Molson Coors's Earnings Outlook Mostly Below Views

26 Janeiro 2016 - 9:20PM

Dow Jones News

Molson Coors Brewing Co. projected fourth-quarter results mostly

below analysts' expectations as the brewer said its performance was

hurt by currency impacts along with the loss of the Modelo brands

and Heineken brewing contracts in the U.S.

Shares fell 2.6% to $85.50 in recent after-hours trading.

The company also unveiled plans to sell $2.35 billion of shares

to raise funds for its deal to buy the rest of the MillerCoors LLC

U.S. joint venture in a $12 billion deal that would pave the way

for SABMiller PLC to cement its blockbuster sale to Anheuser-Busch

InBev NV.

The sale of MillerCoors is necessary for AB InBev to gain U.S.

regulatory approval to buy SABMiller. MillerCoors's brands include

Miller Lite, Miller High Life and Blue Moon.

For the three-month period ended Dec. 31, the company expects

adjusted per-share earnings of 46 cents to 52 cents on net sales of

$830 million to $860 million. Analysts polled by Thomson Reuters

expected per-share profit of 54 cents and revenue of $850

million.

Molson Coors plans to report its fourth-quarter results Feb.

11.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

January 26, 2016 18:05 ET (23:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

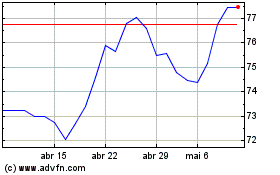

Heineken (EU:HEIO)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Heineken (EU:HEIO)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024