Completed supply chain transformation, yielding

improved margins, and shifted mix toward wholesale

Laird Superfood, Inc. (NYSE American: LSF) (“Laird Superfood,”

“we” and “our”), today reported financial results for its first

quarter ended March 31, 2023.

First Quarter 2023

Highlights

- Net Sales of $8.1 million, in line with our annual operating

plan, compared to $9.3 million in the prior year period.

- Wholesale contributed 45% of total Net Sales and decreased 5.9%

year-over-year, primarily due to higher discounts related to

one-time product quality costs. Excluding one-time charges,

Wholesale Net Sales were flat year-over-year, as 14% Net Sales

growth in the Retail channel behind pricing and distribution

expansion was offset by Club sales.

- E-commerce contributed 55% of total Net Sales and decreased

18.4% year-over-year reflecting lower direct-to-consumer (“DTC”)

revenues behind planned reductions in marketing spend, reflecting a

70% decrease in working media, offset by improved subscription

base, which grew 14% sequentially and 4% compared to the prior year

period, and improved efficiency of customer acquisition.

- Gross Margin was 23.1%, compared to (4.6)% in the fourth

quarter of 2022 and 20.9% in the prior year period. This margin

expansion comes as a benefit of transitioning to a third party

co-manufacturing model resulting in a reduction in fixed overhead

costs. This was partially offset by one-time costs related to the

product quality issue uncovered in the first quarter of 2023.

- Excluding one-time costs associated with the raw material

quality issue, Adjusted Gross Margin, which is a non-GAAP financial

measure, was 27.0% in the first quarter of 2023. This margin

improvement reflects the benefits from the transition to a variable

cost co-manufacturing business model, as well as lower freight

costs. For more details on non-GAAP financial measures, refer to

the information in the Non-GAAP financial measures section of this

press release.

- Net Loss was $4.1 million, or $0.45 per diluted share compared

to a Net Loss of $15.6 million, or $1.69 per diluted share, in the

fourth quarter of 2022 and a Net Loss of $14.1 million, or $1.55

per diluted share, in the prior year period.

- Adjusted Net Loss, which is a non-GAAP financial measure, of

$3.7 million, or $0.40 per diluted share, improved sequentially

versus Adjusted Net Loss of $4.3 million, or $0.47 per diluted

share, in the fourth quarter of 2022 driven by expanded gross

margins and lower marketing and G&A spend. In the prior year

period Adjusted Net Loss was $6.7 million, or $0.74 per diluted

share. For more details on non-GAAP financial measures, refer to

the information in the Non-GAAP financial measures section of this

press release.

Jason Vieth, Chief Executive Officer, commented, "I am

pleased to report that we demonstrated significant progress in our

business transformation during the first quarter of 2023. Our

transition to an asset-light supply chain with co-manufacturing and

third-party distribution has progressed as per our plan, and we are

already seeing the expected and substantial improvement in Gross

Margin, which climbed to 27.0% on an adjusted basis (after

excluding the Raw Material Quality issue that we mentioned last

quarter). We expect further improvement this summer, when we

transition our current liquid creamer to an aseptic format that

will enable better cost management."

"At the same time, we continue to make strong progress in our

strategy to drive outsized growth in our Wholesale business, which

we grew 14% during Q1, excluding Club. Following our rebranding and

subsequent relaunch of the packaging across our entire portfolio,

our Q1 dollar sales velocities increased within our Wholesale

business both at Retail and Club. The deceleration of our online

business is in line with our expectations given the intentional

reduction in marketing and sales spending in that channel, and our

key business metrics in that channel continue to show

year-over-year improvement across customer acquisition cost and

number of subscribers."

Anya Hamill, Chief Financial Officer, commented, "I am

encouraged by the results we achieved in Q1 as we completed the

transition to a third-party co-manufacturing and fulfillment model

in the beginning of the quarter. Our first quarter gross margin had

expanded to 27.0% on an adjusted basis, an eight point improvement

year-over-year and versus prior quarter. This margin expansion is

driven by a reduction of fixed overhead costs, and I expect it to

ramp up throughout the year as we see a full benefit of the

transformation of our supply chain to a variable cost model as well

as other margin improvement initiatives planned for the second half

of the year. We re-affirm our guidance for gross margin in excess

of 30% for full year 2023 excluding any one-time extraordinary

costs."

