SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D. C. 20549

FORM 6-K

REPORT

OF FOREIGN PRIVATE ISSUER

Pursuant

to Rule 13a-16 or 15d-16 of

the

Securities Exchange Act of 1934

For

the month of November 2024

Commission

File Number: 001-06439

SONY

GROUP CORPORATION

(Translation

of registrant’s name into English)

1-7-1 KONAN, MINATO-KU, TOKYO, 108-0075, JAPAN

(Address

of principal executive offices)

The

registrant files annual reports under cover of Form 20-F.

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F,

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

| |

SONY GROUP CORPORATION

(Registrant)

|

| |

|

|

| |

By: |

|

/s/ Hiroki Totoki |

| |

|

|

(Signature) |

| |

Hiroki Totoki |

| |

President, Chief Operating Officer and |

| |

Chief Financial Officer |

Date:

November 8, 2024

List

of Materials

Documents

attached hereto:

Granting of Restricted Stock Units (“RSUs”) and Filing of Shelf Registration Statement regarding Issuance of New Shares or

Disposal of Treasury Shares

November 8, 2024

Sony Group Corporation

Granting

of Restricted Stock Units (“RSUs”) and

Filing

of Shelf Registration Statement regarding

Issuance

of New Shares or Disposal of Treasury Shares

In the fiscal year ended March 31, 2023, Sony

Group Corporation (the “Corporation”) introduced a stock compensation plan under which shares of its common stock are delivered

after the vesting of RSUs (the “Plan”).Today the Corporation announces that its Representative Corporate Executive Officer

has decided to grant RSUs to employees of the Corporation and to the directors, officers and employees of the subsidiaries of the Corporation

(the “Recipients”) under the Plan and that it has, as of today, filed the shelf registration statement regarding the issuance

of new shares or the disposal of treasury shares under the Plan with the Director-General of the Kanto Local Finance Bureau, as follows.

I. Granting of RSUs

| 1. | Summary of Eleventh Series RSUs |

| (1) | Designation of the Recipients, the number of Recipients and the number of RSUs to be granted |

| |

|

Employees of the Corporation |

6 persons |

(RSUs corresponding to a total of up to 3,000 shares) |

On the condition

that the Recipient holds, throughout the period between the date of grant of the RSUs and the first day of the month following the month

of the third anniversary of the date of grant (if such date falls on a holiday of the Corporation, the following business day), a position

as a director, a corporate executive officer and/or any other officer at, or an employee of, the Corporation and/or a Related Company

of the Corporation (a “Related Company” means a “subsidiary (kogaisha)” as defined in Article 8, Paragraph

3 of the Ordinance on the Terminology, Forms and Preparation Methods of Financial Statements, etc. or an “affiliated company (kanren

kaisha)” as defined in Paragraph 5 of such Article (hereinafter the same shall apply); and together with the Corporation, the

“Group Companies”), all RSUs held by the Recipient shall vest on the first day of the month following the month of the third

anniversary of the date of grant (if such date falls on a holiday of the Corporation, the following business day); provided, however,

if, before the vesting, the Recipient ceases to hold all of his or her positions as a director, a corporate executive officer and/or any

other officer at, and, if applicable, ceases to be an employee of, the Group Companies due to his or her death or any other justifiable

reason that is approved by the Compensation Committee or the Representative Corporate Executive Officer of the Corporation, at a certain

time after the loss of such position with the Group Companies as stated in 4. below, a pro-rata portion of the outstanding RSUs shall

vest and the same number of shares (the “Number of Shares for RSUs”) shall be delivered; the pro-rata portion of RSUs shall

be determined by the Corporation according to the length of time between the date of grant of the RSUs and the date of the loss of such

position with the Group Companies. However, the Compensation Committee or the Representative Corporate Executive Officer may adjust the

number of shares to be delivered within the number of RSUs that the Recipient holds.

