Where Did You Make Your Money in the Rally? - Real Time Insight

06 Março 2012 - 10:52AM

Zacks

When asked which two sectors would underperform

this year, I picked Financials and Materials. The first I thought

would still be susceptible to Euro-contagion, US regulation, and

mortgage market fallout. The second I thought would see a

leveling-off in commodity prices as China slowed down. And I

thought Energy would be a top out-performer. Got that one wrong

too... so far.

Surprisingly, Financials (XLF) were the

top-performing sector in the S&P grouping of 9 SelectSectors,

as shown below. I guess they were so trashed in late 2011 that they

had a lot of recovery to do as Euro-worries fell

away.

Two questions...

If you made money in Technology (XLK) and/or

Consumer Discretionary (XLY), what were your biggest

winners?

Energy (XLE) gave back half of its 3-month gains

in only the past 6 or so trading sessions. Is this a bigger signal

about the global economy, or a buying

opportunity?

Cooker

To read this article on Zacks.com click here.

Zacks Investment Research

Industrial Select Sector (AMEX:XLI)

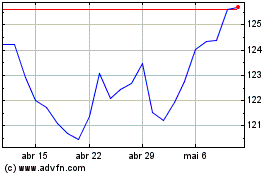

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

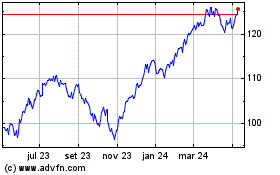

Industrial Select Sector (AMEX:XLI)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025

Notícias em tempo-real sobre Industrial Select Sector da American Stock Exchange bolsa de valores: 0 artigos recentes

Mais Notícias de Industrial Select Sector Spdr Fund