Filed pursuant to Rule 424(b)(3)

Registration No. 333-280510

PROSPECTUS

300,000 Shares of Common Stock

_____________________

This prospectus relates to the resale from time to time by the selling stockholder identified in this prospectus of up to 300,000 shares of common stock of Laird Superfood, Inc., $0.001 par value per share (our “common stock”), issued by us to the selling stockholder pursuant to a sponsorship and support agreement. We will not receive any of the proceeds from the sale of the shares of our common stock by the selling stockholder.

Our registration of the shares of our common stock covered by this prospectus does not mean that the selling stockholder will offer or sell any of the shares of our common stock. The selling stockholder identified in this prospectus may sell the shares of our common stock covered by this prospectus in a number of different ways and at varying prices. We provide more information about how the selling stockholder may sell the securities in the section entitled “Plan of Distribution.”

We are an “emerging growth company” and a “smaller reporting company” as defined under the U.S. federal securities laws and, as such, may elect to comply with certain reduced public company reporting requirements for this and future filings.

Our common stock is listed on the NYSE American Stock Exchange (“NYSE American”) under the symbol “LSF.” On August 23, 2024, the last reported sale price of our common stock on the NYSE American was $4.20 per share. You should read this prospectus and any prospectus supplement, together with additional information described under the headings “Information Incorporated by Reference” and “Where You Can Find More Information,” carefully before you invest in any of our securities.

_____________________

Investing in our securities involves a high degree of risk. You should read “Risk Factors” beginning on page 7 of this prospectus and the other information included and incorporated by reference in this prospectus and any applicable prospectus supplement to read about factors to consider before purchasing our securities.

_____________________

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

_____________________

The date of this prospectus is August 23, 2024

TABLE OF CONTENTS

_____________________

Neither we nor the selling stockholder has authorized anyone to provide you with information different from that contained or incorporated by reference in this prospectus or any accompanying prospectus supplement or free writing prospectus, and neither we nor the selling stockholder takes responsibility for any other information that others may give you. This prospectus is not an offer to sell, nor is it a solicitation of an offer to buy, the securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus or any prospectus supplement or free writing prospectus is accurate as of any date other than the date on the front cover of those documents, or that the information contained in any document incorporated by reference is accurate as of any date other than the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates.

As permitted by the rules and regulations of the Securities and Exchange Commission (the “SEC”), the registration statement of which this prospectus forms a part includes additional information not contained in this prospectus. You may read the registration statement and the other reports we file with the SEC at the SEC’s website as described below under the heading “Where You Can Find More Information.” Before investing in our securities, you should read this prospectus and any accompanying prospectus supplement or free writing prospectus, as well as the additional information described under “Where You Can Find More Information” and “Information Incorporated by Reference.”

References to the “Company,” “Laird Superfood,” “LSF,” “we,” “our” and “us” in this prospectus are to Laird Superfood, Inc., unless the context otherwise requires. Any trade names and trademarks appearing in this document are the property of their respective holders.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the SEC utilizing a shelf registration process. Under the shelf registration process, the selling stockholder may offer, from time to time, the common stock described in this prospectus in one or more offerings.

This prospectus provides you with a description of the common stock which may be offered by the selling stockholder. Each time the selling stockholder sells common stock, the selling stockholder may be required to provide you with this prospectus and, in certain cases, a prospectus supplement containing specific information about the selling stockholder and the terms of the securities being offered.

A prospectus supplement or free writing prospectus may include a discussion of risks or other special considerations applicable to us or the offered securities. A prospectus supplement or free writing prospectus may also add, update or change information contained in this prospectus. If there is any inconsistency between the information in this prospectus and any related prospectus supplement or free writing prospectus, you must rely on the information in the prospectus supplement or free writing prospectus. Please carefully read both this prospectus and the related prospectus supplement or free writing prospectus in their entirety together with additional information described under the heading “Where You Can Find More Information” and “Information Incorporated by Reference” before investing in our common stock.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus forms part of a registration statement on Form S-3 filed by us with the SEC under the Securities Act of 1933, as amended (the “Securities Act”). As permitted by the SEC, this prospectus does not contain all the information set forth in the registration statement filed with the SEC. For a more complete understanding of this offering, you should refer to the complete registration statement, including the exhibits thereto, on Form S-3 that may be obtained as described below. Statements contained or incorporated by reference in this prospectus or any prospectus supplement about the contents of any contract or other document are not necessarily complete. If we have filed any contract or other document as an exhibit to the registration statement or any other document incorporated by reference in the registration statement of which this prospectus forms a part, you should read the exhibit for a more complete understanding of the document or matter involved. Each statement regarding a contract or other document is qualified in its entirety by reference to the actual document.

