false

0001543418

A1

0001543418

2024-02-09

2024-02-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________

FORM

8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 9, 2024

_______________________

Trilogy

Metals Inc.

(Exact name of registrant as specified in its charter)

_______________________

| |

|

|

| British Columbia |

001-35447 |

98-1006991 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification Number) |

Suite 1150, 609 Granville Street

Vancouver, British Columbia

Canada, V7Y 1G5

(Address of principal executive offices, including

zip code)

(604) 638-8088

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2 below):

☐ Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.24d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.23e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Shares |

TMQ |

NYSE American

Toronto Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ☐

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 | Results of Operations and Financial Condition |

On February 9, 2024, Trilogy Metals Inc. (the “Company”)

issued a press release reporting financial results for the fiscal year and fourth quarter ended November 30, 2023. A copy of the press

release is furnished as Exhibit 99.1 to this report.

In accordance with General Instruction B.2 of Form

8-K, the information in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed to be “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liability

of that section, and shall not be incorporated by reference into any registration statement or other document filed under Securities Act

of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

| Item 7.01 | Regulation FD Disclosure |

On February 9, 2024, the Company issued a press release reporting financial

results for the fiscal year and fourth quarter ended November 30, 2023.

A copy of the press release is furnished as Exhibit 99.1 to this report.

In accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K, including Exhibit 99.1, shall

not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement

or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific

reference in such filing

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

|

TRILOGY METALS INC. |

| |

|

|

| Dated:

February 9, 2024 |

By: |

/s/ Elaine Sanders |

| |

|

Elaine Sanders, Chief Financial Officer |

Exhibit 99.1

Trilogy Metals Reports Fiscal 2023 Year End Results

VANCOUVER, BC, Feb. 9, 2024 /CNW/ - Trilogy Metals

Inc. (TSX: TMQ) (NYSE American: TMQ) ("Trilogy Metals", "Trilogy" or "the Company") announces its financial

results for the year and fourth quarter ended November 30, 2023. Details of the Company's financial results are contained in the audited

consolidated financial statements and Management's Discussion and Analysis in our annual report on Form 10-K which will be available on

the Company's website at www.trilogymetals.com, on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov. All amounts are in United

States dollars unless otherwise stated.

Annual Financial Results

The following selected annual information is prepared

in accordance with U.S. GAAP.

in thousands of dollars,

except for per share amounts |

| Selected financial results |

Year ended

November 30,

2023

$ |

Year ended

November 30,

2022

$ |

| Exploration expense |

43 |

47 |

| General and administrative |

1,328 |

1,287 |

| Investor relations |

130 |

183 |

| Professional fees |

1,073 |

998 |

| Salaries |

753 |

984 |

| Salaries & directors fees – stock-based compensation |

3,887 |

3,427 |

| Share of loss on equity investment |

7,844 |

17,360 |

| Comprehensive loss for the year |

(14,951) |

(24,257) |

| Basic and diluted loss per common share |

(0.10) |

(0.17) |

For the year ended November 30, 2023, we reported

a net loss of $15.0 million (or $0.10 basic and diluted loss per common share) compared to a net loss of $24.3 million (or $0.17 basic

and diluted loss per common share) in fiscal 2022. The $9.3 million decrease in comprehensive loss in the current year, when compared

to fiscal 2022, is due to the decrease in our share of losses from our equity investment in Ambler Metals LLC of $9.5 million, decrease

in salaries of $0.2 million and partially offset from an increase of $0.6 million in salaries and directors expense – stock-based

compensation, when compared to prior fiscal year 2022. The decrease in our share of losses of Ambler Metals of $9.5 million is mainly

due to the decrease in mineral property expenses over the comparative fiscal year 2022. The lack of an exploration drilling program during

the 2023 summer field season resulted in decreases in drilling, engineering, and project support cost and partially offset from the increase

in spending on the Ambler Access Project.

