US index futures are lower on Wednesday morning, due to weak

activity data in China and Europe, which renewed fears of a global

recession.

By 6:59 AM, Dow Jones (DOWI:DJI) futures were down 142

points, or 0.41%. S&P 500 futures were down 0.40%, while

Nasdaq-100 futures were down 0.47%. Yields on 10-year

Treasuries are at 3.853%.

The services and composite PMI indices in China decelerated,

while in the Euro Zone the composite PMI was below

consensus. The PMIs for Germany, France, Italy and India also

frustrated the consensus.

In another matter of the day, China canceled the visit of the

European Union’s foreign policy chief to the country without

offering a specific justification. The cancellation comes one

day before the scheduled visit of US Treasury Secretary Janet

Yellen.

On Wednesday’s American economic agenda, the highlight of the

day is the release of the minutes of the Federal Reserve’s last

interest rate meeting at 2:00 PM, which may provide details on the

strategy for pausing interest rate hikes. Some economists

predict that the Fed will take a stance of raising rates in an

alternating pattern until the fall in inflation is more

pronounced. Other expected indicators are US Factory Orders

and US Economic Optimism both at 10:00 AM. At 4:30 PM, changes

in API oil inventories are expected.

Elsewhere in commodities markets, West Texas Intermediate crude

for August was up 1.95% at $71.15 a barrel. Brent crude for

September is close to $76.01 a barrel. Iron

ore rose 0.73% in Dalian, China, at $114.39.

At the close of Monday, which ended early due to Independence

Day, the Dow Jones added 10.87 points, or 0.03%, closing at

34,418.47 points. The S&P 500 was up 0.12%

to close at 4,455.59 points, while the Nasdaq Composite

advanced 0.21% to 13,816.77 points. The great highlight of the

market was the result of Tesla, which showed record sales figures,

despite the expectation of some slowdown. This, before the

beginning of the earnings season, throws some hope of an extension

of the risk assets rally in the country. Even so, several

factors added up to demand more caution from investors, such as the

slowdown of the US economy – reinforced by the industrial PMI,

which came in lower than expected – and the expectation of at least

one more increase in interest rates by the Fed.

Wall Street Corporate Highlights for Today

Big Tech – Seven companies,

including Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL), Alphabet (NASDAQ:GOOGL),

Meta (NASDAQ:META) and Microsoft (NASDAQ:MSFT), claim to comply

with the new “gatekeeper” criteria of European Union, according to

EU industry commissioner Thierry Breton. Samsung and ByteDance

(which owns TikTok) also claimed to meet the criteria, although

TikTok disputed its inclusion on the

list. Booking.com (NASDAQ:BKNG) hopes to move into the

gatekeeper category in the coming year. Under the EU’s Digital

Markets Act (DMA), these companies are subject to stricter rules,

including interoperability of messaging apps and a ban on favoring

their own services over competitors. Fines of up to 10% of

global annual turnover may apply for DMA violations. The

European Commission will confirm gatekeeper designations by 6

September.

Alphabet (NASDAQ:GOOGL) – Alphabet’s

Google removed more than half of links to Twitter pages in search

results. These actions were taken in the wake of limitations

placed by Elon Musk on the amount of how many tweets Twitter users

could read. Musk said verified accounts are limited to reading

6,000 posts a day. For unverified accounts, the number drops

dramatically to 600 posts a day. New unverified users can only

access 300 posts per day.

Meta Platforms (NASDAQ:META) – Meta

Platforms will launch its Twitter competitor Threads app on

Thursday, allowing users to maintain their Instagram

followers. The launch directly challenges Twitter, which has

faced criticism after restrictions imposed by Elon Musk. In

other news, a social media account affiliated with the Beijing

Daily criticized Meta’s founder for his criticism of Chinese

censorship and alleged theft of intellectual property. The

editorial comes after reports of talks between Meta and Tencent

Holdings Ltd. to sell the Quest VR headset in China despite

Facebook and Instagram lockdown. Zuckerberg’s relationship

with China has been rocky, and the editorial suggests he may be the

biggest obstacle to finding a solution in China.

