Filed Pursuant to Rule 424(b)(5)

Registration Statement

No. 333-266536

PROSPECTUS

SUPPLEMENT

(To Prospectus dated August 4, 2022)

Up to 50,000,000 Shares

Class A Common Stock

We have entered into a sales

and registration agreement (the “Sales and Registration Agreement”) with Goldman Sachs & Co. LLC, from time to

time acting in its capacity as (1) our sales agent (in such capacity, the “Sales Agent”) or (2) the Forward Seller

of any and all Hedging Shares offered by the Forward Counterparty (in each case, as defined below), and Goldman Sachs International,

acting in its capacity as Forward Counterparty, relating to an aggregate of up to 50,000,000 of shares of our Class A common stock, par

value $0.01 (the “Class A common stock”) offered by this prospectus supplement and the accompanying prospectus.

In accordance with the Sales

and Registration Agreement and during the term thereof, we may issue and sell shares of our Class A common stock covered by this prospectus

supplement at any time and from time to time through the Sales Agent. The Sales Agent may act as agent on our behalf or purchase shares

of our Class A common stock from us as principal for its own account.

We may also from time to

time during the term of the Sales and Registration Agreement enter into one or more forward transactions (each, a

“Forward”), under which we will agree to sell the number of shares of our Class A common stock specified in such

Forward (subject to adjustment as set forth therein) to Goldman Sachs International (in its capacity as buyer under any Forward, the

“Forward Counterparty”). If we enter into a Forward with the Forward Counterparty, to establish a hedge position

under such Forward, the Forward Counterparty will have a pledge of up to the maximum number of shares of our Class A common stock

deliverable under such Forward (the “Hedging Shares”) from us, as described in “Forward

Transactions”, with a right to rehypothecate the pledged shares, and will rehypothecate and sell up to such maximum number of

shares through Goldman Sachs & Co. LLC acting as the statutory underwriter (in such capacity, the “Forward

Seller”) in an offering under this prospectus supplement and the accompanying prospectus over

a period of time to be agreed between us and the Forward Counterparty for such Forward (an “Initial Hedging

Period”), all subject to the terms of the Sales and Registration Agreement and the Forward. We have been advised by the Forward

Counterparty that it expects that, on the same days during the Initial Hedging Period when it is selling a number of Hedging Shares

underlying the Forward, the Forward Counterparty or its affiliate(s) will be contemporaneously purchasing a substantial portion of

such number of shares in the open market for its own account, as the Forward Counterparty expects its initial hedge position in

respect of any Forward to be substantially less than the number of shares underlying such Forward, see “Forward

Transactions”. The Initial Hedging Period for any Forward that we may enter into during a reporting quarter is expected to

terminate during such reporting quarter or shortly thereafter. The number of shares underlying any Forward will be reduced in the

event that the Forward Counterparty is unable to introduce the maximum number of shares deliverable under the Forward into the public

market during the Initial Hedging Period therefor (including as a result of the prospectus being unavailable at any time during such

Initial Hedging Period). See “Plan of Distribution (Conflicts of Interest).”

Sales, if any, of our Class

A common stock under this prospectus supplement and the accompanying prospectus may be made in sales deemed to be “at the market

offerings” as defined in Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”), including

by sales made by means of ordinary brokers’ transactions on or through the New York Stock Exchange (“NYSE”)

or another market for our Class A common stock, sales made to or through a market maker other than on an exchange, including in the over-the-counter

market, in negotiated transactions (including block trades), at market prices prevailing at the time of sale or at negotiated prices,

through a combination of any such methods of sale, or by any other method permitted by law. Goldman Sachs & Co. LLC, acting either

as the Sales Agent or as the Forward Seller, is not required to sell any specific number or dollar amount of shares of our Class A common

stock, but, subject to the terms and conditions of the Sales and Registration Agreement and, in relation to sales of the Hedging Shares,

the applicable Forward, the Sales Agent and the Forward Seller will use its respective commercially reasonable efforts, consistent with

its normal trading and sales practices, to sell up to the designated shares of our Class A common stock. In respect of any sales by the

Sales Agent on our behalf and in respect of any sales of the Hedging Shares by the Forward Seller on behalf of the Forward Counterparty,

we may specify that no shares of our Class A common stock may be sold, if the sales cannot be effected at or above the price designated

by us, and we may specify other trading parameters for such sales (including volume limitations). Accordingly, any sales by the Sales

Agent on our behalf and any sales of the Hedging Shares by the Forward Seller may be suspended at any time, and there can be no assurance

that either the Sales Agent or the Forward Seller will be able to sell any shares pursuant to the Sales and Registration Agreement. No

sales of shares of our Class A common stock by the Sales Agent acting on our behalf will occur simultaneously with any sales of the Hedging

Shares by the Forward Seller on behalf of the Forward Counterparty, in each case, pursuant to the Sales and Registration Agreement.

The compensation to the

Sales Agent will be a mutually agreed commission that will not exceed 1.0% of the gross sales price per share of our Class A common

stock sold through it on our behalf under the Sales and Registration Agreement. We will not receive any proceeds from the sale of

any Hedging Shares by the Forward Counterparty under this prospectus supplement, but we expect to receive a prepayment under each

Forward after completion of the respective Initial Hedging Period for such Forward, and we may receive an additional payment upon

settlement at maturity of such Forward (or a portion thereof), as described in “Forward Transactions”. We refer you to “Plan of

Distribution (Conflicts of Interest)” beginning on page S-30 of this prospectus supplement for additional information

regarding compensation of the Sales Agent, the Forward Seller and the Forward Counterparty.

In connection with the sale

of shares of Class A common stock on our behalf by the Sales Agent and on behalf of the Forward Counterparty by the Forward Seller, the

Sales Agent and the Forward Seller, respectively, will be deemed to be an “underwriter” within the meaning of the Securities

Act. The compensation of the Sales Agent and the Forward Seller will be deemed to be underwriting commissions or discounts.

Our Class A common stock

is listed on the NYSE under the symbol “AMC.” The market prices and trading volume of our shares of Class A common stock

have been and may continue to be subject to extreme fluctuations in response to numerous factors, many of which are beyond our control,

which could cause purchasers of our Class A common stock to incur substantial losses.

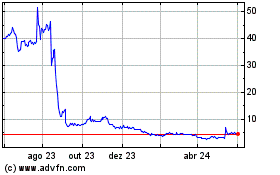

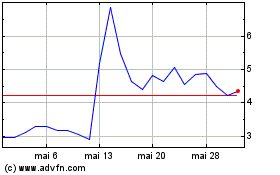

During 2024 to date, the

market price of our Class A common stock has fluctuated from an intra-day low on the NYSE of $2.38 per share on April 16, 2024 to an

intra-day high on the NYSE of $11.88 on May 14, 2024, and the last reported sale price of our Class A common stock on the NYSE on December

5, 2024 was $5.20 per share.

