Selling pressure and option expirations mark eventful week for

Bitcoin and Ethereum

This week saw selling pressure among Bitcoin miners, with

reserves hitting their lowest level since May, reflecting a steady

decline since October. Currently, reserves are at about 1.832

million BTC, with around 3,000 bitcoins sold in the last 24 hours.

The market value of Bitcoin is at $42,315 at the time of writing.

Additionally, the cryptocurrency options market records the

expiration today of more than 178,000 Bitcoin contracts and 1.49

million Ethereum contracts, totaling notional values of $7.6

billion and $3.47 billion, respectively. The market trend for

Bitcoin (COIN:BTCUSD) and Ethereum (COIN:ETHUSD) is bearish, with a

possible increase in volatility due to the expectation of a halving

in April and the expiration of options.

Delisting of privacy cryptocurrencies by OKX causes market drop

The market for privacy-focused cryptocurrencies, including Zcash

(COIN:ZECUSD) and Monero (COIN:XRMUSD), suffered a significant

decline following the announcement by exchange OKX on December 29

of its decision to delist them on January 5. Other affected

cryptocurrencies such as Dash (COIN:DASHUSD), Powerpool, and

Horizen (COIN:ZENUSD) also experienced substantial drops in the

last 24 hours. Meanwhile, OKX suspended deposits and set a deadline

until March 2024 for withdrawals of these assets. Surprisingly,

some privacy cryptocurrencies like Mina (COIN:MINAUSD) remained

listed and even appreciated after the announcement.

Avalanche Foundation explores meme coin market in new campaign

The Avalanche Foundation (COIN:AVAXUSD) plans to acquire meme

coins to diversify its portfolio and recognize different niches in

the crypto market. This initiative, inspired by the recent success

of tokens like Bonk (COIN:BONKUSD) on the Solana network, will

include purchasing specific meme coins from Avalanche. The

selection will be based on criteria such as popularity, liquidity,

project maturity, and fair launch principles. The foundation aims

to celebrate the culture and humor represented by these coins,

recognizing their significant cultural role in cryptographic

communities.

Ark 21Shares Bitcoin Trust refines details for ETF launch

The Ark 21Shares Bitcoin Trust made 16 crucial updates in its S1

filing, ranging from the Bitcoin-dollar index price to regulatory

and operational details. Changes include clarifications about

Bitcoin counterparties (COIN:BTCUSD), revision of share redemption

processes, and marketing agreements. Additionally, risks of

creation and redemption were detailed, and a limit was set on the

Bitcoin trade balance. The Trust can now use Bitcoin to pay certain

expenses, with updated tax implications for shareholders in the

sale of shares and redemption process. The filing details

additional expenses related to issuing and distributing shares,

providing a deeper understanding of the financial obligations

involved and offering a more transparent and robust framework for

the ETF’s operation.

Goldman Sachs anticipates growth in institutional interest in

crypto with ETFs

Mathew McDermott, leader of a growing digital assets team at

Goldman Sachs (NYSE:GS), predicts an increase in institutional

interest in cryptocurrencies with the potential approval of Bitcoin

(COIN:BTCUSD) and Ether (COIN:ETHUSD) ETFs. He believes this will

broaden market liquidity, facilitating the involvement of

institutions such as pension funds and insurers, who will be able

to trade institutional products without directly interacting with

the underlying assets. McDermott sees this change as gradual,

happening over the next year, with hopes for SEC approval. He also

highlights growth in tokenization and the role of blockchain in

commercial applications, mentioning the use of Goldman Sachs’

tokenization platform, GS DAP, in Hong Kong for the sale of

tokenized green bonds.

Coinbase sets a 10X leverage limit on perpetual futures contracts

Coinbase International Exchange announced the implementation of

a 10X leverage limit on all its perpetual futures contracts, aiming

to promote more efficient trading strategies. This change allows

users to continue trading within this limit but restricts new

transactions to leverage according to the company’s Standard

Initial Margin (DIM) rules. Additionally, Coinbase established a

maximum notional value limit of $90,000 per Ultimate Beneficial

Owner (UBO), with specific limits for positions in BTC, ETH, and 13

other assets. The company, which regularly reviews these limits,

mentioned it could offer higher limits based on user activity.

Coinbase International, part of the Coinbase (NASDAQ:COIN) group

and regulated by the Bermuda Monetary Authority, serves

international clients, excluding the US.

CZ of Binance requests judicial secrecy for travel documents and

preserves personal fortune

Changpeng “CZ” Zhao, founder and former CEO of Binance,

requested a US court to keep his travel documents secret, aiming to

protect his family’s privacy. This action comes amid travel

restrictions preventing him from returning to the United Arab

Emirates for a hearing in February 2024. CZ particularly seeks to

protect the medical privacy of his son. Meanwhile, CZ has

maintained his position as one of the world’s richest billionaires,

with a net worth of $37.2 billion, ranking 35th on the Bloomberg

Billionaires Index, behind names like Elon Musk and Jeff Bezos.

