SABMiller CEO Clark Faces Challenge

17 Setembro 2015 - 10:40AM

Dow Jones News

LONDON—Roughly two years after taking the helm of SABMiller PLC,

Alan Clark is grappling with the biggest challenge—or

opportunity—the beer giant he runs has faced in decades.

Mr. Clark, who turns 56 years old next week, is unlikely to have

been taken by surprise by Anheuser-Busch InBev NV's overture—made

public Wednesday—following years of speculation about a possible

tie-up between the world's two largest brewers.

If he was, he probably didn't show it. The South African is

described by those who know him as being calm and rational, traits

that will come in handy as he assesses any formal offer from AB

InBev.

In 2012, when SABMiller said Mr. Clark was being named chief

operating officer as a prelude to becoming CEO, nobody was

surprised. Having spent more than two decades at SAB in various

roles, he had developed a close relationship with his predecessor

Graham Mackay, who was involved in his hiring.

Since taking the reins, Mr. Clark has been fighting an uphill

battle amid a slump in emerging markets, extreme gyrations in

foreign exchange and weak underlying demand for mass-market beer

brands around the world as the drink faces competition from craft

beers, wine and spirits.

SABMiller's stock price has dropped 14% since Mr. Clark became

CEO. By comparison, Carlsberg A/S's has fallen 5.1% during this

period, while shares of Heineken NV and AB InBev's have both risen

25%.

Should SABMiller fend off the offer by AB InBev, Mr. Clark would

be under pressure to wring out further costs from the company and

accelerate its push into premium drinks.

The first in his family to go to college, Mr. Clark—some call

him Dr. Clark—holds a master's degree in clinical psychology and a

doctorate in literature and philosophy from the University of South

Africa, and has worked as an associate professor of cognitive

development at South Africa's Vista University. He also worked as a

part-time prison warden as part of the government's conscription

policy.

While teaching university students, Mr. Clark and a friend set

up a corporate consulting business in the 1980s, landing what was

then South African Breweries PLC as a client. Mr. Clark eventually

joined SAB in 1990 in a human-resources role as head of training

and development, climbing the ranks via positions in operations and

marketing, before becoming the brewer's managing director for

Europe in 2003 and then eventually its CEO in 2013.

The son of a cleric and a tradesman, Mr. Clark now works out of

SAB's head office in London's swanky district of Mayfair, a stone's

throw away from a park that was once the private gardens of

Kensington Palace.

Mr. Clark is seen by some as lacking the charisma of Mr. Mackay,

who transformed SABMiller from a successful domestic South African

beer maker into the No. 2 brewer in the world by sales. Some people

inside SABMiller view Mr. Clark as being somewhat cold and distant.

"The ice man," said one former senior SABMiller executive. A

spokesman for SABMiller declined to comment.

Judging by how AB InBev—which is run by Rio de Janeiro native

Carlos Brito—has moved following other deals, "Mr. Clark is going

to lose his job" said Barclays analyst Kenny Lam.

"He might not want to go from leading the world's second-largest

brewer to becoming a second man in a combined entity," he said.

Still, Bernstein analysts note that Mr. Clark and the rest of

SAB's management would get a hefty payout from a sale, sharing

roughly $1.8 billion between them at a potential offer price of £

39 ($60.57) a share—a 30% premium to SAB's share price before the

latest news of a potential deal emerged—as their shares and options

vest.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

Access Investor Kit for "AB InBev"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=BE0003793107

Access Investor Kit for "AB InBev"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US03524A1088

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 17, 2015 09:25 ET (13:25 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

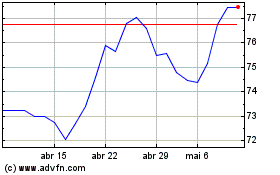

Heineken (EU:HEIO)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Heineken (EU:HEIO)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024