Spot Solana ETFs: Analyst Says Don’t Get Too Excited About The Market Recovery

28 Junho 2024 - 11:00AM

NEWSBTC

Crypto analyst Ali Martinez has warned the crypto community not to

get too excited about the recent market recovery trigger by Spot

Solana ETFs filing. Bitcoin (BTC) and the broader crypto market

witnessed a relief bounce following recent bullish developments,

but the analyst highlighted what could send the market into a

downtrend again. Why The Crypto Community Should Not

Get “Too Excited” After Solana ETFs Rally Martinez mentioned in an

X (formerly Twitter) post that the crypto community should not get

too excited because $22 million will be liquidated from the crypto

market if Bitcoin drops to $60,700. A significant amount in

liquidations could lead to further decline in the crypto market,

especially with other traders and investors looking to close their

positions for fear of being liquidated. Related Reading: Why

Is The Bitcoin Price Down Today? Martinez issued this warning

following the market rebound made by Bitcoin and altcoins. This

rebound followed news that asset manager VanEck had filed for a

Spot Solana ETF with the US Securities and Exchange Commission

(SEC). Solana, in particular, saw a price gain of over 8% and

rallied to as high as $150 following the news. The crypto

market was also buoyed in anticipation of the US presidential

debate. The crypto community had anticipated crypto being a major

talking point during the discussion, although that didn’t happen.

Regardless, there is still enough reason for the crypto market to

be excited, as VanEck’s filing for the first-ever Spot Solana ETF

marks a significant milestone not just for the Solana ecosystem but

the crypto ecosystem in general. Other asset managers

can be expected to file for a Spot Solana ETF in due time, and the

potential approval of these funds could usher in more crypto ETFs

just as the approval of a Spot Bitcoin and Ethereum ETF motivated

VanEck to file for this Spot Solana ETF. Meanwhile, the Spot

Ethereum ETFs are expected to begin trading soon, providing more

bullish momentum for the crypto market. Technical Indicators

Also Point To More Rallies For Bitcoin Martinez recently

highlighted an Adam and Eve bottoming pattern, which he claimed

seems to be forming on Bitcoin’s chart. He stated that this signals

a potential 6% rise towards $66,000 if Bitcoin can maintain a

candlestick close above $62,000. Additionally, Martinez recently

noted that the crypto market sentiment has turned into fear, which

suggests that crypto prices are currently undervalued and that a

market rebound is imminent. According to Martinez, Bitcoin’s

relative strength index (RSI) also shows that this is a good time

to buy the Bitcoin dip. Historical trends suggest that a parabolic

rally is already on the cards for the flagship crypto. Once Bitcoin

makes its move to the upside, the broader crypto market is expected

to enjoy a massive bounce. Related Reading: Dogecoin

Profitability Rises To 75% As Shiba Inu Plunges To 52% Crypto

analyst Javon Marks also alluded to Bitcoin’s RSI and highlighted a

bullish divergence pattern that had formed on Bitcoin’s chart which

he claimed validates a bullish outlook for the crypto token. He

predicted that Bitcoin could soon make a rebound to $72,000 and

possibly new all-time highs (ATHs) should this bullish pattern

hold. Featured image created with Dall.E, chart from

Tradingview.com

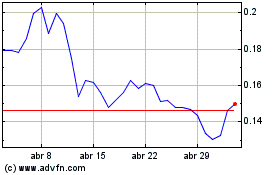

Dogecoin (COIN:DOGEUSD)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Dogecoin (COIN:DOGEUSD)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024