During 2024 to date, according

to the NYSE, daily trading volume for our Class A common stock ranged from approximately 3,755,000 to 634,246,600 shares. The extreme

fluctuations in the market price and trading volume of our Class A common stock in recent years have been accompanied by reports of strong

and atypical retail investor interest, including on social media and online forums. While the market prices of our Class A common stock

may respond to developments regarding our liquidity, operating performance and prospects and developments regarding our industry, we

believe that volatility and our current market prices also reflect market and trading dynamics unrelated to our underlying business,

or macro or industry fundamentals, and we do not know how long these dynamics will last. Within the last seven business days, the market

price of our Class A common stock has fluctuated from an intra-day low on the NYSE of $4.71 on November 26, 2024 to an intra-day high

of $5.56 on December 5, 2024. Under the circumstances, we caution you against investing in our Class A common stock, unless you are

prepared to incur the risk of losing all or a substantial portion of your investment. See “Risk Factors — Risks Related

to This Offering.”

Settlement of any sales of

our Class A common stock will occur on the first business day following the date on which such sales were made (or such earlier day as

is industry practice for regular-way trading). There is no arrangement for funds to be received in an escrow, trust or similar arrangement.

Sales of our Class A common stock as contemplated in this prospectus supplement will be settled through the facilities of The Depository

Trust Company or by such other means as may be designated by the Sales Agent or the Forward Seller (as applicable) at the time of sale.

Investing in our Class

A common stock is highly speculative and involves risks. You should carefully read and consider the risk factors included in this prospectus

supplement, in our periodic reports, in the accompanying prospectus and in any other documents we file with the U.S. Securities and Exchange

Commission (the “SEC”). See the sections entitled “Risk Factors” below on page S-10, in our other filings with

the SEC and in the accompanying prospectus.

Neither the SEC nor any

state securities commission has approved or disapproved of these securities or determined if this prospectus supplement is truthful or

complete. Any representation to the contrary is a criminal offense.

Goldman

Sachs & Co. LLC

The date of this prospectus supplement is December

6, 2024.

TABLE OF CONTENTS

Prospectus Supplement

ABOUT

THIS PROSPECTUS SUPPLEMENT

On August 4, 2022, we filed

with the SEC a registration statement on Form S-3 utilizing a shelf registration process related to the securities described in this

prospectus supplement, which was automatically declared effective upon filing.

This document is in two parts.

The first part is this prospectus supplement, which describes the specific terms of the sales that may be made hereunder and also adds

to and updates information contained in the accompanying prospectus and the documents incorporated by reference into this prospectus

supplement and the accompanying prospectus. The second part, the accompanying prospectus, gives more general information, some of which

may not apply to any offering under this prospectus supplement. Generally, when we refer to this prospectus, we are referring to both

parts of this document combined. In this prospectus supplement, as permitted by law, we “incorporate by reference” information

from other documents that we file with the SEC. This means that we can disclose important information to you by referring you to those

documents. The information incorporated by reference is considered to be a part of this prospectus supplement and the accompanying prospectus

and should be read with the same care. When we update the information contained in documents that have been incorporated by reference

by making future filings with the SEC, the information included or incorporated by reference in this prospectus supplement is considered

to be automatically updated and superseded. In other words, in case of a conflict or inconsistency between information contained in this

prospectus supplement and information in the accompanying prospectus or incorporated by reference into this prospectus supplement, you

should rely on the information contained in the document that was filed later.

You should rely only on the

information contained in this prospectus supplement and the accompanying prospectus, including the information incorporated by reference

herein as described under “Where You Can Find More Information; Incorporation of Documents by Reference,” and any free writing

prospectus that we prepare and distribute.

We have not, and neither

the Sales Agent, nor the Forward Seller nor its affiliate Forward Counterparty have, authorized anyone to provide you with information

other than that contained in or incorporated by reference into this prospectus supplement, the accompanying prospectus or any free writing

prospectus related hereto that we may authorize to be delivered to you. If given or made, any such other information or representation

should not be relied upon as having been authorized by us. The Sales Agent and the Forward Seller may only offer to sell, and seek offers

to buy, any securities in jurisdictions where offers and sales are permitted.

This prospectus supplement

and the accompanying prospectus and any other offering materials do not contain all of the information included in the registration statement

as permitted by the rules and regulations of the SEC. For further information, we refer you to the registration statement on Form S-3,

including its exhibits. We are subject to the informational requirements of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), and, therefore, file reports and other information with the SEC. Statements contained in this prospectus supplement

and the accompanying prospectus or other offering materials about the provisions or contents of any agreement or other document are only

summaries. If SEC rules require that any agreement or document be filed as an exhibit to the registration statement, you should refer

to that agreement or document for its complete contents.

You should assume that

the information in this prospectus supplement, the accompanying prospectus or any other offering materials is only accurate as of the

date on its respective cover, and that any information incorporated by reference is accurate only as of the date of the document incorporated

by reference, unless otherwise indicated. Our business, financial condition, results of operations and prospects may have changed since

such date.

Unless we state otherwise,

references to “we,” “us,” “our,” the “Company” or “AMC” refer to AMC Entertainment

Holdings, Inc. and its consolidated subsidiaries.

WHERE

YOU CAN FIND MORE INFORMATION;

INCORPORATION OF DOCUMENTS BY REFERENCE

We file annual, quarterly

and current reports, proxy statements and other information with the SEC. The SEC maintains an Internet site that contains our reports,

proxy and other information regarding us and other issuers that file electronically with the SEC, at http://www.sec.gov. Our SEC filings

are also available free of charge at our website (www.amctheatres.com). However, except for our filings with the SEC that are incorporated

by reference into this prospectus supplement, the information on our website is not, and should not be deemed to be, a part of, or incorporated

by reference into, this prospectus supplement.

This prospectus supplement

contains summaries of certain of our agreements. The descriptions contained in this prospectus supplement of these agreements do not

purport to be complete and are subject to, or qualified in their entirety by reference to, the definitive agreements.

The SEC allows “incorporation

by reference” into this prospectus supplement of information that we file with the SEC. This permits us to disclose important information

to you by referencing these filed documents. Any information referenced this way is considered to be a part of this prospectus supplement

and any information filed by us with the SEC subsequent to the date of this prospectus supplement automatically will be deemed to update

and supersede this information. We incorporate by reference the following documents which we have filed with the SEC (excluding any documents

or portions of such documents that have been “furnished” but not “filed” for purposes of the Exchange Act):

| · | our

quarterly reports on Form 10-Q for the fiscal quarter ended March 31, 2024, filed with the

SEC on May 8, 2024, for the fiscal quarter

ended June 30, 2024, filed with the SEC on August 2, 2024, and for the fiscal quarter

ended September 30, 2024, filed with the SEC on November 6, 2024 (each a “Quarterly

Report”); |

| · | our

Current Reports on Form 8-K filed with the SEC on January

2, 2024, March

1, 2024, March

12, 2024, March

28, 2024, April

19, 2024, April

26, 2024, May

15, 2024, June

7, 2024, July

22, 2024 (as amended by the Form

8-K/A filed on July 25, 2024), July

24, 2024, September

16, 2024, September

30, 2024, and November

12, 2024; |

We incorporate by reference

any filings made by us with the SEC in accordance with Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act on or after the date of

this prospectus supplement and the date all of the securities offered hereby are sold or the offering is otherwise terminated, with the

exception of any information furnished under Item 2.02 and Item 7.01 (including any financial statements or exhibits relating thereto

furnished pursuant to Item 9.01) of Form 8-K, which is not deemed filed and which is not incorporated by reference herein. Any such filings

shall be deemed to be incorporated by reference and to be a part of this prospectus supplement from the respective dates of filing of

those documents.

