Alphabet (NASDAQ:GOOGL) – Alphabet CEO Sundar

Pichai has reached a fortune of ten digits, a result of the

remarkable growth of Google’s stock since he took the helm in 2015.

He has led the company through a period of expansion and

innovation, boosting the stock value and company profits. His

journey, from a humble childhood in India to becoming one of the

world’s most successful executives, highlights his commitment and

contribution to Alphabet’s success.

Microsoft (NASDAQ:MSFT) – Microsoft will invest

$1.7 billion in expanding cloud services and artificial

intelligence in Indonesia over the next four years, including the

construction of data centers, announced CEO Satya Nadella.

Additionally, Microsoft aims to train 2.5 million people in

Southeast Asia in AI usage by 2025.

Apple (NASDAQ:AAPL) – The European Commission

has designated the iPad operating system as a guardian of the

bloc’s historic tech rules due to its significance for business

users, as established by the Digital Markets Act. Apple, along with

other major tech firms, faces potential fines for violations.

Meta Platforms (NASDAQ:META) – The European

Union is investigating Meta Platforms’ Facebook and Instagram for

failures in combating Russian misinformation. Under the Digital

Services Act, advertising policies and researcher access are

examined. The bloc acted following warnings about pro-Kremlin

campaigns before elections.

International Business Machines (NYSE:IBM) –

IBM is expanding its cloud services and IT infrastructure offerings

in Ontario, Canada, aiming to extend AI to more businesses. The

Technology Expert Labs team will be based in Markham, Ontario,

supporting the adoption of IBM’s data and AI platform, WatsonX.

Tesla (NASDAQ:TSLA) – Elon Musk fired two

senior Tesla executives and plans to cut hundreds more jobs due to

declining sales. The public policy team will also be disbanded.

Musk seeks to drastically reduce costs while facing a challenging

price war in the electric vehicle market. Additionally, investors

who bet against Tesla lost $5.5 billion over four sessions

following the promise of more affordable cars. The stock rose

nearly 40% since the announcement on April 24, causing losses of

$2.11 billion in April, along with a strong rise on Monday.

Additionally, by introducing its “Full Self-Driving” system in

China, Tesla enters the global race for autonomous vehicles. During

his visit to Beijing, Elon Musk discussed the potential launch of

FSD and international data transfer issues, facing local

competitors like BYD and Huawei, stimulating innovation in the

industry.

Stellantis (NYSE:STLA) – Three Stellantis

plants in Europe, stopped due to a strike at a parts supplier, will

resume operations in early May.

Ford Motor (NYSE:F) – Following two fatal

accidents involving Ford’s BlueCruise feature, U.S. automotive

regulators have initiated an investigation. Both Mustang Mach-E

SUVs, equipped with BlueCruise, collided with stationary vehicles

on highways during the night. About 130,050 Mach-E vehicles are

under investigation.

Goldman Sachs (NYSE:GS),

Barclays (NYSE:BCS), General

Motors (NYSE:GM) – Goldman Sachs is in talks to transfer

its General Motors credit card program to Barclays, according to

the Wall Street Journal. Barclays is the leading candidate, with

about $2 billion in outstanding balances, while other contenders

have dropped out.

Goldman Sachs (NYSE:GS) – Goldman Sachs notes

that momentum traders, who are investors that follow short-term

trends, are planning to buy stocks next week, regardless of whether

the market is rising or falling. They expect commodity trading

advisors (CTAs), who use systematic strategies to trade futures

contracts, to buy approximately $106 billion in global stock

futures, which could boost the recovery of stocks after a

challenging period.

Morgan Stanley (NYSE:MS) – Glass Lewis has

recommended that Morgan Stanley shareholders vote against its

executive compensation proposal, criticizing high payouts relative

to performance. Former CEO James Gorman received $37 million, while

his successor, Ted Pick, and other candidates received $20 million

each.

