GameStop (NYSE:GME) – GameStop shares are

volatile in pre-market trading on Friday, after soaring nearly 50%

the day before, following the announcement by the influencer known

as “Roaring Kitty” of an upcoming live broadcast on YouTube today

at 12 PM, Eastern Time (ET). Since Gill resumed social media

activities in May, GameStop’s market value has increased by $11

billion. This rise is part of a pattern of volatile trading

influenced by his activities. Gill’s broadcast has garnered over

12,000 registrations. The stock reversed from a gain of over 30% to

a 16.4% drop in pre-market trading shortly after the video game

retailer announced its first-quarter results.

Meta Platforms (NASDAQ:META) – Meta launched an

AI-based ad targeting program on WhatsApp to generate revenue,

marking a new approach for the messaging service. The tools use

behavioral data from Facebook and Instagram to target potential

customers, representing a shift in WhatsApp’s privacy

practices.

Nvidia (NASDAQ:NVDA) – As Nvidia threatens to

become the world’s most valuable company, surpassing Microsoft,

some investors are skeptical and are betting that its sharply

rising shares may depreciate. Short bets against Nvidia total about

$34 billion, nearly double the combined bets against Apple and

Tesla. After today’s market close, Nvidia will conduct a 10-for-1

stock split, making its shares more accessible and potentially

broadening its appeal to individual investors. After the split, the

share price will be proportionally reduced, which could favor the

company’s inclusion in the Dow Jones, which is price-weighted.

Microsoft (NASDAQ:MSFT),

Nvidia (NASDAQ:NVDA) – The U.S. Department of

Justice and the Federal Trade Commission have reached an agreement

to conduct antitrust investigations into Microsoft, OpenAI, and

Nvidia, related to these companies’ dominance in the artificial

intelligence market.

Apple (NASDAQ:AAPL) – Next week, Apple will

launch a new app called “Passwords” to facilitate login to websites

and programs. This feature, part of iOS 18, iPadOS 18, and macOS

15, is an extension of iCloud Keychain and aims to simplify

password management, increasing competition with other password

managers.

Netflix (NASDAQ:NFLX) – Fiona Harvey, a

Scottish lawyer, is suing Netflix and Richard Gadd for defamation,

seeking at least $170 million. She claims that the miniseries “Baby

Reindeer” falsely portrays her as a stalker and criminal, damaging

her reputation, as many viewers believe she is the “real” Martha,

the show’s character. Additionally, Netflix has revealed details of

the animated films “Spellbound” and “Pookoo,” developed in

collaboration with Skydance Animation. “Spellbound” tells the story

of Ellian, who seeks to break the spell that turned her parents

into monsters, set for release on November 22. “Pookoo” explores

the adventure of enemies swapping places, set to premiere in

2025.

Amazon (NASDAQ:AMZN) – Amazon faces a $1.3

billion lawsuit from about 35,000 British retailers, alleging that

the company misused their data on the Marketplace to favor its own

products and profit, thereby harming competition. The lawsuit was

initiated by the British Independent Retailers Association in

London.

Mercado Libre (NASDAQ:MELI) – The Latin

American e-commerce leader plans to increase its investments in

Brazil to more than $4.35 billion (23 billion reais), exceeding the

initial forecast due to higher-than-expected sales. The company

also expects to hire 11,000 people, up from the initially planned

6,500.

Walmart (NYSE:WMT) – Walmart is replacing paper

labels with digital ones in its stores, allowing for quick price

updates on more than 120,000 items in minutes. Previously, weekly

updates took up to two days. This will improve efficiency and price

management, as well as streamline product selection for online

orders.

Starbucks (NASDAQ:SBUX) – Starbucks is starting

a partnership with Grubhub to deliver coffee and beverages in the

U.S., beginning in Pennsylvania, Colorado, and Illinois, with plans

for national expansion by August. Meanwhile, Brazilian restaurant

operator Zamp has closed a deal to acquire the rights to operate

the Starbucks brand in Brazil for R$ 120 million, which includes

managing some stores.

Costco Wholesale (NASDAQ:COST) – According to

Reuters, when Costco opened a store in a rural Japanese town, it

sparked strong competition for workers by offering high wages. In

response, a local noodle shop increased wages by a third to retain

and attract employees, despite the financial difficulties this

posed.

Taiwan Semiconductor Manufacturing Co.

(NYSE:TSM) – TSMC’s sales in May grew 30%, reaching $7.1 billion,

driven by demand in artificial intelligence and the recovery of

consumer electronics.

Lyft (NASDAQ:LYFT) – Lyft plans to maintain its

competitiveness in the U.S. ride-sharing market, aiming for annual

gross bookings growth of 15% by 2027. The company is also

diversifying its revenue sources and expects its new advertising

sector to grow eightfold in the same period.

Hertz Global Holdings (NASDAQ:HTZ) – Bloomberg

reported on Thursday that Hertz is considering raising at least

$700 million through secured debt and convertible notes to

strengthen its balance sheet.

Instacart (NASDAQ:CART) – Instacart launched a

new $500 million share repurchase program to bolster confidence in

its growth potential. Completing two previous buyback rounds, the

company reiterated its commitment to growth.