| 2. | Summary of Twelfth Series RSUs |

| (1) | Designation of the Recipients, the number of Recipients and the number of RSUs to be granted |

| |

|

Employees of the Corporation |

472 persons |

(RSUs corresponding to a total of up to 461,400 shares) |

| |

|

Directors and any other officers of the subsidiaries of the Corporation |

52 persons |

(RSUs corresponding to a total of up to 414,773 shares) |

| |

|

Employees of the subsidiaries of the Corporation |

3,367 persons |

(RSUs corresponding to a total of up to 6,577,946 shares) |

| |

|

Total |

3,891 persons |

(RSUs corresponding to a total of up to 7,454,119 shares) |

On the condition

that the Recipient holds, throughout the period between the date of grant of the RSUs and each date of vesting set out in column (1) of

the table below, a position as a director, a corporate executive officer and/or any other officer at, or an employee of any of the Group

Companies, the RSUs shall vest on each date of vesting as set out in column (2) of the table below (or, if the date falls on a holiday

of the Corporation, the following business day). The number of the units that vest on the first day of the month following the month of

the first anniversary of the date of grant or the first day of the month following the month of the second anniversary of the date of

grant will be rounded down to the nearest one (1) units.

| |

|

|

<Date of vesting> (1) |

<Number of vesting units> (2) |

| |

|

a. |

First day of the month following the month of the 1st anniversary of the date of grant |

One-third of the number of units granted |

| |

|

b. |

First day of the month following the month of the 2nd anniversary of the date of grant |

One-third of the number of units granted |

| |

|

c. |

First day of the month following the month of the 3rd anniversary of the date of grant |

Remaining number of units granted |

If, before the vesting,

the Recipient ceases to hold all of his or her positions as a director, a corporate executive officer and/or any other officer at, and,

if applicable, ceases to be an employee of, the Group Companies due to his or her death or any other justifiable reason that is approved

by the Compensation Committee or the Representative Corporate Executive Officer of the Corporation, at a certain time after the loss of

such position with the Group Companies as stated in 4. below, a pro-rata portion of the outstanding RSUs shall vest and the Number of

Shares for RSUs shall be delivered; the pro-rata portion of RSUs shall be determined by the Corporation according to the length of time

between the grant date of the RSUs and the date of the loss of such position with the Group Companies. However, the Compensation Committee

or the Representative Corporate Executive Officer may adjust the number of shares to be delivered within the number of RSUs that the Recipient

holds.

November 25, 2024

(scheduled)

| 4. | Method and Timing of Delivery of the Shares of Common Stock of the Corporation |

After the vesting

of the Eleventh Series RSUs and the Twelfth Series RSUs, the Corporation will promptly deliver the shares of common stock of the Corporation

in the Number of Shares for RSUs by way of issuing new shares or transferring treasury shares pursuant to the decision of the Representative

Corporate Executive Officer of the Corporation through contribution in kind of monetary compensation receivables against the Group Companies

that are provided by the Group Companies to the Recipients (the Corporation will cumulatively assume the debt obligation owed to the Recipients

of the Related Companies in relation to the monetary compensation receivables that are granted to such Recipients of the Related Companies).

However, if deemed necessary by the Corporation, instead of the Related Companies granting a monetary compensation receivable to the Recipient,

the Corporation may take measures it deems appropriate, such as having such Related Companies pay money to such Recipient in an amount

equal to the amount of such monetary compensation receivable. In this case, such Recipient shall acquire the shares of common stock of

the Corporation in the Number of Shares for RSUs by paying cash to the Corporation in exchange for such shares. If the total number of

issued shares of common stock of the Corporation increases or decreases due to stock consolidation or stock split (including free distribution

of shares (musho wariate)), the Corporation will adjust the number of shares to be delivered by multiplying such number by the

ratio of the consolidation or split.

In addition, the

amount to be paid per share for the shares of common stock of the Corporation to be issued or transferred under the Plan shall be determined

by the Corporation (i) based on the closing price of the share of common stock of the Corporation in the regular trading thereof on the

Tokyo Stock Exchange on the trading day immediately preceding the date when the Representative Corporate Executive Officer of the Corporation

makes a decision with respect to such issuance or transfer (or, if no transaction has been effected on such trading day, the closing price

on the immediately preceding trading day) and (ii) at a price that is not particularly favorable to the Recipients and within a range

that will be in compliance with applicable laws and regulations.