This prospectus supplement

and any accompanying prospectus are part of a registration statement that we filed with the SEC and do not contain all of the information

in the registration statement. The full registration statement may be obtained from the SEC or us, as provided below. Statements in this

prospectus supplement or any accompanying prospectus or free writing prospectus about these documents are summaries and each statement

is qualified in all respects by reference to the document to which it refers. You should refer to the actual documents for a more complete

description of the relevant matters. You may inspect a copy of the registration statement at the SEC’s website, as provided above.

Any statement contained in

a document incorporated or deemed to be incorporated by reference in this prospectus supplement will be deemed to be modified or superseded

to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated

by reference in this prospectus supplement modifies or supersedes that statement. Any statement so modified or superseded will not be

deemed, except as so modified or superseded, to constitute a part of this prospectus supplement.

We will provide to each person,

including any beneficial owner, to whom a prospectus is delivered, without charge, upon written or oral request, a copy of any or all

of the documents that are incorporated by reference into this prospectus supplement but not delivered with this prospectus supplement,

excluding any exhibits to those documents unless the exhibit is specifically incorporated by reference as an exhibit in this prospectus

supplement. You should direct requests for documents to:

AMC Entertainment Holdings, Inc.

One AMC Way

11500 Ash Street

Leawood, Kansas 66211

(913) 213-2000

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain statements made in

this prospectus supplement, the documents that are incorporated by reference in this prospectus supplement and other written or oral

statements made by or on behalf of AMC may constitute “forward-looking statements” within the meaning of Section 27A of the

Securities Act and Section 21E of the Exchange Act. Forward-looking statements may be identified by the use of words such as “may,”

“will,” “forecast,” “estimate,” “project,” “intend,” “plan,”

“expect,” “should,” “believe” and other similar expressions that predict or indicate future events

or trends or that are not statements of historical matters. These forward-looking statements are based only on our current beliefs, expectations

and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy

and other future conditions and speak only as of the date on which it is made. Examples of forward-looking statements include statements

we make regarding future attendance levels, revenues and our liquidity. These forward-looking statements involve known and unknown risks,

uncertainties, assumptions and other factors, including those discussed in “Risk Factors,” which may cause our actual results,

performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such

forward-looking statements. These risks and uncertainties include, but are not limited to, the following:

| · | the

risks and uncertainties relating to the sufficiency of our existing cash and cash equivalents

and available borrowing capacity, including following the termination of our senior secured

revolving credit facility (“Senior Secured Revolving Credit Facility”),

to fund operations, and satisfy obligations including cash outflows for deferred rent and

planned capital expenditures currently and through the next twelve months. In order to achieve

net positive cash flows provided by operating activities and long-term profitability, revenues

will need to increase from current levels to levels at least in line with pre-COVID-19 revenues.

However, there remain significant risks that may negatively impact revenues and attendance

levels, including changes to movie studios release schedules (including as a result of production

delays and delays to the release of movies caused by labor stoppages) and direct to streaming

or other changing movie studio practices. If we are unable to achieve increased levels of

attendance and revenues, we will be required to obtain additional liquidity. If such additional

liquidity is not obtained or is insufficient, we likely would seek an in-court or out-of-court

restructuring of our liabilities, and in the event of such future liquidation or bankruptcy

proceeding, holders of our Class A common stock and other securities would likely suffer

a total loss of their investment; |

| · | the

risks and uncertainties relating to the Refinancing Transactions (as defined below), including,

but not limited to, (i) the potential for additional future dilution of our Class A common

stock as a result of issuance of shares underlying our 6.00%/8.00% Cash/PIK Toggle Senior

Secured Exchangeable Notes (the “Exchangeable Notes”), (ii) the possibility

that the extension of certain debt maturities will not provide enough time for attendance

and revenues to increase to sufficient levels and will not generate net positive cash flows

from operating activities and long-term profitability to overcome liquidity concerns or may

be insufficient to do so if the Company does not achieve revenue levels at least in line

with pre-COVID-19 revenues and (iii) the impact on the market price of our Class A common

stock and our capital structure of litigation resulting from the Refinancing Transactions

or the claims of default or any additional litigation that has arisen or may arise in connection

with the Refinancing Transactions; |

| · | changing

practices of distributors, which accelerated during the COVID-19 pandemic, including increased

use of alternative film delivery methods including premium video on demand, streaming platforms,

shrinking exclusive theatrical release windows or release of movies to theatrical exhibition

and streaming platforms on the same date, the theatrical release of fewer movies, or transitioning

to other forms of entertainment; |

| · | the

impact of changing movie-going behavior of consumers; |

| · | the

risk that the North American and international box office in the near term will not recover

sufficiently, resulting in higher cash burn and the need to seek additional financing; |

| · | risks

and uncertainties relating to our significant indebtedness, including our borrowings and

our ability to meet our financial maintenance and other covenants; |

| · | the

dilution caused by recent and potential future sales of our Class A common stock and future

potential share issuances to repay, refinance, redeem or repurchase indebtedness (including

expenses, accrued interest and premium, if any); |

| · | risks

relating to motion picture production, promotion, marketing, and performance, including labor

stoppages affecting the production, supply and release schedule of theatrical motion picture

content; |

| · | the

seasonality of our revenue and working capital, which are dependent upon the timing of motion

picture releases by distributors, such releases being seasonal and resulting in higher attendance

and revenues generally during the summer months and holiday seasons, and higher working capital

requirements during the other periods such as the first quarter; |

| · | intense

competition in the geographic areas in which we operate among exhibitors, streaming platforms,

or from other forms of entertainment; |

| · | certain

covenants in the agreements that govern our indebtedness and limit our ability to take advantage

of certain business opportunities and limit or restrict our ability to pay dividends, incur

additional debt, pre-pay debt, and also to refinance debt and to do so at favorable terms,

and such covenants that impose additional administrative and operational burdens on our business; |

| · | risks

relating to impairment losses, including with respect to goodwill and other intangibles,

and theatre and other closure charges; |

| · | general

and international economic, political, regulatory, social and financial market conditions,

including potential economic recession, inflation, rising interest rates, the financial stability

of the banking industry, and other risks that may negatively impact discretionary income

and our revenues and attendance levels; |

| · | our

lack of control over distributors of films; |

| · | limitations

on the availability of capital or poor financial results may prevent us from deploying strategic

initiatives; |

| · | an

issuance of preferred stock could dilute the voting power of the common stockholders and

adversely affect the market value of our outstanding Class A common stock; |

| · | limitations

on the authorized number of shares of Class A common stock could in the future prevent us

from raising additional capital through Class A common stock; |

| · | our

ability to achieve expected synergies, benefits and performance from our strategic initiatives; |

| · | our

ability to refinance our indebtedness on terms favorable to us or at all; |

| · | our

ability to optimize our theatre circuit through new construction, the transformation of our

existing theatres, and strategically closing underperforming theatres may be subject to delay

and unanticipated costs; |

| · | failures,

unavailability or security breaches of our information systems, including due to cybersecurity

incidents; |

| · | our

ability to utilize interest expense deductions will be limited annually due to Section 163(j)

of the Internal Revenue Code of 1986, as amended (the “Code”), as amended

by the Tax Cuts and Jobs Act of 2017; |

| · | our

ability to recognize interest deduction carryforwards, net operating loss carryforwards and