We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public from commercial retrieval services and at the website maintained by the SEC at www.sec.gov. The reports and other information filed by us with the SEC are also available at our website. The address of the Company’s website is www.lairdsuperfood.com. Information contained on our website or that can be accessed through our website is not incorporated by reference into this prospectus.

INFORMATION INCORPORATED BY REFERENCE

The SEC allows us to incorporate information into this prospectus “by reference,” which means that we can disclose important information to you by referring you to another document that we file separately with the SEC. The information incorporated by reference is considered to be a part of this prospectus, and information that we file later with the SEC will automatically update and supersede information contained in this prospectus and any accompanying prospectus supplement. These documents contain important information about the Company and its financial condition, business and results.

We are incorporating by reference the Company’s filings listed below, except we are not incorporating by reference any information furnished (but not filed) for purposes of the Securities Exchange Act of 1934, as amended (the “Exchange Act”):

| |

●

|

our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the SEC on March 13, 2024;

|

| |

●

|

our definitive Proxy Statement on Schedule 14A, filed with the SEC on May 15, 2024;

|

| |

●

|

our Current Reports on Form 8-K (except that any portions thereof which are “furnished” and not “filed” shall not be deemed incorporated) filed with the SEC on January 3, 2024, March 15, 2024, May 6, 2024, May 10, 2024 (as amended on May 15, 2024), May 31, 2024, and June 28, 2024;

|

| |

●

|

the description of our common stock contained in Exhibit 4.3 to our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the SEC on March 13, 2024, including any amendments or reports filed for the purpose of updating such description.

|

In addition, all documents filed after the date of the filing of the registration statement of which this prospectus forms a part and prior to the effectiveness of the registration statement and all documents subsequently filed by us with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (excluding any information “furnished” pursuant to Item 2.02 or Item 7.01 with the SEC on any Current Report on Form 8-K and other portions of documents that are “furnished,” but not “filed,” pursuant to applicable rules promulgated by the SEC, unless otherwise noted), prior to the completion or termination of the applicable offering under this prospectus and any applicable prospectus supplement, shall be deemed to be incorporated by reference into this prospectus.

We will provide a copy of the documents we incorporate by reference, at no cost, to any person who receives this prospectus, if such person makes a written or oral request directed to:

Laird Superfood, Inc.

5303 Spine Road, Suite 204

Boulder, Colorado 80301

Attn: Corporate Secretary

(541) 588-3600

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, any accompanying prospectus supplement or free writing prospectus, and the documents we have incorporated by reference contain forward-looking statements within the meaning of the federal securities laws that involve risks and uncertainties that could cause actual results to differ materially from projections or estimates contained herein. Forward-looking statements convey our current expectations or forecasts of future events. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

Forward-looking statements convey our current expectations or forecasts of future events and are not guarantees of future performance. They are based on numerous assumptions that we believe are reasonable, but are open to a wide range of uncertainties and business risks. Any statements contained in this prospectus, any accompanying prospectus supplement or free writing prospectus, and the documents incorporated by reference in this prospectus that are not statements of historical fact may be forward-looking statements. The words “intends,” “estimates,” “predicts,” “potential,” “continues,” “anticipates,” “plans,” “expects,” “believes,” “should,” “could,” “may,” “would,” “will,” “seeks,” or the negative of these terms or other comparable terminology, are intended to identify forward-looking statements. Actual results could differ materially from those in forward-looking statements because of, among other reasons, the factors described below and in the periodic reports that we file with the SEC from time to time, including on Forms 10-K, 10-Q and 8-K and any amendments thereto.

Key factors that could cause actual results to be different than expected or anticipated include, but are not limited to:

| |

●

|

our limited operating history and ability to become profitable;

|

| |

●

|

our ability to manage our growth, including our human resource requirements;

|

| |

●

|

our reliance on third parties for raw materials and production of our products;

|

| |

●

|

our future capital resources and needs;

|

| |

●

|

our ability to retain and grow our customer base;

|

| |

●

|

our reliance on independent distributors for a substantial portion of our sales;

|

| |

●

|

our ability to evaluate and measure our business, prospects and performance metrics;

|

| |

●

|

our ability to compete and succeed in a highly competitive and evolving industry;

|

| |

●

|

the health of the premium organic and natural food industry as a whole;

|

| |

●

|

risks related to our intellectual property rights and developing a strong brand;

|

| |

●

|

our reliance on key personnel, including Laird Hamilton and Gabrielle Reece;

|

| |

●

|

the risk of substantial dilution from future issuances of our equity securities; and

|

| |

●

|

other risks and uncertainties described in our most recent Annual Report on Form 10-K, subsequent Quarterly Reports on Form 10-Q, if any, and our other filings with the SEC.

|

In light of these risks, uncertainties and assumptions, you are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date of this prospectus, any accompanying prospectus supplement or free writing prospectus, or any document incorporated by reference in this prospectus. When considering forward-looking statements, you should keep in mind the cautionary statements in this prospectus, any accompanying prospectus supplement or free writing prospectus, and the documents incorporated by reference in this prospectus. We are not under any obligation, and we expressly disclaim any obligation, to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in or incorporated by reference in this prospectus or any accompanying prospectus supplement or free writing prospectus might not occur.

