XRP Faces Big Challenge: Scaling The $0.55 Wall – Possible?

28 Agosto 2023 - 8:00AM

NEWSBTC

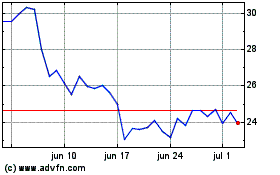

XRP, the cryptocurrency tied to Ripple, found itself entangled in a

familiar tussle with the $0.55 resistance level as bearish forces

thwarted its early attempts at a rebound. While last month’s

pivotal summary judgment offered a glimmer of regulatory clarity

for XRP, the ongoing specter of the SEC appeal and an impending

trial slated for the first half of 2024 are fostering an air of

skepticism among the investor community. Despite the much-needed

legal clarity provided by the recent summary judgment, a cloud of

uncertainty still hangs over XRP’s trajectory. The forthcoming SEC

appeal and the looming trial timeline have combined to cast doubt

on the cryptocurrency’s immediate future. The ripple effect of

these uncertainties is palpable as investors remain cautious about

diving back into the XRP market. Related Reading: Worldcoin

Meltdown: 50% Crash Caused By Mounting Data Privacy Paranoia XRP

Bearish Sentiment Prevails Price analysis indicates that the

prevailing bearish sentiment pervading the broader cryptocurrency

market is acting as a significant impediment to XRP’s upward

breakout. Santiment’s Network Value to Transaction Volume (NVT)

ratio, which gauges the relationship between a blockchain network’s

transactional activity and its recent price performance, reveals

the extent to which bearish undercurrents are hampering XRP’s

ascent. XRP price action in the daily chart. Source: Coingecko As

of now, XRP’s price hovers around $0.513, marking a decline of 2.8%

over the last 24 hours. The past week has seen the cryptocurrency

grappling with losses amounting to 1.6%, CoinGecko data shows. The

struggle to break through the $0.55 resistance level seems to

mirror the broader market sentiment, reflecting the challenges that

lie ahead. XRP market cap currently at $27.1 billion. Chart:

TradingView.com A Glimmer Of Positivity Coinalyze’s data presents a

somewhat brighter aspect. XRP’s funding rates turned green on

August 25, signifying an improved stance. Moreover, the Open

Interest (OI) rates, which indicate the total number of outstanding

derivative contracts, have risen from approximately $340 million to

surpass $360 million. This increase could signal growing interest

among traders and investors, adding a dash of optimism to the

otherwise cautious outlook. Source: Coinalyze In addition, seasoned

crypto investor Austin Hilton offers a contrarian view, suggesting

that XRP is poised for a significant 20% breakout in the short

term. Hilton points to various indicators and fundamental factors

underpinning his projection. Related Reading: The Great Bitcoin

Comeback: Will Alpha Coin Retake $28,000 Before August Ends?

Notably, his argument centers around a Tradingview indicator that

tracks momentum shifts on the daily timeframe, helping traders

determine optimal entry and exit points. XRP’s journey forward

remains intricate, marked by legal battles, market sentiment, and

technical indicators. As the cryptocurrency navigates these

multifaceted challenges, investors and enthusiasts alike eagerly

await the next chapter in XRP’s tumultuous saga. (This site’s

content should not be construed as investment advice. Investing

involves risk. When you invest, your capital is subject to risk).

Featured image from LinkedIn

Dash (COIN:DASHUSD)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Dash (COIN:DASHUSD)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024