other tax attributes to reduce our future tax liability; |

| · | our

ability to recognize certain international deferred tax assets which currently do not have

a valuation allowance recorded; |

| · | review

by antitrust authorities in connection with acquisition opportunities; |

| · | risks

relating to the incurrence of legal liability, including costs associated with the ongoing

securities class action lawsuits; |

| · | dependence

on key personnel for current and future performance and our ability to attract and retain

senior executives and other key personnel, including in connection with any future acquisitions; |

| · | increased

costs in order to comply or resulting from a failure to comply with governmental regulation,

including the General Data Protection Regulation (“GDPR”) and all other

current and pending privacy and data regulations in the jurisdictions where we have operations; |

| · | supply

chain disruptions may negatively impact our operating results; |

| · | the

availability and/or cost of energy, particularly in Europe; |

| · | the

market price and trading volume of our shares of Class A common stock has been and may continue

to be volatile, and purchasers of our securities could incur substantial losses; |

| · | future

offerings of debt, which would be senior to our Class A common stock for purposes of distributions

or upon liquidation, could adversely affect the market price of our Class A common stock; |

| · | the

potential for political, social, or economic unrest, terrorism, hostilities, cyber-attacks

or war, including the conflict between Russia and Ukraine and other international conflicts; |

| · | the

potential impact of financial and economic sanctions on the regional and global economy,

or widespread health emergencies, such as pandemics or epidemics, causing people to avoid

our theatres or other public places where large crowds are in attendance; |

| · | anti-takeover

protections in our Third Amended and Restated Certificate of Incorporation (the “Certificate

of Incorporation”) and our amended and restated bylaws (the “bylaws”)

may discourage or prevent a takeover of our Company, even if an acquisition would be beneficial

to our stockholders; and |

| · | other

risks and uncertainties identified in this prospectus supplement and in the documents incorporated

herein by reference. |

This list of factors that

may affect future performance and the accuracy of forward-looking statements is illustrative but not exhaustive. In addition, new risks

and uncertainties may arise from time to time. Accordingly, all forward-looking statements should be evaluated with an understanding

of their inherent uncertainty and we caution accordingly against relying on forward-looking statements.

Consider these factors carefully

in evaluating the forward-looking statements. Additional factors that may cause results to differ materially from those described in

the forward-looking statements are set forth in this prospectus supplement under “Risk Factors,” as well as those

set forth in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Item

1A. Risk Factors” in the Annual Report (as defined in “Where You Can Find More Information; Incorporation of Documents

By Reference” in this prospectus supplement), “Item 1A. Risk Factors” in our

Quarterly Report on Form 10-Q for the period ended September 30, 2024 and subsequent reports filed by us with the SEC, including

on Form 8-K. Because of the foregoing, you are cautioned against relying on forward-looking statements, which speak only as of the date

hereof. We do not undertake to update any of these statements in light of new information or future events, except as required by applicable

law.

PROSPECTUS

SUPPLEMENT SUMMARY

This summary highlights

information contained elsewhere in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference.

This summary sets forth the material terms of this offering, but does not contain all of the information you should consider before investing

in the Class A common stock. You should read carefully this entire prospectus supplement and the accompanying prospectus, including the

documents incorporated by reference in this prospectus supplement and the accompanying prospectus, before making an investment decision

to purchase our Class A common stock, especially the risks of investing in the Class A common stock discussed in the section titled “Risk

Factors” in this prospectus supplement as well as the consolidated financial statements and notes to those consolidated financial

statements incorporated by reference into this prospectus supplement and the accompanying prospectus.

THE

COMPANY

We are the world’s

largest theatrical exhibition company and an industry leader in innovation and operational excellence. We operate theatres in 11 countries

throughout the United States and Europe. Over the course of our 100+ year history, we have pioneered many of the theatrical exhibition

industry’s most important innovations. We introduced Multiplex theatres in the 1960s and the North American stadium-seated Megaplex

theatre format in the 1990s. Most recently, we continued to innovate and evolve the movie-going experience with the deployment of our

theatre renovations featuring plush, powered recliner seating and the launch of our U.S. subscription loyalty tier, AMC Stubs® A-List.

Our growth has been driven by a combination of organic growth through reinvestment in our existing assets and through the acquisition

of some of the most significant companies in the theatrical exhibition industry.

We were incorporated under the laws of the state

of Delaware on June 6, 2007. We maintain our principal executive offices at One AMC Way, 11500 Ash Street, Leawood, Kansas 66211 and

our telephone number is (913) 213-2000. Our corporate website address is www.amctheatres.com. Our website and the information contained

on, or that can be accessed through, the website is not incorporated by reference in, and is not part of, this prospectus supplement.

You should not rely on any such information in making your decision whether to purchase shares of our Class A common stock.

THE

OFFERING

| Issuer |

AMC Entertainment Holdings, Inc. |

| |

|

| Securities Offered Hereby |

In

an aggregate amount of up to 50,000,000 shares of our Class A common stock.

See “Plan of Distribution

(Conflicts of Interest)” on page S-30.

|

| |

|

| Class A Common Stock to be Outstanding after

this Offering |

Up to 431,470,553 shares of our Class A common

stock (including, without duplication, up to 50,000,000 shares of our Class A common stock that may be pledged by us (with a right

to rehypothecate) to the Forward Counterparty and sold under this prospectus supplement to hedge one or more Forwards to the Forward

Counterparty, as described in “Forward Transactions—Share Pledge Arrangement”, starting on page S-19. |

| |

|

| Manner of Offering |

Sales,

if any, of our Class A common stock under this prospectus supplement and the accompanying prospectus

may be made in sales deemed to be “at the market offerings” as defined in Rule 415 under

the Securities Act, including by sales made by means of ordinary brokers’ transactions on or

through the New York Stock Exchange (“NYSE”) or another market for our Class A

common stock, sales made to or through a market maker other than on an exchange, including in the

over-the-counter market, in negotiated transactions (including block trades), at market prices prevailing

at the time of sale or at negotiated prices, through a combination of any such methods of sale, or

any other method permitted by law.

See “Plan of Distribution

(Conflicts of Interest)” on page S-30.

|

| |

|

| Use of Proceeds |

We intend to use (1) the net proceeds, if any, we

receive from the Sales Agent upon issuance and sale of shares of Class A common stock to or through the Sales Agent and (2) any

amount received from the Forward Counterparty upon prepayment and, if applicable, settlement of one or more Forwards (or a portion

thereof), in each case, if any, to strengthen our balance sheet and reinvest in our core business to elevate and differentiate the

movie-going experience under our AMC GO Plan. We intend to strengthen the balance sheet by bolstering our liquidity, and by

repaying, redeeming or refinancing our existing debt (including expenses, accrued interest and premium, if any). Investments under

the AMC GO Plan include such areas as seating, sight and sound enhancements, including an increase in the number of branded premium

large format screens. See “Use of Proceeds” on page S-18. |

| |

|

| Conflicts of Interest |

Because Goldman Sachs International, as Forward Counterparty, and/or Goldman Sachs & Co. LLC, as Forward Seller, may receive more than 5% of the net proceeds of the offering of any Hedging Shares (as defined in “Forward Transactions”) under this prospectus supplement, Goldman Sachs & Co. LLC is deemed to have a “conflict of interest” under Rule 5121 of the Financial Industry Regulatory Authority, Inc. (“FINRA”). Accordingly, this offering is being made in compliance with the requirements of FINRA Rule 5121. Pursuant to that rule, the appointment of a “qualified independent underwriter” is not required in connection with this offering as a “bona fide public market,” as defined in FINRA Rule 5121, exists for our Class A common stock.