Outlook for 2024

Ambler Metals LLC ("Ambler Metals" or the

"Joint Venture"), the joint venture operating company owned equally by Trilogy and South32 Limited (ASX, LSE, JSE: S32; ADR:

SOUHY), had $63.8 million of cash as at the fiscal year end on November 30, 2023. The owners have approved a budget for Ambler Metals

for fiscal 2024 in the amount of $5.5 million (2023 - $9.2 million) and $2.5 million (2023 - $12.3 million) for the Ambler Access Project

of which the entire amounts are funded by the Joint Venture. The main focus of this year's $5.5 million budget for Ambler Metals

is to support external and community affairs, maintain the State of Alaska mineral claims in good standing and the maintenance of physical

assets.

The Company has approved a 2024 cash budget for corporate,

head office, activities of approximately $2.8 million (2023 - $4.0 million). The corporate budget consists of personnel and related

costs of $0.7 million (2023 - $0.9 million), professional fees of $0.6 million (2023 - $1.5 million), investor relations and marketing

costs of $0.1 million ( 2023 - $0.2 million), office related costs of $0.4 million (2023 - $0.4 million), insurance costs of $0.6 million

(2023 - $0.6 million), regulatory costs of $0.3 million (2023 - $0.3 million) and exploration activities of $0.1 million (2023 - $0.1

million). Trilogy had $2.6 million of cash at the fiscal year end on November 30, 2023. The Company intends to finance its

future budget requirements through a combination of debt and/or equity issuance.

Liquidity and Capital Resources

On April 25, 2023, the Company completed a non-brokered

private placement of 5,854,545 common shares of the Company (the "Common Shares") at a price of $0.55 per Common Share for gross

proceeds of $3.2 million and net proceeds of $3.1 million. Financing costs consisted of legal and stock exchange fees.

During the 2023 fiscal year, we expended $3.1 million

on operating activities with the majority of cash spent on corporate salaries, professional fees related to our annual regulatory filings,

annual insurance renewal, annual fees paid to the Toronto Stock Exchange and the NYSE American Exchange and with the American and Canadian

securities commissions.

As at November 30, 2023, we had $2.6 million in cash

and working capital (current assets less current liabilities) of $2.4 million. Management continues with cash preservation strategies

to reduce cash expenditures where feasible, including but not limited to reductions in marketing and investor conferences and office expenses.

In addition, the Company's Board of Directors have agreed to take all of their fees in shares of the Company in an effort to preserve

cash and increase share ownership. The Company's senior management team are also taking a portion of their base salaries in shares

of the Company to preserve cash.

All project related costs are funded by the Joint

Venture. Ambler Metals is well funded to advance the Upper Kobuk Mineral Projects ("UKMP") with $63.8 million in cash and $62.4

million in working capital as at November 30, 2023. There are sufficient funds at the Joint Venture to fund an operating budget of $5.5

million and $2.5 million for the Ambler Access Project for fiscal 2024. Trilogy does not anticipate having to fund the activities of Ambler

Metals until the current cash balance of $63.8 million is expended.

Future cash requirements may vary materially from

current expectations. The Company will need to raise additional funds in the future to support its operations and administration expenses.

Future sources of liquidity are likely in the form of an equity financing but may include debt financing, convertible debt, exercise of

options, or other means. The continued operations of the Company are dependent on its ability to obtain additional financing or to generate

future cash flows. There is no assurance that the Company will be able to obtain such financings or obtain them on favourable terms. These

uncertainties raise substantial doubt about the Company's ability to continue as a going concern.

Qualified Persons

Richard Gosse, P.Geo, Vice President Exploration for

Trilogy Metals Inc., is a Qualified Person as defined by National Instrument 43-101. Mr. Gosse has reviewed the technical information

in this news release and approves the disclosure contained herein.

