Although Europe clearly has some severe issues, the situation is

much better in the U.S. market. While the jobs picture is still

cloudy, the industrial side of the equation is looking much more

robust.

Recent data suggests that industrial production levels are

rising at a solid clip, led by strength in manufacturing and even a

move higher in the capacity utilization rate. In fact, this figure

is now approaching 80% while inventories are still at a healthy

level.

However, while the economy may be improving ever so slightly in

the U.S., the sentiment regarding the industrial sector has been

decidedly negative as of late. This reversal is partially due to

weakness in some of the regional Fed reports and durable goods

orders, while fears over lower European and emerging market demand

haven’t helped matters either.

Thanks to this shifting perception of the space, the most

popular way to invest in the segment in ETF form, the

Industrial Select Sector SPDR (XLI) has been a

weak performer in recent trading. The ultra popular ETF is now up

just 3.8% on the year and has slid by about 5.1% in the past month

alone.

Meanwhile, from an individual stock perspective, the view isn’t

much better. GE performed well to start the year,

but has been stuck in a tight and bearish range as of late, casting

a shadow over the entire sector. Additionally, United

Technology Corp (UTX) has seen a similar bout of weakness

in the past month and could see more trouble thanks to a downgrade

from ratings agency Fitch.

Clearly, the industrial sector, even with decent fundamental

data, is quickly become a segment to avoid in the near term,

especially if these current trends continue. It appears as though

investors are, at least for now, focusing on the global environment

rather than looking at some of the otherwise solid prospects in the

space.

However, while XLI and a few other large cap focused, passive

ETFs have floundered in recent months, the trend hasn’t been

universal by any means. Instead, a number of ETFs have managed to

put up solid gains in this uncertain market environment bucking the

bearish tone that is clearly plaguing most of the securities in the

industrial sector (see more on ETFs at the Zacks ETF

Center).

Below, we highlight three of these industrial ETFs which have

outperformed XLI in both the current quarter and from a

year-to-date look as well. While there is no guaranteeing that any

of these products will continue to outgain their State Street

counterpart, it is probably worth noting which segments of the

broad industrial sector have been the star performers during this

difficult time:

Guggenheim Airline ETF (FAA)

Despite some concerns over business travel and oil prices, the

airline industry has been a solid segment of the Industrial sector.

FAA is now up close to 9.7% over the course of 2012 while it has

lost just 1.4% so far in the quarter (read Utility ETFs: Slumping

Sector In Rebounding Market).

Clearly, the product has been helped by slumping oil prices and

some bargain buying in the space as of late helping to push this

product away from its 52 week lows. Oil prices represent a

significant input cost for airlines so the $15/bbl. slide over the

course of May certainly helped FAA hold up nicely in the otherwise

rough market for industrials.

In terms of holdings, the ETF has about 25 securities in its

basket, with airlines coming from around the world. Major U.S.

airlines dominate the top spots although close to 25% of the fund

is from international airlines as well.

For the style box, blend securities comprise roughly half of the

assets while value takes up much of the rest. However, this value

tilt is likely balanced out by the strong mid cap presence in the

fund as just 7% of the product is in large caps or bigger.

iShares MSCI ACWI ex US Industrials Sector Index Fund

(AXID)

While some foreign markets may be slowing down, it appears as

though investors haven’t yet soured on the international

industrials market. This developed market fund is up more than 11%

so far this year while it has lost just 2.1% so far this

quarter.

This might be somewhat surprising to investors as the product

has significant exposure to European securities in its portfolio.

The product also puts nearly 23% of its assets in securities that

are euro denominated, a situation which probably hasn’t helped the

return as of late (see The Comprehensive Guide to Consumer Staples

ETFs).

Instead, the product appears to be saved by its solid exposure

to Japan (29%), and strong European countries such as Germany,

Switzerland, and Sweden. Beyond this, the product puts just about

5% in PIIGS nations, suggesting that the exposure to the weakest

economies of all is pretty light.

Thanks to this profile as well as a heavy focus on large cap

securities, AXID has managed to avoid much of the turmoil that the

rest of the industrial sector has faced. Additionally, since the

fund holds over 220 securities in its basket and pays a solid yield

of over 3%, it has been a less volatile play on the segment as

well.

EGShares Industrials GEMS ETF (IGEM)

Much like the developed markets, emerging market industrials

have managed to avoid much of the turmoil in the past few weeks,

largely thanks to solid growth prospects. While this has admittedly

come down in recent sessions, emerging markets still are among the

highest growth areas that investors have left. In fact, so far in

2012, IGEM has added about 15.3% while it has lost about 3.2% since

the beginning of the quarter.

However, investors should note that the product is very thinly

traded and is much more expensive than other industrial ETFs on the

market today. Additionally, it isn’t a pure industrial play as it

has significant exposure to consumer and basic material stocks as

well. Lastly, the ETF is also trading at a large premium to NAV, a

factor that can work in an investor’s favor initially, at least

until this eventually collapses.

Still, the product has been the top performer in the industrial

space so far this year, while during down markets its losses have

been quite tolerable. This is likely due to the heavy focus on both

value securities and those in the large cap space (see The Guide to

Small Cap Emerging Market ETFs).

Beyond this, investors should also note that the fund has a

significant holding in Indian and Chinese securities (close to 50%

of the portfolio in these two nations) while South Africa,

Malaysia, and Mexico round out the top five. This diversified

country exposure helps to take the sting out of the relatively

small portfolio size—30 firms— and less concentrated portfolio.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

GENL ELECTRIC (GE): Free Stock Analysis Report

UTD TECHS CORP (UTX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

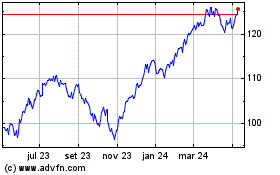

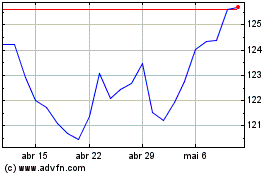

Industrial Select Sector (AMEX:XLI)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Industrial Select Sector (AMEX:XLI)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025