Heineken Holding N.V. reports 2023 half year results

Amsterdam, 31 July 2023 – Heineken Holding N.V.

(EURONEXT: HEIO; OTCQX: HKHHY) announces:

- The net result of

Heineken Holding N.V.'s participating interest in Heineken N.V. for

the first half year of 2023 amounts to €589 million

- Revenue growth

6.3%

- Net revenue (beia)

6.6% organic growth; per hectolitre 12.7%

- Beer volume organic

growth -5.6%; Heineken® volume 1.7% growth (excluding Russia

3.7%)

- Operating profit

growth -22.2%; operating profit (beia) organic growth -8.8%

- Net profit growth

-8.6%; net profit (beia) organic growth -11.6%

- Diluted EPS €2.04;

diluted EPS (beia) €2.03

- FY 2023 outlook updated. Operating

profit (beia) stable to mid-single-digit organic growth.

|

IFRS Measures |

€ million |

|

Total growth |

|

BEIA Measures |

€ million |

Organic growth2 |

|

Revenue |

17,436 |

|

6.3% |

|

Revenue (beia) |

17,423 |

5.5% |

| Net revenue |

14,524 |

|

7.7% |

|

Net

revenue (beia) |

14,514 |

6.6% |

| Operating profit |

1,611 |

|

-22.2% |

|

Operating

profit (beia) |

1,939 |

-8.8% |

| |

|

|

|

|

Operating

profit (beia) margin |

13.4% |

|

| Net profit of Heineken Holding

N.V. |

589 |

|

-8.6% |

|

Net

profit (beia) |

1,150 |

-11.6% |

| Diluted EPS (in €) |

2.04 |

|

-7.3% |

|

Diluted

EPS (beia) (in €) |

2.03 |

-12.0% |

| |

|

|

|

|

Free

operating cash flow |

-467 |

|

|

|

|

|

|

|

Net debt / EBITDA (beia)3 |

2.7x |

|

1 Consolidated figures are used throughout this report, unless

otherwise stated. Please refer to the Glossary for an explanation

of non-GAAP measures and other terms.Page 15 includes a

reconciliation versus IFRS metrics. These non-GAAP measures are

included in internal management reports that are reviewed by the

Executive Board of Heineken N.V., as management believes that

this measurement is the most relevant in evaluating the results.

Heineken Holding N.V.’s half year report has not been audited nor

reviewed by its external auditor.2 Organic growth shown, except for

Diluted EPS (beia), which is total growth. 3 Includes acquisitions

and excludes disposals on a 12 month pro-forma basis.

Heineken Holding N.V. engages in no activities other than its

participating interest in Heineken N.V. and the management or

supervision of and provision of services to that company.

During the first half of 2023, HEINEKEN focused on executing its

EverGreen strategy to deliver superior and balanced growth in a

fast-changing world while transforming its business to be

future-ready. HEINEKEN is making progress, albeit some short-term

challenges given the volatile economic context, with the slowdown

of the economy in some countries and unprecedented inflation

levels.

HEINEKEN's focus has been on its EverGreen priorities, starting

with its dream to shape the future of beer and beyond to win the

hearts of consumers. HEINEKEN is also shaping the future with its

ambition to become the best digitally connected brewer, raising the

bar on sustainability and responsibility and evolving its culture,

operating model and capabilities. At the same time, HEINEKEN is

stepping up on productivity to fund the investments required for

its brands, digitalisation, capabilities and sustainability, and

improve profitability and capital efficiency.

HEINEKEN's ambition is to deliver sustained superior growth with

a healthy balance between volume and value growth. HEINEKEN aims to

achieve this through launching winning beverage propositions in

fast-growing consumer segments, building and scaling strong premium

brands everywhere and further developing its advantaged geographic

and portfolio footprint. This year, HEINEKEN front-loaded

significant price increases, often leading the market, to offset

unprecedented levels of commodity and energy inflation, which

impacted consumer off-take.

Revenue for the first half of 2023 was 17,436

million (2022: 16,401 million). Net revenue (beia)

increased 6.6% organically; a combination of a 5.4% decline in

total consolidated volume and a 12.7% increase in net revenue

(beia) per hectolitre. The underlying price-mix on a constant

geographic basis was up 11.8%, principally driven by the strong

inflation-led pricing, whilst mix was slightly positive driven by

premiumisation. Currency translation negatively impacted net

revenue (beia) by €91 million or 0.7%, mainly driven by the

Nigerian Naira, the Egyptian Pound, the South African Rand, the

Indian Rupee and the UK Pound Sterling, partially offset by a

strong Mexican Peso. Consolidation changes had a positive impact to

net revenue (beia) of €231 million, mainly driven by Heineken

Beverages in Southern Africa and Beavertown in the UK.