About Trilogy Metals

Trilogy Metals Inc. is a metal exploration and development

company holding a 50 percent interest in Ambler Metals LLC, which has a 100 percent interest in the Upper Kobuk Mineral Projects in northwestern

Alaska. On December 19, 2019, South32, a globally diversified mining and metals company, exercised its option to form a 50/50 joint venture

with Trilogy. The UKMP is located within the Ambler Mining District which is one of the richest and most-prospective known copper-dominant

districts in the world. It hosts world-class polymetallic volcanogenic massive sulphide ("VMS") deposits that contain copper,

zinc, lead, gold and silver, and carbonate replacement deposits which have been found to host high-grade copper and cobalt mineralization.

Exploration efforts have been focused on two deposits in the Ambler Mining District – the Arctic VMS deposit and the Bornite

carbonate replacement deposit. Both deposits are located within a land package that spans approximately 190,929 hectares. Ambler Metals

has an agreement with NANA Regional Corporation, Inc., an Alaska Native Corporation that provides a framework for the exploration and

potential development of the Ambler Mining District in cooperation with local communities. Trilogy's vision is to develop the Ambler Mining

District into a premier North American copper producer while protecting and respecting subsistence livelihoods.

Cautionary Note Regarding Forward-Looking Statements

This press release includes certain "forward-looking

information" and "forward-looking statements" (collectively "forward-looking statements") within the meaning

of applicable Canadian and United States securities legislation including the United States Private Securities Litigation Reform Act of

1995. All statements, other than statements of historical fact, included herein, including, without limitation, proposed advancement of

the Ambler Road Project, planned activities at the UKMP, the outlook for 2024, the Company's anticipated budget for corporate activities

and the Company's ability to fund its operations and the requirement for additional funding at Ambler Metals, resource estimates, are

forward-looking statements. Forward-looking statements are frequently, but not always, identified by words such as "expects",

"anticipates", "believes", "intends", "estimates", "potential", "possible",

and similar expressions, or statements that events, conditions, or results "will", "may", "could", or "should"

occur or be achieved. Forward-looking statements involve various risks and uncertainties. There can be no assurance that such statements

will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Important

factors that could cause actual results to differ materially from the Company's expectations include the uncertainties involving the outcome

of pending litigation, success of exploration activities, permitting timelines, requirements for additional capital, risks pertaining

to the outbreak of the coronavirus (COVID-19), government regulation of mining operations, environmental risks, prices for energy inputs,

labour, materials, supplies and services, uncertainties involved in the interpretation of drilling results and geological tests, unexpected

cost increases and other risks and uncertainties disclosed in the Company's Annual Report on Form 10-K for the year ended November 30,

2023 filed with Canadian securities regulatory authorities and with the United States Securities and Exchange Commission and in other

Company reports and documents filed with applicable securities regulatory authorities from time to time. The Company's forward-looking

statements reflect the beliefs, opinions and projections on the date the statements are made. The Company assumes no obligation to update

the forward-looking statements or beliefs, opinions, projections, or other factors, should they change, except as required by law.

View original content:https://www.prnewswire.com/news-releases/trilogy-metals-reports-fiscal-2023-year-end-results-302058225.html

SOURCE Trilogy Metals Inc.

View original content: http://www.newswire.ca/en/releases/archive/February2024/09/c2959.html

%CIK: 0001543418

For further information: Company Contacts: Tony Giardini, President

& Chief Executive Officer; Elaine Sanders, Vice President & Chief Financial Officer, Phone: 604-638-8088

CO: Trilogy Metals Inc.

CNW 06:30e 09-FEB-24

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

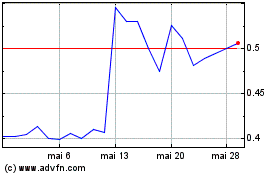

Trilogy Metals (AMEX:TMQ)

Gráfico Histórico do Ativo

De Out 2024 até Out 2024

Trilogy Metals (AMEX:TMQ)

Gráfico Histórico do Ativo

De Out 2023 até Out 2024