AMSTERDAM—Heineken NV, long content as the world's third-largest

brewer, is now a very distant No. 2, facing off with suddenly much

larger Anheuser-Busch InBev NV around the world as many of the

Dutch beer maker's mature-market strongholds slow and some

fast-growing emerging ones become more volatile.

Who best to navigate the new landscape? Heineken said Wednesday

it would seek a rare fourth, four-year term for Chief Executive

Jean-Franç ois van Boxmeer, who has led Heineken since 2005.

The Belgian national has been credited with expanding Heineken's

presence in fast-growing markets in Latin America and Asia in

recent years, while further strengthening the brewer's activities

in Africa. Mr. van Boxmeer, 55 years old, now faces the daunting

task of competing head-to-head with his deep-pocketed countrymen at

Belgium-based AB InBev.

Earlier this month, AB InBev completed its $100 billion-plus

megamerger with the former SABMiller PLC, combining what, for

years, had been the world's No. 1 and No. 2 publicly listed brewers

by revenue into the undisputed King of Beers.

The new AB InBev now controls 27% of the global beer market,

compared with 9% for Heineken and 6% for the industry's new No. 3,

Carlsberg A/S of Denmark.

With six times as much free cash flow as Heineken, AB InBev has

the financial firepower to promote its brands across most of the

markets it already dominates, analysts say, and it is expected to

revive sales of its more profitable premium-category brands, one of

Heineken's traditional strengths.

AB InBev, by specifically targeting Africa in its tie-up with

SABMiller, also will be competing head-on with Heineken in some of

the Dutch brewer's oldest and fastest-growing emerging markets.

On Wednesday, Heineken reported third-quarter consolidated beer

volume grew 2% to 54 million hectoliters on an organic basis,

beating analyst expectations. Its premium-category namesake lager,

which accounts for roughly 15% of group volume, recorded 3.5%

growth.

Those strong numbers underscore the advantages Mr. van Boxmeer

has coming into his David vs. Goliath fight with AB InBev:

geographic diversification and a portfolio of more expensive

premium brands like Heineken and Sol that are increasingly popular

around the world.

In an interview earlier this year, Mr. van Boxmeer said he

didn't feel intimidated by the new AB InBev, but he acknowledged

that his rival would have "mind-boggling" firepower. "I rarely have

seen such a concentration on a global scale," he said.

Mr. van Boxmeer, who joined Heineken in 1984, has helped

transform the company into "a real global brewer," NIBC Markets

analyst Gerard Rijk said in a research note. "Although a

reappointment for a fourth term does not fit into modern governance

practices, for the Heineken structure this decision is not

[illogical]," he said.

Only the late Freddy Heineken, whose grandfather founded the

company more than 150 years ago, had a longer tenure at the helm

than Mr. van Boxmeer. While unusual for most publicly traded

companies in the Netherlands, Mr. van Boxmeer's longevity reflects

the continuity that Heineken and the controlling family prefer,

analysts said.

Heineken has bought three major brewers since 2008, including

Mexico's Femsa Cerveza and Asia Pacific Breweries Ltd., and did a

series of smaller deals including an investment in California's

Lagunitas Brewing, a craft brewer.

With increased competition from AB InBev, the Dutch company

might look for more acquisitions in the near future, including in

Africa and Asia, analysts said.

But with the Heineken family eager to retain control, pursuing

large deals could be difficult. In 2014, Heineken rebuffed an

overture by SABMiller because the family wanted to keep the company

independent.

Heineken's foray into emerging markets has been successful,

although it is currently facing problems in the Africa, Middle East

and Eastern Europe region. It said volumes fell 3.6% in the third

quarter amid weakness in Russia, Egypt and the Democratic Republic

of Congo.

It also warned of negative currency effects in Nigeria, one of

its biggest markets, underscoring the new headwinds in these sorts

of developing markets—which have provided brewers with their

biggest growth opportunities in recent years.

Growth was strongest in the Asia Pacific region, where Heineken

posted a 15% rise in volume thanks to strong sales in Vietnam and

Cambodia. In the Americas, beer volume grew 3% as strong sales in

Mexico helped to offset declines in Brazil and the U.S. In Europe,

where beer consumption has been falling, warm summer weather led to

a surprise 0.6% growth rate.

Write to Maarten van Tartwijk at maarten.vantartwijk@wsj.com

(END) Dow Jones Newswires

October 26, 2016 08:15 ET (12:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

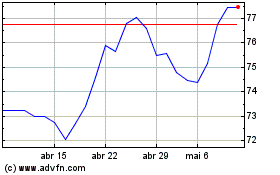

Heineken (EU:HEIO)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Heineken (EU:HEIO)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024