UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of

The Securities Exchange Act of 1934 (Amendment No.

)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☐ |

Soliciting Material Pursuant to §240.14a-12 |

ESPEY MFG. & ELECTRONICS CORP.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other

than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

ESPEY MFG. & ELECTRONICS CORP.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO

BE HELD DECEMBER 2, 2022

October 28, 2022

To the Shareholders of

ESPEY MFG. & ELECTRONICS CORP.:

You are cordially invited

to attend the Annual Meeting of Shareholders of Espey Mfg. & Electronics Corp., which will be held at The Courtyard by Marriott, 11

Excelsior Ave., Saratoga Springs, New York, on December 2, 2022, at 9:00 a.m., Eastern Standard Time, for the following purposes:

| 1. | To elect as a Class B Director to serve for a three year term expiring at the 2025 Annual Meeting or until

her successor is duly elected and qualifies, the nominee named in the attached proxy statement; |

| 2. | To approve, on an advisory (non-binding) basis, the compensation of the Company’s Named Executive

Officers; and |

| 3. | To ratify the appointment of Freed Maxick CPAs, P.C. as the Company’s independent public accountants

for the fiscal year ending June 30, 2023. |

No other business may be transacted at the meeting.

The Board of Directors

has fixed the close of business on October 13, 2022, as the record date for the purpose of determining shareholders entitled to notice

of, and to vote at, said meeting or any adjournment thereof. The books for transfer of the Company’s capital stock will not be closed.

Even if you expect to attend

the meeting in person, it is urged by the Company that you mark, sign, date, and return the enclosed proxy. The proxy may be revoked at

any time before it is voted and shareholders who execute proxies may nevertheless attend the meeting and vote their shares in person.

Every properly signed proxy will be voted as specified unless previously revoked.

Voting will be permitted

only by proxy or by attending the meeting and providing the Corporate Secretary in advance with a legal proxy from an intermediary, if

your shares are not owned by you directly.

| |

By Order of the Board of Directors, |

| |

Peggy A. Murphy |

| |

Corporate Secretary |

IMPORTANT NOTICE REGARDING

THE AVAILABILITY OF PROXY MATERIALS FOR

THE ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD DECEMBER 2, 2022:

This notice of Annual Meeting,

Proxy Statement and accompanying Annual Report to the Shareholders are available at our website at http://www.espey.com.

Please make your selection

and sign and date the enclosed proxy and mail it promptly in the accompanying pre-addressed, postage-free envelope.

ESPEY MFG. & ELECTRONICS CORP.

233 Ballston Avenue

Saratoga Springs, New York 12866

PROXY STATEMENT

The enclosed proxy is solicited

by the Board of Directors of Espey Mfg. & Electronics Corp. (the “Company”) for use in voting at the Annual Meeting of

the Shareholders of the Company to be held at The Courtyard by Marriott, 11 Excelsior Ave., Saratoga Springs, New York, on December 2,

2022, at 9:00 a.m., Eastern Standard Time, and at any postponement or adjournment thereof, for the purposes set forth in the attached

Notice of Meeting. It is anticipated that the Notice of Annual Meeting of Shareholders, this Proxy Statement and the form of proxy will

be mailed on or about October 28, 2022.

VOTING AND REVOCABILITY

OF PROXIES

Every properly dated, executed

and returned proxy will be voted at the Annual Meeting in accordance with the instructions of the shareholder. If no specific instructions

are given, the shares represented by such proxy will be voted (i) FOR the election of the Class B Director nominated by the Board of Directors,

for a three year term, and (ii) FOR approval, on an advisory (non-binding) basis, of the compensation of the Company’s Named Executive

Officers, and (iii) FOR ratification of the appointment of Freed Maxick CPAs, P.C. as the Company’s independent public accountants

for the fiscal year ending June 30, 2023. Any shareholder giving a proxy has the power to revoke it at any time prior to the voting thereof

by voting in person at the Annual Meeting, by giving written notice to the Secretary prior to the Annual Meeting, or by signing and delivering

a new proxy card bearing a later date. The Company’s only class of voting securities is its Common Stock, par value $.33-1/3 per

share (the “Common Stock”). Each share of Common Stock outstanding on the record date will be entitled to one vote on all

matters. In accordance with the Company’s By-Laws and applicable state law, the election of directors will be determined by a plurality

of the votes cast by the holders of shares of Common Stock present and entitled to vote thereon, in person or by proxy, at the Annual

Meeting. Shares present which are properly withheld as to voting with respect to any one or more nominees, and shares present with respect

to which a broker indicates that it does not have authority to vote (“broker non-votes”) will not be counted. Cumulative voting

in connection with the election of directors is not permitted.

Please note that in

accordance with rules of the New York State Stock Exchange governing brokers, each of, the election of directors (Proposal No. 1), and

the approval on an advisory (non-binding) basis, of the compensation of the Company’s Named Executive Officers (Proposal No. 2),

is a “non-discretionary” item. Shares which are held in a brokerage account as to which the broker does not receive instructions

on how to vote with respect to these items may not be voted with respect to these proposals and those votes will be counted as “broker

non-votes.”

What are Broker Non-Votes?

Broker non-votes are shares held in the street name by a broker that the broker has no discretionary authority to vote. Brokers do not

have authority to vote on matters considered to be non-routine unless they have received instructions from the beneficial owners of the

shares.

The affirmative vote of

shares representing a majority of the votes cast by the holders of shares present and entitled to vote is required to approve the ratification

of the appointment of the independent accountants.

Shares which are voted

to abstain and broker non-votes are not counted as votes cast on any matter to which they relate.

The By-Laws of the Company

provide that the majority of the shares of the Common Stock of the Company issued and outstanding and entitled to vote, present in person

or by proxy, shall constitute a quorum at the Annual Meeting. Shares which are voted to abstain are considered as present at the Annual

Meeting for the purposes of determining a quorum. Broker non-votes are considered as present at the Annual Meeting for the purposes of

determining a quorum.

RECORD DATE

AND SHARE OWNERSHIP

Only holders of Common

Stock of record on the books of the Company at the close of business on October 13, 2022, will be entitled to vote at the meeting. There

were 2,702,633 shares of Common Stock outstanding and entitled to vote on October 13, 2022.

Proposal no. 1

ELECTION OF

DIRECTORS

The Company’s Certificate

of Incorporation, as amended, provides that the Board of Directors shall consist of not less than three nor more than nine persons with

the actual number determined in accordance with the Company’s By-Laws. The Certificate of Incorporation further provides that there

shall be three classes of directors (Class A, Class B and Class C) with overlapping three-year terms and that all classes shall be as

nearly equal in number as possible.

The term of one Class B

Director expires at the Annual Meeting. There are also presently two Class C Directors, whose terms expire at the 2023 Annual Meeting,

and two Class A Directors, whose terms expire at the 2024 Annual Meeting.

The Board of Directors

approved the recommendation of the Nominating Committee and has nominated Ms. Nancy K. Patzwahl to stand for election as a Class B Director.

The votes will be cast

pursuant to the enclosed proxy for the election of the Class B nominee named unless specification is made withholding such authority.

Should said nominee become unavailable, which is not anticipated, the proxies named in the enclosed proxy will vote for the election of

such other person as the Board of Directors may recommend. Proxies may not be voted for a greater number of persons than the nominees

named.

The names and business

experience for the past five years of the person who has been nominated by the Board of Directors to stand for election as director at

the Annual Meeting, the person whose term as a Class B Director will be ending at the Annual Meeting and the remaining directors whose

terms are continuing until the 2023 or 2024 Annual Meeting appear below.