Apple (NASDAQ:AAPL) – The London Court of

Appeal ruled that Apple had infringed two telecommunications

patents essential to 4G standards. Texan company Optis

Cellular Technology sued Apple in 2019. In other news, Reuters

pointed out that the exceptional performance of Apple shares is

raising concerns among fund managers that they may not own enough

of these shares. The rise in Apple’s stock price has boosted

its share of stock indexes to record levels, making its weighting

disproportionately high. This can hurt active fund managers

looking to outperform benchmarks. According to the Financial

Times, Apple is reducing production targets for the Vision Pro

headset due to difficulties with its complex design. The

company hopes to manufacture fewer than 400,000 units next year,

below the internal target of 1 million. Manufacturers have

been struggling with micro-OLED displays, the most expensive part

of the device.

Microsoft (NASDAQ:MSFT) – The European

Union is likely to open an antitrust investigation against

Microsoft in the coming months. Remediation discussions to

avoid this measure have hit a snag. Microsoft has been

targeted by the EU following a complaint

by Salesforce (NYSE:CRM) about Teams

being integrated into Office 365. The company is trying to avoid an

investigation and has offered to reduce the price of Office without

Teams. The European Commission seeks a deeper price

cut. Microsoft remains cooperative and may improve its

proposal prior to the initiation of the investigation.

Amazon (NASDAQ:AMZN) – Amazon is to begin

rolling out first Rivian electric vans

(NASDAQ:RIVN) in Germany in the coming weeks. 300 electric

vans will hit the roads in the Munich, Berlin and Dusseldorf

regions as part of an order for 100,000 vehicles placed in 2019.

Amazon has already launched Rivian vans in the US and plans to have

100,000 Rivian vehicles in its global fleet by 2030. In other news,

Bloomberg reported that Amazon CEO Andy Jassy is reviewing the

company’s Hollywood studio spending on original TV

programming. With an increased focus on costs, he’s looking at

the budgets and performance of the biggest shows. Amazon is

looking to cut costs across the company and Jassy has abandoned

projects deemed unnecessary. In other news, tech companies

known as “the Magnificent Seven” have regained their dominance in

the market, led by Nvidia Corp.

Amazon (NASDAQ:AMZN), Microsoft (NASDAQ:MSFT), Nvidia (NASDAQ:NVDA), AMD (NASDAQ:AMD)

– According to the Wall Street Journal, the Biden administration

plans to restrict China’s access to cloud computing services

provided by American companies such as Microsoft and

Amazon. These restrictions could affect companies like Nvidia

and AMD, making it difficult for Chinese companies working on AI

applications to sell advanced chips. Nvidia has expressed

concerns about a possible “permanent loss of opportunity”. The

move comes amid the Sino-US chip war and trade tensions between the

two countries.

Tesla (NASDAQ:TSLA) – Tesla posted

better-than-expected quarterly deliveries, boosted by discounts and

volume increases, sending its shares up about 7% on

Monday. Tesla’s market capitalization increased by about $57

billion. In other news, Kentucky has become the first state to

require the Tesla charging plug at electric vehicle charging

stations as part of a statewide program to electrify

highways. Adoption of NACS has been a growing trend among

electric vehicle manufacturers in the United States. However,

a group of EV charger manufacturers and operators are contesting

the requirement in Texas, citing safety certification and

standardization concerns.

Lucid (NASDAQ:LCID) – Shares in Lucid

Group posted their sixth consecutive gain on Monday, rising 7.3% to

close at $7.39. Although one analyst downgraded its rating to

neutral, optimism over delivery and production data from other EV

manufacturers buoyed the sector. According to a note from

Citi, near-term demand for the Lucid Air EV and the company’s gross

margin remain uncertain.

Nikola (NASDAQ:NKLA) – Nikola Corp

announced it is liquidating the assets of battery maker Romeo Power

less than a year after the acquisition. The company faced

challenges in meeting investor expectations and is now ending its

operations with Romeo Power. Other electric vehicle startups

are also struggling.

Rivian (NASDAQ:RIVN) – Rivian Automotive

beat expectations for second-quarter deliveries, buoyed by

increased production and steady demand, sending its shares up 17.4%

on Monday. The company delivered 12,640 vehicles, beating

estimates of 11,000. These positive results indicate that

Rivian may be overcoming production and competition challenges in

the electric vehicle market. Its production target of 50,000

vehicles for this year looks achievable. Analysts highlighted

Rivian’s focus on internal development, which has helped the

company stand out among other startups in the industry. The

company expects demand to remain stable through 2023.

