ETH/BTC Bounces From A 7-Year Support Trend Line: Ethereum To $4,900?

27 Maio 2024 - 4:30PM

NEWSBTC

After a crucial week for Ethereum, a technical candlestick

arrangement shows that ETH prices could prepare for a sharp upturn

in the coming weeks and months. Pointing out events in the monthly

chart, one analyst notes that the ETH/BTC ratio reverses from a

multi-year support trend line. Usually, the analyst continued, when

prices bounce from this line, altcoin prices tend to react,

trending higher. ETH/BTC Rising From Crucial Support Trend

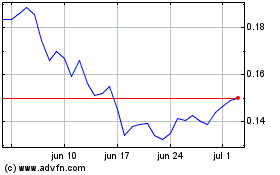

Line The ETH/BTC is a ratio closely monitored by technical

analysts. It compares the performance of the world’s first and

second most valuable coins. Although Bitcoin has been firm for the

better part of the last two years, the monthly chart clearly shows

a descending channel, indicating an upward trend. So far, there

have been a series of higher lows. This suggests that bulls have

been soaking in selling pressure over the years, keeping prices

higher. Related Reading: XRP Bullish Outlook: Analyst Predicts Mega

Run On The Horizon Looking at the monthly chart, this month’s bar

will close firmly as bullish. This will result in a double-bar

bullish reversal pattern that may ignite demand. This will

subsequently help pump ETH prices even higher. Even so, the

relatively lower trading volume, lower than those seen in July

2022, suggests that participation is not at historically high

levels. A bullish bar in June confirming this month’s gain could be

the base of another leg up. If this happens, it will mirror those

of January 2021. Another 40% gain versus Bitcoin could see ETH

close above 0.08 BTC, propelling the coin closely toward 2017

highs. Overall, Bitcoin has been firm. From September 2022,

BTC has been outperforming ETH, erasing gains from 2020 and 2021.

The result was a descending channel, though this phase of lower

lows also had relatively low participation levels. Technically,

based on a volume analysis, this is bullish for ETH. Even so, a

close above 0.08 BTC would be a strong testament from the bulls. It

could potentially set a foundation to cement ETH, further narrowing

BTC’s dominance. Spot Ethereum ETFs To Drive Demand: Path To

$4,900? Over the years since launching and the final approval of

spot Bitcoin exchange-traded funds (ETFs) in January, the digital

asset was the only one recognized by the United States Securities

and Exchange Commission (SEC). Because of this advantage, the

approval of the derivative product has seen BTC become an

institution’s go-to asset. Wall Street players like Fidelity and

BlackRock have been enabling exposure to BTC via spot ETFs over the

past four months, resulting in billions being poured into the

asset. Related Reading: Chart Whisperer Spots Algorand

Breakout: Get Ready For A 50% Rally However, this changed last week

when the United States SEC approved listing all spot Ethereum ETFs.

ETH staking was removed from amended 19b-4 files. Still, the fact

that Ethereum is almost being clarified represents a massive boost

for the network and the platform. ETH prices shot by as much as 30%

in response, outperforming Bitcoin. It is highly likely that ETH

prices will continue rising in the coming weeks. Though it remains

to be seen how the reception will be, especially among investors,

the coin, like BTC prices post mid-January 2024, will rally,

perhaps breaking $4,100 and even all-time highs of 2021.

Feature image from iStock, chart from TradingView

Algorand (COIN:ALGOUSD)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Algorand (COIN:ALGOUSD)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024