The Board has determined

that all of the Board members with the exception of David A. O’Neil, are independent in accordance with the listing standards of

the NYSE American and the By-Laws of the Company.

The independent members

of the Board met five times during the fiscal year ended June 30, 2022, including incidental to each regularly scheduled Board of Directors,

with no members of management present.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE ELECTION

OF THE FOLLOWING

NOMINEE FOR CLASS B DIRECTOR.

| Name |

Age |

Offices and

Positions

Held With

Company |

Principal Occupation or Employment |

Period to

Date

Served as

Director |

| Nancy K. Patzwahl |

56 |

|

Certified Public Accountant employed as a principal at UHY Advisors NY since January 2020. Previously she was a shareholder in the Hudson, NY accounting firm of Pattison, Koskey, Howe & Bucci, CPAs P.C. from 1997 through 2019 and a Senior Manager in Albany, NY with KPMG LLP. She has over 25 years of board experience, serving on both non-profit and for-profit boards and serving as chair of board audit committees. |

|

CONTINUING CLASS C

DIRECTORS – SERVING FOR A THREE YEAR TERM

EXPIRING AT

THE 2023 ANNUAL MEETING.

| |

|

|

|

|

| Name |

Age |

Offices and

Positions

Held With

Company |

Principal Occupation or Employment |

Period to

Date

Served as

Director |

| Paul J. Corr |

78 |

|

Certified Public Accountant who was a Principal at Capital Financial Advisors of New York, LLC, Clifton Park, NY from 2003 through 2021. Mr. Corr remains a consultant to the firm. From 2016 through 2021 he was Visiting Associate Professor of Management and Business at Skidmore College where he taught financial accounting theory and financial analysis. He originally retired from Skidmore College in May 2007 where he had taught since 1981. Mr. Corr was also a shareholder in the Clifton Park, NY accounting firm of Rutnik & Corr, P.C. from July 1999 through August 2011, and he had practiced as a certified public accountant for many years prior to 1999. |

1992 |

| Michael Wool |

76 |

|

Attorney engaged in private practice of law and senior partner since 1982 in the law firm of Langrock, Sperry & Wool, with offices in Burlington, VT and Middlebury, VT. Mr. Wool also serves on the board of the New England Board of Higher Education as former Chair and as a Director Emeritus of the Boys and Girls Club of Burlington, VT. |

1990 |

CONTINUING CLASS A

DIRECTORS – SERVING FOR A THREE YEAR TERM

EXPIRING AT

THE 2024 ANNUAL MEETING.

| Name |

Age |

Offices and

Positions

Held With

Company |

Principal Occupation or Employment |

Period to

Date

Served as Director

|

| Carl Helmetag |

74 |

Chairman of the Board |

An independent business consultant working for profit and non-profit entities. Mr. Helmetag has a MBA from The Wharton School of Business, University of Pennsylvania and a BA in Economics from the University of Wisconsin. He is on the Board of Managers, chair of the Audit Committee and Treasurer of the Providence Art Club. |

1999 |

| David A. O’Neil |

57 |

President and CEO |

Certified Public Accountant who has been President

and CEO since January 1, 2022. He previously served as Treasurer and Chief Financial Officer of the Company from January 4, 2000, and

Executive Vice President from December 2, 2016. Mr. O’Neil served as Interim President and CEO from June 2, 2014 until January 31,

2015. Prior to joining the Company, he was a Senior Manager at the accounting firm KPMG LLP.

|

2018 |

Non-CONTINUING CLASS

B DIRECTOR

TERM EXPIRING

AT THE 2022 ANNUAL MEETING.

| Name |

Age |

Offices and

Positions

Held With

Company |

Principal Occupation or Employment |

Period to

Date

Served as

Director |

| Roger N. Sexauer II |

64 |

|

An independent consultant primarily working with companies in the defense industry, specializing in strategic planning and business development. From 2004-2018, Mr. Sexauer served in various senior positions with Leonardo DRS, Inc., holding the titles Executive Vice President, Business Development, 2016-2018; President DRS Maritime and Combat Support Systems, 2014-2016; President DRS Power and Environmental Systems, 2008-2014; President, DRS Power Systems, 2005-2008; DRS C41 Group Vice President Business Development, 2004-2008. Prior thereto, he was employed by General Dynamics Electric Boat. Mr. Sexauer is a graduate of the United States Naval Academy. He serves on the Board of Directors of the Naval Submarine League. |

2018 |

None of the directors holds

a directorship in any other company with a class of securities registered pursuant to Section 12 of the Securities Exchange Act of 1934

or subject to the requirements of Section 15(d) of the Securities Act of 1933 or any company registered as an Investment Company under

the Investment Company Act of 1940.

BOARD OF DIRECTORS QUALIFICATIONS

The Board of Directors

believes that with respect to current Board members, a demonstration of dedicated commitment to the responsibilities of a director is

a leading criteria for assessing such person’s qualifications for continued service on the Board. The Board will also consider a

nominee’s relationship to the Company and the following skill sets and experience in evaluating Board candidates: industry experience,

corporate management experience, financial acumen, experience in international sales, mergers and acquisition experience and corporate

governance experience.

The specific experiences,

qualifications, attributes and skills of the nominee for director and the individuals continuing as directors are as follows:

Director Nominee

Ms. Patzwahl’s experience

as a certified public accountant, and service of chairs on audit committee boards, brings strong financial skills to the Board, is an

invaluable resource for the Board for financial risk assessment, and qualifies her to be an Audit Committee financial expert for the Company.

Continuing Directors

Mr. Corr’s experience

as a certified public accountant, investment advisor and professor of management and business at Skidmore College teaching accounting

theory, financial analysis, and finance, brings strong financial skills to the Board and qualifies him as the Audit Committee financial

expert and the person on the Board responsible for risk assessment oversight.

Mr. Helmetag has a very

strong business leadership, financial management and strategic planning background through his long career as a senior executive in several

corporations. His personal experience in business development, economic conditions and financial issues is an invaluable resource for

the Board on a myriad of matters it must consider from time to time.

Mr. O’Neil is the

Company’s President and Chief Executive Officer and through his day-to-day involvement in all aspects of the Company’s operations

provides a vital link between senior management personnel and the general oversight and policy setting responsibilities of the Board.

He has served as a Company Officer since 2000. Mr. O’Neil is integrally involved with the Company’s strategic business development

plans, bids for new business, and the administration of the Company’s relationships with long-term customers.

Mr. Wool is a business

and tax lawyer with over forty years of experience advising a broad range of clients in a broad spectrum of business, tax, governmental,

commercial, employment and transactional matters. He provides valuable insight and legal advice to the Espey Board and to senior management

upon request, in its deliberations and consideration of strategic initiatives including potential business combinations and acquisitions,

employee and executive compensation matters, advice and analysis concerning contractual matters, corporate governance matters and other

legal issues. Mr. Wool played a key role in the design and adoption, amendments, administration, ongoing compliance and new transactions

of the Espey Employee Stock Ownership Plan (“ESOP”) and consults with management concerning the plan’s ongoing operation.

Non-continuing Director

Mr. Sexauer has long-term

and strong leadership, financial acumen, strategic planning and business development skills in the defense industry. His long-term employment

with Leonardo DRS, and before that General Dynamics, as well as his historic relationships with the United States Navy, are assets to

the Board in its oversight of the development of the Company’s business with defense industry contractors.

