Ring Energy Announces Production Results and Continued Debt Reduction for Fourth Quarter 2023 and Partial Guidance for the First Quarter 2024

29 Janeiro 2024 - 8:45AM

Ring Energy, Inc. (NYSE American: REI) (“Ring” or the “Company”)

today provided an operational and financial update for the fourth

quarter of 2023, as well as production and capital spending

guidance for the first quarter of 2024.

Key

Highlights

-

Fourth quarter 2023 sales volumes were approximately 19,400 barrels

of oil equivalent per day (“Boe/d”) (70% oil), near the high end of

the Company’s guidance, which was 18,900 to 19,500 Boe/d;

-

Positively impacting fourth quarter sales was three full months of

production from the recently completed acquisition of the Founders

Oil & Gas IV, LLC (“Founders” and the “Founders Acquisition”)

assets that closed on August 15, 2023, as well as the success of

the Company’s 2023 development program that concluded in late

November;

-

Further reduced debt by $3.0 million in the fourth quarter of 2023,

while also funding the $11.9 million final payment in December for

the Founders Acquisition;

-

Ended 2023 with $425 million of borrowings against the Company’s

credit facility;

-

Guiding first quarter 2024 average sales to be 18,000 to 18,500

Boe/d (~69% oil);

-

Impacting the Company’s sales to date was deferred production of

approximately 1,900 Boe/d for 10 days, which was associated with

recent severe cold winter weather. Production has since been

restored;

-

Ring completed its 2023 drilling program in late November and

initiated its 2024 program in early January, with the first well

expected to be online in February; and

-

Anticipate first quarter capital spending of $37 million to $42

million, primarily associated with a phased, two-rig drilling

program (one horizontal and one vertical);

-

Plan to drill four to five horizontal wells and four to six

vertical wells.

Mr. Paul D. McKinney, Chairman of the Board and

Chief Executive Officer, commented, “We enjoyed record sales during

the fourth quarter of 2023 near the high end of guidance, but more

importantly exceeded the high end of our expectations for crude oil

sales. The result was an outstanding fourth quarter and we look

forward to reporting our full results in early March. Contributing

to our success in the period was a full quarter of production

impact from our recent Founders Acquisition, as well as the ongoing

success of our 2023 drilling program that concluded in late

November. In addition, we paid down debt by $3.0 million while

making our final deferred payment of $11.9 million for the Founders

Acquisition. Debt reduction remains a key priority for the Company,

and our targeted acquisitions in 2022 and 2023 are allowing us to

pay down debt at a much faster rate than we would have done on a

standalone basis.”

Mr. McKinney concluded, “As we enter 2024, we

intend to retain the flexibility to adjust capital spending levels

commensurate with changing oil and gas prices. We began 2024 with a

phased, two-rig drilling program, targeting our highest

rate-of-return horizontal and vertical drilling inventory. This

approach provides us with the flexibility necessary to respond to

changing market conditions. As in the past, our efforts are

squarely focused on enhancing the financial position of the

Company, with further debt reduction a top priority. We appreciate

the support of our stockholders and look forward to a successful

2024.”

About Ring Energy, Inc.

Ring Energy, Inc. is an oil and gas exploration,

development, and production company with current operations focused

on the development of its Permian Basin assets. For additional

information, please visit www.ringenergy.com.

Safe Harbor Statement

This release contains forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements involve a wide variety of risks

and uncertainties, and include, without limitation, statements with

respect to the Company’s strategy and prospects. The

forward-looking statements include statements about expected future

reserves, production, financial position, business strategy,

revenues, earnings, costs, capital expenditures and debt levels of

the Company, and plans and objectives of management for future

operations. Forward-looking statements are based on current

expectations and assumptions and analyses made by Ring and its

management in light of their experience and perception of

historical trends, current conditions and expected future

developments, as well as other factors appropriate under the

circumstances. However, whether actual results and developments

will conform to expectations is subject to a number of material

risks and uncertainties, including but not limited to: declines in

oil, natural gas liquids or natural gas prices; the level of

success in exploration, development and production activities;

adverse weather conditions that may negatively impact development

or production activities; the timing of exploration and development

expenditures; inaccuracies of reserve estimates or assumptions

underlying them; revisions to reserve estimates as a result of

changes in commodity prices; impacts to financial statements as a

result of impairment write-downs; risks related to level of

indebtedness and periodic redeterminations of the borrowing base

and interest rates under the Company’s credit facility; Ring’s

ability to generate sufficient cash flows from operations to meet

the internally funded portion of its capital expenditures budget;

the impacts of hedging on results of operations; and Ring’s ability

to replace oil and natural gas reserves. Such statements are

subject to certain risks and uncertainties which are disclosed in

the Company’s reports filed with the Securities and Exchange

Commission, including its Form 10-K for the fiscal year ended

December 31, 2022, and its other filings. Ring undertakes no

obligation to revise or update publicly any forward-looking

statements except as required by law.

Contact Information

Al Petrie AdvisorsAl Petrie, Senior

PartnerPhone: 281-975-2146Email: apetrie@ringenergy.com

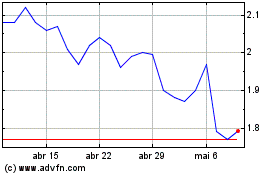

Ring Energy (AMEX:REI)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

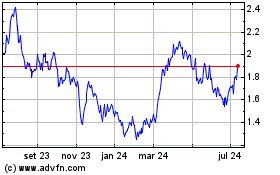

Ring Energy (AMEX:REI)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025