Meta Stock Slumps Despite Beating Estimates

26 Outubro 2023 - 7:12AM

Finscreener.org

Shares of social media

giant Meta Platforms (NASDAQ:

META) are trading lower

in early market today. The company announced its Q3 results after

market close on October 25th and

reported revenue of $34.15 billion and adjusted earnings of $4.39

per share.

Comparatively, analysts expected

it to report sales of $33.56 billion and earnings of $3.63 per

share in Q3. Meta’s top line surged by 23% in Q3, which was its

fastest growth rate in two years. While META stock initially gained

momentum in extended trading, these gains were soon revised due to

its cautious outlook for the near term.

What drove Meta revenue and earnings in Q3?

Meta surpassed estimates on

several metrics. It reported:

- Daily active users or DAUs of 2.09 billion vs.

estimates of 2.07 billion

- Monthly active users of 3.05 billion, which was

in line with estimates

- Average revenue per user of $11.23, higher than

estimates of $11.05

Meta emphasized its top-line

growth accelerated in Q3, allowing it to recover from a tumultuous

period in 2022 where it fell for three consecutive quarters. Its

focus on cost efficiencies also enabled Meta to grow net income by

164% to $11.58 billion in the September quarter.

Meta is outpacing peers such as

Alphabet and Snap, which grew ad sales by 9.5% and 5%,

respectively, in Q3.

Meta’s robust performance in the

September quarter can be attributed to the improving effectiveness

of online ads following iOS privacy changes, which were introduced

in late 2021, making it difficult for ad platforms to target

potential customers.

Moreover, Meta has emphasized its

considerable investment in artificial intelligence, which plays a

pivotal role in attracting retailers keen on offering personalized

promotions to customers.

On its recent earnings call, CEO

Mark Zuckerberg mentioned a 7% increase in Facebook usage and a 6%

rise in Instagram this year due to enhanced recommendation

algorithms.

The companyU+02019s CFO, Susan

Li, indicated that online commerce was the primary driver for the

growth in advertisement revenue over the past year. This was

followed by the consumer goods and gaming sectors.

However, she also mentioned the

companyU+02019s broader revenue guidance for the upcoming quarter,

pointing to uncertainties in the Middle East caused by the

Israel-Hamas conflict. Li noted some ad softness correlating with

the conflictU+02019s onset, adding that itU+02019s challenging to

link this to any specific geopolitical event directly.

For the upcoming quarter, Meta

anticipates a revenue range of $36.5 billion to $40 billion. The

estimated midpoint would mark approximately 19% growth compared to

the same period last year.

Meta focuses on cost reductions

MetaU+02019s 2023 expenses are

forecasted to be between $87 billion and $89 billion, lower than

its earlier projection. For 2024, the expenses are predicted to

range from $94 billion to $99 billion. Zuckerberg highlighted that

AI would be the primary investment focus in 2024, spanning

engineering and computational resources.

MetaU+02019s Reality Labs,

specializing in VR and AR tech, reported $3.74 billion in quarterly

operational losses. Since the previous year, the division has

accumulated nearly $25 billion in losses, even after launching

products like the Quest 3 headset. Despite these losses, Zuckerberg

praised his teamU+02019s strides in AI and mixed reality,

particularly highlighting the Quest 3 and Ray-Ban Meta Smart

Glasses launches.

The firm expects the operational

losses of Reality Labs to rise due to continued product development

and efforts to expand its ecosystem.

As of the end of September,

MetaU+02019s workforce stood at 66,185, marking a 24% reduction

from the previous year. The decrease is attributed to substantial

cost-cutting measures. The company shared that it has largely

wrapped up the planned layoffs by September 30, 2023, while

evaluating facility consolidations and data center restructuring

strategies.

Overall costs and expenses for

the company dropped by 7%

year-over-year to $20.4 billion. This aligns with

ZuckerbergU+02019s proclamation earlier in the year emphasizing the

importance of an efficient and streamlined workforce.

MetaU+02019s stock has surged by

approximately 150% this year, making it the second-best performer

in the

S&P 500, only

trailing AI chip manufacturer Nvidia

(NASDAQ:

NVDA).

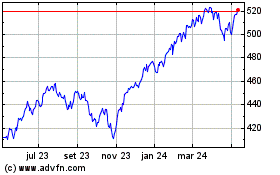

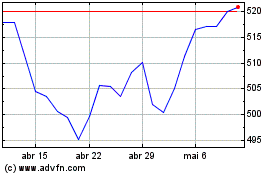

SPDR S&P 500 (AMEX:SPY)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

SPDR S&P 500 (AMEX:SPY)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024