Molson Coors Hurt by Declining Beer Volumes

11 Fevereiro 2016 - 11:20AM

Dow Jones News

Molson Coors Brewing Co. reported lower profit and revenue for

its fourth quarter, hurt by lower earnings in its MillerCoors LLC

venture and declining beer volumes.

Molson Coors and its U.S. venture, MillerCoors LLC, have been

hurt lately by the rising popularity of craft brews and cocktails

over domestic lagers. Higher spending on marketing has offset the

benefits of cost-cutting.

Molson is planning to buy the rest of the MillerCoors LLC

venture in a $12 billion deal that would pave the way for SABMiller

PLC to cement its blockbuster sale to Anheuser-Busch InBev NV.

MillerCoors's brands include Miller Lite, Miller High Life and Blue

Moon.

In all for the period ended Dec. 31, Molson Coors said profit

fell to $32.8 million, or 18 cents a share, from $94.1 million, or

50 cents a share, a year earlier.

Excluding special items, per-share earnings slipped to 49 cents

from 55 cents. Analysts polled by Thomson Reuters had forecast 49

cents a share in earnings.

Molson cited currency movements, higher marketing investment and

the loss of Modelo brands and Heineken brewing contracts for the

lower profit.

Net sales fell 13% to $844.4 million, just missing analysts'

expectations for $844.8 million in sales. Molson Coors said sales

would have fallen 3.5% excluding currency impacts.

During the period, world-wide beer volumes fell 1.7%, though

Coors Light volume improved by 0.8%.

At MillerCoors, core profit fell 10% to $191.5 million, driven

by lower volume and increased spending on marketing and

technology.

Write to Chelsey Dulaney at Chelsey.Dulaney@wsj.com

(END) Dow Jones Newswires

February 11, 2016 08:05 ET (13:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

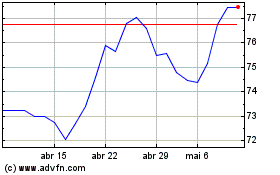

Heineken (EU:HEIO)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Heineken (EU:HEIO)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024