AGL to Supply Natural Gas to GLNG Project

23 Dezembro 2015 - 8:51PM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--AGL Energy Ltd. (AGL.AU) has struck a deal

to sell natural gas to the Gladstone liquefied natural gas project,

one of three massive gas-export venture ramping up production on

Australia's east coast.

The gas will be supplied over an 11-year period beginning in

January 2017, with pricing based on an oil-linked formula, the

energy generator and retailer said Thursday.

It is AGL's first longterm gas sale to the GLNG project but the

third sale from the company's wholesale gas portfolio to LNG

projects in eastern Queensland state.

Santos Ltd. (STO.AU), which has a 30% stake in the GLNG project,

separately said the purchase deal was for 254 petajoules of natural

gas sourced from coal-seam gas fields in Queensland.

The project has shipped six LNG cargos since the first left the

site in October.

France's Total SA (TOT) and Malaysia's Petroliam Nasional Bhd.

each own 27.5% of GLNG, and South Korean utility Korea Gas Corp.

the remaining 15%.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

December 23, 2015 17:36 ET (22:36 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

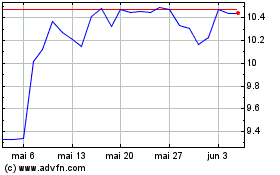

AGL Energy (ASX:AGL)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

AGL Energy (ASX:AGL)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024

Notícias em tempo-real sobre AGL Energy Limited da Australian Stock Exchange bolsa de valores: 0 artigos recentes

Mais Notícias de Agl Energy Fpo