OTHER EXECUTIVE

OFFICERS

The only individuals currently

considered executive officers of the Company not previously identified are:

Katrina L. Sparano, 52,

Chief Financial Officer and Treasurer since January 1, 2022, and previously Assistant Treasurer and Principal Accounting Officer of the

Company since November 12, 2004. Ms. Sparano is a Certified Public Accountant. Prior to joining the Company on July 29, 2004, she was

the Assistant Controller for Cambridge Heart, Inc. Ms. Sparano served as Interim Principal Financial Officer from June 2, 2014 until January

31, 2015.

Peggy A. Murphy, 64, Secretary

of the Company since December 11, 1998. She has been employed by the Company as Director of Human Resources and Facility Security Officer

since October 1998.

The terms of office of

all executive officers are until the next Annual Meeting of the Board of Directors unless successors are sooner appointed by the Board

of Directors.

BOARD OF DIRECTORS

MEETINGS AND COMMITTEES

During the Company’s

fiscal year ended June 30, 2022, the Board of Directors held a total of six meetings, and each director then in office attended at least

75% of such meetings. Under the policies of the Board, Directors are expected to attend regular Board meetings, Board committee meetings,

as applicable, and the Annual Meeting of Shareholders.

The Board has a standing

Audit Committee whose members are Paul J. Corr, Chairman, Carl Helmetag, Roger N. Sexauer II and Michael Wool. The functions of this Committee

include reviewing the engagement of the independent accountants, the scope and timing of the audit and any non-audit services to be rendered

by the independent accountants, reviewing with the independent accountants and management the Company’s policies and procedures

with respect to internal auditing, accounting and financial controls, and reviewing the report of the independent accountants upon completion

of its audit. During the fiscal year ended June 30, 2022, the Audit Committee held eight meetings, and each Committee member attended

at least 75% of such meetings.

The Board has a standing

Nominating Committee whose members are Carl Helmetag, Chairman, Michael Wool, Paul J. Corr and Roger N. Sexauer II. The function of this

Committee is to identify and recommend to the Board individuals for nomination to fill vacancies in, and for re-nomination to, positions

as Directors of the Company. During the fiscal year ended June 30, 2022, the Nominating Committee held one meeting and each Committee

member attended the meeting.

The Board of

Directors has a standing Compensation Committee whose members are Michael Wool, Chairman, and Carl Helmetag. The functions of this

Committee include recommending to the full Board all compensation programs applicable to executive officers including salaries paid

to executive officers, the compensation paid to non-employee directors and the grant of all forms of bonuses and stock-based

compensation including to whom, and the time or times at which, options or stock awards will be granted, the number of shares of

common stock that underlie each grant and the exercise price and vesting schedule. During the fiscal year ended June 30, 2022, the

Compensation Committee held six meetings and each Committee member attended such meetings.

The Board also has a Succession

Committee, members of which are Paul J. Corr, and Michael Wool, and a Mergers and Acquisition Committee, members of which are Michael

Wool, David O’Neil, and Roger N. Sexauer II.

Board Independence -

The Board has determined that all of the members of the Audit Committee and the Nominating Committee meet the independence criteria for

audit committee and nominating committee members as set forth in the listing standards of the NYSE American. The Board has further determined

that Mr. Corr qualifies as an audit committee financial expert in accordance with the rules of the United States Securities and Exchange

Commission (“SEC”).

Board Leadership

- The Board of Directors has not designated an individual as the lead independent director. Rather, the Board will designate one of its

independent directors to act as a lead director on an ad hoc basis, taking into account the nature of the matter being addressed and the

applicable skill set required.

Risk Oversight and Cybersecurity

- The Board oversees the Company’s processes to manage risk and the Company’s cybersecurity program, and has delegated the

primary responsibility for reviewing policies with respect to risk assessment, risk management and cybersecurity to the Audit Committee.

Management is responsible for the development, implementation and maintenance of the risk management processes and cybersecurity program.

The Audit Committee consults with the Company’s Director of Information Technology regarding ongoing cybersecurity initiatives,

and requests such individual, together with senior management, to report to the Audit Committee or the full Board regularly on their assessment

of operational, financial and accounting, competitive, reputational, cybersecurity and legal risks to the Company.

NON-EMPLOYEE

DIRECTOR COMPENSATION

Company employees who also serve on the Company’s

Board of Directors do not receive director’s fees. The non-employee Directors receive an annual fee of $60,000 for being a member

of the Board of Directors. The current annual fee became effective on January 1, 2019.

Each Director who also serves

as a member of the Audit Committee is compensated an additional annual fee of $2,500 with the exception of the Chairman who is compensated

an additional annual fee of $5,000. Each Director who serves as a member of the Compensation Committee or the Mergers and Acquisition

Committee is compensated an additional annual fee of $2,500 for each committee. Mr. Wool, the Chairman of the ESOP Committee, is compensated

an additional annual fee of $2,500. These fees are paid in monthly installments to the Directors.

The following table sets

forth the compensation of the Company’s non-employee Directors for the fiscal year ending June 30, 2022:

| |

Fees Earned or |

Option |

|

| Name |

Paid in Cash $ |

Awards (1) $ |

Total $ |

| |

|

|

|

| Paul Corr |

$65,000 |

$8,441 |

$73,441 |

| Carl Helmetag |

$65,000 |

$8,441 |

$73,441 |

| Roger N. Sexauer II |

$65,000 |

$8,441 |

$73,441 |

| Michael Wool |

$68,750 |

$8,441 |

$77,191 |

(1) Represents the aggregate

grant date fair value dollar amount computed in accordance with ASC Topic 718. For information concerning the assumptions made in the

valuation of awards, see Note 11 of the Company’s financial statements for fiscal year ended June 30, 2022

The non-employee Directors held the following unexercised options

at June 30, 2022:

| Name |

Number of Securities

Underlying Unexercised

Options # Exercisable |

Number of Securities

Underlying Unexercised

Options # Unexercisable (a) |

Option

Exercise

Price $ |

Option

Expiration

Date |

| |

|

|

|

|

| Paul J. Corr |

1,600 |

|

$27.22 |

08/23/2023 |

| |

1,600 |

|

$26.09 |

06/12/2025 |

| |

2,000 |

|

$26.25 |

12/02/2026 |

| |

2,400 |

|

$21.75 |

10/10/2027 |

| |

2,242 |

|

$27.21 |

12/07/2028 |

| |

2,550 |

|

$20.50 |

12/06/2029 |

| |

|

2,550 |

$18.05 |

10/21/2030 |

| |

|

2,300 |

$13.98 |

12/10/2031 |

| Name |

Number of Securities

Underlying Unexercised

Options # Exercisable |

Number of Securities

Underlying Unexercised

Options # Unexercisable (a) |

Option

Exercise

Price $ |

Option

Expiration

Date |

| Carl Helmetag |

1,600 |

|

$27.22 |

08/23/2023 |

| |

1,600 |

|

$26.09 |

06/12/2025 |

| |

1,600 |

|

$26.25 |

12/02/2026 |

| |

2,000 |

|

$21.75 |

10/10/2027 |

| |

1,842 |

|

$27.21 |

12/07/2028 |

| |

2,150 |

|

$20.50 |

12/06/2029 |

| |

|

2,150 |

$18.05 |

10/21/2030 |

| |

|

2,300 |

$13.98 |

12/10/2031 |

| |

|

|

|

|

| Roger N. Sexauer II |

1,842 |

|

$27.21 |

12/07/2028 |

| |

2,150 |

|

$20.50 |

12/06/2029 |

| |

|

2,150 |

$18.05 |

10/21/2030 |

| |

|

2,300 |

$13.98 |

12/10/2031 |

| |

|

|

|

|

| Michael Wool |

1,600 |

|

$27.22 |

08/23/2023 |

| |

1,600 |

|

$26.09 |

06/12/2025 |

| |

1,600 |

|

$26.25 |

12/02/2026 |

| |

2,000 |

|

$21.75 |

10/10/2027 |

| |

1,842 |

|

$27.21 |

12/07/2028 |

| |

2,150 |

|

$20.50 |

12/06/2029 |

| |

|

2,150 |

$18.05 |

10/21/2030 |

| |

|

2,300 |

$13.98 |

12/10/2031 |

| (a) | Unexercisable options vest as follows: (i) Options with an expiration date of October 21, 2030 vest on October 21, 2022 (ii) Options

