MakerDAO Debates New EDSR Optimization Plan As MKR Bears Retain Market Control

09 Agosto 2023 - 6:00PM

NEWSBTC

MakerDAO has been in the headlines recently following a boost in

the maximum Dai Savings Rate (DSR) from 3.19% to 8% on Sunday,

August 6. This temporary increment termed the Enhanced Dai Savings

Rate (EDSR), was designed to encourage more Dai (Maker’s

stablecoin) holders to deposit their tokens on the Maker protocol

and earn interest. Following the implementation of EDSR, the Dai

token has experienced some traction, with its market cap rising by

over $570 million since Sunday, according to data from

CoinMarketCap. In addition, data from the Makerburn

dashboard shows the number of DAI in the DSR program has surged,

moving 396.8 million on August 6 to its current value of 906.7

million. However, amidst the massive success of the EDSR,

MakerDAO co-founder Christen Rune has proposed to adjust this

incentive plan “based on observed data.” MakerDAO Co-Founder

Proposes EDSR Optimization Plan To Curb ETH Whale Dominance

On August 8, Rune submitted a governance proposal on the MakerDAO

forum to optimize the Enhanced Dai Savings Rate citing an ongoing

ETH whale dominance over regular Dai holders in terms of the

program’s benefits. Related Reading: Maker (MKR) Signals

Bullish Price Formation – Is $1.300 Around The Corner? According to

Rune, offering yields on Dai that are higher than the cost of

borrowing Dai has led to certain borrowing activity known as

“borrow arbitrage,” whereby traders borrow Dai at 3.19% and deposit

in the EDSR program for 8% profit. Rune noted that this was not the

intended purpose of the EDSR plan. He stated that this investment

strategy was mainly practiced by ETH and staked ETH whales, who now

receive a higher yield at the expense of regular Dai holders,

the primary target of the EDSR program. To counter this unforeseen

circumstance, Christen Rune proposed to reduce the maximum EDSR

interest rate from 8% to 5%. Furthermore, the MakerDAO

cofounder proposes an increment in the DAI borrowing rate to be

equivalent to the EDSR rate at a minimum of 5%, thus halting the

ongoing large-scale “borrow arbitrage” activities. The proposal

also states that MakerDAO should extend Tier 1 EDSR to cover a

utilization range of 0-40% and introduce a Tier 2 EDSR for

utilization between 40-55% with the aim of making the EDSR plan

sustainable. For context, utilization refers to the portion

of the total capacity of the EDSR system that is in use. Currently,

data from Makerburn states that the EDSR has an 18% utilization

rate. Originally, the EDSR maximum yield was meant to drop to

5.8% once utilization surged to 20%, albeit that would not occur

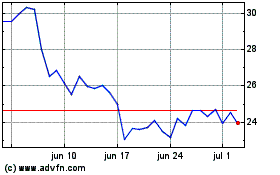

upon approval of Rune’s latest proposal. Maker (MKR)

Maintains Bearish Form Amidst ESDR Success In other news, MKR, the

native token of the MakerDAO lending protocol, has seen its market

price fall in recent days despite the massive boost in DAI’s market

shares. According to data from CoinMarketCap, MKR’s price is

down by 0.84% in the last 24 hours. This price drop adds to the

token’s prolonged bearish state, whereby it has lost over 8.26% of

its market value in the last seven days. Related Reading:

Record-Breaking $10 Billion Open Interest Fuels Bullish Speculation

For Bitcoin Reversal During this period, MKR’s price declined from

$1,339.22 on Aug.3 to as low as $1,187.66 on Aug.7. However, most

MKR investors still likely retain faith in the DeFi token, which

boasts of a positive monthly performance gaining by 32.30% in the

last 30 days. At the time of writing, MKR is trading at $1,214.28,

with a 0.39% loss in the last hour. With a market cap of $1.18

billion, the token is ranked as the 42nd largest cryptocurrency in

the market. MKR trading at 1,214.7 on the hourly chart | Source:

MKRUSD chart on Tradngview.com Featured image from Binance Academy,

chart from Tradingview.

Dash (COIN:DASHUSD)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Dash (COIN:DASHUSD)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024