Crypto Analyst Predicts More Trouble Ahead For Bitcoin Price, Here’s Why

21 Setembro 2023 - 5:45AM

NEWSBTC

Crypto analyst Nicholas Merten has given an insight into the future

trajectory of the Bitcoin price, suggesting that the flagship

cryptocurrency may experience turbulent times ahead. The Calm

Before The Storm For Bitcoin In a recent episode of his YouTube

channel DataDash, Merton mentioned that Bitcoin, other altcoins,

and the broader asset market were on the brink of a major move as

several macro factors were coming together. He further went ahead

to discuss how these different “dominos” could “potentially

cause a lot of pain in the economy.” Related Reading: Bearish

Signal? Bitcoin Whale Wakes Up From 6-Year Slumber And Transfers

$56 Million The first macro factor he mentioned was equities.

According to him, the direction of equities and the broader assets

are going to have a “direct impact” on Bitcoin. He showed a direct

relation between the equity market and the crypto market as coins

began to pick up at the beginning of the year, right around when

the former was on a high. However, he pointed out that the equity

market has been relatively quiet as the narratives that are meant

to push it higher haven’t done the job. As such, he believes that

if stocks like Apple’s, Microsoft’s, and Fang’s (basically the

stocks of major tech companies) don’t start picking up, then there

could be a “really big problem” (most likely in reference to the

crypto market). Re-Inflation On The Rise Another factor that he

emphasized was the inflation data. Merton seemed to suggest that

the Fed wasn’t doing enough to curb inflation and bring it down to

the target of 2%. According to him, the Fed could have taken a more

stringent approach by raising the rates by 75 basis points or even

100. The inflation rate is known to have a significant impact

on the crypto market, as a higher rate means that investors may

have little or nothing to spend in the crypto market. Merton noted

that it is evident that the Fed isn’t doing enough as the prices of

several goods and services (including energy) seem to be

re-inflating. He made a comparison to the ‘70s when inflation

was also at an all-time high and stated that if this time is nearly

similar to then or if there is a trend, then it could be a “huge

problem.” Related Reading: Is $10,000 Possible For XRP Price?

Crypto Analysts Weigh In Some may argue that the ‘70s were extreme

times, especially with the oil embargo, which makes it different

from this period. However, Merton noted that there isn’t much

difference as we have the situation with BRICS, which suggests that

the world is de-globalizing and nations are less trusting of one

another. This would invariably affect trade deals and foreign

relations, something which Merton believes would have “inflationary

pressures,” and the Fed is well aware of this. He stated that the

major reason we are experiencing this re-inflation is because

supply and demand aren’t balanced. According to him, there is

excess money in the system due to the “excess printing of money”

which people got rich off and the stimulus checks during the COVID

era. As such, there is so much purchasing power without there being

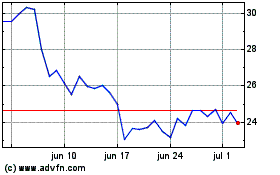

enough supply to meet these demands. BTC price drops below $27,000

once again | Source: BTCUSD on Tradingview.com Featured image from

iStock, chart from Tradingview.com

Dash (COIN:DASHUSD)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Dash (COIN:DASHUSD)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024