Stellantis (NYSE:STLA) – Stellantis will

invest up to €200 million at its Mirafiori site in Italy as part of

its “green campus” program, transforming it into a carbon-neutral

base. The project will house 10,000 workers and be completed

by 2025, with a focus on electrified transmissions and the circular

economy.

Ryanair Holdings (NASDAQ:RYAAY) – Ryanair

announced it carried a record 17.4 million passengers in June, the

most ever recorded for a single month, representing a 9%

year-on-year increase. The company also reported that the

flights had an average occupancy rate of 95%, the same as the

previous year. Ryanair canceled more than 900 flights due to

air traffic controller strikes, affecting around 160,000

passengers.

Exxon Mobil (NYSE:XOM) – Exxon Mobil faces

a dilemma as it expands its global trading division: whether or not

to pay cash bonuses to traders. Unlike other companies in the

industry, Exxon pays regular salaries and small stock awards, which

has led to frustration and hiring difficulties. The company

pursues a cautious approach, without taking the same levels of risk

as its competitors.

Nasdaq (NASDAQ:NDAQ), Blackrock (NYSE:BLK)

– Nasdaq has re-filed an application to the US SEC to list a

BlackRock Bitcoin ETF.

Coinbase (NASDAQ:COIN) – Shares of

Coinbase surged 13% on Monday after Cboe revealed it is working

with the company to launch a bitcoin spot exchange-traded fund

(ETF). Cboe addressed the SEC’s concerns by naming Coinbase as

the cryptocurrency platform that would help detect fraud in bitcoin

markets. The SEC has also raised similar concerns about a

BlackRock ETF filing. On Wednesday, Coinbase was downgraded to

“Neutral” by Piper Sandler, with a target price lowered to $60.

Deutsche Bank (NYSE:DB) – Russian

subsidiary RusKhimAlyans, with a stake in Gazprom, has filed

lawsuits seeking a lump sum of 31 billion rubles ($348 million)

from Deutsche Bank and Commerzbank, according to Russian court

documents. RusKhimAlyans is seeking more than 22 billion

rubles from Deutsche Bank and more than 8 billion rubles from

Commerzbank.

UBS (NYSE:UBS) – The Ethos Foundation,

representing former Credit Suisse shareholders, is supporting a

class action lawsuit brought by LegalPass against the exchange

ratio established in the acquisition of Credit Suisse by

UBS. Credit Suisse shareholders have received an offer that

Ethos considers unfavorable. Other holders of Credit Suisse

bonds are also seeking damages. LegalPass claims the deal was

made without proper consultation with shareholders and the case

will be filed in court in Zurich. In other news, UBS has

started a US recruitment drive for wealth managers despite planned

30% global workforce cuts.

Bank of

America (NYSE:BAC), Citi (NYSE:C)

– Bank of America and Citigroup have entered into a dialogue with

the Federal Reserve to understand divergences between the central

bank’s stress test results and those of the companies

themselves. BofA has yet to announce a potential dividend

increase, unlike its rivals. JPMorgan Chase, Citigroup, Wells

Fargo, Goldman Sachs and Morgan Stanley increased their

dividends. BofA seeks to understand differences in

comprehensive results. Citigroup also made a similar

statement, seeking to understand the differences in its stress test

scores.

HSBC (NYSE:HSBC) – HSBC Holdings Plc will

be the first UK bank to test an advanced data security system, in

partnership with BT Group Plc, Amazon and Toshiba Corp. The

test will involve distributing quantum keys to strengthen cyber

defenses and protect financial transactions from hackers. This

technology is considered an important part of the defense strategy

as modern cryptography may be vulnerable to future quantum

computers. HSBC hopes to analyze threats and better protect

data through this test.

Jefferies Financial Group (NYSE:JEF) –

Rizal Gozali, managing director of Credit Suisse, is joining

Jefferies to strengthen its presence in Asia. He will start in

September and will help oversee Indonesia’s coverage. Gozali

is one of several Jefferies hires from Credit Suisse, with other

top professionals also making the switch. Rival banks such as

Deutsche Bank are also recruiting talent from Credit Suisse.