ABOUT LAIRD SUPERFOOD, INC.

Laird Superfood creates highly differentiated, plant-based, and functional foods, many of which incorporate adaptogens which may support a variety of brain functions. The core pillars of the Laird Superfood platform are currently Superfood Creamer coffee creamers, Hydrate hydration products and beverage enhancing supplements, harvest snacks and other food items, and functional roasted and instant coffees, teas, and hot chocolate. Consumer preferences within the evolving food and beverage industry are shifting away from processed and sugar-laden food and beverage products, as well as those containing significant amounts of highly processed and artificial ingredients. Laird Superfood’s long-term goal is to build the first scale-level and widely recognized brand that authentically focuses on natural ingredients, nutritional density, and functionality, allowing the Company to maximize penetration of a multi-billion-dollar opportunity in the grocery market.

Recent Developments

Redomestication

On December 31, 2023 (the “Effective Date”), we changed our state of incorporation from the state of Delaware to the state of Nevada (the “Redomestication”) by means of a plan of conversion, as described in our definitive proxy statement on Schedule 14A filed with the SEC on October 10, 2023.

As of the Effective Date:

| |

●

|

our domicile changed from the state of Delaware to the state of Nevada; and

|

| |

●

|

the affairs of the Company ceased to be governed by the Delaware General Corporation Law and the Company’s then existing certificate of incorporation and bylaws, and instead became governed by the Nevada Revised Statutes (the “NRS”) and the Company’s new articles of incorporation and bylaws.

|

The Redomestication was previously submitted to a vote of, and was approved by, the Company’s stockholders at our Annual Meeting of Stockholders held on December 19, 2023. The Redomestication did not result in any change in the business, physical location, management, assets, liabilities or net worth of the Company, nor did it result in any change in location of the Company’s current employees, including management. The Redomestication did not affect any of the Company’s material contracts with any third parties, and the Company’s rights and obligations under those material contractual arrangements continue to be the rights and obligations of the Company after the Redomestication. The daily business operations of the Company have continued as they were conducted prior to the Redomestication. The consolidated financial condition and results of operations of the Company immediately after consummation of the Redomestication remains the same as immediately before the Redomestication.

Corporate Information

Our principal executive offices are located at 5303 Spine Road, Suite 204, Boulder, Colorado 80301, and our telephone number is (541) 588-3600. Our website is located at www.lairdsuperfood.com. Information contained on our website or that can be accessed through our website is not incorporated by reference into this prospectus. For additional information as to our business, properties and financial condition, please refer to the documents cited in “Where You Can Find More Information” and “Information Incorporated by Reference.”

Implications of Being an Emerging Growth Company

As a company with less than $1.235 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart our Business Startups Act of 2012 (the “JOBS Act”). An emerging growth company may take advantage of specified reduced reporting and other burdens that are otherwise applicable generally to public companies. These provisions include:

| |

●

|

a requirement to have only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations;

|

| |

●

|

an exemption from the auditor attestation requirement on the effectiveness of our internal control over financial reporting;

|

| |

●

|

reduced disclosure about our executive compensation arrangements; and

|

| |

●

|

no non-binding advisory votes on executive compensation or golden parachute arrangements.

|

We may take advantage of these provisions until the end of the fiscal year in which the fifth anniversary of our initial public offering occurs, or such earlier time when we no longer qualify as an emerging growth company. We would cease to be an emerging growth company on the earlier of (1) the last day of the fiscal year (a) in which we have more than $1.235 billion in annual revenue or (b) in which we have more than $700 million in market value of our capital stock held by non-affiliates, or (2) the date on which we issue more than $1.0 billion of non-convertible debt over a three-year period. We may choose to take advantage of some but not all these reduced burdens.

In addition, the JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. This provision allows an emerging growth company to delay the adoption of some accounting standards until those standards would otherwise apply to private companies. We have elected to avail ourselves of this exemption from new or revised accounting standards, and therefore we will not be subject to the same requirements to adopt new or revised accounting standards as other public companies that are not emerging growth companies.

