What to Know from March's Strategy Report - Analyst Blog

11 Março 2013 - 10:22AM

Zacks

After the stock market’s strong year-to-date gains, we have

updated our outlook for the market in the Zacks Market

Strategy report for March, available on Zacks Premium.

Here is a short summary of the report’s key points:

Year-end 2013 Target for the S&P 500

At 14.7 times this year’s conservative earning estimate, stocks

remain slightly undervalued. Consider the average stock market P/E

is 15. Apply that to $113 per share optimists expect for the

S&P 500 in 2013 (Ticker:SPY).

That computes to fair value at 1695!

Even if you say those earnings projections are high (we would

agree), trimming to a more conservative level of $105 per share

gives S&P 500 fair value of 1575.

With the above, we remain comfortable putting out a 2013 target of

1600 for the year-end S&P 500. That is an earnings yield of

6.56%. In fact, if we get towards the end of 2013 with U.S.

GDP in healthy shape and no U.S. recession on the horizon, we could

easily get a nice stretch above 1600.

Stocks have run for close to 4 months. Is a pause or correction

due? The last two macro event relief rallies in 2010 and 2011

lasted six months. Sell in May and go away?

Fourth Quarter Earnings Season Concluded

For Q4, 97% S&P 500 companies have reported earnings and

revenues. They were up +2.2% and +1.5% y/y, respectively.

Revenue outperformance has been largely a function of subdued

expectations. This was better than Q3, but the second lowest growth

rates since the recovery got underway in 2009.

The market doesn’t seem overly concerned. It is looking ahead

to expected GDP growth in 2H-13. Earnings growth in 2H-13 and 2014,

which mirror estimates for GDP growth, shows a material ramp

up. A less worrisome tone on company guidance in Q4 earnings

calls and recent favorable macro data raised confidence.

This has been at play in the S&P 500’s positive momentum.

March S&P 500 Sector Update

(A) With a rise in Feb. U.S. jobs numbers and upward 2013 jobs

revisions, and a stock market hitting multi-year highs, the

personal sides of Consumer Staples (Ticker: XLP) and

Consumer Discretionary (Ticker: XLP) are highly

ranked: Soap & Cosmetics, Home Furnishing -

Appliance, Apparel and Leisure Activities ranked

well.

The basics underperform: Food, Beverages,

Autos-Tires-Trucks and Tobacco industries showed us

very weak Zacks Ranks in the space.

(B) High Zacks Ranked industries arrived from building U.S.

momentum in the Finance sector (Ticker: XLF) focused on

home finance and the stock market. Thrifts & Mortgage

Finance and Investment Banking & Brokering

industries showed up strong.

Real Estate (REITs and Management) remains a Market

Weight.

(C) Marked improvement in the domestic and global outlook (mostly

China) pushed up the Materials (Ticker: XLB) sector.

Strength was apparent in high Zacks Industry Ranks for

Chemicals and Paper.

(D) In addition, there is a notable change inside the Industrials

sector (Ticker:XLI) on this stronger domestic and global

outlook. Electrical Machinery, Construction -

Building Services, Transportation and Transportation -

Air rebounded nicely.

Industrial Products - Services, Metal Fabricating

and Business Products still struggle.

(E) IT (Ticker: XLK) looks strong now, as Telco Hardware

and Electronics rose to become attractive Zacks Ranked

Industries. Semiconductors remained a market weight.

Computer Software & Services ranked as a market weight

industry after the conclusion of Q4-12 earnings too.

(F) Stronger gasoline at the pump prices played out within the

Energy sector (Ticker: XLE). We saw

Oil-Misc. with its Refiners do best in the Zacks

Ranks, though there was a Zacks Rank rise in Drilling,

E&P and Integrated Oil companies further

downstream.

Alternative Energy and Coal remain weak, victims

of low natural gas prices.

SPDR-MATLS SELS (XLB): ETF Research Reports

SPDR-EGY SELS (XLE): ETF Research Reports

SPDR-FINL SELS (XLF): ETF Research Reports

SPDR-TECH SELS (XLK): ETF Research Reports

SPDR-CONS STPL (XLP): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

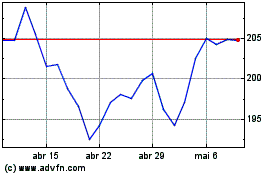

Technology Select Sector (AMEX:XLK)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

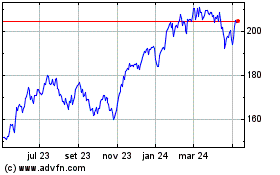

Technology Select Sector (AMEX:XLK)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024