with an expiration date of December 10, 2031 vest on December 10, 2023. |

COMPENSATION

OF EXECUTIVE OFFICERS

The following table summarizes

the annual compensation for each of the fiscal years ended June 30, 2022 and June 30, 2021 received by the Company’s former President

and Chief Executive Officer, Company’s President and Chief Executive Officer, and two most highly compensated executive officers

who received over $100,000 in total compensation for the fiscal year ended June 30, 2022 (collectively, the “Named Executive Officers”):

| SUMMARY COMPENSATION TABLE |

| |

|

|

|

|

|

|

| Name and |

|

|

|

Option (3,4) |

All Other (5) |

|

| Principal Position |

Year |

Salary $ (2) |

Bonus $ |

Awards $ |

Compensation $ |

Total $ |

| |

|

|

|

|

|

|

| Patrick T. Enright, Jr. (1,2,4) |

2022 |

$281,611 |

$80,000 |

$22,380 |

$1,300 |

$385,291 |

| Former President and |

2021 |

$276,322 |

$0 |

$9,540 |

$11,015 |

$296,877 |

| Chief Executive Officer |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| David O'Neil (1) |

2022 |

$236,500 |

$30,000 |

$22,380 |

$12,976 |

$301,856 |

| President and Chief |

2021 |

$195,938 |

$0 |

$5,963 |

$12,279 |

$214,180 |

|

Executive Officer

Katrina Sparano (1) |

2022 |

$150,654 |

$10,000 |

$18,650 |

$8,419 |

$187,723 |

|

Chief Financial Officer and Treasurer

|

|

|

|

|

|

|

| Peggy A. Murphy |

2022 |

$136,425 |

$15,000 |

$22,380 |

$10,044 |

$183,849 |

| Dir. HR/Corp. Sec'y |

2021 |

$130,625 |

$0 |

$5,963 |

$7,365 |

$143,953 |

| |

|

|

|

|

|

|

|

|

| (1) | Patrick T. Enright, Jr. resigned as President and Chief Executive Officer and director of the Company

on December 31, 2021. David O'Neil was appointed President and Chief Executive Officer and Katrina Sparano was appointed Chief Financial

Officer and Treasurer effective January 1, 2022. Prior to such date Mr. O’Neil was Executive Vice President, Treasurer and Chief

Financial Officer and Ms. Sparano was Assistant Treasurer and Principal Accounting Officer. |

| (2) | Mr. Enright’s salary reported for Fiscal Year 2022 includes $142,788 paid to him in accordance with

his separation agreement. |

| (3) | Represents the aggregate grant date fair value dollar amount computed in accordance with ASC Topic 718.

For information concerning the assumptions made in the valuation of awards, see Note 11 of the Company’s financial statements for

fiscal year ended June 30, 2022. |

| (4) | In the case of Mr. Enright these grants were not vested at the time of his departure from the Company

and are no longer available for exercise. |

| (5) | All other compensation includes (i) the value of shares of the Company’s common stock allocated

to the Named Executive Officers’ accounts in the Company’s ESOP and, (ii) the Company’s matching contributions to the

Company 401(k) Plan, as set forth below. Dividends are paid on allocated shares in the Company’s ESOP at the same time and rate

and in the same form as dividends paid on common shares generally. ESOP shares allocated to the Named Executive Officers’ accounts

vest in accordance with the terms of the plan. At June 30, 2022, Messrs. Enright and O’Neil and Mses. Sparano and Murphy were 100%,

100%, 100% and 100% vested respectively. |

| |

|

|

Value of allocated |

Company |

|

| |

|

|

Shares in Company |

Contributions |

|

| Name |

|

Year |

ESOP ($) |

to 401(k) Plan ($) |

Total |

| Patrick T. Enright, Jr. |

|

2022 |

$0 |

$1,300 |

$1,300 |

| |

|

2021 |

$9,715 |

$1,300 |

$11,015 |

| |

|

|

|

|

|

| David O'Neil |

|

2022 |

$10,376 |

$2,600 |

$12,976 |

| |

|

2021 |

$9,655 |

$2,624 |

$12,279 |

| |

|

|

|

|

|

| Katrina Sparano |

|

2022 |

$8,159 |

$260 |

$8,419 |

| |

|

|

|

|

|

| Peggy A. Murphy |

|

2022 |

$7,813 |

$2,231 |

$10,044 |

| |

|

2021 |

$6,437 |

$928 |

$7,365 |

The following table sets

forth information concerning outstanding equity awards held by the Company’s Named Executive Officers at fiscal year-end June 30,

2022:

OUTSTANDING EQUITY

AWARDS AT FISCAL YEAR END

| Name |

Number of Securities

Underlying Unexercised

Options # Exercisable |

Number of Securities

Underlying Unexercised

Options # Unexercisable (a) |

Option

Exercise

Price $ |

Option

Expiration

Date |

| |

|

|

|

|

| David O’Neil |

2,000 |

|

$27.22 |

08/23/2023 |

| |

2,000 |

|

$26.09 |

06/12/2025 |

| |

2,250 |

|

$26.25 |

12/02/2026 |

| |

2,925 |

|

$21.75 |

10/10/2027 |

| |

2,500 |

|

$27.21 |

12/07/2028 |

| |

2,500 |

|

$20.50 |

12/06/2029 |

| |

|

3,750 |

$18.05 |

10/21/2030 |

| |

|

6,000 |

$14.87 |

07/01/2031 |

| Name |

Number of Securities

Underlying Unexercised

Options # Exercisable |

Number of Securities

Underlying Unexercised

Options # Unexercisable (a) |

Option

Exercise

Price $ |

Option

Expiration

Date |

| |

|

|

|

|

| Katrina Sparano |

1,500 |

|

$27.22 |

08/23/2023 |

| |

1,750 |

|

$26.09 |

06/12/2025 |

| |

1,500 |

|

$26.25 |

12/02/2026 |

| |

1,950 |

|

$21.75 |

10/10/2027 |

| |

1,950 |

|

$27.21 |

12/07/2028 |

| |

1,950 |

|

$20.50 |

12/06/2029 |

| |

|

2,500 |

$18.05 |

10/21/2030 |

| |

|

5,000 |

$14.87 |

07/01/2031 |

| |

|

|

|

|

| Peggy Murphy |

1,500 |

|

$27.22 |

08/23/2023 |

| |

1,500 |

|

$26.09 |

06/12/2025 |

| |

2,000 |

|

$26.25 |

12/02/2026 |

| |

2,600 |

|

$21.75 |

10/10/2027 |

| |

2,500 |

|

$27.21 |

12/07/2028 |

| |

2,500 |

|

$20.50 |

12/06/2029 |

| |

|

3,750 |

$18.05 |

10/21/2030 |

| |

|

6,000 |

$14.87 |

07/01/2031 |

| |

|

|

|

|

| (a) | Unexercisable options vest as follows: (i) Options with an expiration date of October 21, 2030 vest on October 21, 2022 (ii) Options

with an expiration date of July 1, 2031 vest on July 1, 2023. |

SECURITIES AUTHORIZED

FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

The following table sets

forth information as of June 30, 2022 with respect to compensation plans under which equity securities of the Company may be issued:

