CORRECT: Heineken To Buy Femsa Beer Operations in All-Share Deal

11 Janeiro 2010 - 8:19AM

Dow Jones News

Brewer Heineken NV (HINKY) said Monday it will acquire the beer

operations of Fomento Económico Mexicano SAB de CV (FMX), or Femsa,

through an all-share transaction, valuing Femsa at EUR5.3

billion.

"This is a compelling and significant development for Heineken

which will transform our future in the Americas, offering

opportunities for accelerating sales in the rapidly growing markets

of Brazil and Mexico", said Heineken Chief Executive Jean Francois

van Boxmeer.

Investors welcomed the news. At 0910 GMT, Heineken shares were

up 4% at EUR34.25.

Van Boxmeer said the percentage of Heineken's earnings before

interest, tax and amortisation from emerging markets will rise to

40% from 32% after the deal.

Femsa will hold a 20% stake in Heineken Group, with 12.5% of

Heineken NV and 14.9% of Heineken Holding. It will also have the

right to appoint two non-executive representatives to Heineken's

board, and one of these representatives will also be appointed to

the Board of Directors of Heineken Holding.

Femsa will become the second largest shareholder of Heineken NV

while Heineken Holding retains its 50% stake in Heineken NV.

Heineken Chief Financial Officer Rene Hooft Graafland said the

structure of the all-share deal was at Femsa's request. "Femsa

wanted to diversify by reinvesting in a major brewer," he said.

The Dutch brewer estimates that annual cost synergies will

amount to EUR150 million by 2013, whereby the deal is earnings per

share accretive after two years.

Following the structure of the all share deal, Heineken's net

debt to EBITDA ratio remains largely unchanged at 3.1.

Heineken expects to close the transaction in the second quarter

of 2010.

By Anna Marij van der Meulen; Dow Jones Newswires, +31-20-5715

201; annamarij.vandermeulen@dowjones.com

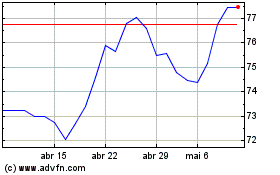

Heineken (EU:HEIO)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Heineken (EU:HEIO)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024