain limitations,

including that these measures do not reflect our future contractual

commitments and do not represent the total increase or decrease in

our cash balance for a given period. Free cash flow does not

necessarily represent funds available for discretionary use and is

not necessarily a measure of our ability to fund our cash

needs.

Lyft’s definitions may differ from the definitions used by other

companies and therefore comparability may be limited. In addition,

other companies may not publish these or similar metrics.

Furthermore, these measures have certain limitations in that they

do not include the impact of certain expenses that are reflected in

our consolidated statement of operations that are necessary to run

our business. Thus, our non-GAAP financial measures should be

considered in addition to, not as substitutes for, or in isolation

from, measures prepared in accordance with GAAP.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240606350279/en/

Investor Contact: Aurélien Nolf investor@lyft.com

Media Contact: Stephanie Rice press@lyft.com

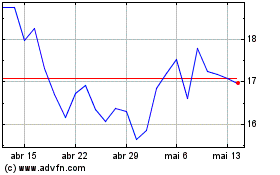

Lyft (NASDAQ:LYFT)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

Lyft (NASDAQ:LYFT)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024