If any special circumstances make

it difficult to deliver the shares of common stock of the Corporation or if the Corporation otherwise deems it necessary, the Corporation

may, in its discretion, pay monies of equal value as a substitute for the delivery of the shares of common stock of the Corporation.

| 5. | Other matters common to the Eleventh Series RSUs and the Twelfth Series RSUs |

| (1) | Events that would extinguish the RSUs |

In the event that

(i) the Recipient chooses to forego his or her RSUs by the date of vesting, or (ii) the Recipient is subject to imprisonment or other

serious criminal penalty, (iii) a petition for the commencement of bankruptcy proceedings, the commencement of civil rehabilitation proceedings

or the commencement of any other similar proceedings is filed against the Recipient, (iv) a petition for attachment, provisional attachment,

provisional disposition, compulsory execution or public auction is filed against the Recipient, or the Recipient receives a penalty for

any default on the payment of taxes or other public dues, or (v) certain other events stipulated in advance by the Corporation occur,

all of the unvested RSUs will be extinguished.

| (2) | Handling in the event where reorganization or any other similar events occur |

If a proposal with

respect to a merger agreement under which the Corporation will be dissolved, a share exchange agreement or a share transfer plan under

which the Corporation will become a wholly-owned subsidiary, or any other reorganization is approved at a shareholders’ meeting

of the Corporation (or by the Board of the Corporation if such approval at a shareholders’ meeting of the Corporation is not required

with respect to such reorganization) or any other events stipulated by the Corporation occur, the Corporation may deliver to the Recipients

the shares of common stock of the Corporation, money, or shares of the other party to such reorganization in the number or amount reasonably

stipulated in accordance with the resolution of the Compensation Committee or the decision of the Representative Corporate Executive Officer

of the Corporation based on the period that has elapsed between the date of grant and the effective date of such reorganization or any

other factors.

| (3) | Restriction on disposal of the RSUs |

The Recipients may

not transfer or encumber or otherwise dispose of any RSUs in any manner whatsoever.

The Corporation will

file a registration statement (Form S-8) regarding the delivery of shares under the Plan with the U.S. Securities and Exchange Commission.

II. Filing of Shelf Registration Statement regarding

Issuance of New Shares or Disposition of Treasury Shares

Today, the Corporation

filed the shelf registration statement regarding issuance of new shares or disposition of treasury shares under the Plan with the Director-General

of the Kanto Local Finance Bureau. An outline of the shelf registration statement is shown in the table below.

| 1. Types of securities offered |

Shares |

| 2. Scheduled period of issuance |

Scheduled effective date of the shelf registration (November 16, 2024) through the date that is two years from such scheduled effective date (November 15, 2026). |

| 3. Scheduled amount of issuance |

25,800 million yen |

| 4. Use of proceeds |

In principle, there will be no proceeds, as the shares of common stock of the Corporation will be allocated to the Recipients through contribution in kind of monetary compensation receivables that will be provided to the Recipients. If the Corporation takes measures it deems appropriate, such as having the Related Company pay money to such Recipient, instead of such Related Company granting a monetary compensation receivable to the Recipient, some proceeds are charged. The proceeds will be allocated to the payment of various expenses related to the program and other operating funds. |

The assumption as

of today on the number of shares to be issued or disposed of upon the vesting of the RSUs during the “Scheduled period of issuance”

stated above is around 21.4 million shares (around 6.4 million shares in Japan and around 15 million shares outside Japan). The amount

stated in the “Scheduled amount of issuance” column above is the maximum amount of shares to be newly issued or disposed of,

calculated based on such assumed number of shares in Japan under certain conditions.

End

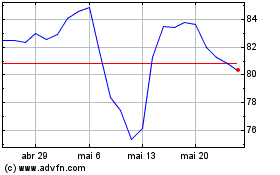

Sony (NYSE:SONY)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Sony (NYSE:SONY)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025