AMZN: Can Amazon Stock Stage a Rebound In 2023

21 Dezembro 2022 - 9:18AM

Finscreener.org

Shares of the world’s largest

e-commerce retailer, Amazon (NASDAQ:

AMZN), are now down 55%

from all-time highs, valuing the company at a market cap of $896

billion. Amazon shares closed trading at $84.92 yesterday, the

lowest price since March 16, 2020.

Amazon stock is down 49% in 2022,

its worst year since the dot-com crash in 2000. The tech giant had

then seen an 80% fall in share prices.

Similar to other tech stocks,

Amazon is currently wrestling with challenges related to soaring

inflation, supply chain disruptions, and higher interest rates. In

fact, the tech-heavy Nasdaq Composite index is likely to trail the

S&P 500 index in

consecutive years for the first time since the dot-com

bubble.

Shares of Amazon and other

e-commerce companies gained pace at the onset of COVID-19 due to

the worldwide shift towards online. But as economies reopened,

Amazon experienced a deceleration in top-line growth for its core

retail business.

Amazon spooked Wall Street after

it forecasted sales between $140 billion and $148 billion in Q4,

indicating a year-over-year growth rate between 2% and 8%.

Comparatively, analysts expected Q4 sales at $155.15

billion.

To tide over an uncertain

environment, Amazon announced a hiring freeze while laying off

thousands of employees to reduce its cost

structure.

Will AMZN stock price resurge in 2023?

Amazon and most other tech stocks

are likely to remain under the pump in the near term and are

unlikely to recover overnight. But Amazon is well poised to weather

the ongoing downturn and stage a rebound once the market

recovers.

Amazon continues to lead

multi-billion-dollar markets such as online retail and public

cloud, both of which are growing at a healthy pace. While demand

for e-commerce peaked amid the pandemic, Amazon’s online store

increased sales by 13% year over year to 53.5 billion in Q3 of

2022. Its third-party seller revenue also rose by 23% to $28.7

billion in the September quarter.

The global e-commerce market

might surpass $55 trillion by 2028, providing Amazon with enough

room to grow its sales in the medium term.

Amazon’s core business is a

low-margin segment. But this will be offset by growth in Amazon

Prime and online advertising, which clocked revenue of $8.9 billion

and $9.5 billion, respectively, in Q3.

Amazon Web Services, which is the

company’s public cloud

division, enjoys a 32% market share globally. In the last four

quarters, AWS reported revenue of $76.5 billion, an increase of 34%

year over year.

Analysts expect the cloud

computing market to expand by 15.7% annually through 2030 to touch

$1.55 trillion. So, if AWS can grow by 15% each year in the next

year, annual sales for this business will surge by over $154

billion by 2027.

Further, Amazon Web Services

generates the majority of the profits for Amazon. In fact, AWS

ended Q3 with an operating margin of 30%. If the company can

maintain its operating margin and market share, annual profits for

the cloud business will be close to $45 billion in the next five

years.

What next for Amazon stock price and

investors?

The ongoing pullback provides

investors the opportunity to buy a quality tech stock at a

depressed valuation. Wall Street expects Amazon to increase sales

by 8.6% to $510.3 billion in 2022 and by 10.5% to $564 billion in

2023.

So, AMZN stock is priced at 1.6x

forward sales, which is quite reasonable for a high-flying growth

stock. Currently, Amazon stock price is trading at a discount of

70%, given consensus price target estimates.

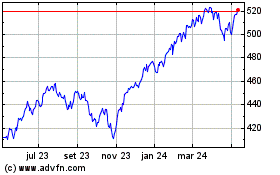

SPDR S&P 500 (AMEX:SPY)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

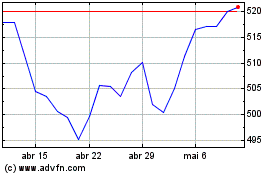

SPDR S&P 500 (AMEX:SPY)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024