What Next for Investors As S&P 500 Enters Bull Market Territory?

11 Junho 2023 - 5:27PM

Finscreener.org

The S&P

500 index entered bull

market territory last week, trading 20% above 52-week highs. U.S.

investors experienced its longest bear market since 1948, lasting

248 trading days. The shift back to a bull market took place

despite aggressive interest rate hikes by the Federal Reserve,

regional banking collapses, and persistent fears of a recession

that hasnU+02019t fully manifested.

Expect S&P 500 stocks to remain volatile in the

near-term

According to

Yahoo Finance, Ryan Detrick, Chief Market Strategist at

Carson Group, warns that the journey up for stocks might take a lot

of work. He studied 13 instances since 1956 where stocks rebounded

by 20% from a 52-week low. Typically, the first three months show

instability, with the benchmark index averaging a 0.5% decline in

the first month after hitting bull market territory.

However, the long-term view is

quite optimistic. DetrickU+02019s research shows that after a 20%

rebound from market lows, the S&P 500 typically returns 10%

over the next six months and 17.7% over the following

year.

Despite these optimistic

projections, the road to higher stocks may still be bumpy. On

Wednesday, markets expect the Federal Reserve to halt its interest

rate hike process, which

isnU+02019t necessarily good news for stocks. Economists predict

that the Federal ReserveU+02019s pause may be in anticipation of

the "lagging impact" of its fiscal policy.

Should this be the case, it could

result in slowed economic growth, which might lessen inflation but

pressurize earnings growth. Morgan Stanley recently referenced this

scenario when they forecasted a 16% drop in corporate profits by

year-end.

Inflation is on the radar of the Federal

Reserve

This Tuesday, weU+02019ll be

awaiting MayU+02019s latest Consumer Price Index (CPI), as released

by the Labor Department. The CPI is anticipated to have increased

by 0.2% in May, showing a slight deceleration from the 0.4%

increase in April. The forecast for the annual rate is 4.1%,

marking a decrease from the previous monthU+02019s

4.9%.

As for the core CPI, which leaves

out the more fluctuating food and energy prices, itU+02019s

predicted to have risen by 0.4% in the past month and by 5.3%

year-over-year, down from AprilU+02019s 5.5%.

The Producer Price Index (PPI)

for May, reflecting wholesale inflation, is set to be released on

Wednesday. After the 0.2% increase in April, producer prices are

predicted to have dipped by 0.1% in May, with the annual rate

likely slowing down to 1.5% from 2.3% in the previous

month.

The Federal ReserveU+02019s

Federal Open Market Committee (FOMC) will announce its decision on

interest rates. With the last ten meetings resulting in rate hikes

to temper inflation—which, while below its 2022 peaks, still

remains high—the central bank is widely anticipated to hold off on

further hikes in the upcoming meeting. The Fed funds rate is

expected to stay in its 5-5.25% range, and the CME GroupU+02019s

FedWatch Tool currently shows a 74.8% probability of a rate hike

pause.

The Census Bureau will deliver an

update on U.S. retail sales next week, providing insights into

consumer spending patterns and the impact inflation has had on

these. After two months of falling numbers, U.S. retail sales are

projected to have increased by 0.5% in May, following a 0.4% rise

in April, as shoppers wary of inflation start spending again. In

April, online shopping and food saw a surge in sales, whereas home

furnishings and electronics sales took a hit.

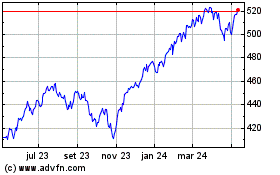

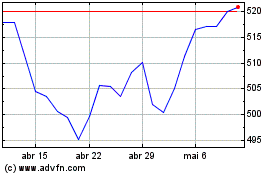

SPDR S&P 500 (AMEX:SPY)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

SPDR S&P 500 (AMEX:SPY)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024