Beer volume for the first half of 2023

decreased 5.6% organically versus last year. The cumulative effect

of pricing actions taken and a challenging economic backdrop led to

a 7.6% organic decline in the second quarter. A disappointing

performance in Vietnam and socio-economic volatility in Nigeria

affecting consumer off-take accounted for over half of the decline

in the first six months. The Americas region was impacted by a soft

beer market, notably in the second quarter, combined with the

continuing impact from OXXO mixing in Mexico. Volume in Europe

performed broadly in line with HEINEKEN's expectations for the

first six months. HEINEKEN gained or held market share in more than

half of its markets.

| Beer

volume |

2Q23 |

|

|

|

Organicgrowth |

|

HY23 |

|

|

|

Organicgrowth |

|

(in mhl) |

|

2Q22 |

|

|

|

HY22 |

|

|

Heineken N.V. |

65.3 |

|

70.4 |

|

-7.6% |

|

120.1 |

|

126.9 |

|

-5.6% |

Premium beer volume declined by 6.5%, driven by

Vietnam and Russia. Outside these markets, premiumisation trends

remain strong as premium volume grew by a low-single-digit, ahead

of the total beer portfolio in aggregate and in more than half of

HEINEKEN's markets. The growth was driven by Heineken®, further

supported by the growth of Desperados, Birra Moretti, Beavertown,

Bedele Especial and El Águila among others.

Heineken® continued to lead

HEINEKEN's portfolio and grew volume by 1.2% (2.1% excluding

Russia) in the second quarter to close the first half with a 1.7%

increase (3.7% excluding Russia). Growth was broad-based across 50

markets, most notably in China, Brazil, Mexico, Ethiopia, Panama,

Portugal, Croatia and Algeria.

Heineken® Silver

is now present in 45 markets and grew volume by more than

forty-five percent, led by China, Vietnam and Mexico. We continue

to build Heineken® Silver across European markets and the launch in

the USA shows promising early results as we scale distribution and

reach more and more consumers.

|

Heineken® volume |

|

2Q23 |

|

Organicgrowth |

|

HY23 |

|

Organicgrowth |

|

(in mhl) |

|

|

|

|

|

Total |

|

14.2 |

|

1.2% |

|

26.3 |

|

1.7% |

HEINEKEN's EverGreen strategy is a multi-year and multi-faceted

journey to future-proof the company and deliver superior, balanced

growth for long-term value creation. HEINEKEN has executed its

plans in line with its EverGreen priorities and HEINEKEN is making

clear progress in building a premium portfolio, driving

consumer-centric innovation, digitisation, sustainability and in

improving productivity.

In the second half of 2023, HEINEKEN expects significantly

improved operating profit (beia) growth inclusive of:

- Lower pressure from

inflation in input costs, transport and energy & water, from

mid-teens in the first-half to low-teens in the second-half on a

per hectolitre basis

- Pricing starting to

moderate with volume trends gradually improving to a

low-single-digit decline

- An improved outlook

in Vietnam and Nigeria, relative to the significant disruption in

the first half

- A similar absolute

level of investment in marketing and sales when compared to the

first half

- Productivity savings

delivering at least €300 million, cumulatively well-ahead of the €2

billion gross savings target.

Overall, HEINEKEN's updated expectation for the full year of

2023 is stable to a mid-single-digit operating profit (beia)

organic growth. HEINEKEN also anticipate an average interest rate

for the year of around 3.2% (2022: 2.8%). Other assumptions on

CAPEX and effective tax rate are unchanged.

Looking ahead, the unprecedented commodity and energy cost

inflation in recent years will be partially reversed next year,

easing the pressure on pricing. Together with the structural

changes HEINEKEN is making with EverGreen, HEINEKEN is confident

this will set HEINEKEN up for a balanced growth delivery in 2024,

while HEINEKEN remains cautious about the macroeconomic and

geopolitical environment. HEINEKEN's strong cost and productivity

efforts will continue and enable further support behind its growth

agenda, fund investments behind EverGreen and contribute to

operating profit growth. Therefore, HEINEKEN's medium-term guidance

of superior, balanced growth with operating leverage over time

remains unchanged.

|

|

Translational Calculated Currency Impact |

Based on the impact to date, and applying spot rates of 27 July

2023 to the 2022 financial results as a baseline for the remainder

of the year, the calculated negative currency translational impact

would be approximately €780 million in net revenue (beia), €110

million at consolidated operating profit (beia), and €30 million at

net profit (beia).

According to the Articles of Association of Heineken Holding

N.V. both Heineken Holding N.V. and Heineken N.V. pay an identical

dividend per share. HEINEKEN's dividends are paid in the form of an

interim dividend and a final dividend. In accordance with its

dividend policy, HEINEKEN fixes the interim dividend at 40% of the

total dividend of the previous year. As a result, an interim

dividend of €0.69 per share (2022: €0.50) will be paid on 10 August

2023. Both the Heineken Holding N.V. shares and the Heineken N.V.

shares will trade ex-dividend on 2 August 2023.

