Solana Faces A Trend Decision, But The Bull Case Prevails

26 Abril 2023 - 6:05AM

NEWSBTC

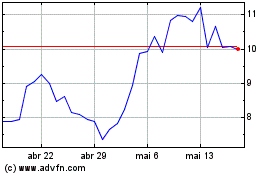

The price of Solana is facing an extremely important trend decision

in the 1-day chart. Will the uptrend continue or will it be

invalidated? The latter could threaten a drop to the

psychologically important $20 level. A look at the 1-day chart

shows that SOL failed in several attempts at the 200-day

Exponential Moving Average (EMA) (blue) in mid-April. The indicator

has an extremely high significance for the long-term trend. While

Bitcoin and numerous altcoins are already trading above the 200-day

EMA, SOL is still stuck below the trend indicator as a consequence

of the FTX crash. After falling below the 50-day EMA (orange) on

Friday, the SOL price has fought its way back above the level

today. Still, the price is at a key support, an ascending trendline

(black) that has proven directional since the December 28, 2022 low

at $7.98. A retracement could wipe out the uptrend and trigger

another drop to $20. On the other hand, a break above the 200-day

EMA currently at $25.13 could turn the chart picture in favor of

the bulls. SOL Bull Case Prevails Solana rose to $25.96 in

mid-April, but could not sustain the breakout above the 200-day

EMA. In order to start a new attempt towards the north, Solana must

break above $22.78 on a daily closing basis. If a stabilization

above this resistance level succeeds, the buy side could again

target the 200-day EMA. Only when this major trend line is broken

dynamically, the yearly high at $27.13 comes into focus, where the

38.2% Fibonacci level is also located. If the Bitcoin price also

rises to a new high for the year at this point, the SOL price could

shoot straight up to the $30.44 resistance level. However, Solana

is likely to make a stop here. The next target area after a

consolidation would then be the 50% Fibonacci level at around $33.

Related Reading: Solana (SOL) Rebounding After A Major Drop, Will

It Recover Previous Losses? In a bearish scenario, Solana falls

below the black uptrend line and then also breaks the 23.6%

Fibonacci retracement at $19.39 on the daily close. In this case,

Solana is likely to trend towards the March 10 low near $16.

Bullish News From Solana Ecosystem Fundamentals also point to a

bull case for Solana. Just recently, the Helium (HNT) Network

migrated to Solana. In early April, the Render Token (RNDR)

community voted to migrate to the high-speed blockchain. Related

Reading: Solana (SOL) Plunges Over 13% – Will It Bounce Back?

Today, Solana Labs announced an open-source reference

implementation for a ChatGPT plugin that will allow users to

interact with the SOL network directly from ChatGPT. Once

available, ChatGPT plugins will allow users to check their wallet

balance, transfer tokens, and purchase NFTs. Solana also continues

to mingle at the top of the NFT space. As one community member

points out, four of the top 10 NFT collections are based on the

Solana blockchain. Probably a dead chain 4 solana projects in the

top 10 pic.twitter.com/3158xT6XDx — Paulo (@TycoonPal) April 24,

2023 Featured image from PHD Media, chart from TradingView.com

Render Token (COIN:RNDRUSD)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Render Token (COIN:RNDRUSD)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024