Three Months Ended March

31,

2023

2022

$

% of Total

$

% of Total

Coffee creamers

$

5,117,359

63

%

$

5,454,407

58

%

Hydration and beverage enhancing

supplements

670,851

8

%

1,457,431

16

%

Harvest snacks and other food items

1,753,026

22

%

1,686,791

18

%

Coffee, tea, and hot chocolate

products

1,969,295

24

%

1,816,184

19

%

Other

29,729

0

%

238,324

3

%

Gross sales

9,540,260

117

%

10,653,137

114

%

Shipping income

303,226

4

%

248,192

3

%

Returns and discounts

(1,730,548

)

(21

)%

(1,561,316

)

(17

)%

Sales, net

$

8,112,938

100

%

$

9,340,013

100

%

E-commerce

4,427,681

55

%

5,423,951

58

%

Wholesale

3,685,257

45

%

3,916,062

42

%

Sales, net

$

8,112,938

100

%

$

9,340,013

100

%

Balance Sheet and Cash Flow

Highlights

The Company had $11.9 million of cash and cash equivalents as of

March 31, 2023, and no outstanding debt.

Net cash used in operating activities was $6.1 million for the

three months ended March 31, 2023, compared to $3.2 million in the

fourth quarter of 2022, and $3.6 million in the prior year period.

Increased cash burn in the first quarter of 2023 was driven by the

reduction of accrued expenses which included costs associated with

exit and disposal activities of $1.0 million and increase in

accounts receivable driven by the timing of wholesale sales at the

end of the quarter.

2023 Outlook

We anticipate that an uncertain economic environment with

historically high inflation rates impacting consumer spending will

continue into the remaining quarters of 2023. We also believe that

strategic actions we took in 2022, and continue to take in 2023,

have begun to bear fruit as evident in the first quarter results

and we are well on the way to achieving our annual operating

targets. We re-confirm our guidance to achieve gross margin in

excess of 30% in fiscal 2023, and we expect net sales growth to be

in the mid to high single digits. Gross margin guidance excludes

any one-time charges associated with any non-recurring actions.

Conference Call and Webcast Details

The Company will host a conference call and webcast at 5:00 p.m.

ET today to discuss results. Participants may access the live

webcast on the Laird Superfood Investor Relations website at

https://investors.lairdsuperfood.com under “Events”.

About Laird Superfood

Laird Superfood, Inc. creates award-winning, plant-based

superfood products that are both delicious and functional. The

Company's products are designed to enhance your daily ritual and

keep consumers fueled naturally throughout the day. The Company was

co-founded in 2015 by the world's most prolific big-wave surfer,

Laird Hamilton. Laird Superfood's offerings are environmentally

conscientious, responsibly tested and made with real ingredients.

Shop all products online at lairdsuperfood.com and join the Laird

Superfood community on social media for the latest news and daily

doses of inspiration.

Forward-Looking Statements

This press release and the conference call referencing this

press release contain “forward-looking” statements, as that term is

defined under the federal securities laws, including but not

limited to statements regarding Laird Superfood’s future financial

performance and growth. These forward-looking statements are based

on Laird Superfood’s current assumptions, expectations and beliefs

and are subject to substantial risks, uncertainties, assumptions

and changes in circumstances that may cause Laird Superfood’s

actual results, performance or achievements to differ materially

from those expressed or implied in any forward-looking statement.

We expressly disclaim any obligation to update or alter any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law.