THE OFFERING

| |

|

|

Issuer

|

Laird Superfood, Inc.

|

| |

|

|

Shares of our Common Stock Offered by the Selling Stockholder

|

Up to 300,000 shares.

|

| |

|

|

Use of Proceeds

|

We will not receive any proceeds from the sale of shares of our common stock by the selling stockholder.

|

| |

|

|

Market for our Common Stock

|

Our common stock is listed on the NYSE American under the symbol “LSF”.

|

| |

|

|

Risk Factors

|

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 7 of this prospectus for a discussion of factors you should carefully consider before investing in our common stock.

|

RISK FACTORS

An investment in our securities involves a high degree of risk. In addition to all of the other information contained or incorporated by reference into this prospectus and any accompanying prospectus supplement, you should carefully consider the risk factors incorporated by reference from our Annual Report on Form 10-K for the year ended December 31, 2023, and the risk factors contained or incorporated by reference into any accompanying prospectus supplement before acquiring any of the securities. The risks described in these documents are not the only ones we face, but those that we consider to be material. There may be other unknown or unpredictable economic, business, competitive, regulatory or other factors that could have material adverse effects on our future results. If any of these risks actually occur, our business, financial condition or results of operations could be harmed. This could cause the trading price of our common stock to decline, resulting in a loss of all or part of your investment. Please also read carefully the section titled “Cautionary Note Regarding Forward-Looking Statements.”

USE OF PROCEEDS

All of the shares of common stock being offered hereby may be sold from time to time by the selling stockholder identified in this prospectus. We will not receive any proceeds from the sale of common stock by the selling stockholder.

DESCRIPTION OF COMMON STOCK

Common Stock

The following summary describes our capital stock and certain provisions of our articles of incorporation, our bylaws, and the Nevada Revised Statutes. Because the following is only a summary, it does not contain all of the information that may be important to you. For a complete description, you should refer to our articles of incorporation and bylaws, copies of which have been filed as exhibits to the registration statement of which this prospectus forms a part.

Our articles of incorporation authorize us to issue 100,000,000 shares of common stock, par value $0.001 per share. As of August 16, 2024, there were 10,644,946 shares of our common stock issued and 10,279,242 shares of our common stock outstanding, all of which are fully paid and non-assessable. As of August 16, 2024, there were 1,652,428 shares of common stock issuable upon the exercise of outstanding options, and 1,101,810 shares of common stock issuable upon the vesting of outstanding restricted stock units.

Holders of our common stock are entitled to one vote for each share of common stock held of record for the election of directors and on all matters submitted to a vote of stockholders. A majority vote of the votes cast by holders of common stock is generally required to take action under our articles of incorporation and bylaws. Holders of our common stock are entitled to receive dividends ratably, if any, as may be declared by our board of directors out of legally available funds, subject to any preferential dividend rights of any preferred stock then outstanding. Upon our dissolution, liquidation or winding up, holders of our common stock are entitled to share ratably in our net assets legally available after the payment of all our debts and other liabilities, subject to the preferential rights of any preferred stock then outstanding. Holders of our common stock have no preemptive, subscription, redemption or conversion rights and no sinking fund provisions are applicable to our common stock. The rights, preferences and privileges of holders of our common stock are subject to, and may be adversely affected by, the rights of the holders of shares of any series of preferred stock that we may designate and issue in the future.

Broadridge Corporate Issuer Solutions, Inc. is the transfer agent and registrar for our common stock.

Our common stock is listed on the NYSE American under the symbol “LSF.”

Anti-Takeover Effects of Provisions of our Articles of Incorporation, Bylaws and Nevada Law

Certain provisions of Nevada law, our articles of incorporation and our bylaws may have the effect of delaying, deferring or preventing another party from acquiring control of the Company. These provisions may discourage and prevent coercive takeover practices and inadequate takeover bids.

Nevada Law

Business Combinations

The “business combination” provisions of Sections 78.411 to 78.444, inclusive, of the NRS generally prohibit a Nevada corporation with at least 200 stockholders from engaging in various “combination” transactions with any interested stockholder for a period of two years after the date of the transaction in which the person became an interested stockholder, unless the transaction is approved by the board of directors prior to the date the interested stockholder obtained such status or the combination is approved by the board of directors and thereafter is approved at a meeting of the stockholders by the affirmative vote of stockholders representing at least 60% of the outstanding voting power held by disinterested stockholders. The prohibition extends beyond the expiration of the two-year period, unless: (a) the combination was approved by the board of directors prior to the person becoming an interested stockholder or the transaction by which the person first became an interested stockholder was approved by the board of directors before the person became an interested stockholder or the combination is later approved by a majority of the voting power held by disinterested stockholders; or (b) if the consideration to be paid by the interested stockholder is at least equal to the highest of: (i) the highest price per share paid by the interested stockholder within the two years immediately preceding the date of the announcement of the combination or in the transaction in which it became an interested stockholder, whichever is higher, (ii) the market value per share of common stock on the date of announcement of the combination and the date the interested stockholder acquired the shares, whichever is higher, or (iii) for holders of preferred stock, the highest liquidation value of the preferred stock, if it is higher.