See the sections titled “Use of Proceeds” on page S-18 and “Plan of Distribution (Conflicts of Interest)” on page S-30. |

| |

|

| Clear Market |

If we enter

into any Forward, such Forward may limit our ability to conduct transactions related to our

Class A common stock, as described in more details in “Forward Transactions –

Clear Market”. |

| Material U.S. Federal Income Tax Consequences |

For a discussion of the material U.S.

federal income tax consequences to non-U.S. holders (as defined below) of the purchase, ownership and disposition of our Class A

common stock, see “Material U.S. Federal Income Tax Consequences” on page S-26. |

| |

|

| Risk Factors |

Investing in our Class A common stock is highly

speculative and involves a high degree of risk. See “Risk Factors” beginning on page S-10, as well as the

other information included in or incorporated by reference in this prospectus supplement and the accompanying prospectus, for a discussion

of risks you should carefully consider before investing in our Class A common stock. |

| |

|

| NYSE Symbol |

The Class A common stock is listed on the NYSE

under the symbol “AMC.” |

RISK

FACTORS

Investing in our Class

A common stock is highly speculative and involves a high degree of risk. You should carefully consider the risk factors described in

Part I, Item 1A, “Risk Factors” in our Annual Report and any updates to those risk factors or new risk factors contained

in our subsequent quarterly reports and current reports, all of which is incorporated by reference into this prospectus supplement, the

accompanying prospectus and in any other documents incorporated into this prospectus supplement or the accompanying prospectus by reference.

We expect to update these Risk Factors from time to time in the periodic and current reports that we file with the SEC after the date

of this prospectus supplement. These updated risk factors will be incorporated by reference in this prospectus supplement and the accompanying

prospectus. Before making any investment decision, you should carefully consider these risks as well as other information we include

or incorporate by reference in this prospectus supplement or in the accompanying prospectus. For more information, see the section entitled

“Where You Can Find More Information; Incorporation of Documents by Reference” above. These risks could materially affect

our business, results of operations or financial condition and affect the value of our Class A common stock. You could lose all or part

of your investment. Additionally, the risks and uncertainties discussed in this prospectus supplement or in any document incorporated

by reference into this prospectus supplement are not the only risks and uncertainties that we face, and additional risks and uncertainties

not presently known to us or that we currently deem immaterial may also affect our business, results of operations or financial condition.

Risks Related to this Offering

There has been significant recent dilution

and there may continue to be significant additional future dilution of our Class A common stock, which could adversely affect the market

price of shares of our Class A common stock. The risks of future dilution must also be weighed against the risks of failing to increase

our authorized shares of Class A common stock.

From January 1, 2020 through

December 4, 2024, the outstanding shares of our Class A common stock have increased by 376,262,545 shares (on a Reverse Stock Split adjusted

basis) in a combination of at the market sales, conversion of Series A Convertible Participating Preferred Stock, shareholder litigation

settlement, conversion of Class B common stock, conversion of notes, exchanges of notes, transaction fee payments, and equity grant vesting.

On March 14, 2023, we held a special meeting of our stockholders and obtained the requisite stockholder approval for the Charter Amendments

(as defined in the Annual Report) and on August 14, 2023 we filed the amendment to our Certificate of Incorporation implementing the

Charter Amendments, effective as of August 24, 2023. Accordingly, in accordance with the Charter Amendments, we increased the total number

of authorized shares of Class A common stock from 524,173,073 to 550,000,000 shares of Class A common stock and effectuated a reverse

stock split at a ratio of one share of Class A common stock for every ten shares of Class A common stock outstanding (the “Reverse

Stock Split”). In accordance with the terms of the Certificate of Designations governing the Series A Convertible Participating

Preferred Stock, following the effectiveness of the Charter Amendments all outstanding shares of our Series A Convertible Participating

Preferred Stock converted into 99,540,642 shares of Class A common stock.

On July 22, 2024, the Company

and certain of its subsidiaries consummated a series of refinancing transactions (the “Refinancing Transactions”)

with certain lenders under the Company’s existing senior secured term loans maturing 2026 (the “Existing Term Loans”)

and certain holders of its 10.00%/12.00% Cash/PIK Toggle Second Lien Subordinated Notes due 2026 (the “2L Notes”).

As a part of the Refinancing Transactions, and certain subsequent open-market purchases of Existing Term Loans, the Company repurchased

and/or exchanged all of its Existing Term Loans for new terms loans maturing in 2029 and repurchased $414.4 million of its 2L Notes.

In connection with the Refinancing Transactions, Muvico, LLC, a newly formed wholly-owned subsidiary of the Company, issued $414.4 million

aggregate principal amount of Exchangeable Notes that are exchangeable into up to a maximum aggregate of 92,197,819 shares of Class A

common stock, which includes shares of Class A common stock underlying any additional Exchangeable Notes issued as interest paid-in-kind.

More information on the details of the Refinancing Transactions can be found in our Quarterly Report on Form 10-Q for the period ended

September 30, 2024.

As of December 5, 2024, there

were 381,470,553 shares of Class A common stock issued and outstanding. We expect to issue additional shares of Class A common stock,

including pursuant to this prospectus supplement. In addition, shares of our Class A common stock may be used to settle conversion of

the Exchangeable Notes, including any additional Exchangeable Notes or interest paid in-kind by issuing Exchangeable Notes, or for other

purposes. We may also issue preferred equity securities or securities convertible into, or exchangeable for, or that represent the right

to receive, shares of Class A common stock or acquire interests in other companies, or other assets by using a combination of cash and

shares of Class A common stock, or just shares of Class A common stock. Additionally, vesting of outstanding awards pursuant to our current

and legacy equity compensation programs results in the issuance of new shares of Class A common stock, net of any shares withheld to

cover tax withholding obligations upon vesting. Any of these events may significantly dilute the ownership interests of current stockholders,

reduce our earnings per share or have an adverse effect on the price of our shares of Class A common stock.

Following this offering,

we will have remaining approximately 1,070,547 authorized shares of Class A common stock that have not been issued or reserved for issuance

in connection with our employee plans or outstanding of certain future Exchangeable Notes. As a result, we may in the future seek to

obtain the requisite stockholder approval for the authorization of an additional number of authorized and unissued and unreserved shares

of Class A common stock, which may be used for at-the-market sales, exchanges of notes, private placement transactions, equity grant

vesting and other dilutive issuances. These future issuances may be dilutive and may result in a decline in the market price of our Class

A common stock.