Equity Compensation

Plan INFORMATION

| Plan Category |

Number of securities to

be issued upon exercise

of outstanding options,

warrants and rights |

Weighted-average

exercise price of

outstanding options,

warrants and rights |

Number of Securities

remaining available for

future issuance under

equity compensation plan

(excluding securities

reflected in Column (a)) |

| |

(a) |

(b) |

(c) |

| Equity compensation plans approved by security holders |

246,273 |

$20.89 |

204,477 |

|

Equity compensation plans not approved by security holders

Total |

--

_______

246,273 |

--

|

--

______

204,477 |

INSURANCE

The executive officers

of the Company can elect to be covered under the company-sponsored medical health plans, which do not discriminate in favor of the officers

of the Company and which are available generally to all employees. In addition, the executive officers are covered under a group life

plan, which does not discriminate, and is available to all employees.

The Company maintains insurance

coverage, as authorized by Section 726 of the New York Business Corporation Law, providing for (a) reimbursement of the Company for payments

it makes to indemnify officers and directors of the Company, and (b) payment on behalf of officers and directors of the Company for losses,

costs and expenses incurred by such individuals in any actions.

EMPLOYEE RETIREMENT

PLAN AND TRUST

Under the Company’s

ESOP, approved by the Board of Directors on June 2, 1989, effective July 1, 1988, all non-union employees of the Company, including the

Company’s executive officers and non-executive officers are eligible to participate. The ESOP is a non-contributory plan, which

is designed to invest primarily in shares of common stock of the Company. Certain technical amendments not considered material were adopted

effective as of June 10, 1994, July 1, 2003, July 1, 2005, July 1, 2016, and January 1, 2020.

Of the 496,091 shares of

common stock of the Company allocated to participants of the ESOP as of June 30, 2022, 3,938 shares were allocated to Mr. Enright, 18,456

shares were allocated to Mr. O’Neil, 6,610 shares were allocated to Ms. Sparano, and 8,149 shares were allocated to Ms. Murphy.

Messrs. Enright, and O’Neil and Mses. Sparano and Murphy were 100%, vested in their respective accounts as of June 30, 2022.

The ESOP’s purchase

of common stock from the Company has been financed by loans from the Company to the ESOP. Each year the Company makes contributions to

the ESOP, which is used to make loan interest and principal payments to the Company. Following each payment of principal on the loan,

a portion of the unallocated shares held by the ESOP is allocated to participants.

On December 1, 2020, pursuant

to a Stock Purchase Agreement dated as of such date, the Company sold 300,000 shares of its common stock to the ESOP. The ESOP paid $18.29

per share, for an aggregate purchase price of $5,487,000. The ESOP borrowed from the Company an amount equal to the purchase price. The

loan will be repaid in fifteen (15) equal annual installments of principal and the unpaid balance will bear interest at a fixed rate of

3.00% per annum.

The Board of Directors

of the Company had approved a purchase price equal to the fair market value as determined by an independent valuation firm retained by

the ESOP. The average trading pricing of the Company’s common stock of the NYSE – American on November 30, 2020 was $19.12.

EMPLOYMENT CONTRACTS

AND TERMINATION OF EMPLOYMENT

The Company had an Executive

Employment agreement with Patrick T. Enright Jr., the former President and Chief Executive Officer, who resigned effective December 31,

2021. The agreement was effective February 1, 2018. It provided for the payment of base compensation and bonus compensation. Mr. Enright

was entitled to an annual performance-based cash bonus comprised of three components, with the maximum aggregate amount payable not to

exceed his annual base salary. The first component was discretionary, based upon an annual performance assessment and could not exceed

50% of the base salary. The second component was based on the increase in combined sales plus backlog over the average of the prior three

fiscal years, times 0.5% (one half of one percent), and could not exceed 50% of base salary. The third component was based on the increase

in operating earnings over the average of the prior three fiscal years, times 5% (five percent), and could not exceed 50% of base salary.

In calculating backlog, adjustments were made in the case of a specific customer contract. In accordance with the terms of a Separation

Agreement, Mr. Enright was paid his bonus for the fiscal year ended June 30, 2021 and was entitled to receive nine months of severance

pay based upon his final base salary.

The Company had an Executive

Employment Agreement with David A. O’Neil in his capacity as Executive Vice President, Treasurer and Chief Financial Officer, which

was effective March 1, 2013 and had automatically renewed annually subsequent to June 30, 2016. Incidental to his appointment as the Company’s

new President and Chief Executive Officer on January 1, 2022, the Company entered a new Employment Agreement with Mr. O’Neil for

a two year term ending January 1, 2024. The Agreement provides for the payment of base compensation and bonus compensation. Mr. O’Neil

is entitled to an annual performance-based cash bonus comprised of three components, with the maximum aggregate amount payable not to

exceed his annual base salary. The first component

is discretionary, based upon an annual performance assessment and may not exceed 50%

of the base salary. The second component is based on the increase in combined sales plus backlog over the average of the prior three fiscal

years, times 0.5% (one half of one percent), and may not exceed 50% of base salary. The third component is based on the increase in operating

earnings over the average of the prior three fiscal years, times 5% (five percent), and may not exceed 50% of base salary. If Mr. O’Neil

is terminated “without cause” he is entitled to receive nine months of severance pay based upon his base salary.

Incidental to her appointment

as Chief Financial Officer and Treasurer effective January 1, 2022, the Company entered an Employment Agreement with Katrina L. Sparano

for a term of one year which automatically renews for additional one year periods unless either the Company or Ms. Sparano gives at least

60 days’ notice to the contrary. Ms. Sparano receives an annual base salary and may be paid bonus compensation, at the discretion

of the Board, based upon the recommendation of the President and Chief Executive Officer. If Ms. Sparano is terminated “without

cause” she is entitled to nine months of severance pay based upon her base salary.

The Company had an Executive

Employment Agreement with Peggy A. Murphy Director of Human Resources/Corporate Secretary which was effective March 1, 2013, and had automatically

renewed for additional one year periods subsequent to June 30, 2016. Effective January 1, 2022, the Company entered a new Employment Agreement

with Ms. Murphy for a term of one year which automatically renews for additional one year periods unless either the Company or Ms. Murphy

gives at least 60 days’ notice to the contrary. Ms. Murphy receives an annual base salary and may be paid bonus compensation, at

the discretion of the Board, based upon the recommendation of the President and Chief Executive Officer. If Ms. Murphy is terminated “without

cause” she is entitled to nine months of severance pay based upon her base salary.

STOCK TRADING POLICY – HEDGING

The Board has implemented

a stock trading policy that applies to the Board of Directors, executive officers and other persons whom the Company may designate from

time to time as “insiders” because of their access to information. Under this policy, trading in the Company’s securities

is prohibited except during specifically designated windows. Additionally, these persons are prohibited from engaging in various trading

practices which would suggest speculation in Company securities, including short sales, puts, calls, trading on margin, swaps, or other

hedging transactions. The policy also disallows these persons from pledging the Company securities as collateral for a loan.

AUDIT COMMITTEE

REPORT

The Audit Committee of

the Board of Directors (the “Committee”) is comprised of four independent directors and operates under a written charter,

revised most recently by the Board on September 7, 2018. The Audit Committee Charter is available on the Company’s website at www.espey.com

under the tab “Corporate Governance”.