A “combination” is generally defined to include mergers or consolidations or any sale, lease exchange, mortgage, pledge, transfer, or other disposition, in one transaction or a series of transactions, with an “interested stockholder” having: (a) an aggregate market value equal to 5% or more of the aggregate market value of the assets of the corporation, (b) an aggregate market value equal to 5% or more of the aggregate market value of all outstanding shares of the corporation, (c) 10% or more of the earning power or net income of the corporation, and (d) certain other transactions with an interested stockholder or an affiliate or associate of an interested stockholder.

In general, an “interested stockholder” is a person who, together with affiliates and associates, owns (or within two years, did own) 10% or more of a corporation’s voting stock. The statute could prohibit or delay mergers or other takeover or change in control attempts and, accordingly, may discourage attempts to acquire our Company even though such a transaction may offer our stockholders the opportunity to sell their stock at a price above the prevailing market price.

Control Share Acquisitions

The “control share” provisions of Sections 78.378 to 78.3793, inclusive, of the NRS apply to “issuing corporations” that are Nevada corporations with at least 200 stockholders, including at least 100 stockholders of record who are Nevada residents, and that conduct business directly or indirectly in Nevada. The control share statute prohibits an acquirer, under certain circumstances, from voting its shares of a target corporation’s stock after crossing certain ownership threshold percentages, unless the acquirer obtains approval of the target corporation’s disinterested stockholders. The statute specifies three thresholds: (a) one-fifth or more but less than one-third, (b) one-third but less than a majority, and (c) a majority or more, of the outstanding voting power.

Generally, once an acquirer crosses one of the above thresholds, those shares in an offer or acquisition and acquired within 90 days thereof become “control shares” and such control shares are deprived of the right to vote until disinterested stockholders restore the right. These provisions also provide that if control shares are accorded full voting rights and the acquiring person has acquired a majority or more of all voting power, all other stockholders who do not vote in favor of authorizing voting rights to the control shares are entitled to demand payment for the fair value of their shares in accordance with statutory procedures established for dissenters’ rights.

A corporation may elect to not be governed by, or “opt out” of, the control share provisions by making an election in its articles of incorporation or bylaws, provided that the opt-out election must be in place on the 10th day following the date an acquiring person has acquired a controlling interest, that is, crossing any of the three thresholds described above. Pursuant to Article XI of our articles of incorporation, we have opted out of the control share statutes and will not be subject to these statutes if we are an “issuing corporation” as defined in such statutes.

The effect of the Nevada control share statutes is that the acquiring person, and those acting in association with the acquiring person, will obtain only such voting rights in the control shares as are conferred by a resolution of the stockholders at an annual or special meeting. The Nevada control share law, if applicable, could have the effect of discouraging takeovers of our Company.

Articles of Incorporation and Bylaws

No Written Consent of Stockholders

Our articles of incorporation provide that all stockholder actions are required to be taken by a vote of the stockholders at an annual or special meeting, and that stockholders may not take any action by written consent in lieu of a meeting. This limit may lengthen the amount of time required to take stockholder actions and would prevent the amendment of our bylaws or removal of directors by our stockholders without holding a meeting of stockholders.

Meetings of Stockholders

Our articles of incorporation and bylaws provide that a special meeting of stockholders may be called only by our board of directors, the chairperson of our board of directors or our chief executive officer or president (in the absence of a chief executive officer), and only those matters set forth in the notice of the special meeting may be considered or acted upon at a special meeting of stockholders. Our articles of incorporation and bylaws also limit the business that may be conducted at an annual meeting of stockholders to those matters properly brought before the meeting.

Advance Notice Requirements

Our bylaws establish advance notice procedures with regard to stockholder proposals relating to the nomination of candidates for election as directors or new business to be brought before meetings of our stockholders. These procedures provide that notice of stockholder proposals must be timely given in writing to our corporate secretary prior to the meeting at which the action is to be taken. Generally, to be timely, notice must be received at our principal executive offices not less than 90 days nor more than 120 days prior to the first anniversary date of the annual meeting for the preceding year. Our bylaws specify the requirements as to form and content of all stockholders’ notices. These requirements may preclude stockholders from bringing matters before the stockholders at an annual or special meeting.

Amendment to Articles of incorporation or Bylaws

Any amendment of our articles of incorporation must first be approved by a majority of our board of directors, and if required by law or our articles of incorporation, must thereafter be approved by two-thirds of the then outstanding voting power of our capital stock entitled to vote thereon in the case of amendments relating to certain matters involving our board of directors, stockholder action by written consent in lieu of a meeting, special meetings of stockholders, amendments to our bylaws, and forum selection provisions, and a majority of the then outstanding voting power of our capital stock entitled to vote thereon in the case of other amendments. In addition, our bylaws may be amended or repealed by a majority vote of our board of directors or by the affirmative vote of two-thirds of the then outstanding voting power of our capital stock entitled to vote thereon.

