Boussard & Gavaudan Holding Ltd (EUR): Interim Management

Statement for the Quarter ended 31 March 2024

Boussard & Gavaudan Holding

Limited A closed-ended investment company

incorporated with limited liability under the laws of Guernsey,

with registration number 45582.

Interim Management Statement

For the Quarter ended 29th

March 2024

I. Principal

Activities

Boussard & Gavaudan Holding Limited (“BGHL”

or “the Company”), a closed-ended investment company incorporated

under the laws of Guernsey, announces its interim management

statement for the period from 1 January to 29 March 2024 (“the

period”).

The Company is registered with the Dutch

Authority for Financial Markets and is listed on the NYSE Euronext

Amsterdam, and the London Stock Exchange.

During the period, BGHL has invested indirectly

in BG Master Fund ICAV (“BG Fund” or “the Fund”), a Europe-focused

multi-strategy hedge fund established in Ireland and authorised by

the Central Bank as a Qualified Investor Fund (QIF), through a

dedicated share class of the feeder fund, BG Umbrella Fund Plc. The

Fund aims primarily at arbitraging instruments with linear or

non-linear pay-offs on equities and credit markets. The overall

investment objective of the Fund is to provide investors with

consistent absolute returns, primarily through investing and

trading in financial instruments of companies incorporated in, or

whose principal operations are in, Europe.

In addition, a proportion of the net assets of

BGHL may be invested in other hedge funds and/or other financial

assets.

Boussard & Gavaudan Investment Management

LLP (“BGIM” or “the Investment Manager”) is the Investment Manager

for both the Company and the Fund.

II. Highlights

| |

|

29-Mar-24 |

31-Dec-23 |

|

Assets under management (€m) |

342 |

342 |

|

Market capitalisation (€m) |

320 |

313 |

|

Shares outstanding |

12,422,606 |

12,422,606 |

| |

NAV per

Share |

Share

price* |

Discount to

NAV |

| |

€

shares |

£

shares |

€

shares |

£

shares |

€

shares |

£

shares |

|

29-Mar-24 |

€ 27.55 |

£24.65 |

€ 25.80 |

£21.50 |

-6.36% |

-12.78% |

|

31-Dec-23 |

€ 27.55 |

£24.57 |

€ 25.20 |

£20.50 |

-8.52% |

-16.56% |

|

Performance |

0.02% |

0.32% |

2.38% |

4.88% |

|

|

*Amsterdam (AEX) market close for the Euro Share

and London (LSE) market close for the Sterling share

III. Performance

Global equity markets rallied during Q1 2024;

the Euro Stoxx 50® Total Return was up +12.8% in Europe, and in the

US the S&P500® Total Return was up +10.6%. In this risk-on

context the market implied volatility measure VStoxx® remained

stable and low slipping marginally from 13.6% to 13.4% while credit

markets tightened, with the iTraxx Crossover® (S38) moving from

246bps at year-end to 217bps at the end of March.

1. BG Fund

BG Fund (EUR B) contributed positively for the

quarter.

1.1. Volatility

strategies

Mandatory Convertible Bond

Arbitrage Mandatory convertible bonds contributed slightly

positively.

Convertible Bond Arbitrage

Convertible bond strategies detracted over this period, mainly

impacted by specific idiosyncratic risk positions which experienced

refinancing stress. The Investment Manager remains confident that

positive solutions will emerge for these positions soon. Apart from

these specific detractors, the fund experienced positive

contributions from positioning on volatility trades while carefully

selected credit positions also had a positive performance. The key

frustration was that European primary issuance continued to remain

at low levels. The Investment Manager hopes this is just a

temporary delay in the expected pipeline.

On the positive side, US convertible bonds had

an overall decent performance with a slow but steady rise in

valuations across the board. New issue activity was healthy, and

the anticipated pipeline has started to arrive in earnest. The fund

was selective and positioning cautiously as the large amount of

primary could lead to some cheapening in secondary markets.

Volatility Trading The period

remained challenging for volatility strategies as both realised and

implied volatility remained subdued in the continued bull market

environment. In this environment, there were few new trading

opportunities. Nevertheless, volatility trading succeeded in

contributing positively thanks to dispersion trades. During the

period, the Investment Manager made modest portfolio adjustments,

incrementally increasing positions and engaging in marginal trades

while remaining vigilant and staying alert to market shifts, ready

to take advantage of opportunities as they arose.

Warrant Trading Warrant

arbitrage contributed slightly positively.

1.2. Equity Strategies

Equity strategies ended the period almost flat.