The risks and uncertainties referred to above include, but are

not limited to: (1) the effects of the current COVID-19 pandemic,

or of other global outbreaks of pandemics or contagious diseases or

fear of such outbreaks, including on our supply chain, the demand

for our products, and on overall economic conditions and consumer

confidence and spending levels; (2) volatility regarding our

revenue, expenses, including shipping expenses, and other operating

results; (3) our ability to acquire new direct and wholesale

customers and successfully retain existing customers; (4) our

ability to attract and retain our suppliers, distributors and

co-manufacturers, and effectively manage their costs and

performance; (5) effects of real or perceived quality or health

issues with our products or other issues that adversely affect our

brand and reputation; (6) our ability to innovate on a timely and

cost-effective basis, predict changes in consumer preferences and

develop successful new products, or updates to existing products,

and develop innovative marketing strategies; (7) adverse

developments regarding prices and availability of raw materials and

other inputs, a substantial amount of which come from a limited

number of suppliers outside the United States, including in areas

which may be adversely affected by climate change; (8) effects of

changes in the tastes and preferences of our consumers and consumer

preferences for natural and organic food products; (9) the

financial condition of, and our relationships with, our suppliers,

co-manufacturers, distributors, retailers and food service

customers, as well as the health of the food service industry

generally; (10) the ability of ourselves, our suppliers and

co-manufacturers to comply with food safety, environmental or other

laws or regulations; (11) our plans for future investments in our

business, our anticipated capital expenditures and our estimates

regarding our capital requirements; (12) the costs and success of

our marketing efforts, and our ability to promote our brand; (13)

our reliance on our executive team and other key personnel and our

ability to identify, recruit and retain skilled and general working

personnel; (14) our ability to effectively manage our growth; (15)

our ability to compete effectively with existing competitors and

new market entrants; (16) the impact of adverse economic

conditions; and (17) the growth rates of the markets in which we

compete.

LAIRD SUPERFOOD, INC.

UNAUDITED CONSOLIDATED

CONDENSED STATEMENTS OF OPERATIONS

(Unaudited)

Three Months Ended March

31,

2023

2022

Sales, net

$

8,112,938

$

9,340,013

Cost of goods sold

(6,239,062

)

(7,390,203

)

Gross profit

1,873,876

1,949,810

General and administrative

Impairment of goodwill and long-lived

assets

—

8,026,000

Other expense

2,998,444

3,802,644

Total general and administrative

expenses

2,998,444

11,828,644

Research and product

development

83,866

103,833

Sales and marketing

Advertising

1,161,208

1,791,737

Related party marketing agreements

89,788

10,500

Other expense

1,843,052

2,169,403

Total sales and marketing expenses

3,094,048

3,971,640

Total expenses

6,176,358

15,904,117

Operating loss

(4,302,482

)

(13,954,307

)

Other income (expense)

170,994

(179,321

)

Loss before income taxes

(4,131,488

)

(14,133,628

)

Income tax expense

(12,422

)

(5,774

)

Net loss

$

(4,143,910

)

$

(14,139,402

)

Net loss per share:

Basic

$

(0.45

)

$

(1.55

)

Diluted

$

(0.45

)

$

(1.55

)

Weighted-average shares of common stock

outstanding used in computing net loss per share of common stock,

basic and diluted

9,213,723

9,095,441

LAIRD SUPERFOOD, INC.

UNAUDITED CONSOLIDATED

CONDENSED STATEMENTS OF CASH FLOWS

(Unaudited)

Three Months Ended March

31,

2023

2022

Cash flows from operating

activities

Net loss

$

(4,143,910

)

$

(14,139,402

)

Adjustments to reconcile net loss to net

cash from operating activities:

Depreciation and amortization

87,953

284,301

Provision for inventory obsolescence

365,024

4,430

Impairment of goodwill and other

long-lived assets

—

8,026,000

Other operating activities, net

177,842

513,302

Changes in operating assets and

liabilities:

Accounts receivable

(1,438,063

)

(57,012

)

Inventory

(58,623

)

360,517

Prepaid expenses and other current

assets

402,299

800,179

Operating lease liability

(31,315

)

(184,560

)

Accounts payable

1,312,821

77,155

Accrued expenses

(2,728,290

)

713,117

Net cash from operating activities

(6,054,262

)

(3,601,973

)

