Big Tech Earnings In Focus for S&P 500 and Investors?

24 Julho 2023 - 7:41AM

Finscreener.org

The stock markets have staged a

stellar comeback in the first seven months of 2023. The table below

shows that the stock market is up 17.5% year-to-date, outpacing

other asset classes such as gold and bonds.

In the upcoming week, the big

tech earnings

of Microsoft (NASDAQ:

MSFT),

Alphabet (NASDAQ: GOOGL), and Meta Platforms

(NASDAQ:

META) will likely drive

the

S&P 500 index.

Let’s see what investors expect from each of these companies in the

June quarter.

What to expect from Microsoft, Meta, and Alphabet stock

in Q2?

Analysts tracking Microsoft

expect sales to rise by 7% to $55.47 billion and adjusted earnings

to rise by 14.3% to $2.55 per share.

Wall Street forecasts Meta to

increase sales by 8% to $31.1 billion, while adjusted earnings are

expected to surge 18.3% to $2.91 per share in the June

quarter.

For Alphabet, analysts expect

revenue and adjusted earnings in Q2 of 2023 to rise 4.5% and 10.7%

to $72.8 billion and $1.34 billion, respectively.

The tech giants have already

outpaced the broader markets by a wide margin in 2023. For

instance, shares of Meta, Microsoft, and Alphabet have surged

144.5%, 44%, and 36%, respectively, this year.

A final interest rate hike by the Fed?

On Tuesday, the Federal Open

Market Committee (FOMC) will hold a two-day meeting involving

Federal Reserve policymakers. The gathering will conclude on

Wednesday with an interest rate announcement and a press conference

led by Chair Jerome Powell. CME GroupU+02019s FedWatch Tool

suggested that the Fed will increase interest rates by 25 basis

points (bps).

Since March 2022, the Fed has

amplified its benchmark federal funds rate by 500 bps to control

the highest inflation rates seen in over 40 years. A rise of 25 bps

would place the federal funds rate between 5.25% and 5.5%, marking

the highest levels in 22 years.

On Thursday, the Bureau of

Economic Analysis (BEA) will release second-quarter GDP figures. As

per the forecasts from the Conference Board, the U.S. economy is

likely to have expanded by 1.1% in the second quarter, surpassing

initial growth projections of 0.6%.

Moving forward, although growth

might significantly slow down in the latter half of 2023, a robust

labor market coupled with easing inflation suggests that the U.S.

economy will likely steer clear of a recession, as per

Deloitte.

Inflation will be under focus

Friday will see the release of

the Personal Consumption Expenditures (PCE) Price Index for June by

the BEA. This index is the FedU+02019s favored measure of

inflation. Price increases for June are anticipated to be 0.1%,

matching the pace of May.

The annual rate of price

increases likely dropped sharply to 2.9% from 3.8% in May, drawing

closer to the FedU+02019s 2% target. Core prices, excluding the

unstable food and energy costs, probably increased by 0.2% from May

and 4.3% from the same period last year.

The Fed prefers the PCE Price

Index as an inflation gauge as it more accurately reflects consumer

spending decisions compared to the Consumer Price Index (CPI), and

its basket of goods is updated more regularly.

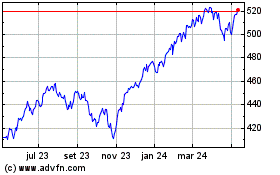

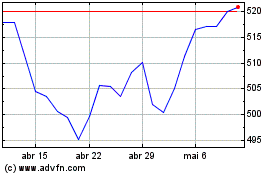

SPDR S&P 500 (AMEX:SPY)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

SPDR S&P 500 (AMEX:SPY)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024