Amsterdam, 24 April 2013 - Heineken Holding N.V.

today announced its trading update for the first quarter of 2013.

In the quarter:

·

Group beer volume declined 2.7%

organically, following strong growth of 4.7% in the comparative

prior year period and one less selling day in the quarter. This

performance also reflects volatile global economic conditions,

unfavourable weather conditions and destocking in France and the

USA;

·

HEINEKEN's* revenue grew 8.1% mainly reflecting the first time

consolidation of Asia Pacific Breweries (ABP) and Asia Pacific

Investment Pte Ltd (APIPL). Revenue declined 2.7% organically with

lower volume only partly offset by revenue per hectolitre growth of

1.8%;

· Strong

performance of APB with low-double

digit volume and revenue growth. The integration of APB is

progressing well and is expected to complete by June 2013;

·

Heineken® volume in the

international premium segment was 4.7% lower (declined in the low

single digits after adjusting for one less selling day and

destocking);

·

EBIT (beia)1 increased in

the mid-teens and declined organically by mid-single digits.

The first quarter is seasonally less significant

in terms of volume and profit contribution. In 2012, the first

quarter represented 21% of consolidated beer volume and

considerably less in terms of profit contribution.

Heineken Holding N.V. engages in

no activities other than its participating interest in Heineken

N.V. and the management and supervision of and provision of

services to that company.

Financial

results

Revenue of HEINEKEN increased 8.1% to €4,145

million in the first quarter of 2013. First time consolidations

added €449 million (+11.7%) with unfavourable currency translation

movements reducing revenues by €34 million (-0.9%). On an organic

basis, revenue declined 2.7% reflecting lower total consolidated

volume of 4.5%, partly offset by revenue per hectolitre growth of

1.8%. Planned price increases contributed to revenue per hectolitre

growth across all regions.

EBIT

(beia) grew in the mid-teens including a net positive

consolidation and negative foreign currency impact. On an organic

basis, EBIT (beia) declined in the

mid-single digits reflecting lower revenue only partly offset by

the lower phasing of marketing expense and the realisation of TCM2

cost savings.

Reported net

profit of Heineken N.V. in the quarter was €227 million

compared with €166 million2 in the first

quarter of 2012

* HEINEKEN means Heineken Holding

N.V., Heineken N.V., its subsidiaries and interests in joint

venture and associates.

1 The calculation of EBIT (beia) organic growth

assumes HEINEKEN's joint venture share of 41.9% of APB and 50% of

APIPL prior to consolidation is maintained through to 15 November

2013.

2 Restated for revised accounting standard IAS19.

IAS19

Impact on financials

The implementation of the revised

accounting standard IAS19 is expected to result in an increase in

pre-tax pension expense of €98 million in 2013, spread equally over

each quarter. This comprises an increase of €41 million in

personnel expense (which will reduce EBIT (beia)) and an increase

of €57 million in other net finance costs. For the full year 2013,

the impact of IAS19 is expected to reduce net profit (beia) by €75

million and EPS (beia) by €0.13. In 2013, the first time impact on

EBIT (beia), net profit (beia) and EPS (beia) will be treated as a

non-organic item.

Further assessment of the impact

of IAS19 on 2012 (for restatement purposes) resulted in an increase

in pre-tax pension expense of €45 million and a reclassification

from personnel expense to other net finance costs of €51 million.

This results in a restated 2012 EBIT (beia) of €2,918 million, net

profit (beia) of €1,661 million and EPS (beia) of €2.89.

Changes in

consolidation

The main consolidation scope

changes impacting financial results include:

· The acquisition of a controlling stake

(58.1%) in APB and APIPL (50%), both consolidated from 15 November

2012;

· The acquisition of Efes Breweries International's 28%

stake in Central Europe Beverages, Serbia, now a wholly owned

subsidiary, and disposal of a 28% stake in Efes Kazakhstan on 8

January 2013;

· The divestment of Pago International, a wholly owned subsidiary,

on 15 February 2013;

Full year outlook

Global market conditions remain

volatile, contributing to a weaker than expected first quarter.

Challenging trading conditions in austerity affected markets in

Europe and inflationary pressures in Nigeria are expected to

continue to impact volume development for the balance of year,

leading to a moderation in organic growth expectations for the full

year. Overall, HEINEKEN still anticipates organic volume and

revenue growth for the full year 2013, with higher growth regions

offsetting volume weakness in certain developed countries. HEINEKEN

reaffirms all other elements of its full year outlook for 2013 as

stated in its full year 2012 earnings release dated 13 February

2013.

Investor calendar Heineken

Holding N.V.