If we were to seek but not

obtain the requisite shareholder approval to increase our authorized shares, this could creative substantial risks, which could have

an adverse effect on the market price of our Class A common stock, including that:

| · | we

will be limited in our ability to issue equity to bolster our liquidity and respond to future

challenges, including if revenues and attendance levels do not increase; |

| · | for

future financing, we may be required to issue additional debt, which may be unavailable on

favorable terms or at all, and which would exacerbate the challenges created by our high

leverage; and |

| · | we

may be unable to issue currency in strategic transactions, including acquisitions, joint

ventures or in connection with landlord negotiations, which may prevent us from entering

into transactions that could increase shareholder value. |

The market price and trading volume of

our shares of Class A common stock have experienced, and may continue to experience, extreme volatility, which could cause purchasers

of our Class A common stock to incur substantial losses.

The market prices and trading

volume of our shares of Class A common stock have experienced, and may continue to experience, extreme volatility, which could cause

purchasers of our Class A common stock to incur substantial losses. For example, during 2024 to date, as adjusted for the Reverse Stock

Split, the market price of our Class A common stock has fluctuated from an intra-day low on the NYSE of $2.38 per share on April 16,

2024 to an intra-day high on the NYSE of $11.88 on May 14, 2024. The last reported sale price of our Class A common stock on the NYSE

on December 5, 2024, was $5.20 per share. During 2024 to date, daily trading volume ranged from approximately 3,755,000 to 634,246,600

shares.

We believe that volatility

and market prices of our shares may reflect market and trading dynamics unrelated to our underlying business, or macro or industry fundamentals,

and we do not know how long these dynamics will last. Under the circumstances, we caution you against investing in our Class A common

stock, unless you are prepared to incur the risk of losing all or a substantial portion of your investment.

Extreme fluctuations in the

market price of our Class A common stock have been accompanied by reports of strong and atypical retail investor interest, including

on social media and online forums. The market volatility and trading patterns we have experienced create several risks for investors,

including the following:

| · | the

market price of our Class A common stock has experienced and may continue to experience rapid

and substantial increases or decreases unrelated to our operating performance or prospects,

or macro or industry fundamentals, and substantial increases may be significantly inconsistent

with the risks and uncertainties that we continue to face; |

| · | factors

in the public trading market for our Class A common stock may include the sentiment of retail

investors (including as may be expressed on financial trading and other social media sites

and online forums), the direct access by retail investors to broadly available trading platforms,

the amount and status of short interest in our securities, access to margin debt, trading

in options and other derivatives on our Class A common stock and any related hedging and

other trading factors; |

| · | our

market capitalization, as implied by various trading prices, currently reflects valuations

that diverge significantly from historical valuations, and to the extent these valuations

reflect trading dynamics unrelated to our financial performance or prospects, purchasers

of our Class A common stock could incur substantial losses if there are declines in market

prices; |

| · | to

the extent volatility in our Class A common stock is caused, or may from time to time be

caused, as has widely been reported, by a “short squeeze” in which coordinated

trading activity causes a spike in the market price of our Class A common stock as traders

with a short position make market purchases to avoid or to mitigate potential losses, investors

purchase at inflated prices unrelated to our financial performance or prospects, and may

thereafter suffer substantial losses as prices decline once the level of short-covering purchases

has abated; and |

| · | if

the market price of our Class A common stock declines, investors may be unable to resell

shares of our Class A common stock at or above the price at which their investment was made.

Our Class A common stock may continue to fluctuate or decline significantly in the future,

which may result in substantial losses. |

Future increases or decreases

in the market price of our Class A common stock may not coincide in timing with the disclosure of news or developments by or affecting

us. Accordingly, the market price of our shares of Class A common stock may fluctuate dramatically, and may decline rapidly, regardless

of any developments in our business. Overall, there are various factors, many of which are beyond our control, that could negatively

affect the market price of our Class A common stock or result in fluctuations in the price or trading volume of our Class A common stock,

including:

| · | actual

or anticipated variations in our annual or quarterly results of operations, including our

earnings estimates and whether we meet market expectations with regard to our earnings; |

| · | restrictions

on our ability to pay dividends or other distributions; |

| · | publication

of research reports by analysts or others about us or the motion picture exhibition industry,

which may be unfavorable, inaccurate, inconsistent or not disseminated on a regular basis; |

| · | changes

in market interest rates that may cause purchasers of our shares to demand a different yield; |

| · | changes

in market valuations of similar companies; |

| · | market

reaction to any additional equity, debt or other securities that we may issue in the future,

and which may or may not dilute the holdings of our existing stockholders; |

| · | additions

or departures of key personnel; |

| · | actions

by institutional or significant stockholders; |

| · | short

interest in our securities and the market response to such short interest; |

| · | the

dramatic increase or decrease in the number of individual holders of our Class A common stock

and their participation in social media platforms targeted at speculative investing; |

| · | speculation

in the press or investment community about our company or industry; |

| · | strategic

actions by us or our competitors, such as acquisitions or other investments; |

| · | legislative,

administrative, regulatory or other actions affecting our business or our industry, including

positions taken by the Internal Revenue Service (“IRS”); |

| · | strategic

actions taken by motion picture studios, such as the shuffling of film release dates; |

| · | investigations,

proceedings, or litigation that involve or affect us; |

| · | ongoing

impacts from the COVID-19 pandemic; |

| · | the

occurrence of any of the other risk factors included or incorporated by reference in our

Annual Report; and |

| · | general

market and economic conditions. |

The market price of our Class A common

stock and our business may be materially adversely affected by the Noteholder Action and related claims.

The market price of our

Class A common stock could also be negatively affected by an unfavorable outcome in the Noteholder Action described in Note 11

– Commitments and Contingencies of the Notes to the Company’s condensed Consolidated Financial Statements in Item 1 of

Part 1 of our Quarterly Report on Form 10-Q for the period ended September 30, 2024. In addition, the noteholders pursuing the

Noteholder Action have directed the trustee under the indenture governing the Existing First Lien Notes to provide a notice of

default thereunder, claiming that breaches alleged in the Noteholder Action as well as other claimed breaches arising under the

Refinancing Transactions give rise to defaults and an event of default under the Existing First Lien Notes. Even though the

noteholders have not at this time attempted to accelerate the Existing First Lien Notes, and the Company would reject any such

attempt as invalid, any such acceleration could in turn result in the acceleration of the Company’s other outstanding debt or

have other negative consequences on our ability to operate and finance our business or otherwise. Such an event could thereby have

a material adverse effect on our business, financial condition and results of operations and on the market prices of our securities,

including our Class A common stock. Additional litigation brought by the noteholders, other tactics associated therewith, or any

publicity in connection therewith could also negatively affect the market price of our Class A common stock.

A “short squeeze” due to a

sudden increase in demand for shares of our Class A common stock that largely exceeds supply and/or focused investor trading in anticipation

of a potential short squeeze have led to and could again lead to extreme price volatility in shares of our Class A common stock.

