Lawsuit Alleges Banks Manipulated Australian Rate

18 Agosto 2016 - 8:10AM

Dow Jones News

MELBOURNE, Australia—A lawsuit filed in the U.S. accuses

Australia's biggest banks and a number of international investment

banks of fixing Australia's primary interest-rate benchmark.

The class-action lawsuit echoes allegations against three of the

Australian lenders by the country's securities regulator, which

accuses them of manipulating the bank-bill swap rate from

2010-2012. All three have denied wrongdoing.

A lawsuit, filed by two U.S. investment funds and a trader,

casts a wider net, claiming that more than a dozen banks and two

brokerages intentionally and systematically manipulated the

benchmark rate and rate-based derivatives prices to gain hundreds

of millions of dollars or more in illegitimate profits.

The suit—filed on behalf of anyone who engaged in U.S.-based

transactions priced, benchmarked or settled based on the bank-bill

swap rate from at least January 2003—demands a jury trial and is

seeking injunctions against the defendants and damages for the

alleged violations.

The filing names, among others, Australia & New Zealand

Banking Group Ltd., Commonwealth Bank of Australia Ltd., National

Australia Bank Ltd., Macquarie Group Ltd. and Westpac Banking

Corp.

The Australian Securities and Investments Commission had

previously filed lawsuits against National Australia Bank, Westpac

and ANZ.

The U.S. lawsuit claims that the bank communications the

commission filed in Australia as part of its cases show that the

defendants manipulated the benchmark rate and the prices of

derivatives based on the rate.

The suit is led by Sonterra Capital Master Fund, FrontPoint

Financial Services Fund LP and trader Richard Dennis, and alleges

that the plaintiffs manipulated money-market transactions during

the fixing window for the bank-bill swap rate, made false rate

submissions, bought or sold money-market instruments at a loss to

create artificial derivatives prices, and shared proprietary

information on derivatives based on the bank-bill swap rate.

The result, the suit alleges, was that members of the class

action were overcharged and underpaid in their own transactions and

were unable to accurately price derivatives based on the benchmark

rate or determine their settlement value.

Westpac denied the allegations in the claim and said that if

served, it would defend the allegations vigorously. ANZ and

Commonwealth Bank also said they planned to defend against any

action, while National Australia Bank reiterated that it didn't

agree with the claims previously made by Australia's securities

regulator. Macquarie declined to comment.

A spokesman at HSBC Holdings PLC, which was among the

international banks named in the class-action suit, said the

company wasn't able to comment on continuing legal action. Other

plaintiffs weren't immediately reachable for comment.

The lawsuit was filed in the U.S. District Court for the

Southern District of New York on Tuesday, according to a copy

viewed by The Wall Street Journal.

In June, the Australian Securities and Investments Commission

launched legal action against National Australia Bank in the

federal court in Melbourne, alleging "unconscionable conduct" and

market manipulation with regard to rate setting between June 2010

and December 2012. The commission began similar proceedings against

Westpac in early April and against ANZ a month earlier.

Since 2012, the regulator has been investigating banks' trading

dating back to 2007 in Australia's bank-bill swap-rate market, the

benchmark used in the country's markets. The probe came after

rate-fixing scandals elsewhere, including one over manipulation of

the London interbank offered rate, or Libor.

Before late September 2013, the Australian benchmark was based

on submissions from up to 14 local and overseas banks. After

eliminating the highest and lowest, the Australian Financial

Markets Association would calculate the mean of the rest. Since

September 2013, the benchmark has used an electronic compilation of

the midpoint in the locally traded market for reference bank bills,

eliminating the need for submissions from the banks.

On Thursday, ANZ said that there had been no allegations by the

Australian regulator of collusion among the banks it has taken

action against.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

August 18, 2016 06:55 ET (10:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

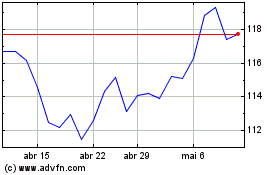

Commonwealth Bank Of Aus... (ASX:CBA)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Commonwealth Bank Of Aus... (ASX:CBA)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024