Cash flows from investing

activities

Proceeds from sale of investment

securities available-for-sale

—

8,513,783

Other investing activities, net

135,737

(701,886

)

Net cash from investing activities

135,737

7,811,897

Cash flows from financing

activities

(4,410

)

14,248

Net change in cash and cash

equivalents

(5,922,935

)

4,224,172

Cash and cash equivalents beginning of

year

17,809,802

23,049,234

Cash and cash equivalents end of year

$

11,886,867

$

27,273,406

Supplemental disclosures of cash flow

information

Right-of-use assets obtained in exchange

for operating lease liabilities

$

352,501

$

5,285,330

Supplemental disclosures of non-cash

investing activities

Receivable from sale of assets

held-for-sale included in other current assets at the end of the

period

$

581,835

$

—

Imputed interest related to operating

leases

$

7,830

$

49,014

Amounts reclassified from accumulated

other comprehensive loss

$

—

$

61,016

Amounts reclassified from property, plant,

and equipment to fixed assets held-for-sale

$

—

$

947,394

Purchases of equipment included in

deposits at the beginning of the period

$

—

$

372,507

LAIRD SUPERFOOD, INC.

UNAUDITED CONSOLIDATED

CONDENSED BALANCE SHEETS

As of

March 31, 2023

December 31, 2022

Assets

Current assets

Cash, cash equivalents, and restricted

cash

$

11,886,867

$

17,809,802

Accounts receivable, net

2,908,864

1,494,469

Inventory, net

5,390,164

5,696,565

Prepaid expenses and other current assets,

net

2,709,611

2,530,075

Total current assets

22,895,506

27,530,911

Noncurrent assets

Property and equipment, net

228,493

150,289

Fixed assets held-for-sale

—

800,000

Intangible assets, net

1,240,396

1,292,118

Related party license agreements

132,100

132,100

Right-of-use assets

455,707

133,922

Total noncurrent assets

2,056,696

2,508,429

Total assets

$

24,952,202

$

30,039,340

Liabilities and Stockholders’

Equity

Current liabilities

Accounts payable

$

2,393,088

$

1,080,267

Accrued expenses

3,583,850

6,312,140

Lease liability, current portion

135,697

59,845

Total current liabilities

6,112,635

7,452,252

Long-term liabilities

Lease liability

329,240

76,076

Total long-term liabilities

329,240

76,076

Total liabilities

6,441,875

7,528,328

Stockholders’ equity

Common stock, $0.001 par value,

100,000,000 shares authorized as of March 31, 2023 and December 31,

2022; 9,585,204 and 9,219,500 issued and outstanding at March 31,

2023, respectively; and 9,576,117 and 9,210,414 issued and

outstanding at December 31, 2022, respectively.

9,220

9,210

Additional paid-in capital

118,780,049

118,636,834

Accumulated deficit

(100,278,942

)

(96,135,032

)

Total stockholders’ equity

18,510,327

22,511,012

Total liabilities and stockholders’

equity

$

24,952,202

$

30,039,340

Non-GAAP Financial Measures

In this press release, we report adjusted gross margin, adjusted

net loss, and adjusted net loss per diluted share, which are

financial measures not required by, or presented in accordance

with, accounting principles generally accepted in the United States

of America (“GAAP”). Management uses these adjusted metrics to

evaluate financial performance because they allow for

period-over-period comparisons of the Company’s ongoing operations

before the impact of certain items described below. Management

believes this information may also be useful to investors to

compare the Company’s results period-over-period. We define

adjusted net loss and adjusted net loss per diluted share to

exclude certain one-time costs defined in detail in the tables to

follow. We define adjusted gross margin to exclude the net sales

and costs of goods sold components of one-time costs defined in the

tables to follow. Please be aware that adjusted gross margin,

adjusted net loss, and adjusted net loss per diluted share have

limitations and should not be considered in isolation or as a

substitute for gross margin, net loss, or diluted net loss per

share. In addition, we may calculate and/or present adjusted gross

margin, adjusted net loss, and adjusted net loss per diluted share

differently than measures with the same or similar names that other

companies report, and as a result, the non-GAAP measures we report

may not be comparable to those reported by others.