Pfizer (NYSE:PFE) – Samsung Biologics has

entered into two deals with Pfizer worth a combined $897 million to

manufacture biotechnology products. The contracts involve the

production of biosimilar products in South Korea until 2029. With

these orders, the combined value of Pfizer’s contracts with Samsung

Biologics reaches US$1.08 billion. The South Korean company

sees these agreements as an expansion of its strategic partnership

and has already surpassed last year’s annual contract volume.

Taiwan Semiconductor

Manufacturing (NYSE:TSM) – Globalization is taking a

backseat to national security and technological leadership, with

US-China relations characterized more by competition than

cooperation, said Morris Chang, retired founder of TSMC. He

pointed out that globalization has been redefined to allow

business-to-business transactions as long as they do not undermine

national security, technological supremacy and economic

leadership. Chang mentioned that globalization peaked in the

2010s and has weakened in recent years, with the US and China

strengthening their domestic chip industries.

Alibaba (NYSE:BABA) – Alibaba is

considering options for its video streaming platforms, including

the possibility of transferring assets to Alibaba Pictures Group

and expanding its operations in Hong Kong.

Altria Group (NYSE:MO) – The FTC announced

that it has dismissed a complaint against Altria Group, maker of

Marlboro cigarettes, and Juul Labs, maker of e-cigarettes. The

FTC will also overturn an administrative judge’s decision favorable

to the companies in 2022. Altria dropped its stake in Juul and

asked the FTC to drop the case. Altria expressed satisfaction

with the withdrawal of the complaint.

Mondelez (NASDAQ:MDLZ) – Mondelez Global

LLC has voluntarily withdrawn two varieties of belVita Breakfast

Sandwich crackers from the United States due to the possibility of

an undeclared presence of peanuts in the products. The company

identified the possible presence of peanut protein residues in its

manufacturing line. The recall is being conducted in

compliance with the US Food and Drug Administration. To date,

three possible allergic reactions related to these products have

been reported. This action does not affect other belVita

products or non-US markets.

AstraZeneca (NASDAQ:AZN) – AstraZeneca

announced on Monday that its experimental precision drug,

datopotamab deruxtecan, has been shown to slow the progression of

advanced-stage lung cancer. However, the company’s shares fell

on concerns that the benefits may not be as pronounced as

expected. The drug belongs to the class of antibody drug

conjugates and targets the TROP2 protein. AstraZeneca said the

drug’s safety profile is in line with previous observations in

clinical trials.

View (NASDAQ:VIEW) – The United States

Securities and Exchange Commission (SEC) has accused “smart” window

maker View Inc and its former chief financial officer of

underestimating the costs of replacing defective windows, resulting

in an upgrade. View will not pay a fine for its cooperation

with the SEC, but the former CFO faces fraud charges. The

company will restate its financials and its stock has dropped

significantly since the merger.

UPS (NYSE:UPS) – Negotiations between UPS

and the union representing more than 340,000 workers broke down,

paving the way for a possible massive strike later in the

month. The union rejected an offer deemed unacceptable by UPS

and no further negotiations are scheduled. Workers voted in

favor of a strike if a new agreement is not reached.

Marvell Technology (NASDAQ:MRVL) – Marvell

Technology, with its exposure to artificial intelligence, has the

potential to thrive, analyst Oppenheimer said on Monday. The

analyst reiterated his “Outperform” rating with a price target of

$70. The company, which provides chips and hardware products, has

delivered solid results and expects to double AI revenue by 2024.

Shares rose 2.6% on Monday -Friday, and 44% in the last 12

months.

Netflix (NASDAQ:NFLX) – Netflix was

upgraded from “Sell” to “Neutral” by Goldman Sachs, which also

raised its stock price target to $400.

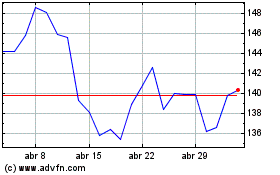

Ryanair (NASDAQ:RYAAY)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

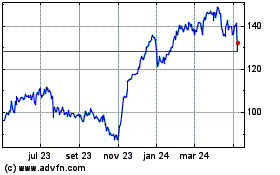

Ryanair (NASDAQ:RYAAY)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024