Investors may purchase shares

of our Class A common stock to hedge existing exposure or to speculate on the price of our Class A common stock. Speculation on the price

of our Class A common stock may involve long and short exposures. To the extent aggregate short exposure exceeds the number of shares

of our Class A common stock available for purchase on the open market, investors with short exposure may have to pay a premium to repurchase

shares of our Class A common stock for delivery to lenders of our Class A common stock. Those repurchases may, in turn, dramatically

increase the price of shares of our Class A common stock until additional shares of our Class A common stock are available for trading

or borrowing. This is often referred to as a “short squeeze.” A large proportion of our Class A common stock has been in

the past and may be traded in the future by short sellers, which may increase the likelihood that our Class A common stock will be the

target of a short squeeze, and there is widespread speculation that the trading price of our Class A common stock has been from time

to time the result of a short squeeze. A short squeeze and/or focused investor trading in anticipation of a short squeeze have led to

and could again lead to volatile price movements in shares of our Class A common stock that may be unrelated or disproportionate to our

operating performance or prospects and, once investors purchase the shares of our Class A common stock necessary to cover their short

positions, or if investors no longer believe a short squeeze is viable, the price of our Class A common stock may rapidly decline. Investors

that purchase shares of our Class A common stock during a short squeeze may lose a significant portion of their investment. Investors

that purchase in anticipation of a short squeeze that is never realized may also lose a significant portion of their investment. Under

the circumstances, we caution you against investing in our Class A common stock, unless you are prepared to incur the risk of losing

all or a substantial portion of your investment.

Negative sentiment among AMC’s retail

stockholder base could have a material adverse impact on the market price of the Class A common stock and your investment therein.

Some of our retail investors

have referred to themselves as “Apes” on social media and in other forums. Self-proclaimed “Apes” are widely

viewed as playing a significant role in the market dynamics that have resulted in substantial increases and volatility in the market

prices of AMC’s Class A common stock and other so-called “meme” stocks. See “— The market price and trading

volume of our shares of Class A common stock have experienced, and may continue to experience, extreme volatility, which could cause

purchasers of our Class A common stock to incur substantial losses.” While AMC and its management have actively sought to foster

positive relationships with its significant retail stockholder base as the owners of AMC, and while AMC’s retail stockholder base

has been credited favorably with assisting AMC in raising significant capital in the past, there is no guarantee that AMC will be able

to continue to benefit from support from its retail stockholder base in the future. Negative investor sentiment, including as a result

of this offering or this prospectus supplement, could have a material adverse impact on the market price of our Class A

common stock.

Information available in public media that

is published by third parties, including blogs, articles, online forums, message boards and social and other media may include statements

not attributable to the Company and may not be reliable or accurate.

We have received, and may

continue to receive, a high degree of media coverage that is published or otherwise disseminated by third parties, including blogs, articles,

online forums, message boards and social and other media. This includes coverage that is not attributable to statements made by our directors,

officers or employees. You should read carefully, evaluate and rely only on the information contained in this prospectus supplement,

the accompanying prospectus or any applicable free writing prospectus or incorporated documents filed with the SEC in determining whether

to purchase our shares of Class A common stock. Information provided by third parties may not be reliable or accurate and could materially

impact the trading price of our Class A common stock, which could cause losses to your investments.

The Class A common stock offered hereby

will be sold in “at the market offerings,” and investors who buy shares at different times will likely pay different prices.

Investors who purchase our

Class A common stock in this offering at different times will likely pay different prices, and so may experience different outcomes in

their investment results. We will have discretion, subject to market demand, to vary the timing, prices, and numbers of shares of Class

A common stock sold, if any, and there is no minimum or maximum sales price, other than one that may be set by us Investors may experience

a decline in the value of their Class A common stock as a result of sales made at prices lower than the prices they paid.

The actual number of Class A common stock

we will issue under the Sales and Registration Agreement, at any one time or at all, is uncertain.

Subject to certain

limitations in the Sales and Registration Agreement and (if applicable) the Forward terms, as well as compliance with applicable

law, we (x) have the discretion to deliver a notice to the Sales Agent at any time throughout the term of the Sales and Registration

Agreement and (y) if we enter into a Forward, we will retain discretion to set the trading parameters related to the sales of the

Hedging Shares for such Forward during the Initial Hedging Period. The number of shares of Class A common stock that are sold by the Sales Agent or the Forward

Seller will fluctuate based on the market price of the Class A common stock during the applicable offering period and limits we set

with the Sales Agent or the Forward Counterparty. Because the price per share of each share sold will fluctuate based on the market

price of our common shares during such period, it is not possible at this stage to predict the number of shares of Class A common

stock that will be ultimately sold or issued, the gross proceeds that will be raised in connection with such sales or the amounts deliverable to us as upon prepayment and/or settlement of any Forward.

Future offerings of debt, which would be

senior to our Class A common stock upon liquidation, and/or other preferred equity securities, which may be senior to our Class A common

stock for purposes of distributions or upon liquidation, could adversely affect the market price of our Class A common stock.

In the future, we may attempt

to increase our capital resources by making additional offerings of debt or preferred equity securities, including convertible or non-convertible

senior or subordinated notes, convertible or non-convertible preferred stock, medium-term notes and trust preferred securities, to raise

cash or bolster our liquidity, to repay, refinance, redeem or repurchase indebtedness (including expenses, accrued interest and premium,

if any), for working capital, to finance strategic initiatives and future acquisitions or for other purposes. Upon liquidation, holders

of our debt securities and lenders with respect to other borrowings will receive distributions of our available assets prior to the holders

of our Class A common stock. In addition, any additional preferred stock we may issue could have a preference on liquidating distributions

or a preference on distribution payments that could limit our ability to make a distribution to the holders of our Class A common stock.

Since our decision to issue securities in any future offering will depend on market conditions and other factors beyond our control,

we cannot predict or estimate the amount, timing or nature of our future offerings. Thus, our stockholders bear the risk of our future

offerings potentially reducing the market price of our Class A common stock.

Anti-takeover protections in our Certificate

of Incorporation and our bylaws may discourage or prevent a takeover of our Company, even if an acquisition would be beneficial to our

stockholders.

Provisions contained in our

Certificate of Incorporation and bylaws, as amended, as well as provisions of the Delaware General Corporation Law (the “DGCL”)

delay or make it more difficult to remove incumbent directors or for a third party to acquire us, even if a takeover would benefit our

stockholders. These provisions include:

| · | a

classified board of directors; |

| · | the

sole power of a majority of the board of directors to fix the number of directors; |

| · | limitations

on the removal of directors; |

| · | the

sole power of the board of directors to fill any vacancy on the board of directors, whether

such vacancy occurs as a result of an increase in the number of directors or otherwise; |

| · | the

ability of our board of directors to designate one or more series of preferred stock and

issue shares of preferred stock without stockholder approval; and |

| · | the

inability of stockholders to call special meetings. |

Our issuance of shares of

preferred stock could delay or prevent a change of control of our company. Our board of directors (the “AMC Board”)

has the authority to cause us to issue, without any further vote or action by the stockholders, up to 50,000,000 shares of preferred

stock, par value $0.01 per share, in one or more series, to designate the number of shares constituting any series, and to fix the rights,

preferences, privileges and restrictions thereof, including dividend rights, voting rights, rights and terms of redemption, redemption

price or prices and liquidation preferences of such series. The issuance of shares of preferred stock may have the effect of delaying,

deferring or preventing a change in control of our company without further action by the stockholders, even where stockholders are offered

a premium for their shares. As of September 30, 2024, 50,000,000 shares of preferred stock are authorized and available for issuance.

Our incorporation under Delaware

law, the ability of the AMC Board to create and issue a new series of preferred stock or a stockholder rights plan and certain other

provisions of our Certificate of Incorporation and bylaws, as amended, could impede a merger, takeover or other business combination

involving our company or the replacement of our management or discourage a potential investor from making a tender offer for our Class

A common stock, which, under certain circumstances, could reduce the market value of our Class A common stock.