These non-GAAP measures are reconciled to the most directly

comparable GAAP measures in the table that follows.

LAIRD SUPERFOOD, INC.

NON-GAAP FINANCIAL

MEASURES

(Unaudited)

Three Months Ended

March 31, 2023

Net loss

$

(4,143,910

)

Adjusted for:

Strategic organizational shifts

(a)

(135,380

)

Product quality issue

(b)

491,861

Company-wide rebranding costs

(c)

61,451

Adjusted net loss

$

(3,725,978

)

Adjusted net loss per share,

diluted:

(0.40

)

Weighted-average shares of common stock

outstanding used in computing adjusted net loss per share of common

stock, diluted

9,213,723

(a) Costs incurred as part of the

strategic downsizing of the Company's operations, including

severances, forfeitures of stock-based compensation, and other

personnel costs, IT integration costs, and freight costs to move

inventory to third-party facilities.

(b) In the first month of the first

quarter of 2023, we identified a product quality issue with raw

material from one vendor and we voluntarily withdrew any affected

finished goods. We incurred costs associated with product testing,

discounts for replacement orders, and inventory obsolescence

costs.

(c) Costs incurred as part of the

company-wide rebranding efforts that launched in Q1 2023.

Three Months Ended

March 31, 2022

Net loss

$

(14,139,402

)

Adjusted for:

Impairment of goodwill and long-lived

assets

(a)

8,026,000

Strategic organizational shifts

(b)

(581,351

)

Other, net

(c)

(22,296

)

Adjusted net loss

$

(6,717,049

)

Adjusted net loss per share,

diluted:

(0.74

)

Weighted-average shares of common stock

outstanding used in computing adjusted net loss per share of common

stock, diluted

9,095,441

(a) Impairment charges to goodwill and

long-lived intangible assets assumed in the acquisition of Picky

Bars which occurred Q2 2021, in the amounts of $6.5 million and

$1.5 million, respectively.

(b) Costs incurred as part of the

strategic downsizing of the Company's operations, including

severances, forfeitures of stock-based compensation, and other

personnel costs arising from the resignations of certain members of

executive leadership.

(c) Realized losses on the liquidation of

all of the Company's available-for-sale securities included in

other income in Q1 2022. Recovery of costs incurred in connection

with an insurance claim following loss of product during handling

by a third party included in costs of goods sold in Q1 2022.

LAIRD SUPERFOOD, INC.

NON-GAAP FINANCIAL

MEASURES

(Unaudited)

Three Months Ended

March 31, 2023

December 31, 2022

March 31, 2022

Gross Margin

23.1

%

-4.6

%

20.9

%

Adjusted for:

Strategic organizational shifts

(a)

-0.2

%

13.1

%

—

Product quality issue

(b)

4.1

%

6.2

%

—

Company-wide rebranding costs

(c)

—

4.3

%

—

Other

(d)

—

—

-2.2

%

Adjusted gross margin

27.0

%

19.0

%

18.7

%

(a) Costs incurred as part of the

strategic downsizing of the Company's operations, including

severances, forfeitures of stock-based compensation, and other

personnel costs, and freight costs to move inventory to third-party

facilities.

(b) In the first month of the first

quarter of 2023, we identified a product quality issue with raw

material from one vendor and we voluntarily withdrew any affected

finished goods. We incurred costs associated with discounts for

replacement orders and inventory obsolescence costs.

(c) Costs incurred as part of the

company-wide rebranding efforts that launched in Q1 2023.

(d) Recovery of costs incurred in

connection with an insurance claim following loss of product during

handling by a third party included in costs of goods sold in Q1

2022.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230510005804/en/

Investor Relations Contact Steve Richie

srichie@lairdsuperfood.com

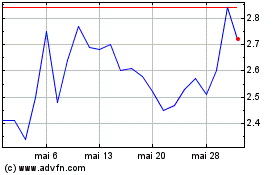

Laird Superfood (AMEX:LSF)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Laird Superfood (AMEX:LSF)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024