Toyota Motor (NYSE:TM), Mitsubishi UFJ

Financial Group (NYSE:MUFG), Sumitomo Mitsui

Financial Group (NYSE:SMFG) – Japan’s largest banks, MUFG

and SMFG, will begin selling their strategic stakes in Toyota,

valued at $8.5 billion. This move aligns with Japan’s corporate

governance reforms, aimed at reducing cross-shareholdings between

companies to avoid conflicts of interest and increase

transparency.

Stellantis (NYSE:STLA) – Fiat, through

Stellantis, has projected the production of the new hybrid Fiat

500e, with an expected annual sales range of 100,000 to 110,000

units. This version combines a gasoline engine and battery,

offering a more affordable option compared to the fully electric

model, which sold fewer than 80,000 units last year.

Nio (NYSE:NIO) – The Chinese electric vehicle

manufacturer predicted on Thursday that its deliveries in the

second quarter will more than double compared to the previous year,

reaching between 54,000 and 56,000 units. The estimated revenue is

about $2.3 billion. Despite the increase in sales, the company

still reports losses.

Delta Air Lines (NYSE:DAL) – Delta Air Lines

will announce plans for a new flight between Seattle and

Washington’s Reagan National Airport, taking advantage of new

legislation creating five new daily slots at this airport. Delta

aims to increase competition and reduce prices on a route already

served by Alaska Airlines (ALK).

Boeing (NYSE:BA) – Boeing’s space taxi, the

CST-Starliner, successfully docked with the International Space

Station, carrying NASA astronauts Sunita Williams and Barry Wilmore

for a critical test flight. Despite initial thruster issues, the

mission marks an important step for Boeing in space

transportation.

Lockheed Martin (NYSE:LMT) – Germany plans to

acquire eight additional F-35 fighters from Lockheed Martin, in

addition to the 35 already ordered, raising the total number to 43.

This acquisition reflects Berlin’s commitment to updating its

defense capabilities with the most advanced aircraft available.

Devon Energy (NYSE:DVN) – Devon Energy lost

bids to acquire three oil and gas companies due to the rejection of

its stock as a form of payment. This includes failing to outbid

offers from ConocoPhillips and Occidental Petroleum, respectively

$22 billion and $12 billion, negatively affecting its competitive

position.

Sociedad Quimica y Minera de Chile (NYSE:SQM),

Rothschild & Co (EU:ROTH) – Rothschild &

Co is leading the search for partners for Codelco in a new major

lithium project in Chile, called the “Paloma Project,” with

production expected to start in 2030. The project initially

contemplates lithium production through evaporation ponds, with a

future possibility of using direct lithium extraction

technology.

Moody’s (NYSE:MCO) – Moody’s Ratings placed the

long-term debt ratings of U.S. regional banks, including Old

National Bancorp (NASDAQ:ONB), under review for downgrade due to

concerns about exposure to the commercial real estate sector. The

justification is the concentration in loans from this sector,

increasing risks during recession periods. Additionally, a Moody’s

report highlights that most global insurers plan to invest more in

the private credit market in the coming years. This market,

although less transparent and riskier than public credit, has

attracted insurers due to attractive returns, especially in the

U.S., where these holdings already represent 36% of their regional

investments.

Emerson (NYSE:EMR), Blackstone

(NYSE:BX) – Emerson agreed to sell its 40% stake in the Copeland

joint venture to Blackstone for $3.5 billion, seeking to simplify

its business and focus more on automation.

PayPal (NASDAQ:PYPL) – PayPal shares are up

0.25% in pre-market trading, following a 5.5% increase on Thursday.

The rise came amid optimistic expectations for the new Fastlane

product, which simplifies the checkout process. This represents a

rebound after underperforming the market in recent years.

Citigroup (NYSE:C) – Analysts at BofA

Securities suggest that Citigroup could sell its wealth management

business due to inefficiency and uncertain results in this segment.

Jane Fraser, Citigroup’s CEO since 2021, is restructuring the bank,

reducing businesses and jobs, and introducing new leaders to

streamline operations.

Morgan Stanley (NYSE:MS) – Morgan Stanley faces

disputes due to a judge’s decision classifying its deferred

compensation programs under ERISA law, affecting arbitrations over

payments. The company seeks review of the decision, arguing that it

complicates its defense in other similar arbitrations.

Waystar Holding Corp. (WAY) – The healthcare

payments software maker set the price of its initial public

offering (IPO) at $21.50 per share, hitting the midpoint of the $20

to $23 range. With this, the company raised $968 million, reaching

a market value of about $3.6 billion. Waystar plans to use the

proceeds to pay off debt. Waystar shares will begin trading on

Friday on the Nasdaq Global Select Market under the symbol WAY.

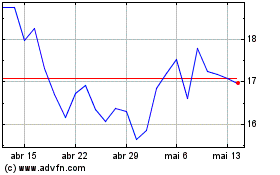

Lyft (NASDAQ:LYFT)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

Lyft (NASDAQ:LYFT)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024