In fulfilling its responsibilities,

the Committee has reviewed and discussed the Company’s audited consolidated financial statements for the fiscal year ended June

30, 2022 with management and the independent public accountants.

The Committee has discussed

with the independent public accountants the matters required to be discussed by Statement on Auditing Standard No. 16, as amended (Communications

with Audit Committees). In addition, the Committee has received and reviewed the written disclosures and the letter from the independent

public accountants required by Independence Standards Board No.1 (Independence Discussions with Audit Committees), and has discussed with

the auditors the auditors’ independence.

The Committee considered

and concluded that the provision of non-audit services by the independent public accountants was compatible with maintaining their independence.

In reliance on the reviews

and discussions referred to above, the Committee recommended to the Board of Directors that the audited financial statements referred

to above be included in the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2022.

| |

Audit Committee: |

| |

Paul J. Corr, Chairman |

| |

Carl Helmetag |

| |

Roger N. Sexauer II |

| |

Michael Wool |

CORPORATE

GOVERNANCE AND NOMINATING COMMITTEE

The Nominating Committee

of the Board of Directors (the “Nominating Committee”) is comprised of four independent directors and operates under a written

charter. A copy of the charter is available on the Company’s website, www.espey.com, under the tab “Corporate Governance”.

The Nominating Committee

will review the present needs of the Board and establish criteria as to particular qualifications in terms of background and experience

that could meet such needs. At a minimum, the Nominating Committee believes that nominees for Directors should have either experience

in the industry in which the Company engages or professional, business or academic qualifications that differ from existing members of

the Board and could augment the aggregate expertise possessed by Board members. In addition to industry experience, the Nominating Committee

will consider the following skill sets and experience; corporate management experience, financial acumen, experience in international

sales, mergers and acquisition experience and corporate governance experience. The Company further believes that all nominees should be

able to make a contribution to the Board that will enhance the development and growth of the Company’s business and shareholder

value; devote adequate time to service as a Director; and work well with other Board members in a collegial manner.

The Nominating Committee

evaluates prospective nominees identified on its own initiative or referred to it by other Board members, management, shareholders or

external sources and all self-nominated candidates. The Nominating Committee will use the same criteria for evaluating candidates nominated

by shareholders and self-nominated candidates as it does for those proposed by other Board members, management and search companies.

The Nominating Committee’s

evaluation of existing Board members and prospective new Board members and the implementation of a diversity policy will be in the context

of determinations made regarding the size of the Board of Directors. The Company is a small business with less than $40 million in sales

and operations at only one location. Due, in part, to the size of the Company’s business and the relatively simple corporate structure,

the Board determined to reduce the fixed number of Directors to six. As existing directors retire, diversity is a factor that will be

considered by the Nominating Committee in selecting new nominees.

The Nominating Committee

will consider bona fide recommendations by shareholders as to potential Director Nominees, who meet the above standards. A shareholder

wishing to submit such a recommendation should send a letter, postmarked no more than 180 days and no later than 120 days prior to the

date on which the Company’s Annual Meeting was held during the prior year, to the Secretary of the Company. In the case of an Annual

Meeting that is called for a date that is not within 30 calendar days before or after the first anniversary date of the Annual Meeting

of Shareholders in the immediately preceding year, any such written proposal of nomination must be received by the Secretary not less

than five days after the Company shall have issued a press release, filed a periodic report with the Securities and Exchange Commission

or otherwise publicly disseminated notice that an Annual Meeting of Shareholders will be held. The letter must identify its writer as

a shareholder of the Company, provide evidence of the writer’s stock ownership and provide:

| • | The name, address, telephone number and social security number of the candidate to be considered; |

| • | A description of understandings, contractual, business or familial relationships between the shareholder

and the candidate, if any, and an unexecuted written consent of the candidate to serve as a director of the Company, if nominated and

elected; |

| • | The candidate’s resume and at least three references; |

| • | A statement of the candidate’s qualifications to serve on the Board of Directors and specified Board

committees which shall include an explanation as to how elements of the candidate’s background and experience would be a benefit

to the Company and its business. |

All candidates recommended

to the Nominating Committee must meet the independence standards of the NYSE American and the definition of “independent director”

in the Company’s By-Laws.

COMPENSATION

COMMITTEE

The Compensation Committee

of the Board of Directors (the “Committee”) is comprised of two independent directors and operates under a written charter,

adopted on February 20, 2009. A copy of the charter is available on the Company’s website, www.espey.com, under the tab “Corporate

Governance”.

The objectives of the compensation

program are designed to align performance with the interests of shareholders, reward performance, retain and recruit qualified and effective

talent.

The Committee will consult

with senior management to establish, review and evaluate the long-term strategy of executive compensation and the types of stock and other

compensation plans utilized by the Company. The Committee will also assist the Board in the establishment of annual goals and objectives

for the Company’s Chief Executive Officer, as well as consulting with the Chief Executive Officer to establish goals and objectives

for other members of senior management. The Committee will assist the Board in establishing plans for executive officer development. The

Committee has not engaged a compensation consultant in connection with the discharge of its responsibilities.

The Committee is responsible

for recommending to the Board all grants and awards under the Company’s stock option plans and other equity-based plans. It is not

intended that the authority of the Board to make grants under the 2017 Stock Option and Restricted Stock Plan be delegated to the Committee,

but rather that the Committee serve in an advisory capacity. The Committee will also consult with the Chief Executive Officer for senior

management grants and awards. The Board has authorized the Chief Executive Officer to grant up to 2,000 stock options, without further

approval, incidental to the hiring of new senior level employees.

The Committee will review

compensation paid to non-employee directors and make recommendations to the Board for any adjustments.

The Committee will review

and approve, in consultation with the Chief Executive Officer, any severance or similar termination payments proposed to be made to any

current or former executive officer of the Company (other than the current Chief Executive Officer), and review and recommend to the Board

any severance or similar termination payments proposed to be made to the current Chief Executive Officer.

SHAREHOLDER

COMMUNICATIONS WITH THE BOARD

Mail can be addressed to

Directors in care of the Office of the Secretary, Espey Mfg. & Electronics Corp., 233 Ballston Avenue, Saratoga Springs, New York

12866. At the direction of the Board of Directors, all mail received will be opened and screened for security purposes. The mail will

then be logged in. All mail, other than trivial or obscene items, will be forwarded. Trivial items will be delivered to the Directors

at the next scheduled Board meeting. Mail addressed to a particular Director will be forwarded or delivered to that Director. Mail addressed

to “Outside Directors” or “Non-Management Directors” will be forwarded or delivered to the Chairman of the Audit

Committee. Mail addressed to the “Board of Directors” will be forwarded or delivered to the Chairman of the Board.

SECURITY OWNERSHIP

OF CERTAIN BENEFICIAL OWNERS

The following table sets

forth information regarding ownership of the Company’s outstanding Common Stock as of October 13, 2022, by each person or group

who is known to the Company to be the beneficial owner of more than five percent of the outstanding shares of Common Stock:

|

Title

Class |

Name and Address of

Beneficial Owner |

Amount and Nature of

Beneficial Ownership of Class |

Percent |

| Common Stock |

Stanley Kesselman

c/o Maxim Group

20 Crossways Park Drive North

Suite 304

Woodbury, NY 11747 |

247,177 - Direct (1) |

9.15% |

| |

|

|

|

| |

Espey Mfg. & Electronics Corp. Employee Retirement Plan and Trust

233 Ballston Ave.

Saratoga Springs, NY 12866

|

758,364 – Indirect (2) |

28% |

| (1) | The information is from Schedule 13G/A filed January 10, 2022 with the SEC by Mr. Kesselman. |

| (2) | The information is from Schedule 13G/A filed February 10, 2022 with the SEC. The ESOP holds an aggregate

of 758,364 shares of the Company’s Common Stock (28% of the outstanding shares). The ESOP has the sole voting power with respect

to shares held by it which have not been allocated to participant accounts, and shared voting power with respect to shares held by it

which have been allocated to participant accounts. |

The ESOP Trustees, Howard Pinsley and Peggy Murphy,

disclaim beneficial ownership of the shares held by the ESOP, with the exception of the 23,117 and 8,149 shares which are allocated to

their respective accounts.

