Buy or Sell: Intel (INTC) - Real Time Insight

09 Abril 2013 - 8:33AM

Zacks

Like many tech stocks to start 2013, Intel

(INTC) has been rangebound. The computer chip giant is

pretty much flat on the year, representing a slight

underperformance when compared to the broad tech (XLK) sector.

This continues the sluggish trend for INTC, as the company has

struggled over the past year, losing about 25% of its value in the

time frame. This is especially bad considering that XLK is more or

less flat in the same period, meaning that INTC has been a chronic

underperformer.

Obviously, this hasn’t always been the case for INTC, as the

firm was crushing the tech competition for a big chunk of 2011 and

2012, before it swooned last April and never looked back. Clearly,

perceptions have changed on INTC lately and some believe that there

aren’t many catalysts to rekindle the company’s prospects going

forward.

Still, INTC remains a vital part of a number of computing

devices, while its weak stock price has sent the yield up to an

impressive level. The company is actually paying out over 4% at

time of writing, so it could be considered a yield destination by

some, and especially those who are looking for income options in

the technology arena.

But what’s next for INTC? Can the company see a rebound in its

share price, or is it doomed to the realm of slow growth higher

yield firms in the tech world?

And most importantly, are you a buyer or seller of INTC at this

point in time?

Reasons to Buy:

- Combine the Forward PE (below 11) and a yield above 4% and you

have a great value in the technology world.

- Earnings estimates have been moving slightly higher for the

current quarter, suggesting analysts are growing more bullish on

the firm’s prospects.

- INTC also has a history of positive surprises; the firm has

beaten expectations for the last four quarters.

Reasons to Sell:

- Year-over-year growth is quite poor for INTC, with current

quarter and current year estimates coming in at negative double

digits.

- While the stock might be in a highly Ranked Zacks Industry, it

is just a 3 and there are plenty of other options in the space that

have better Zacks Ranks.

- INTC has long been the king of PC chips, but can they pick up

the pace (and market share) in the increasingly important

smartphone market despite being the (relative) newcomer to the

space?

Which story wins out for you; the value of this high yielder, or

worries over its future?

Let us know in the comments below!

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

INTEL CORP (INTC): Free Stock Analysis Report

SPDR-TECH SELS (XLK): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

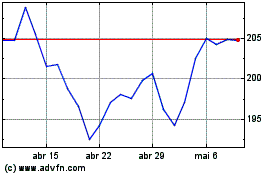

Technology Select Sector (AMEX:XLK)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

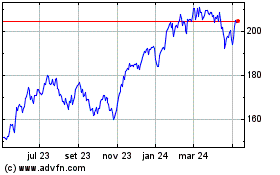

Technology Select Sector (AMEX:XLK)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024