Undesignated Preferred Stock

Our articles of incorporation provide for 5,000,000 authorized shares of preferred stock. The existence of authorized but unissued shares of preferred stock may enable our board of directors to discourage an attempt to obtain control of us by means of a merger, tender offer, proxy contest or otherwise. For example, if in the due exercise of its fiduciary obligations, our board of directors were to determine that a takeover proposal is not in the best interests of our stockholders, our board of directors could cause shares of preferred stock to be issued without stockholder approval in one or more private offerings or other transactions that might dilute the voting or other rights of the proposed acquirer or insurgent stockholder or stockholder group. In this regard, our articles of incorporation grants our board of directors broad power to establish the rights and preferences of authorized and unissued shares of preferred stock. The issuance of shares of preferred stock could decrease the amount of earnings and assets available for distribution to holders of shares of common stock. The issuance may also adversely affect the rights and powers, including voting rights, of these holders and may have the effect of delaying, deterring or preventing a change in control of us.

Choice of Forum

Our articles of incorporation provide that, unless we consent in writing to the selection of an alternative forum, the Court of Chancery of the State of Delaware (or, if the Court of Chancery does not have jurisdiction, the United States District Court for the District of Delaware) will be the sole and exclusive forum for: (1) any derivative action or proceeding brought on our behalf; (2) any action asserting a claim of breach of a fiduciary duty or other wrongdoing by any of our directors, officers, employees or agents to us or our stockholders; (3) any action asserting a claim against us arising pursuant to any provision of the General Corporation Law of the State of Delaware or our certificate of incorporation or bylaws; (4) any action to interpret, apply, enforce or determine the validity of our certificate of incorporation or bylaws; or (5) any action asserting a claim governed by the internal affairs doctrine. In addition, our certificate of incorporation provides that, unless we consent in writing to the selection of an alternative forum, the federal district courts of the United States of America shall, to the fullest extent permitted by law, be the sole and exclusive forum for the resolution of any complaint asserting a cause of action arising under the Securities Act. This provision does not apply to claims under the Exchange Act. Our articles of incorporation also provides that any person or entity purchasing or otherwise acquiring any interest in shares of our capital stock will be deemed to have notice of and to have consented to these choice of forum provisions. It is possible that a court of law could rule that the choice of forum provisions contained in our articles of incorporation are inapplicable or unenforceable if they are challenged in a proceeding or otherwise. Although we believe these provisions benefit us by providing increased consistency in the application of Delaware law and the Securities Act for the specified types of actions and proceedings, the provisions may have the effect of discouraging lawsuits against us or our directors and officers.

SELLING STOCKHOLDER

On August 3, 2023, we entered into a sponsorship and support agreement (as amended, the “Sponsorship and Support Agreement”) with KP River Birch LLC (“KPRB”) relating to certain brand ambassador services to be provided over a one-year term. On August 28, 2023, the Sponsorship and Support Agreement was amended to be effective as of August 14, 2023. Pursuant to the Sponsorship and Support Agreement, we issued to KPRB, among other consideration, restricted stock units relating to 100,000 shares of the Company’s common stock, vesting quarterly over four quarters, and a stock option to purchase up to 300,000 shares at a price of $1.00 per share, which stock option expires ten years from the grant date. The shares of common stock underlying such awards were registered for resale pursuant to our registration statement on Form S-3 (File No. 333-276235), which was declared effective by the SEC on December 29, 2023. In addition, we agreed to issue to KPRB or its designee up to an additional 600,000 shares of our common stock during the term of the Sponsorship and Support Agreement. Pursuant to the Sponsorship and Support Agreement, 600,000 shares of common stock were issuable in six equal tranches of 100,000 shares of common stock on the respective dates in which the Company's stock price reached each of the following thresholds for a volume-weighted period of 10 consecutive days or more than 15 non-consecutive days within any 30-day period. The first tranche was issued on March 27, 2024, upon the stock price of the common stock reaching the $2.00 threshold, the second tranche was issued on June 14, 2024, upon the stock price of the common stock reaching the $3.00 threshold, and the third tranche was issued on July 1, 2024, upon the stock price of the common stock reaching the $4.00 threshold. Such shares of common stock are being registered for resale hereunder. Pursuant to the Sponsorship and Support Agreement, an aggregate of 300,000 additional shares of common stock were issuable in three tranches of 100,000 shares of common stock upon the achievement of $5.00, $6.00, and $7.00 stock price thresholds during the term of the agreement. The Sponsorship and Support Agreement terminated pursuant to its terms on August 14, 2024. As a result, the remaining 300,000 shares of common stock relating to the $5.00, $6.00, and $7.00 stock price thresholds are no longer issuable and are not registered for resale hereunder.

