Is Apecoin On Your Radar? APE Soars By 30% In 48 Hours, Signaling A Potential Bull Run

26 Novembro 2023 - 7:43AM

NEWSBTC

In a month marked by heightened volatility, Apecoin (APE) has been

a battleground for bulls striving to prevent a dip below the

crucial $1 mark. This tug-of-war between bulls and potential

downward pressure underscores the intense market dynamics

surrounding Apecoin, leaving investors on the edge as they monitor

the crypto’s price movements in this volatile November landscape.

The latest data from the spot market reveals a resolute stance from

bullish traders, as orders for more than 11 million APE tokens have

beern strategically placed around the current price. Related

Reading: Bitcoin Price Rockets Past $38,000, Hits Highest Peak

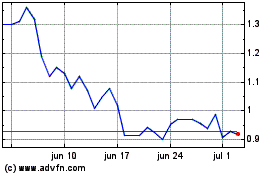

Since May 2022 – Details APE has increased by 30% to surpass $1.70

following a decline to a weekly low of $1.30 on November 21.

On-chain data projects long-term Apecoin investors’ resilience

might reenergize APE price possibilities. APE Total Order Books.

Source: IntoTheBlock Apecoin Price Rebounds From All-Time Low

On October 9, the price of Apecoin plunged to an all-time low and

narrowly avoided breaking below the $1 support level. However, the

APE token has now increased by 40%, and as of November 24, the meme

coin was trading at about $1.45. The market situation that APE is

now operating in is difficult. The recent price increases of the

token are at risk due to bearish on-chain indicators. Over the last

few months, the amount of APE coins available on exchanges has

almost doubled to a little over 50 million, which may signal an

increase in buyer demand. The combination of a decrease in active

addresses and an increase in supply on exchanges indicates a

pessimistic deviation, which may indicate an impending decline in

the price of the meme currency. Two notable corrections have

occurred in APE during its current surge. The 61.8% Fibonacci level

marked the first retracement, and 50% marked the second corrective.

Total crypto market cap is currently at $1.4 trillion. Chart:

TradingView.com These retracements are getting thinner, which is a

bullish indication of increasing momentum and more buyer

conviction. Taking this into consideration, investors may use the

38.2% and 50% Fibonacci levels as a helpful guide when placing

stop-loss orders, acting as a buffer against any market volatility.

Apecoin’s price is now bouncing between $1.063 and $1.506,

indicating that it is in a volatile market. There are some

indications of stability from the 10-Days Moving Average at $1.410

and the 100-Days Moving Average at $1.303. Nonetheless, it’s

important to keep an eye on the resistance levels at $1.695 and

$2.139 and the support levels at $0.365 and $0.808. These levels

will be crucial in influencing the short-term price movements of

APE. APE addresses by time held. Source: IntoTheBlock Shift In

Address Dynamics Meanwhile, as reported by IntoTheBlock, a positive

trend divergence is evident between the long-term and short-term

holder addresses for APE. Illustrated in the Addresses by Time Held

chart, the count of long-term addresses has surged by 6,060 wallets

since the beginning of November. Concurrently, the Apecoin network

has experienced a decrease of 3,800 in the number of

trader/short-term wallets over the same period, highlighting a

noteworthy shift in address dynamics. Related Reading: Coinbase

COIN Hits 18-Month High To Rally Near $117 – Is $150 On The Cards?

The forthcoming week holds significant importance for investors in

APE, as it will serve as a crucial assessment of the durability of

this meme coin and its prospects for more upward movements. (This

site’s content should not be construed as investment advice.

Investing involves risk. When you invest, your capital is subject

to risk). Featured image from Pexels

ApeCoin (COIN:APEUSD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

ApeCoin (COIN:APEUSD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024