An issuance of preferred stock, could dilute

the voting power of the Class A common stockholders and adversely affect the market value of our Class A common stock.

The issuance of shares of

preferred stock with voting rights may adversely affect the voting power of the holders of our other classes of voting stock either by

diluting the voting power of our other classes of voting stock if they vote together as a single class, or by giving the holders of any

such preferred stock the right to block an action on which they have a separate class vote even if the action were approved by the holders

of our other classes of voting stock.

In addition, the issuance

of shares of preferred stock with dividend or conversion rights, liquidation preferences or other economic terms favorable to the holders

of preferred stock could adversely affect the market price for our Class A common stock by making an investment in the Class A common

stock less attractive. For example, investors may not wish to purchase Class A common stock at a price above the conversion price of

a series of convertible preferred stock because the holders of the preferred stock would effectively be entitled to purchase Class A

common stock at the lower conversion price causing economic dilution to the holders of Class A common stock.

Increases in market interest rates may

cause potential investors to seek higher returns and therefore reduce demand for our Class A common stock, which could result in a decline

in the market price of our Class A common stock.

One of the factors that may

influence the price of our Class A common stock is the return on our Class A common stock (i.e., the amount of distributions or price

appreciation as a percentage of the price of our Class A common stock) relative to market interest rates. An increase in market interest

rates may lead prospective purchasers of our Class A common stock to expect a return, which we may be unable or choose not to provide.

Further, higher interest rates would likely increase our borrowing costs and potentially decrease the cash available for distribution.

Thus, higher market interest rates could cause the market price of our Class A common stock to decline.

Our management team may invest or spend

the proceeds of any sales to or through the Sales Agent and any amounts that we may receive under one or more Forwards in ways with which

you may not agree or in ways which may not yield a significant return.

Our management will have

broad discretion over the use of (1) the net proceeds, if any, we receive from the Sales Agent upon issuance and sale of shares

of Class A common stock to or through the Sales Agent and (2) any amount received from the Forward Counterparty upon prepayment and,

if applicable, settlement of one or more Forwards (or a portion thereof). We intend to use such net proceeds, if any, to strengthen

our balance sheet and reinvest in our core business to elevate and differentiate the movie-going experience under our AMC GO Plan.

We intend to strengthen the balance sheet by bolstering our liquidity, and by repaying, redeeming or refinancing our existing debt

(including expenses, accrued interest and premium, if any). Investments under the AMC GO Plan include such areas as seating, sight

and sound enhancements, including an increase in the number of branded premium large format screens. Our management will have

considerable discretion in the application of such net proceeds, and you will not have the opportunity, as part of your investment

decision, to assess whether the proceeds are being used appropriately. The net proceeds may be used for corporate purposes that do

not increase our operating results or enhance the value of our Class A common stock.

You may experience immediate and substantial

dilution in the net tangible book value per share of Class A common stock you purchase.

The price per share of

our Class A common stock being offered in this offering may be higher than the net tangible book value per share of our Class A

common stock outstanding prior to this offering. The shares sold in this offering, if any, will be sold from time to time at various

prices. After giving effect to the sale of 50,000,000 shares of our Class A common stock at an assumed offering price of $5.20 per

share, representing the closing sales price of our Class A common stock on the NYSE on December 5, 2024, and after deducting

commissions to the sales agent, and estimated offering expenses payable by us, our as adjusted net tangible book value as of

September 30, 2024 would have been approximately $(3,926.7) million, or approximately $(9.10) per share. This represents an

immediate increase in net tangible book value of approximately $0.60 per share to our existing stockholders and immediate dilution

in as adjusted net tangible book value of approximately $14.30 per share to purchasers of our Class A common stock in this offering.

See the section entitled “Dilution” below for a more detailed discussion of the dilution you will incur if you

purchase Class A common stock in this offering.

Risks Related to Forward Transactions

The Forwards (if any), including sales

of shares of our Class A common stock by the Forward Seller pledged by us as described in “Forward Transactions—Share Pledge

Arrangement,” and other transactions effected by the Forward Counterparty and/or its affiliates to establish, modify or, in some

cases, unwind the Forward Counterparty’s hedge positions in connection with the Forwards, may have a positive, negative or neutral

impact on the market price of shares of our Class A common stock.

If we enter into any

Forward during the term of the Sales and Registration Agreement, such Forward will provide for an Initial Hedging Period during

which certain terms of such Forward such as the Floor Price and Cap Price as applicable, will be determined. We have been advised

that the Forward Counterparty intends to establish its hedge positions in respect of any such Forward during such period through

sales of shares of our Class A common stock by the Forward Seller under this prospectus supplement that we will agree to pledge to

the Forward Counterparty, as described in “Forward Transactions—Share Pledge Arrangement” (with a right of rehypothecation), and the Forward

Counterparty will rehypothecate and sell up to the maximum number of

shares of our Class A common stock underlying the particular Forward. The establishment of such hedge positions could have

the effect of decreasing, or limiting an increase in, the market price of shares of our Class A common stock.

We

have also been advised by the Forward Counterparty that it expects that, on the same days during the Initial Hedging Period when it (or

its affiliate) is selling a number of Hedging Shares necessary to introduce into the public market up to the maximum number of shares

underlying the particular Forward, the Forward Counterparty or its affiliate(s) will be contemporaneously purchasing a substantial portion

of such number of shares in the open market for its own account, as the Forward Counterparty expects its initial hedge position in respect

of any Forward to be substantially less than the number of shares underlying such Forward. Such purchases in the open market may

have the effect of increasing, or limiting a decrease in the market price of shares of our Class A common stock.

The Floor Price and the Cap Price of each Forward will be determined upon completion of the Initial Hedging Period for such Forward, based

on the prices obtained in connection with sales of the Hedging Shares by the Forward Seller during the Initial Hedging Period, and as

such will be subject to the market risk at the time. The Floor Price is intended to mitigate the downside risk of any potential decline in the Reference Price below the Floor Price during

the valuation period, but the Cap Price would also limit the potential upside benefit to the extent the Reference Price were to exceed

the Cap Price during the valuation period. See “Forward Transactions”.

In addition, we have

been advised that the Forward Counterparty expects to dynamically modify its hedge positions for its own account by it (or its

affiliates and/or agents) buying or selling shares of our Class A common stock or engaging in derivatives or other transactions with

respect to shares of our Class A common stock from time to time during the term of a particular Forward, including during the

applicable valuation period for such Forward. The purchases and sales of shares of our Class A common stock or other hedging

transactions by the Forward Counterparty to dynamically modify the Forward Counterparty’s hedge positions from time to time

during the term of the Forward may variously have a positive, negative or neutral impact on the market price of shares of our Class

A common stock, depending on market conditions at such times.

At maturity of any

Forward (or a portion thereof), to the extent the Reference Price for such Forward exceeds the Floor Price (each as described in

“Forward Transactions”) over the applicable valuation period for such Forward (or a respective portion thereof), we

will, subject to certain conditions specified in such Forward, have the right to elect to receive such excess (but no more than the

Cap Price) in the form of our Class A common stock, instead of cash, with the number of shares to be calculated over a period of

time following the maturity date of such Forward (or a respective portion thereof) based on the 10b-18 VWAP price, as measured under