Coca-Cola (NYSE:KO) – Coca-Cola has signed a

new five-year contract, worth US$1.1 billion, with

Microsoft (NASDAQ:MSFT), utilizing its cloud

computing and artificial intelligence services, including Azure

OpenAI. The agreement aims to enhance Coca-Cola’s productivity with

tools like Microsoft’s Copilot.

Apple (NASDAQ:AAPL) – Apple announced an event

on May 7, with no details revealed, but rumors suggest the launch

of the long-awaited renewed iPad Pro and iPad Air. The company

seeks to revitalize falling sales in the tablet market amid

economic uncertainties.

Alphabet (NASDAQ:GOOGL) – Alphabet is injecting

600 million euros (640.62 million dollars) into a new data center

in Groningen, the Netherlands, creating 125 jobs. Since 2014,

Alphabet has invested more than 3.8 billion euros in digital

infrastructure in the Netherlands, emphasizing sustainability and

positive community impact. Additionally, Google has postponed until

2025 its decision to phase out cookies in the Chrome browser amid

concerns and regulatory reviews. The plan, which aims to transform

digital advertising, is subject to agreements with regulators. This

occurs while the company faces antitrust scrutiny and seeks to

replace cookies with its Privacy Sandbox initiative. Additionally,

Mobvoi, a Chinese AI startup backed by Alphabet, ended its first

day of trading down in Hong Kong, with shares falling 3.2% below

the initial offering price, raising $41 million, below the $200 to

$300 million target from last year.

IBM (NYSE:IBM) – IBM is in advanced

negotiations to acquire cloud software provider

HashiCorp (NASDAQ:HCP), boosting its offerings in

the area. IBM, under CEO Arvind Krishna, has been pursuing

acquisitions to strengthen its cloud presence.

Oracle (NYSE:ORCL) – Larry Ellison, chairman of

Oracle, announced on Tuesday that the company plans to move its

corporate headquarters to Nashville, highlighting the city as a

health hub. The new campus, designed by Norman Foster, will include

a community clinic and a concert hall, aiming to integrate into the

local community.

Super Micro Computer (NASDAQ:SMCI) – Shares of

Super Micro Computer advanced 3.3% in pre-market trading after

analysts at KeyBanc, led by Tom Blakey, initiated coverage with a

Sector Weight rating. They highlighted the company’s position as a

leading provider of full-stack IT solutions at rack scale,

benefiting from AI growth trends.

Trump Media & Technology Group (NASDAQ:DJT)

– On Tuesday, Donald Trump secured a stock bonus worth $1.3 billion

from the company operating his social media app Truth Social. This

award, derived from the SPAC deal, will increase his stake in Trump

Media & Technology Group to $4.1 billion.

Rubrik – The data security and cloud startup

Rubrik, backed by Microsoft (NASDAQ:MSFT),

received about 20 times more orders than the number of shares

available in its planned initial public offering. The company aims

to raise up to $713 million.

Starbucks (NASDAQ:SBUX) – U.S. Supreme Court

justices signaled support for Starbucks against a court order to

rehire seven employees fired in Memphis as they sought

unionization. The case, centered on the National Labor Relations

Act, could impact future injunctions on contested labor practices.

The final decision is expected in June.

Walmart (NYSE:WMT) – The majority-owned fintech

startup One by Walmart began offering “buy now, pay later” (BNPL)

loan options for expensive items in some U.S. stores, joining

Affirm (NASDAQ:AFRM) as a choice for customers.

The initiative seeks to expand the retail giant’s financial

offerings to customers.

Williams-Sonoma (NYSE:WSM) – Williams-Sonoma

agreed to pay a civil fine of $3.18 million to settle FTC charges

of false “Made in USA” claims for some products. A revised order,

requiring judicial approval, increases the original fine from $1

million.

JPMorgan Chase (NYSE:JPM) – The CEO of JPMorgan

Chase, Jamie Dimon, expressed confidence in the robust U.S.

economy, highlighting strong employment and healthy consumer

finances. Dimon warned about the persistence of inflation and

advocated a pragmatic approach to public policy. Additionally,

future plans for government participation were mentioned. In other

news, a Russian court ordered the seizure of funds from JPMorgan

Chase’s bank accounts in Russia, as part of an action brought by

state bank VTB to recover $439.5 million blocked abroad. JPMorgan

sued VTB in New York last week.

UBS Group AG (NYSE:UBS) – Executives from UBS

expressed concerns about tighter capital requirements proposed by

the Swiss government, warning that they could require between $15

to $25 billion additional. Despite this, they reiterated their

commitment to returning excess capital to shareholders through

dividends and share buybacks.