CataX halts operations after security breach and ongoing

investigation

CataX CTS Ltd., operator of the Calgary-based cryptocurrency

trading platform Catalyx, announced the suspension of trading and

withdrawals following a recent security breach. The move comes

after the Alberta Securities Commission issued a cease trade order

against the company and its co-founder Jae Ho Lee on December 21.

The breach resulted in the loss of customer cryptographic assets,

and there are suspicions of employee involvement in the incident.

CataX is conducting an investigation with the help of Deloitte LLP,

which will provide forensic and investigative services. Exact

details of the losses have not been disclosed, and the company

promises updates after the investigation’s conclusion.

SEC partially wins against Terraform Labs in unregistered

securities case

A New York judge ruled in favor of the SEC in part of the case

against Terraform Labs and its co-founder Do Hyeong Kwon,

confirming that the company offered and sold unregistered

securities, such as UST, LUNA, wLUNA, and MIR. Judge Jed Rakoff

stated there is no doubt that these are securities, while

allegations of fraud are still awaiting jury trial. The SEC accused

Terraform and Kwon of orchestrating a fraud with their algorithmic

stablecoin Terra USD. Terraform Labs, in turn, denies the

accusations and prepares to defend itself in the trial scheduled

for January 2024.

FTX in bankruptcy proposes evaluating digital assets in dollars to

speed up the process

FTX, now in bankruptcy proceedings, requested court approval to

assess the digital asset claims of its customers in US dollars,

aiming to facilitate the bankruptcy process. The exchange justifies

that individually liquidating each claim in digital assets is

impractical and would cause unnecessary delays in Chapter 11 cases.

The platform proposed estimated values for various cryptocurrencies

at lower than current market values. However, this action faces

opposition from creditors, who consider it an undervaluation and

are encouraging customers to contest the plan until January 11.

Yeou Jie Goh leaves DeFiance Capital to lead Chromia in

Asia-Pacific

Yeou Jie Goh, head of portfolio growth at DeFiance Capital, led

by Arthur Cheong, resigned from the company to take up a new

position at the blockchain project Chromia as head of the

Asia-Pacific region. Goh, who has been with DeFiance for over two

years, was confirmed in the new role by Or Perelman, co-founder of

Chromia. His departure comes at a challenging time for DeFiance,

which is involved in a legal dispute related to the collapse of

Three Arrows Capital. Meanwhile, Chromia, known for its Rell

programming language and as a project of ChromaWay, plans to launch

its mainnet next year, with Goh focusing on expanding the ecosystem

and attracting developers and users.

Japan’s Monex Group expands presence in crypto with acquisition of

3iQ Digital Holdings

The Monex Group, a Japanese corporation with activities in

online brokerage, cryptocurrency exchange, and asset management,

announced plans to acquire the majority of Canada-based 3iQ Digital

Holdings. The goal is to strengthen its asset management business

and capitalize on the expected growth in the sector of crypto

assets for institutional investors. The Monex, which already owns

Coincheck and TradeStation, aims to maximize synergies and

innovations with 3iQ, highlighting an advancement in the

cryptocurrency industry in Japan, including recent regulations and

partnerships with entities such as Circle and SBI Holdings.

Indonesia combats illegal Bitcoin mining with police operations

Indonesia conducted police operations in ten suspected locations

of illegal Bitcoin (COIN:BTCUSD) mining, using stolen electricity

from the state grid during the Christmas weekend. Although the

country is not a major center for cryptocurrency mining,

electricity theft is a serious crime, subject to up to five years

in prison or hefty fines. In Medan, North Sumatra, 1,314 mining

platforms were found and 26 people detained. The action caused

estimated losses of $100,000 for the state-owned electricity

company, PLN.

India tightens rules on digital assets, impacting major

cryptocurrency platforms

The Financial Intelligence Unit of India has stepped up

regulation of Virtual Asset Service Providers (VASPs), such as

Binance, KuCoin, and Huobi, for failing to comply with Anti-Money

Laundering and Counter-Terrorism Financing (AML-CFT) laws. Issuing

warnings under the Money Laundering Prevention Act, India’s FIU

underscores its commitment to regulating the cryptocurrency sector.

This action affects nine offshore entities, including others like

Kraken and Bitfinex, which operate with Indian users without proper

registration. Additionally, the FIU has requested the blocking of

URLs of these platforms for illegal operation. So far, 31 VASPs

have registered and are in compliance with India’s regulations,

demonstrating the country’s determination to strictly enforce its

financial regulations in the digital asset sector.

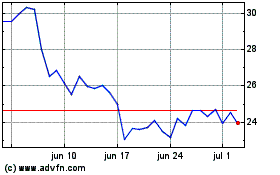

Dash (COIN:DASHUSD)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Dash (COIN:DASHUSD)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024