Pursuant to the ESOP, participants are entitled to

instruct the Trustees as to the voting of shares allocated to their accounts unless the Trustees determine that the instructions would

be a violation of ERISA. Subject to ERISA, the Trustees vote the unallocated shares in the manner directed by the Board of Directors of

the Company, which is currently in the same proportion as the instructions received on the allocated shares.

SECURITY OWNERSHIP

OF MANAGEMENT

The following information

is furnished as of October 13, 2022, as to each class of equity securities of the Company beneficially owned by all Directors and Executive

Officers and by Directors and Executive Officers of the Company as a Group:

| Title Class |

Name of Beneficial

Owner |

Amount and Nature of

Beneficial Ownership |

Percent of Class |

| |

|

|

|

| Common Stock |

Paul J. Corr |

35,381 - Direct (1) |

1.3% |

| |

|

|

|

| Common Stock |

Carl Helmetag |

32,911 - Direct (1) |

1.3% |

| |

|

1,504 - Indirect (3) |

|

| |

|

|

|

| Common Stock |

Peggy Murphy |

272,643 - Direct (1)(4) |

10.3% |

| |

|

8,149 - Indirect (2) |

|

| |

|

|

|

| Common Stock |

David O’Neil |

27,925 - Direct (1) |

1.7% |

| |

|

18,456 - Indirect (2) |

|

| |

|

|

|

| Title Class |

Name of Beneficial

Owner |

Amount and Nature of

Beneficial Ownership |

Percent of Class |

| Common Stock |

Roger N. Sexauer II |

7,142 - Direct |

* |

| |

|

|

|

| Common Stock |

Katrina Sparano |

13,100 - Direct (1) |

* |

| |

|

6,610 - Indirect (2) |

|

| |

|

|

|

| Common Stock |

Michael Wool |

27,942 - Direct (1) |

1% |

| |

|

|

|

| |

Officers and Directors |

417,044 - Direct (1) |

16.1% |

| |

as a Group (7 persons) |

34,719 - Indirect (2), (3) |

|

* Less than one percent

| 1) | Direct shares include options to acquire shares, which are exercisable within 60 days as follows: |

|

Name of Beneficial

Owner |

Exercisable

Options |

Name of Beneficial

Owner |

Exercisable

Options |

| Paul J. Corr |

14,942 |

Roger N. Sexauer II |

6,142 |

| Carl Helmetag |

12,942 |

Katrina Sparano |

13,100 |

| Peggy Murphy |

16,350 |

Michael Wool |

12,942 |

| David O’Neil |

17,925 |

|

|

| 2) | Includes shares allocated to the named officer as of June 30, 2022, as a participant in the Company’s

ESOP and may reflect dispositions that have occurred since the date of the person’s last ownership report on Form 4. Each such person

has the right to direct the manner in which such shares allocated to him or her are to be voted by the ESOP Trustee. |

| 3) | In the case of Mr. Helmetag, represents 1,504 shares held in an IRA account. |

| 4) | Includes 256,293 shares owned by the ESOP which have not been allocated to participant accounts as to

which Ms. Murphy disclaims beneficial ownership. Ms. Murphy serves as Trustee of the ESOP. Pursuant to the ESOP, participants are entitled

to instruct the Trustees as to the voting of shares allocated to their accounts unless the Trustees determine that the instructions would

be a violation of ERISA. Subject to ERISA, the Trustees vote the unallocated shares in the manner directed by the Board of Directors of

the Company, which is currently in the same proportion as the instructions received on the allocated shares. |

There are no arrangements

known to the Company, the operation of which may at a subsequent date, result in change of control of the Company.

CODE OF ETHICS

The Company had adopted

a Code of Ethics which is available on the Company’s website at www.espey.com under the tab “Corporate Governance.”

PROPOSAL NO. 2

ADVISORY VOTE ON EXECUTIVE COMPENSATION

The Dodd-Frank Wall Street

Reform and Consumer Protection Act of 2010 (“Dodd-Frank Act”) requires that shareholders have the opportunity to cast a non-binding

vote on executive compensation, commonly referred to as a “say-on-pay” vote.

This advisory vote can be

conducted every year, every two years, or every three years. In 2019, we asked the shareholders in an advisory vote how frequently we

should conduct the “say-on–pay” vote. We recommended every three years and every three years received the most votes

of our shareholders. Accordingly, in 2019 we held the “say-on-pay” vote, on an advisory basis, on the fiscal year 2019 compensation

which we paid to our Named Executive Officers, and this year we are holding the “say-on-pay” vote, on an advisory basis, on

the 2022 compensation which we paid to our Named Executive Officers.

We are not required to conduct

another advisory vote on the frequency of a “say on pay” vote until 2025.

At present, we have three

Named Executive Officers. We believe that their base compensation is reasonable based upon their experience, the size of the Company and

the Company's annual revenues. As described under the heading "Employment Contracts and Termination of Employment", our President

and Chief Executive Officer is entitled to bonus compensation, in addition to his base compensation which is, in part, derived from formulae

applied to our financial performance and, in part, discretionary. Bonus compensation for our other Named Executive Officers is purely

discretionary with the Board of Directors and will be awarded based upon the Company's performance and the individual's contribution to

such performance.

We do not have separate retirement

plans or benefits for our Named Executive Officers. They are participants in the Company's ESOP and may participate in our 401(k) plan.

In addition, they receive periodic awards of stock options. Our Named Executive Officers also participate in Company-sponsored group benefit

plans available to all employees. The details are under the heading "Compensation of Executive Officers."

The advisory vote on executive

compensation solicited by this proposal is not intended to address any specific item of compensation, but rather the overall compensation

of our Named Executive Officers which we believe is appropriate and fair to both the Company and its executives.

As provided by the say-on-pay

rules, we are asking you to vote on the adoption of the following resolution:

RESOLVED, that the shareholders

of Espey Mfg. & Electronics Corp. approve, on an advisory basis, the compensation of the Company's Named Executive Officers, as disclosed,

pursuant to Item 402 of Regulation S-K of the Securities and Exchange Commission, in the Company's proxy statement for the 2022 annual

meeting of shareholders.

Proxies will be voted in

favor of the resolution unless shareholders specify otherwise in their proxies and except for broker non-votes. The affirmative vote of

at least a majority of the voting power of the shares present, in person or by proxy, and entitled to vote (excluding broker non-votes)

is required for approval of the proposal. As an advisory vote, this proposal is non-binding. However, our Compensation Committee and the

Board of Directors will consider the outcome of the vote when making future compensation decisions for our Named Executive Officers.

THE BOARD OF DIRECTORS RECOMMENDS

THAT YOU VOTE FOR THE ADOPTION OF THE RESOLUTION.