On the positive side, the gains were spread across a wide range of

investments but aggregate performance was held back by an overall

relatively low level of corporate activity in Europe. In the

special situations book a number of expected and rumoured deals

have so far failed to materialise, or are taking longer than

expected to play out, leading to underperformance. This

notwithstanding, the interest rate and financing environment has

become more stable which should encourage the emergence of further

activity. Several new deals were announced during the quarter in

Europe and, despite these being relatively small, the investment

manager is expecting an increase in both the size and volume of

deals to come through.

1.3. Credit Strategies

Credit Long / Short Credit long

/ short contributed positively this period, driven primarily by

private credit positions.

Credit Special Situations

Credit special situations was the main detractor to the fund this

period, impacted primarily by a specific idiosyncratic position on

a French technology services company. Its bonds were extremely

volatile on thin volumes and sold off in reaction to news on

discussions surrounding a likely restructuring of the company's

balance sheet.

1.4. Trading

Trading was the main positive contributor to the

performance of the fund this period, in particular from thematic

discretionary trading and the systematic trend following

strategies.

2. Investments Other Than BG

Fund

The contribution of this investment was flat for

the period.

Rasa Resorts, S.A.P.I. de C.V.

(“Rasa”)

Rasa is a holding company structured as a

private equity fund in terms of fees and organisation and managed

by RSC Development and BK Partners. BGHL holds Rasa shares through

Campastros, S.L.U., a wholly-owned holding company in Spain. Rasa

is dedicated to investing in land, hotels and high-end resort

developments in Mexico. Rasa’s main asset is a majority interest in

ACTUR, a private company owning the land developing assets. ACTUR’s

other shareholders are Mexican public institutions.

In July 2020, Rasa made a cash tender offer to

buy back its own shares, for a price per share of US$0.12270. The

valuation of BGHL’s investment in Rasa shares was marked down on 31

August 2020, using the US$0.12270 per share price as the estimated

fair value of the Rasa shares. This price represents a circa 76%

discount to the latest published NAV per share.

IV. Outlook

Following the holding of the extraordinary

general meeting on 28 September 2023, the investment objective of

the Company changed such that the Company is now focused on

ensuring a realisation of the existing assets of the Company in an

orderly manner for investors that require it. In the meanwhile the

Investment Manager remains committed to manage funds on behalf of

all investors in the Company on an ongoing basis for as long as

required.

For further information contact:

Boussard & Gavaudan Investment

Management LLP

Emmanuel

Gavaudan (London) +44

(0)20 3751 5389

François-Xavier

Baud (Paris) +33

1 44 90 39 47

Disclaimer

The Company is established as a closed-ended

investment company domiciled in Guernsey. The Company has received

the necessary approval of the Guernsey Financial Services

Commission and the States of Guernsey Policy Council. The Company

is registered with the Dutch Authority for the Financial Markets as

a collective investment scheme pursuant to article 2:73 in

conjunction with 2:66 of the Dutch Financial Supervision Act (Wet

op het financieel toezicht). The shares of the

Company (the "Shares") are listed on Euronext Amsterdam.

The Shares are also listed on the Official List of the UK

Listing Authority and admitted to trading on the London Stock

Exchange plc's main market for listed securities.

This is not an offer to sell or a solicitation

of any offer to buy any securities in the United States or in any

other jurisdiction. This announcement is not intended to and does

not constitute, or form part of, any offer or invitation to

purchase any securities or the solicitation of any vote or approval

in any jurisdiction, nor shall there be any sale, issuance or

transfer of the securities referred to in this announcement in any

jurisdiction in contravention of applicable law.

Neither the Company nor BG Fund has been, and

neither will be, registered under the US Investment Company Act of

1940, as amended (the "Investment Company Act"). In addition the

securities referenced in this announcement have not been and will

not be registered under the US Securities Act of 1933, as amended

(the "Securities Act"). Consequently any such securities may not be

offered, sold or otherwise transferred within the United States or

to, or for the account or benefit of, US persons except in

accordance with the Securities Act or an exemption therefrom and

under circumstances which will not require the issuer of such

securities to register under the Investment Company Act. No public

offering of any securities will be made in the United States.

You should always bear in mind that:

- All investment is subject to risk;

- Results in the past are no guarantee of future results;

- The investment performance of BGHL may go down as well as up.

You may not get back all of your original investment; and

- If you are in any doubt about the contents of this

communication or if you consider making an investment decision, you

are advised to seek expert financial advice.

This communication is for information purposes

only and the information contained in this communication should not

be relied upon as a substitute for financial or other professional

advice.

VC 01.05.15.01

- Interim management Information - Q1 2024

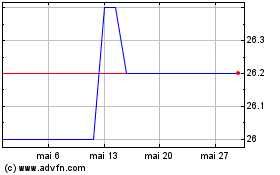

Boussard And Gavaudan (EU:BGHL)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Boussard And Gavaudan (EU:BGHL)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024