Tesla (NASDAQ:TSLA) – Tesla announced on

Tuesday the dismissal of 6,020 employees in Texas and California,

in addition to cutting about 400 jobs, or about 3% of the

workforce, at its gigafactory in Germany near Berlin, without

forced layoffs. The cuts aim to reduce costs, combat slowing

demand, and falling margins. In other news, Tesla has set the price

of its new high-performance Model 3 at 335,900 yuan, equivalent to

US$46,364.29, in China. Deliveries of the vehicle are scheduled to

begin in the third quarter of this year. Tesla also launched a

performance variant of its compact sedan Model 3 in the United

States for US$52,990. Moreover, Elon Musk announced that the

humanoid robot Optimus could be marketed by the end of next year,

aiming to meet labor demands in sectors such as logistics and

retail. Musk highlighted that Tesla is well-positioned for this

endeavor.

Fisker (NYSE:FSR) – Fisker faces the imminent

possibility of filing for bankruptcy protection in 30 days unless

it obtains adequate relief from creditors to meet debt obligations.

The electric vehicle startup is in financial distress after

failures in investment negotiations and falling shares.

Polestar Automotive (NASDAQ:PSNY) – Polestar

Automotive, the Swedish electric vehicle manufacturer, is planning

to transfer production of cars destined for Europe to its U.S.

factory due to rising geopolitical tension. The company explores

exporting the Polestar 3 from the U.S. to the European Union amid

investigations into tariffs. Additionally, Polestar launched its

own smartphone for the Chinese market in collaboration with the

smartphone manufacturer Xingji Meizu Group. The phone, integrated

with Polestar EVs, comes with up to 1 terabyte of storage and a

50-megapixel camera, starting at $1,019.

Boeing (NYSE:BA) – The Federal Aviation

Administration (FAA) is investigating allegations of retaliation by

Boeing against two engineers who requested an engineering review on

the 777 and 787 jets. The union SPEEA denounced unfair labor

practices. Boeing denies retaliation, while the union seeks access

to a crucial report.

Spirit AeroSystems (NYSE:SPR),

Boeing (NYSE:BA) – Spirit

AeroSystems agreed to advance payments of $425 million to

Boeing, aiming to address issues such as high inventories and

reduced cash flow, following FAA restrictions on 737 MAX

production. The agreement aims to sustain Boeing’s contractual

production and stabilize operations.

Ryanair Holdings (NASDAQ:RYAAY) – The CEO of

Ryanair Holdings, Michael O’Leary, expressed optimism about the new

leadership at Boeing Co. and the possibility of increased

production, aiming to deliver 40 jets to Ryanair before the high

travel season. He emphasized the importance of continuity and

precise execution.

JetBlue Airways (NASDAQ:JBLU) – JetBlue Airways

warned on Tuesday that it no longer expects to achieve break-even

in its adjusted operating margin for this year, with depressed

revenues due to excess capacity in Latin America. Its shares fell

about 17%, to $6.25. The company expects second-quarter revenue to

decline up to 10.5% compared to the previous year. JetBlue is also

seeking compensation from Pratt & Whitney due to engine issues,

which are expected to keep an average of 11 aircraft out of service

throughout the year.

L3Harris Technologies (NYSE:LHX) – L3Harris

Technologies of the U.S. will cut 5% of its workforce, about 2,500

employees, as part of cost-saving measures. The cuts, not focused

on the recent acquisition of Aerojet Rocketdyne, aim for efficiency

and cost savings, aligned with the multi-year LHX NeXt plan of $1

billion.

Palantir Technologies (NYSE:PLTR) – Shares of

Palantir are rising 2% before the market opens, after registering

an increase of more than 5% over the past two days, recovering

after six consecutive days of losses.

Bunge (NYSE:BG) – The Competition Department of

Canada has expressed serious concerns about the proposed

acquisition of Bunge by Viterra, backed by

Glencore (LSE:GLEN), posing an obstacle to the

agricultural merger valued at $34 billion. The deal faces scrutiny

over potential anti-competitive effects, awaiting government

decision.

Pfizer (NYSE:PFE), BioNTech

(NASDAQ:BNTX), Moderna (NASDAQ:MRNA) – Pfizer and

BioNTech have filed a petition in London to invalidate Moderna’s

patents on key vaccine technology for Covid-19, amid a global legal

battle. Moderna claims patent infringement by Pfizer and BioNTech,

while these argue technological improvements. The billion-dollar

sales of both vaccines highlight the significance of the case.

Lumen Technologies (NYSE:LUMN) – Lumen

Technologies plans to cut less than 7% of its staff to reduce

expenses amid growth and cash challenges. The costs related to

personnel cuts are expected to reach between $90 million to $100

million, with completion anticipated by the end of the second

quarter. Analysts have expressed skepticism about the company’s

ability to recover, despite improvements in business trends.

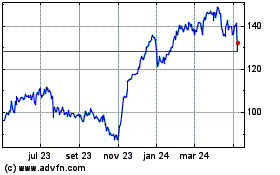

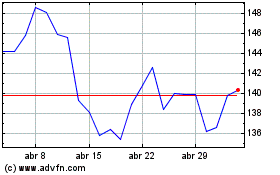

Ryanair (NASDAQ:RYAAY)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Ryanair (NASDAQ:RYAAY)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024