Caterpillar (NYSE:CAT) – Caterpillar Inc.

announced on Monday the withdrawal of its shares from the Euronext

Paris and SIX Swiss Exchange, focusing exclusively on the New York

Stock Exchange, citing low trading volumes and administrative

costs. Additionally, last Thursday, the company warned of a drop in

quarterly sales due to inventory reductions.

Southwest Airlines (NYSE:LUV) – Southwest

Airlines quietly launched a flight delay compensation program as

part of a $140 million settlement with the U.S. Department of

Transportation due to the carrier’s collapse in December 2022. The

program offers travel vouchers to passengers affected by

significant delays.

Boeing (NYSE:BA) – Boeing raised $10 billion in

the debt market on Monday after burning $3.93 billion in free cash

in the first quarter, due to reduced production of the 737 MAX.

BHP Group (NYSE:BHP), Anglo

American (USOTC:NGLOY) – Investors in Anglo are

apprehensive about the potential deal with BHP, fearing losses by

holding shares in South African subsidiaries. The initial proposal

of $39 billion was rejected, citing undervaluation and risks. BHP

suggested selling the Amplats and Kumba units, but the separation

of assets may be complex and time-consuming, generating

uncertainties. Doubts linger about the impact on relations with the

South African government and the stability of commodity prices.

Investors await a better offer from BHP or a complete acquisition

of Anglo.

Capri Holding (NYSE:CPRI),

Tapestry (NYSE:TPR) – Judge Jennifer Rochon set

September 9 as the start of the hearing on blocking the acquisition

of Capri Holding by Tapestry by the U.S. Federal Trade Commission.

The injunction could prevent the merger until the final court

decision of the FTC.

Walmart (NYSE:WMT) – Walmart launched the

bestgoods grocery line, targeting Generation Z shoppers who value

savings. With about 300 items, from dairy to snacks, the line

prioritizes emerging food trends and specialized ingredients,

offering most products for under $5.

Coca-Cola (NYSE:KO) – Coca-Cola is considering

an initial public offering (IPO) for its African bottling business

next year, potentially valued at over $8 billion. The decision is

in the early stages, and details may change. If carried out, it

would be one of the largest listings on the Johannesburg Stock

Exchange (JSE) in years.

PepsiCo (NASDAQ:PEP) – Norway’s sovereign

wealth fund plans to support a shareholder proposal demanding that

PepsiCo conduct a biodiversity risk assessment. This decision

reflects growing investor concerns about the environmental impacts

of corporate operations, challenging the position of the PepsiCo

board.

UnitedHealth Group (NYSE:UNH) – Democratic U.S.

lawmakers, led by Elizabeth Warren, request an SEC investigation

into stock sales by UnitedHealth Group Inc. executives prior to

public disclosure of an antitrust investigation. Transactions,

totaling $101.5 million, occurred between October and February,

raising concerns about adequate disclosure to investors.

Comcast (NASDAQ:CMCSA) – NBCUniversal’s Peacock

streaming service will increase prices by $2 for new subscribers

starting July 18, ahead of the Summer Olympics. The ad-supported

plan will be $7.99/month, and the ad-free plan will be

$13.99/month. Current subscribers will be affected starting August

17.

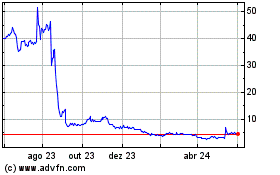

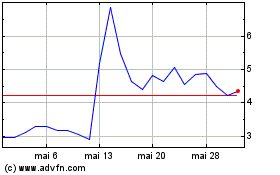

AMC Entertainment (NYSE:AMC) – AMC

Entertainment’s stock fell 11.1% on Monday, the largest drop since

April. CEO Adam Aron mentioned the impacts of last year’s Hollywood

strikes but anticipated satisfactory quarterly performance. The

company faces additional challenges related to its short-term

debt.

AMC Entertainment (NYSE:AMC)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

AMC Entertainment (NYSE:AMC)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025