Annual General Meeting of Shareholders

(AGM) 25 April 2013

What's Brewing Seminar (Sustainability),

Paris 28 June 2013

Half Year 2013

Results 21

August 2013

What's Brewing Seminar (USA), New

York 6

September 2013

Trading update for Q3

2013

23 October 2013

Financial Markets Conference,

Mexico 5-6

December 2013

Heineken Holding N.V. will host an analyst and investor conference

call in relation to this trading update today at 9:00 CET/ 8:00

BST. The call will be audio cast live via the website:

www.heinekeninternational.com/webcasts/investors. An audio replay

service will also be made available after the conference call at

the above web address. Analysts and investors can dial-in using the

following telephone numbers:

Netherlands

United Kingdom

Local line: +31-(0)

45-631-6902 Local

line: +44-207-153-2027

Toll-Free:

0800-265-8611 Toll-Free:

0800-358-0886

Press

enquiries

Investor and analyst enquiries

John

Clarke

George Toulantas

Head of External

Communication

Director of Investor Relations

John-Paul

Schuirink Aarti

Narain

Financial Communications Manager Investor

Relations Manager

E-mail:

pressoffice@heineken.com E-mail:

investors@heineken.com

Tel:

+31-20-5239355

Tel: +31-20-5239590

Definitions:

Organic growth excludes the effect

of foreign currency translational effects, consolidation changes,

accounting policy changes, exceptional items and amortisation of

acquisition related intangibles. Beia refers to financials before

exceptional items and amortisation of acquisition related

intangibles. Group beer volume includes 100 percent of beer volume

produced and sold by fully consolidated companies and joint venture

companies, as well as the volume of HEINEKEN's brands produced and

sold under license by third parties. Consolidated beer volume

includes 100 percent of beer volume produced and sold by fully

consolidated companies (excluding the beer volume brewed and sold

by joint venture companies). Total consolidated volume includes

volume produced and sold by fully consolidated companies (including

beer, cider, soft drinks and other beverages), volume of third

party products and volume of HEINEKEN's brands produced and sold

under license by third parties.

Editorial information:

HEINEKEN is a proud, independent global brewer committed to

surprise and excite consumers with its brands and products

everywhere. The brand that bears the founder's family name -

Heineken® - is available in almost every country on the globe and

is the world's most valuable international premium beer brand.

HEINEKEN's aim is to be a leading brewer in each of the markets in

which it operates and to have the world's most valuable brand

portfolio. HEINEKEN wants to win in all markets with Heineken® and

with a full brand portfolio in markets of choice. HEINEKEN is

present in over 70 countries and operates more than 165 breweries

with volume of 221 million hectoliters of group beer sold. HEINEKEN

is Europe's largest brewer and the world's third largest by volume.

HEINEKEN is committed to the responsible marketing and consumption

of its more than 250 international premium, regional, local and

specialty beers and ciders. These include Heineken®, Amstel,

Anchor, Biere Larue, Bintang, Birra Moretti, Cruzcampo, Desperados,

Dos Equis, Foster's, Newcastle Brown Ale, Ochota, Primus, Sagres,

Sol, Star, Strongbow, Tecate, Tiger and Zywiec. HEINEKEN's leading

joint venture brands include Cristal and Kingfisher. Pro forma 2012

revenue totaled €19,765 million and EBIT (beia) €3,151 million. The

number of people employed is over 85,000. Heineken N.V. and

Heineken Holding N.V. shares are listed on the Amsterdam stock

exchange. Prices for the ordinary shares may be accessed on

Bloomberg under the symbols HEIA NA and HEIO NA and on the Reuter

Equities 2000 Service under HEIN.AS and HEIO.AS. Most recent

information is available on the website:

www.theHEINEKENcompany.com.

Disclaimer:

This press release contains forward-looking statements with regard

to the financial position and results of HEINEKEN's activities.

These forward-looking statements are subject to risks and

uncertainties that could cause actual results to differ materially

from those expressed in the forward-looking statements. Many of

these risks and uncertainties relate to factors that are beyond

HEINEKEN's ability to control or estimate precisely, such as future

market and economic conditions, the behaviour of other market

participants, changes in consumer preferences, the ability to

successfully integrate acquired businesses and achieve anticipated

synergies, costs of raw materials, interest-rate and exchange-rate

fluctuations, changes in tax rates, changes in law, pension costs,

the actions of government regulators and weather conditions. These

and other risk factors are detailed in HEINEKEN's publicly filed

annual reports. You are cautioned not to place undue reliance on

these forward-looking statements, which are only relevant as of the

date of this press release. HEINEKEN does not undertake any

obligation to release publicly any revisions to these

forward-looking statements to reflect events or circumstances after

the date of these statements. Market share estimates contained in

this press release are based on outside sources, such as

specialised research institutes, in combination with management

estimates.

Click here to open media

release

This

announcement is distributed by Thomson Reuters on behalf of Thomson

Reuters clients.

The owner of this announcement warrants that:

(i) the releases contained herein are protected by copyright and

other applicable laws; and

(ii) they are solely responsible for the content, accuracy and

originality of the

information contained therein.

Source: HEINEKEN Holding NV via Thomson Reuters ONE

HUG#1695534

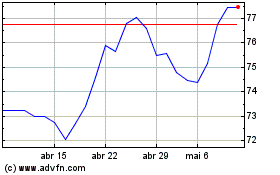

Heineken (EU:HEIO)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Heineken (EU:HEIO)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024