PROPOSAL NO. 3

RATIFICATION OF

APPOINTMENT OF INDEPENDENT PUBLIC ACCOUNTANTS

The Audit Committee has

selected Freed Maxick CPAs, P.C. (“Freed Maxick”) as the Company’s independent public accountants for the fiscal year

ending June 30, 2023.

Unless otherwise specified

by the shareholders, the shares represented by their properly executed proxies will be voted for ratification of the appointment of Freed

Maxick as independent accountants for the fiscal year ending June 30, 2023. The Company is advised by said firm that neither the firm

nor any of its members now has, or during the past three years had, any direct financial interest or material indirect financial interest

or any connection with the Company.

A representative of Freed

Maxick is expected to be present at the Annual Meeting with the opportunity to make a statement if he or she desires to do so and to be

available to respond to appropriate questions from the shareholders.

THE BOARD OF DIRECTORS

RECOMMENDS A VOTE FOR RATIFICATION OF THE APPOINTMENT OF FREED MAXICK CPAS, P.C. AS INDEPENDENT PUBLIC ACCOUNTANTS FOR THE COMPANY FOR

THE FISCAL YEAR ENDING JUNE 30, 2023.

The fees billed or expected

to be billed for professional services by Freed Maxick for the fiscal years ended June 30, 2022 and June 30, 2021 were:

| TYPE OF FEES |

2022 |

2021 |

| (1) Audit Fees |

$114,000 |

$93,750 |

| (2) Audit Related Fees |

$0 |

$0 |

| (3) Tax Fees |

$11,150 |

$12,400 |

| (4) All Other Fees |

None |

None |

| Total |

$125,150 |

$106,150 |

In the above table, in accordance

with the Securities and Exchange Commission’s definitions and rules, “audit fees” are fees for professional services

rendered by the principal accountant for the audit of the Company’s annual financial statements included in Form 10-K and review

of financial statements included in Forms 10-Q, and for services that are normally provided by the principal accountant in connection

with statutory and regulatory filings or engagements; “audit-related fees” are fees for assurance and related services by

the principal accountant that are reasonably related to the performance of the audit or review of the Company’s financial statements;

“tax fees” are fees for tax compliance, tax advice and tax planning rendered by the principal accountant. 100% of the services

set forth in items (1) through (3) above were approved by the Audit Committee in accordance with its charter.

COMPLIANCE WITH

SECTION 16(A) OF THE SECURITIES EXCHANGE ACT

Section 16(a) of the Securities

Exchange Act of 1934, as amended, requires the Company’s directors, executive officers and persons who own more than ten percent

of a registered class or the Company’s equity securities, to file reports of beneficial ownership and changes in beneficial ownership

with the Securities and Exchange Commission. Based solely upon its review of copies of such reports received by it, or upon written representations

obtained from certain reporting persons, the Company believes that its officers, directors, and stockholders who own more than ten percent

of the Company’s equity securities complied with all Section 16(a) filing requirements for the fiscal year ended June 30, 2022.

ANNUAL REPORTS

The Company’s Annual

Report on Form 10-K for the fiscal year ended June 30, 2022, including financial statements as filed with the Securities and Exchange

Commission, accompanies this Proxy Statement. Such financial statements are not incorporated herein by reference.

A copy of the Company’s

Annual Report on Form 10-K (including financial statements and schedules thereto) for the fiscal year ended June 30, 2022, filed with

the Securities and Exchange Commission will be provided without charge upon the written request of shareholders to Espey Mfg. & Electronics

Corp., Attention: Investor Relations, 233 Ballston Avenue, Saratoga Springs, New York 12866. The Company’s Form 10-K for the fiscal

year ended June 30, 2022 can also be viewed electronically through a link at the Company’s website at www.espey.com.

SHAREHOLDER PROPOSALS

Any shareholder proposal

which may be a proper subject for inclusion in the proxy statement and for consideration at the 2023 Annual Meeting must be received by

the Company at its Principal Executive Office no later than July 10, 2023, if it is to be included in the Company’s 2023 proxy statement

and proxy form. In addition, the Company’s By-Laws outline procedures that a shareholder must follow to nominate directors or to

bring other business before an Annual Meeting of Shareholders. Except as required under the Business Corporation Law of New York, shareholder

proposals will not be considered at special meetings.

PROXY SOLICITATION

The solicitation of the

enclosed proxy is being made on behalf of the Board of Directors and the cost of preparing and mailing the Notice of Meeting, Proxy Statement

and form of proxy to shareholders is to be borne by the Company.

| |

By Order of the Board of Directors, |

| |

David O’Neil |

| |

President and Chief Executive Officer |

October 28, 2022

Saratoga Springs, New York

Using a black ink pen, mark your votes with an X as shown in this example. Please do not write outside the designated areas.

Annual Meeting Proxy Card

A Proposals — The Board of Dirreeccttoorrss rreeccoommmmeennddsa avovtoeteFOFRORaltlhtehenonmominiene lsisltiesdteadn, dFOFRORPrPorpoopsoaslaslXs 2– Xanadnd3.for every X YEARS on Proposal X.

For Withhold +

1. TO ELECT: one Class B Director Nancy K. Patzwahl to serve for a three year term expiring at the 2025 annual meeting or until her successor is duly elected and qualifies.

01 - Nancy K. Patzwahl

2. TO APPROVE, on an advisory (non-binding) basis, the compensation of the Company’s Named Executive Officers.

For Against Abstain

3. TO RATIFY the appointment of Freed Maxick CPAs, P.C. as the Company’s independent public accountants for the fiscal year ending June 30, 2023.

For Against Abstain

B Authorized Signatures — This section must be completed for your vote to be counted. — Date and Sign Below

Please sign exactly as name(s) appears hereon. Joint owners should each sign. When signing as attorney, executor, administrator, corporate officer, trustee, guardian, or custodian, please give full title.

Date (mm/dd/yyyy) — Please print date below.

Signature 1 — Please keep signature within the box. Signature 2 — Please keep signature within the box.

03P1CC

1 U P X +

IMPORTANT ANNUAL MEETING INFORMATION IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON DECEMBER 2, 2022.

THE PROXY STATEMENT AND THE ANNUAL REPORT ARE AVAILABLE AT:

WWW.EDOCUMENTVIEW.COM/ESP

Proxy — ESPEY MFG. & ELECTRONICS CORP. +

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

PROXY FOR THE

2022 ANNUAL MEETING OF SHAREHOLDERS December 2, 2022

The undersigned hereby appoints Paul Corr and Michael Wool as Proxies, each with the power to appoint his substitute, and hereby authorizes them or any one of them to represent and to vote, as designated below, all the shares of common stock of ESPEY MFG. & ELECTRONICS CORP. which the undersigned would be entitled to vote if personally present at the 2022 Annual Meeting of Shareholders to be held on December 2, 2022 or any adjournment thereof.

THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE ABOVE SIGNED SHAREHOLDER.

IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED FOR PROPOSALS 1, 2 AND 3.

Please sign exactly as name appears hereon. When shares are held by joint tenants, both should sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If a corporation, please sign in full corporation name by President or other authorized officer. If a partnership, please sign in partnership name by authorized person.

PLEASE COMPLETE, DATE, SIGN, AND MAIL THIS PROXY CARD IN THE ENCLOSED POSTAGE-PAID ENVELOPE

C Non-Voting Items

Change of Address — Please print new address below.

+

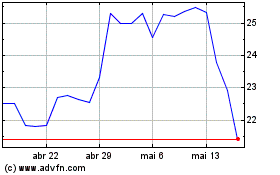

Espey Manufacturing and ... (AMEX:ESP)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Espey Manufacturing and ... (AMEX:ESP)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024