Will a Santa Claus Rally Boost the S&P 500 This Week?

27 Dezembro 2022 - 8:17AM

Finscreener.org

In the last weekU+02019s trading

session, which ended on December 23, 2022, the U.S. equity markets

edged higher as consumer inflation decelerated in the past month.

Market participants now expect price pressures to moderate in the

next few months, which might also result in lower interest rates in

2023.

In the last five trading

sessions, the

Dow Jones index rose by

1.9, while the

S&P 500 and

Nasdaq indices fell by 0.2% and 0.9%, respectively, as

recession fears loomed large on the markets.

The upcoming week will be a short

one as the markets are closed on Monday. Will a holiday-fueled

Santa Claus rally drive the stock market, allowing

investors to offset a portion of these losses?

Let’s see what investors can

expect from the markets as we head toward the end of

2022.

Home prices data

The data for home prices in the

U.S. will be published in the next week. The S&P 500 Global

will release the Case-Shiller National Home Price Index for

November on Tuesday, while mortgage originator Freddie Mac will

disclose the Home Price Index data for the last month.

In October, the Case-Shiller

index suggested home prices fell 1.2% in October after a 1.5%

decline in September. It was the fourth consecutive

month-over-month price decline.

Home prices rose 9.1% year over

year in October, which was lower than the 10.4% year-over-year gain

in September. It was the slowest pace of annual price gains in over

two years, suggests a report from Investopedia.

Later this week, the NAR of the

National Association of Realtors will release data on pending home

sales for November. According to analysts, pending home sales will

slump 0.5% in November and 30% from the year-ago period. Pending

home sales are down in 11 of the past 12 months due to rising

mortgage rates, lower inventory, and a decline in

affordability.

Purchasing managerU+02019s index data remains

key

A key driver of the stock market

in the next week is the Purchasing Managers Index data that will

release on Friday by the Institute for Supply Management. The PMI

tracks manufacturing activity across the midwestern region in the

United States.

PMI in Chicago is likely to fall

after it touched 37.2 points in November compared to 45.2 points in

October. The PMI reading for October was the lowest in more than

two years when the onset of the COVID-19 pandemic resulted in

lockdowns and a slowdown in economic activity. Typically, a PMI

reading of less than 50 suggests a contraction in business

activity.

What next for the S&P 500?

The S&P 500 index entered

the bear market territory in September 2022 and is currently down

19.8% year-to-date. There is a small chance of the index gaining

momentum from a Santa Claus Rally due to investor optimism just

after Christmas.

The markets are moving lower in

December, but the current month has historically been among the

most-strongest months for equity investors. Since 1950, the

S&P 500 index has moved up by an average of 1% in December.

Further, in the last five trading days of December and in the first

two trading days of January, the index has gained 1.3% on average

in this period.

An Investopedia report states,

“There is no definitive explanation for why stocks tend to rise at

the end of the year, but some theories posit that holiday shopping,

seasonal optimism, and institutional investors settling their books

could have helped fuel the trend.”

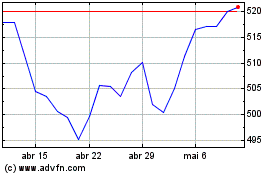

SPDR S&P 500 (AMEX:SPY)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

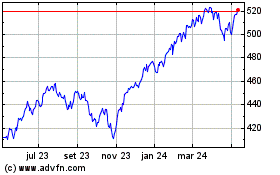

SPDR S&P 500 (AMEX:SPY)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024