Such shares of common stock were sold in a private placement exempt from the registration requirements of the Securities Act in reliance on the exemptions set forth in Section 4(a)(2) of the Securities Act, on the basis that the sale of the securities does not involve a public offering and is made without general solicitation or general advertising.

As used in this prospectus, the term “selling stockholder” includes the selling stockholder set forth below and any donees, pledgees, transferees or other successors-in-interest selling shares of common stock received after the date of this prospectus from the selling stockholders as a gift, pledge, or other non-sale related transfer.

The selling stockholder identified in the table below may from time to time offer and sell under this prospectus any or all of the shares of common stock listed under the column “Number of Shares Being Offered” in the table below. The table below and footnote disclosure following the table sets forth the name of the selling stockholder and the number of shares of our common stock beneficially owned by the selling stockholder prior to and after this offering. The table below has been prepared based upon information furnished to us by the selling stockholder, and the selling stockholder may have sold, transferred or otherwise disposed of some or all of its shares since providing such information to us. Information concerning the selling stockholder may change from time to time and, if necessary, we will amend or supplement this prospectus accordingly and as required.

The number of shares beneficially owned by the selling stockholder is determined under rules issued by the SEC. Under these rules, beneficial ownership includes any shares as to which the selling stockholder has sole or shared voting power or investment power. Percentage ownership is based on 10,279,242 shares of our common stock outstanding as of August 16, 2024. In computing the number of shares beneficially owned by the selling stockholder and the percentage ownership of that person, shares of common stock subject to options or other rights held by such person that are currently exercisable or will become exercisable within 60 days of August 16, 2024 are considered outstanding.

We have assumed that all shares of our common stock reflected in the table as being offered will be sold from time to time by the selling stockholder. The selling stockholder may offer some, all or none of its shares of our common stock.

We believe that the selling stockholder in the table below has sole voting and investment power with respect to the voting securities beneficially owned by it.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares Beneficially Owned

|

|

|

|

Shares Beneficially Owned

|

|

|

|

Prior to the Offering

|

|

Number of Shares

|

|

After the Offering

|

|

Name of Selling Stockholder

|

|

Number of Shares

|

|

Percentage

|

|

Being Offered

|

|

Number of Shares

|

|

Percentage

|

|

KP River Birch LLC

|

|

523,357

|

|

5.1%

|

|

300,000 (1)

|

|

223,357 (2)

|

|

2.2%

|

| |

(1)

|

The resale registration statement of which this prospectus forms a part is registering for resale 300,000 shares of common stock consisting of up to 300,000 shares of common stock granted by us to the selling stockholder.

|

| |

(2)

|

Assumes that all shares of common stock being registered under the resale registration statement of which this prospectus forms a part are sold in this offering, and that such selling stockholder does not acquire additional shares of common stock after the date of this prospectus and prior to completion of this offering, other than through the issuance of common stock as described in footnote (1) above.

|

PLAN OF DISTRIBUTION

The selling stockholder, which term includes its transferees, pledgees or donees or its successors-in-interest, may sell the shares being offered from time to time in one or more transactions:

| |

●

|

on the NYSE American or otherwise;

|

| |

●

|

in ordinary brokers’ transactions, which may include long or short sales;

|

| |

●

|

in transactions involving cross or block trades or otherwise in the over-the-counter market;

|

| |

●

|

through broker-dealers, who may act as agents or principals;

|

| |

●

|

in “at the market” offerings to or through market makers into an existing market for the shares;

|

| |

●

|

in other ways not involving market makers or established markets, including direct sales to purchasers in negotiated transactions;

|

| |

●

|

through a bidding or auction process;

|

| |

●

|

through one or more underwriters on a firm commitment or best efforts basis;

|

| |

●

|

through the writing of options, swaps or other derivatives, whether listed on an exchange or otherwise; or

|

| |

●

|

through a combination of such methods of sale or by any other legally available means.

|

In addition, subject to compliance with applicable law, the selling stockholder may enter into option, derivative or hedging transactions with broker-dealers who may engage in short sales of common stock in the course of hedging the positions they assume with the selling stockholder, and any related offers or sales of shares may be made under this prospectus. In some circumstances, for example, the selling stockholder may write call options, put options or other derivative instruments with respect to the shares, which the selling stockholder settles through delivery of the shares. These option, derivative and hedging transactions may require the delivery to a broker, dealer or other financial institution of shares offered under this prospectus, and that broker, dealer or other financial institution may resell those shares under this prospectus.