|

Media Heineken Holding N.V. |

|

|

|

Kees Jongsma |

|

|

| Tel. +31-6-54798253 |

|

|

| E-mail: cjongsma@spj.nl |

|

|

| |

|

|

|

Media |

|

Investors |

|

Sarah Backhouse / Joris Evers |

|

José Federico Castillo Martinez |

| Director of Global

Communication |

|

Investor Relations

Director |

| Michael

Fuchs |

|

Mark Matthews / Chris

Steyn |

| Global Corporate and Financial

Communications Manager |

|

Investor Relations Manager /

Senior Analyst |

| E-mail:

pressoffice@heineken.com |

|

E-mail:

investors@heineken.com |

| Tel: +31-20-5239355 |

|

Tel: +31-20-5239590 |

|

|

Investor Calendar Heineken N.V. |

(events also accessible for Heineken Holding N.V.

shareholders)

|

Trading Update for Q3 2023 |

|

25 October 2023 |

| Full Year 2023 Results |

|

14 February 2024 |

HEINEKEN will host an analyst and investor conference call in

relation to its 2023 Half Year results today at 14:00 CET/ 13:00

GMT. This call will also be accessible for Heineken Holding

N.V. shareholders. The call will be audio cast live via the

website: www.theheinekencompany.com. An audio replay service will

also be made available after the conference call at the above web

address. Analysts and investors can dial-in using the following

telephone numbers:

United Kingdom (Local): 020 3936 2999

Netherlands (Local): 085 888 7233

USA: 1 646 664 1960

For the full list of dial in numbers, please refer to the

following link: Global Dial-In Numbers

Participation password for all countries: 394664

Editorial information:Heineken Holding N.V. engages in no

activities other than its participating interest in Heineken N.V.

and the management or supervision of and provision of services to

that company.

HEINEKEN is the world's most international brewer. It is the

leading developer and marketer of premium and non-alcoholic beer

and cider brands. Led by the Heineken® brand, the Group has a

portfolio of more than 300 international, regional, local and

specialty beers and ciders. With HEINEKEN’s over 90,000 employees,

HEINEKEN brews the joy of true togetherness to inspire a better

world. HEINEKEN's dream is to shape the future of beer and beyond

to win the hearts of consumers. HEINEKEN is committed to

innovation, long-term brand investment, disciplined sales execution

and focused cost management. Through "Brew a Better World",

sustainability is embedded in the business. HEINEKEN has a

well-balanced geographic footprint with leadership positions in

both developed and developing markets. HEINEKEN operates breweries,

malteries, cider plants and other production facilities in more

than 70 countries. Most recent information is available on

www.heinekenholding.com and www.theHEINEKENcompany.com and follow

HEINEKEN on LinkedIn, Twitter and Instagram.

Market Abuse RegulationThis press release may contain

price-sensitive information within the meaning of Article 7(1) of

the EU Market Abuse Regulation.

Disclaimer: This press release contains forward-looking

statements based on current expectations and assumptions with

regard to the financial position and results of HEINEKEN’s

activities, anticipated developments and other factors. All

statements other than statements of historical facts are, or may be

deemed to be, forward-looking statements. Forward-looking

statements also include, but are not limited to, statements and

information in HEINEKEN’s non-financial reporting, such as

HEINEKEN’s emissions reduction and other climate change related

matters (including actions, potential impacts and risks associated

therewith). These forward-looking statements are identified by

their use of terms and phrases such as “aim”, “ambition”,

“anticipate”, “believe”, “could”, “estimate”, “expect”, “goals”,

“intend”, “may”, “milestones”, “objectives”, “outlook”, “plan”,

“probably”, “project”, “risks”, “schedule”, “seek”, “should”,

“target”, “will” and similar terms and phrases. These

forward-looking statements, while based on management's current

expectations and assumptions, are not guarantees of future

performance since they are subject to numerous assumptions, known

and unknown risks and uncertainties, which may change over time,

that could cause actual results to differ materially from those

expressed or implied in the forward-looking statements. Many of

these risks and uncertainties relate to factors that are beyond

HEINEKEN’s ability to control or estimate precisely, such as but

not limited to future market and economic conditions, the behaviour

of other market participants, changes in consumer preferences, the

ability to successfully integrate acquired businesses and achieve

anticipated synergies, costs of raw materials and other goods and

services, interest-rate and exchange-rate fluctuations, changes in

tax rates, changes in law, environmental and physical risks, change

in pension costs, the actions of government regulators and weather

conditions. These and other risk factors are detailed in HEINEKEN’s

publicly filed annual reports. You are cautioned not to place undue

reliance on these forward-looking statements, which speak only of

the date of this press release. HEINEKEN assumes no duty to and

does not undertake any obligation to update these forward-looking

statements contained in this press release. Market share estimates

contained in this press release are based on outside sources, such

as specialised research institutes, in combination with management

estimates.

- Please click on the PDF to download the full press release

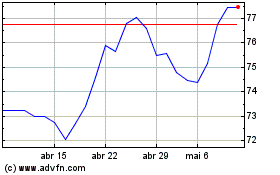

Heineken (EU:HEIO)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Heineken (EU:HEIO)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024