The selling stockholder may sell the shares at market prices prevailing at the time of sale, at prices related to those market prices, at negotiated prices or at fixed prices, which may be changed from time to time. The selling stockholder also may sell the shares pursuant to Rule 144 or other available exemptions adopted under the Securities Act. The selling stockholder may effect transactions by selling shares directly to purchasers or to or through broker-dealers. The broker-dealers may act as agents or principals. Broker-dealers, underwriters or agents may receive compensation in the form of discounts, concessions or commissions from the selling stockholder or the purchasers of the shares, or both. The compensation of any particular broker-dealer, underwriter or agent may be in excess of customary commissions.

The selling stockholder and any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters” within the meaning of Section 2(a)(11) of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. If the selling stockholder or any broker-dealer that participates with the selling stockholder in the distribution of shares is deemed to be an “underwriter” within the meaning of the Securities Act, the selling stockholder and such broker-dealer may be subject to the prospectus delivery requirements of the Securities Act.

The selling stockholder may donate, pledge or otherwise transfer its shares in a non-sale related transaction to any person so long as the transfer complies with applicable securities laws. As a result, donees, pledgees, transferees and other successors in interest that receive such shares as a gift, distribution or other non-sale related transfer may offer shares of common stock under this prospectus.

The selling stockholder has advised us that it has not entered into any agreements, understandings or arrangements with any underwriters or broker-dealers regarding the sale of its securities. There is no underwriter or coordinating broker acting in connection with the proposed sale of shares by the selling stockholder.

The shares will be sold through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in certain states the shares may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

Under applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the shares may not simultaneously engage in market making activities with respect to our common stock for a period of two business days prior to the commencement of such distribution. In addition, the selling stockholder will be subject to applicable provisions of the Exchange Act and the associated rules and regulations under the Exchange Act, including Regulation M, which provisions may limit the timing of purchases and sales of shares of our common stock by the selling stockholder. Certain persons participating in an offering may engage in over-allotment, stabilizing transactions, short-covering transactions and penalty bids in accordance with Regulation M under the Exchange Act that stabilize, maintain or otherwise affect the price of the offered securities. If any such activities may occur, they will be described in an applicable prospectus supplement or a document incorporated by reference to the extent required. We will make copies of this prospectus available to the selling stockholder and have informed the selling stockholder that if it is deemed to be an underwriter, the selling stockholder will need to deliver copies of this prospectus to purchasers at or prior to the time of any sale of the shares.

We will receive no proceeds from the sale of shares by selling stockholder pursuant to this prospectus. We will bear all costs, expenses and fees in connection with the registration of the shares, except that the selling stockholder will bear all commissions and discounts, if any, attributable to the sales of the shares. We will indemnify the selling stockholder, and the selling stockholder will indemnify us, and may agree to indemnify any underwriter, broker-dealer or agent that participates in transactions involving sales of the shares, against certain liabilities, including liabilities arising under the Securities Act.

Upon notification to us by the selling stockholder that any material arrangement has been entered into with a broker-dealer or other agent for the sale or purchase of shares, including through a block trade, special offering, exchange distribution, secondary distribution, or purchase by a broker or dealer, we will file a supplement to this prospectus, if required, disclosing:

| |

●

|

the name of the participating broker-dealers;

|

| |

●

|

the number of shares involved;

|

| |

●

|

the price at which such shares were sold;

|

| |

●

|

the commissions paid or discounts or concessions allowed to such broker-dealers, where applicable;

|

| |

●

|

that such broker-dealers did not conduct any investigation to verify the information set out or incorporated by reference in this prospectus; and

|

| |

●

|

other facts material to the transaction.

|

A prospectus supplement or document incorporated by reference may be filed to disclose additional information with respect to any sale or other distribution of the shares.

LEGAL MATTERS

The validity of the securities offered by this prospectus has been passed upon for us by Haynes and Boone, LLP, Dallas, Texas.

EXPERTS

The consolidated financial statements of Laird Superfood Inc. (the “Company”) incorporated in this prospectus by reference from the Annual Report on Form 10-K of the Company for the year ended December 31, 2023, have been audited by Moss Adams LLP, an independent registered public accounting firm, as stated in their report. Such consolidated financial statements are incorporated by reference in reliance upon the report of such firm given their authority as experts in accounting and auditing.

300,000 Shares of Common Stock

PROSPECTUS

The date of this prospectus if August 23, 2024.

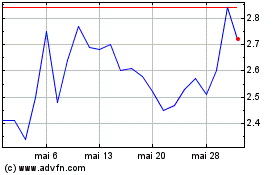

Laird Superfood (AMEX:LSF)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Laird Superfood (AMEX:LSF)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024